Bitcoin - Price Discovery Uptrend 2 Continues

The grander scheme of the Bitcoin Cycle

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

Weekly Bull Flag Reclaimed

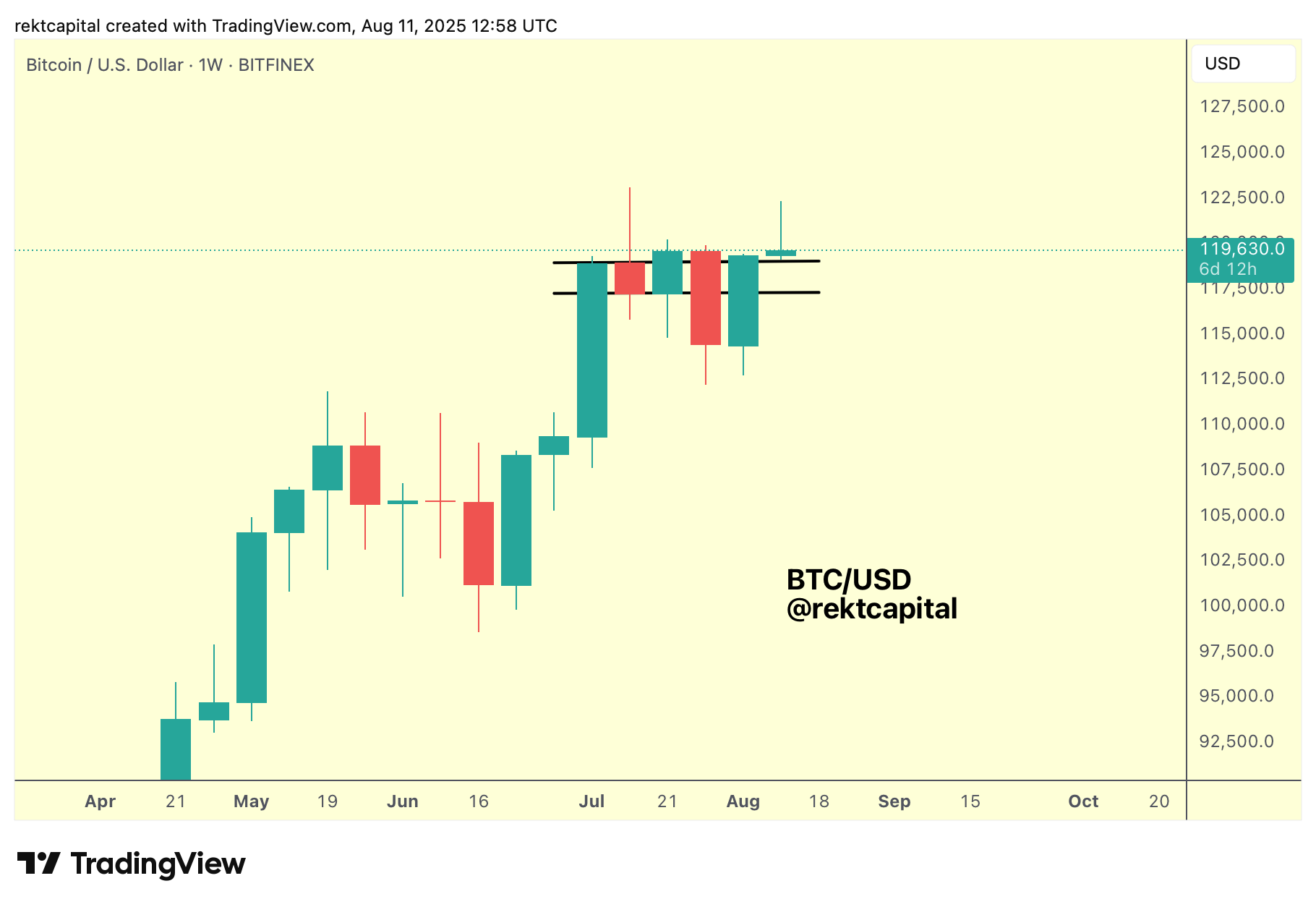

Last week, we spoke about Bitcoin losing the Bull Flag but needing to rally towards the Bull Flag Bottom to give the signal: will price confirm the breakdown or would it actually reclaim the pattern?

We have our answer:

Bitcoin has reclaimed the Bull Flag formation and in doing so - Bitcoin has ended its Downside Deviation in what has been a cycle plagued by Downside Deviations:

Bitcoin has not only reclaimed the Bull Flag but it has positioned itself above it, trying to right the wrong from a few weeks back by attempting to turn the Bull Flag top into new support to confirm the breakout from the pattern overall.

After all, a few weeks back Bitcoin failed to successfully retest the Bull Flag top to confirm the breakout whereas now BTC has another chance.

To confirm a breakout from the Bull Flag, it will need to hold the $119k Bull Flag top as support, with scope for downside wicking back into the pattern being a distinct possibility throughout the week.

