Bitcoin - Price Discovery Uptrend 2 Awaits

What's next for Bitcoin? PLUS Altcoin Market Cap & Bitcoin Dominance analysis

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

The Downside Deviation Is Over

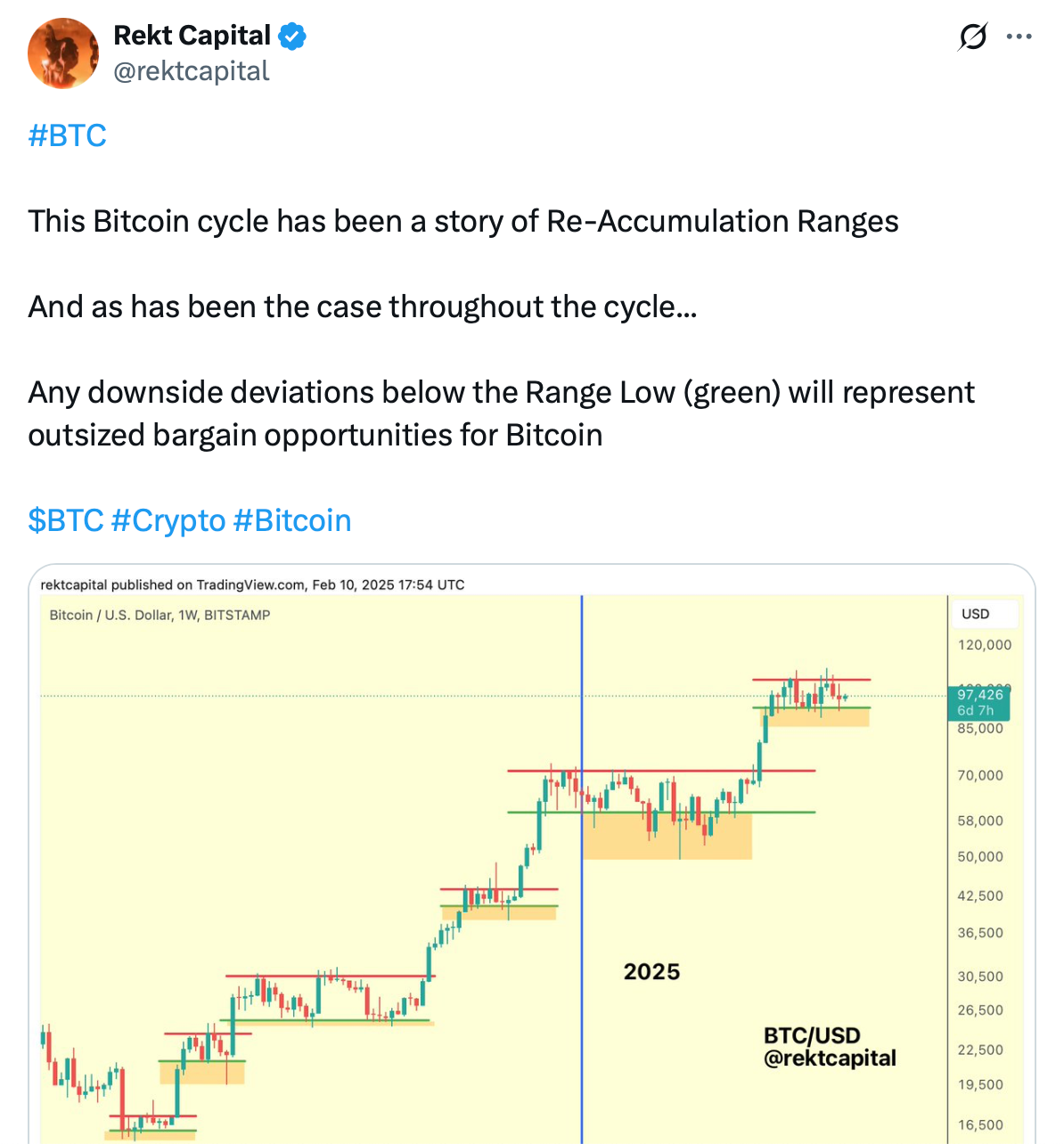

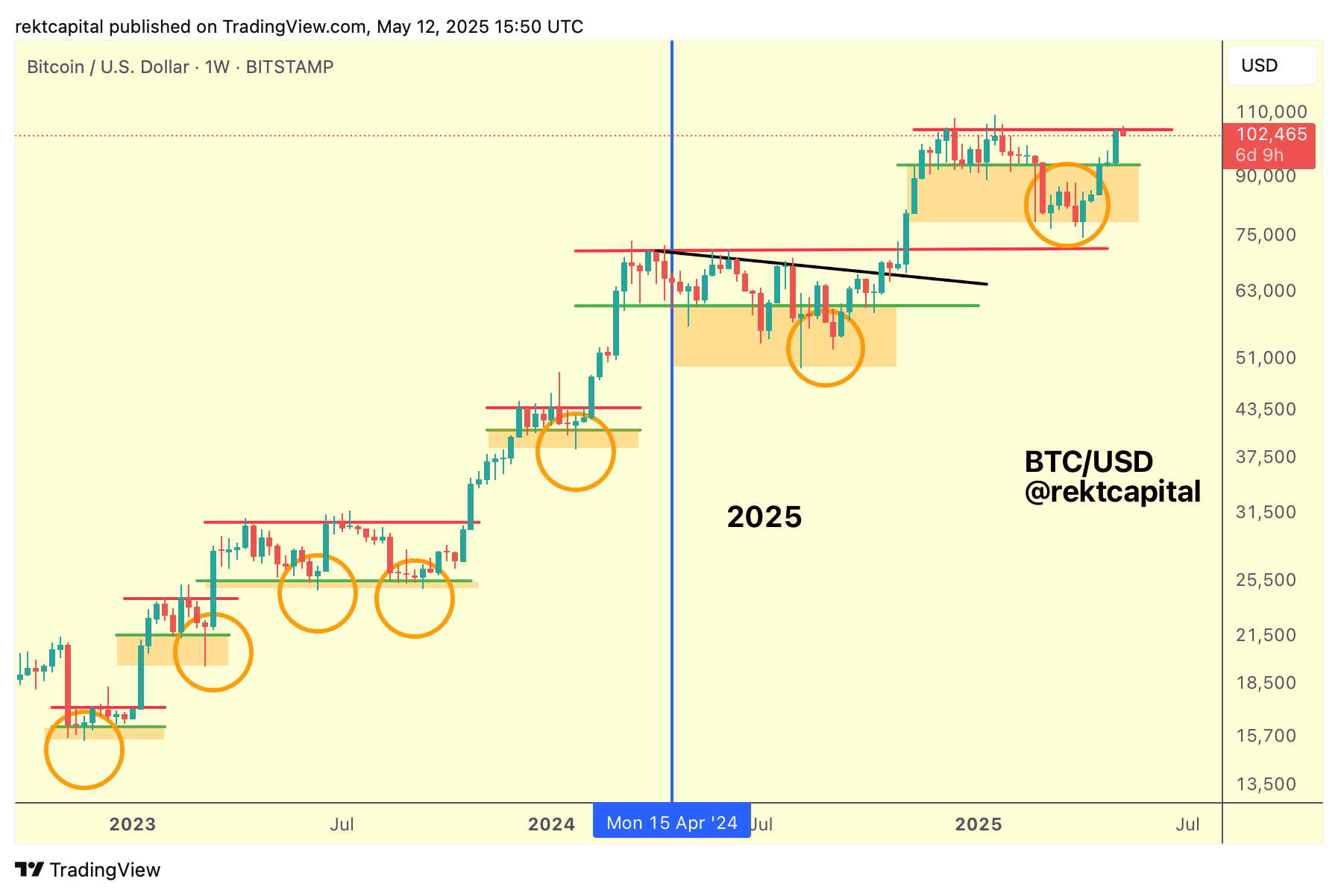

Earlier this year, I posted a tweet about how Bitcoin tends to a) form Re-Accumulation Ranges and b) downside deviate below them (orange circles):

Bitcoin has since concluded that Downside Deviation and rallied right across the entire Range, all the way to the red Range High resistance of $104.5k.