The Bitcoin Roadmap

As a preface to today's analysis, here is last week's update on the BTC Roadmap:

And here's today's update:

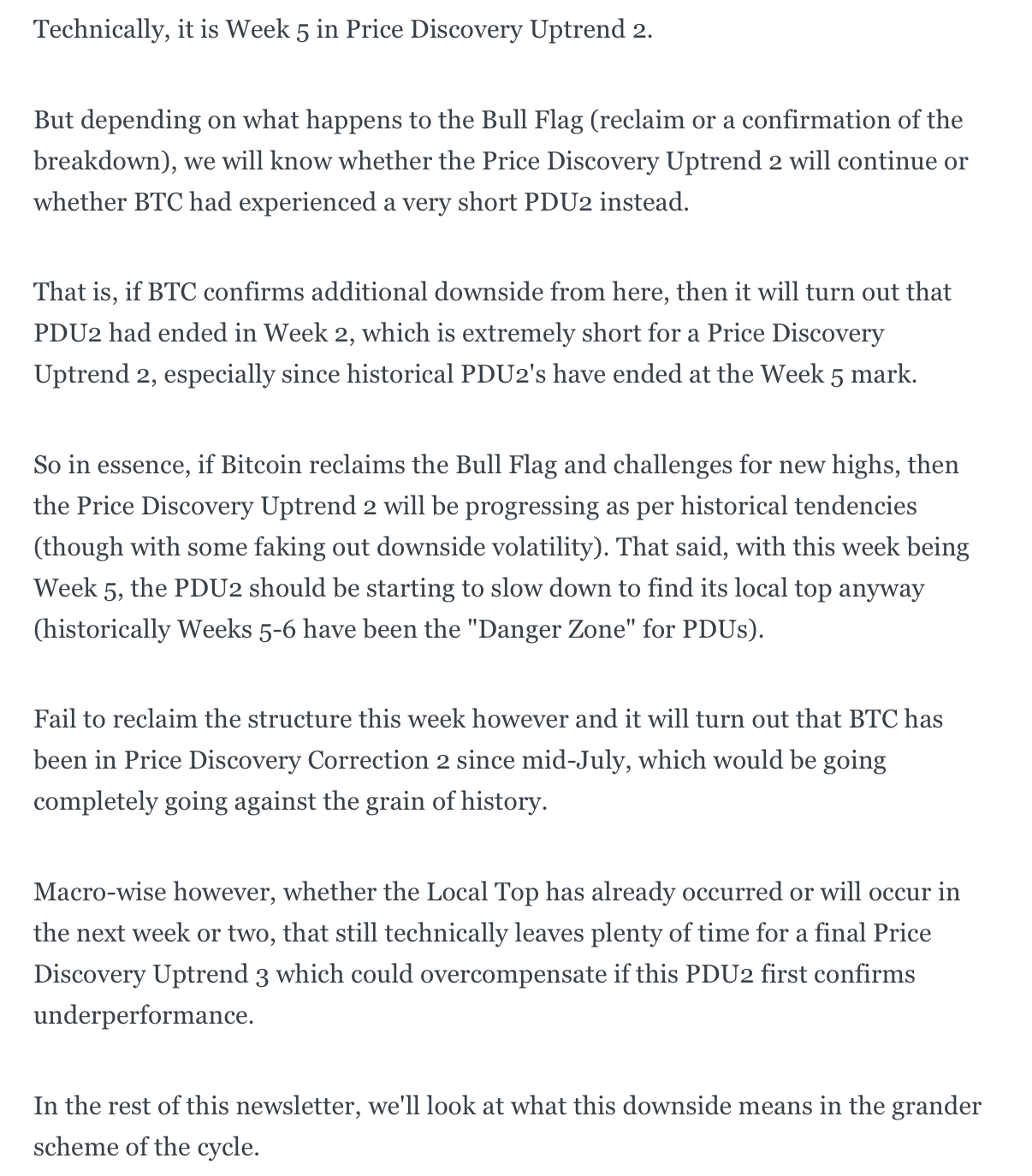

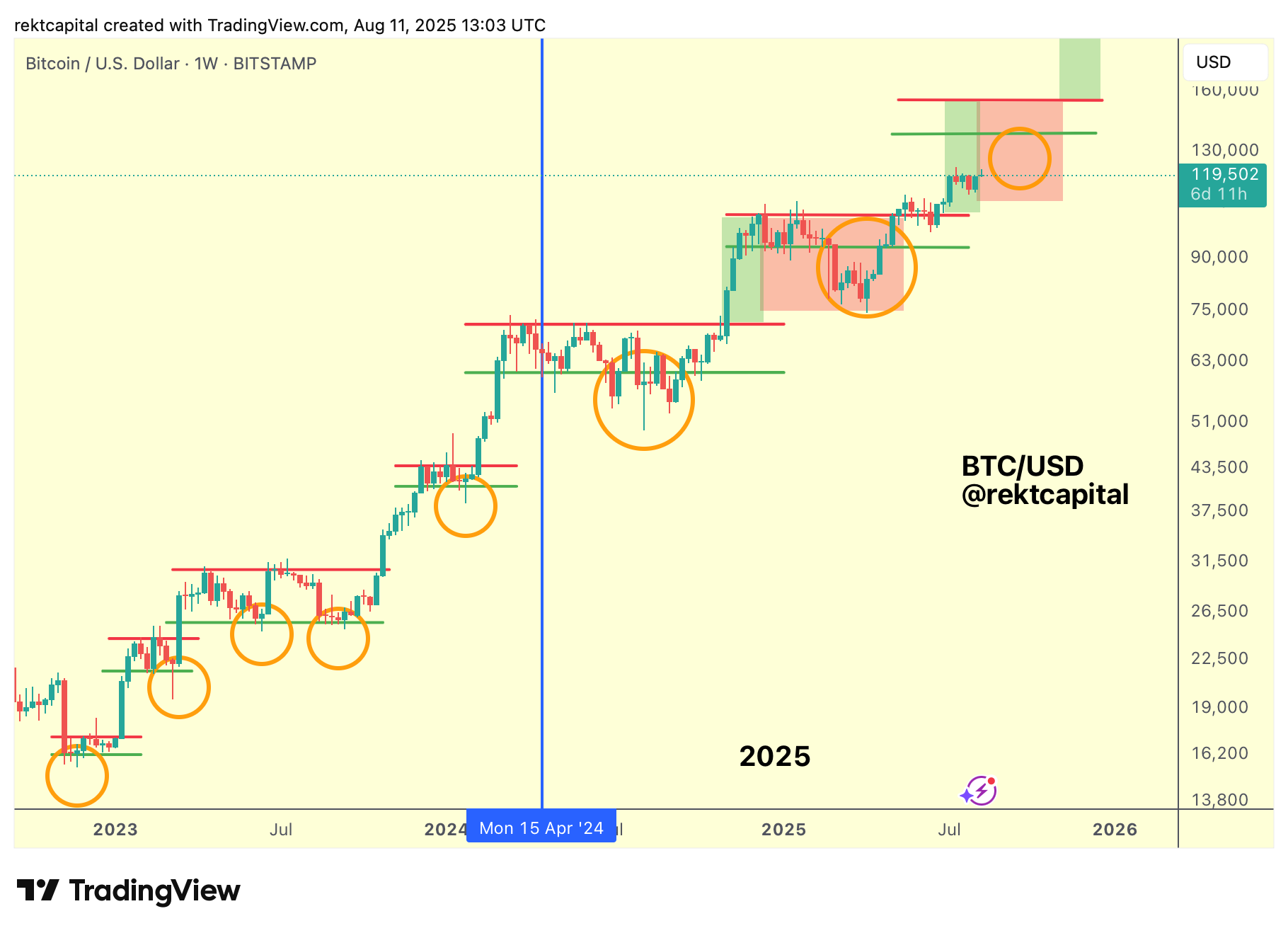

Bitcoin continues to respect historical price tendencies, maintaining its Price Discovery Uptrend 2, despite the -9% dip.

Granted, this dip took a few weeks to resolve (which has been different compared to previous Price Discovery Uptrends) but dips do tend to occur in Price Discovery Uptrends across the cycles - they just have historically resolved within the same week of beginning.

So this dip obviously does not count as a Price Discovery Correction.

And technically, Bitcoin has begun Week 6 of Price Discovery Uptrend 2, never technically breaking its structure, never confirming the breakdown which was the essential signal we were waiting for last week.

But in saying that, it is Week 6 which has historically been the Danger Zone for Bitcoin Local Tops in Price Discovery Uptrend 2.

So while it's great to see Bitcoin recover from its prolonged dip, history suggests price should be close to performing a Local Top anyway.

Of course, one could argue that because this dip took a longer time to resolve itself, the PD Uptrend 2 itself could thus be extended.

And it's true that this Price Discovery Uptrend 2 has been a bit different by standards of history, but it has nonetheless still rhymed, and so the timing for the Local Top should also roughly rhyme.

That said, the way I'd think about this going forward is not necessarily in terms of time (because technically it is slowly time for a Local Top), but now in terms of the key pivotal price level Bitcoin will need to break if it wants to accelerate.

I touched upon this key price point a few weeks back:

Of course, Bitcoin wasn't able to breach that level back then and so that trend acceleration had been left on standby. However with price close to the highs again, this level is once again under consideration.

In saying that, this level does evolve over time as a dynamic resistance and is more close to representing the price point of $126000 at this time, seeing as a full month has since passed.

We'll talk more about this pivotal trend acceleration level later in the Newsletter but the main gist of the matter is this:

Historically, Weeks 5-6 in Price Discovery Uptrend 2 have preceded a Price Discovery Correction 2; so while it is technically time to Local Top, I'll be watching for price confluence as well.

If BTC isn't able to break beyond $126k in the next week or two, then we'll have both time and price confluence for Price Discovery Correction 2.