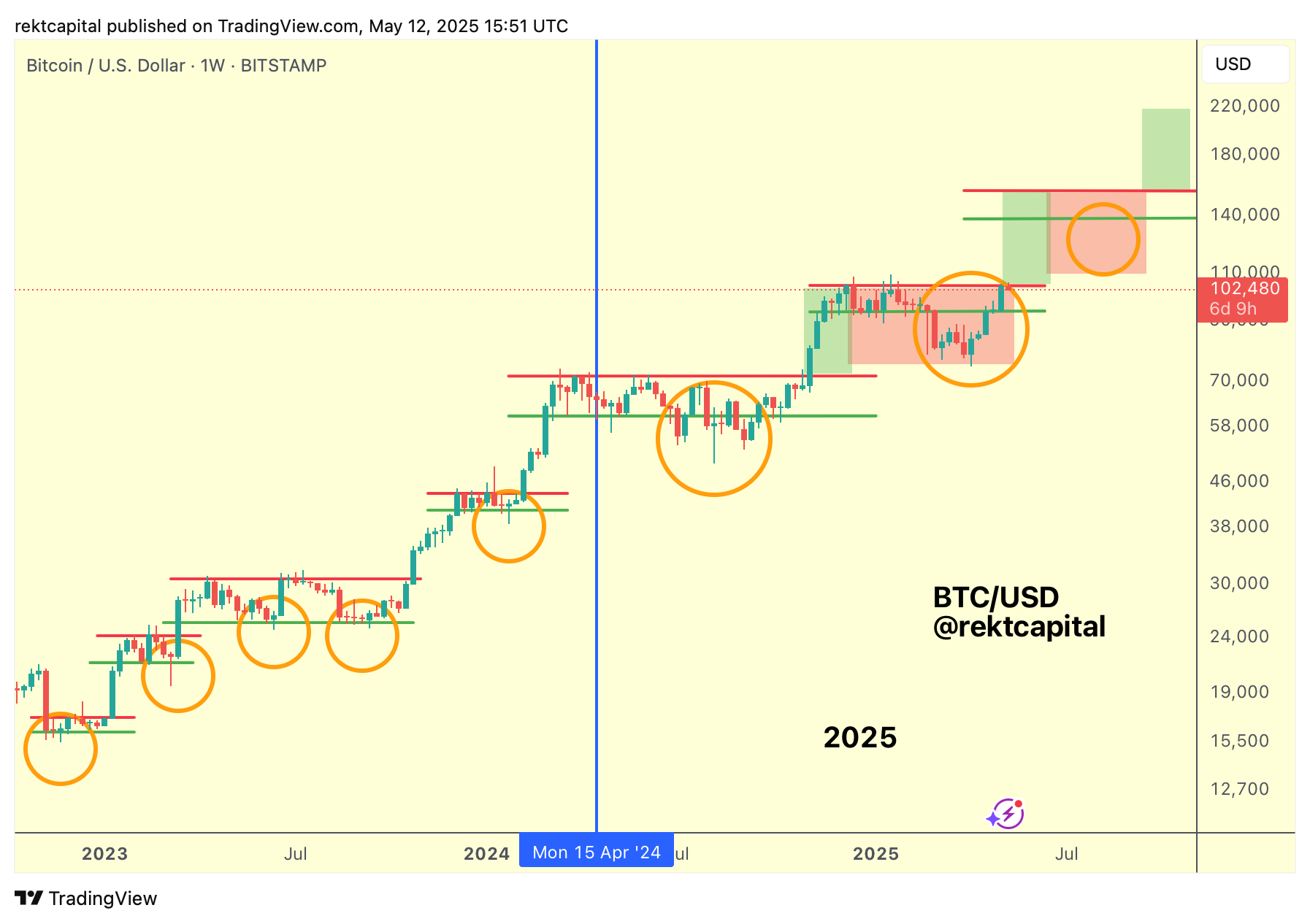

This Range High is the one to turn into support for Bitcoin to break out into its second Price Discovery Uptrend, as per the Bitcoin Roadmap below:

After all, Bitcoin has already enjoyed Price Discovery Uptrend 1 (first green box) and Price Discovery Correction 1 (first red box).

Bitcoin is now trying to confirm Price Discovery Uptrend 2.

However, this phase won't be confirmed until BTC is able to reclaim $104.5k as support first.

And with the Weekly Close occurring just below this Range High, this level continues to act as resistance.

Of course, technically BTC can try to confirm an uptrend beyond this point by Daily Closing above $104.5k and then holding it as support, so it will be worth watching for this lower timeframe confirmation.

However, for the moment, that confirmation isn't there yet.

Which is why until that confirmation is in, this resistance will continue to act as one.

And as resistances do, they tend to reject price.

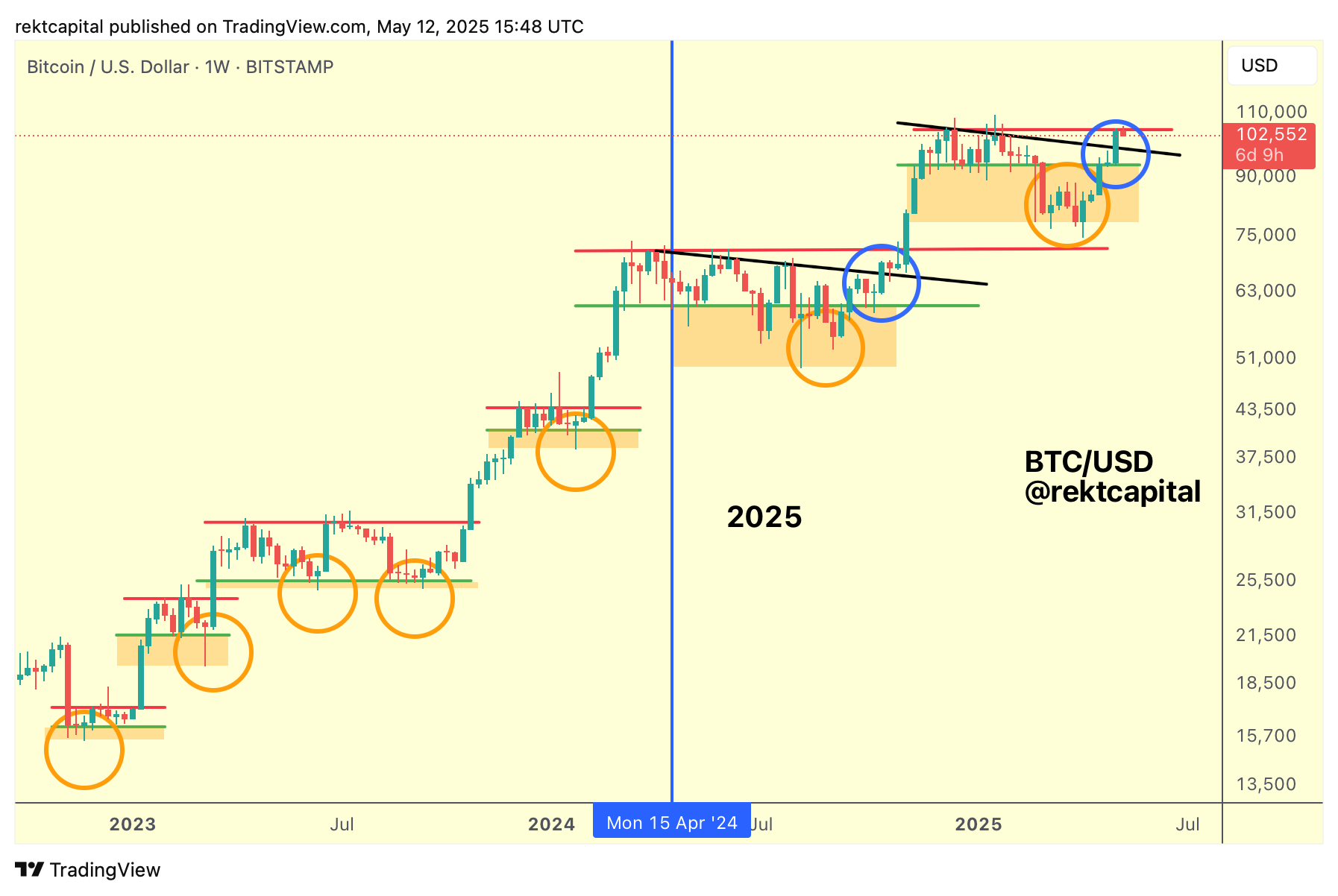

Let's take a look at Bitcoin's Post-Halving Re-Accumulation Range:

In this current Range, Bitcoin repeated quite a few key elements from that Post-Halving Range:

- Downside Deviation below the Range Low in candle-bodied form.

- Lower High trendline resistance (black) within the Range.

- Weekly Close above the Lower High resistance.

If Bitcoin continues to reject from the Range High resistance here, then Post-Halving Range history suggests that BTC could reasonably go for a post-breakout retest of the Lower High resistance (black) as per the blue circle.

The Lower High resistance is currently located at $98500.

This retest doesn't need to happen at all; BTC could very well just Daily Close above $104500 and hold it to then rally to new All Time Highs.

But in the event of a dip, turning the Lower High resistance into a new support could fully confirm the break of this Lower High, turn it into new support and in doing so solidify BTC's positioning in the $98.5k-$104.5k portion of the ReAccumulation Range.

What will it be, Bitcoin?

Daily Closing and price stability above the Range High of $104500 for a confirmed breakout to new All Time Highs?

Or does BTC have one dip left before Price Discovery resumes?