Bitcoin Price Discovery & Altcoin Hype Cycles

The roadmap for the weeks ahead, for both BTC and Altcoins

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

Bitcoin's Short-Term Range

Ever since breaking into Price Discovery, Bitcoin has had brief bouts of consolidation, enabling money flow into Altcoins.

In recent days however, Bitcoin has produced the longest cluster of sideways price action which has been hugely beneficial to Altcoin valuations.

The range is between ~$87300 (blue) and ~$91000 (red).

Bitcoin has been consolidating in a sinusoidal fashion between these two key levels and this price behaviour will continue, especially if this latest Daily Candle continues to demonstrate resistance-rejecting.

In fact, this is the fourth day in a row that BTC has been rejecting from the range resistance here and it is clear that continued rejection could send price a little lower inside the current range and that a Daily Close above the red resistance is needed to set price up for a breakout into new All Time Highs.

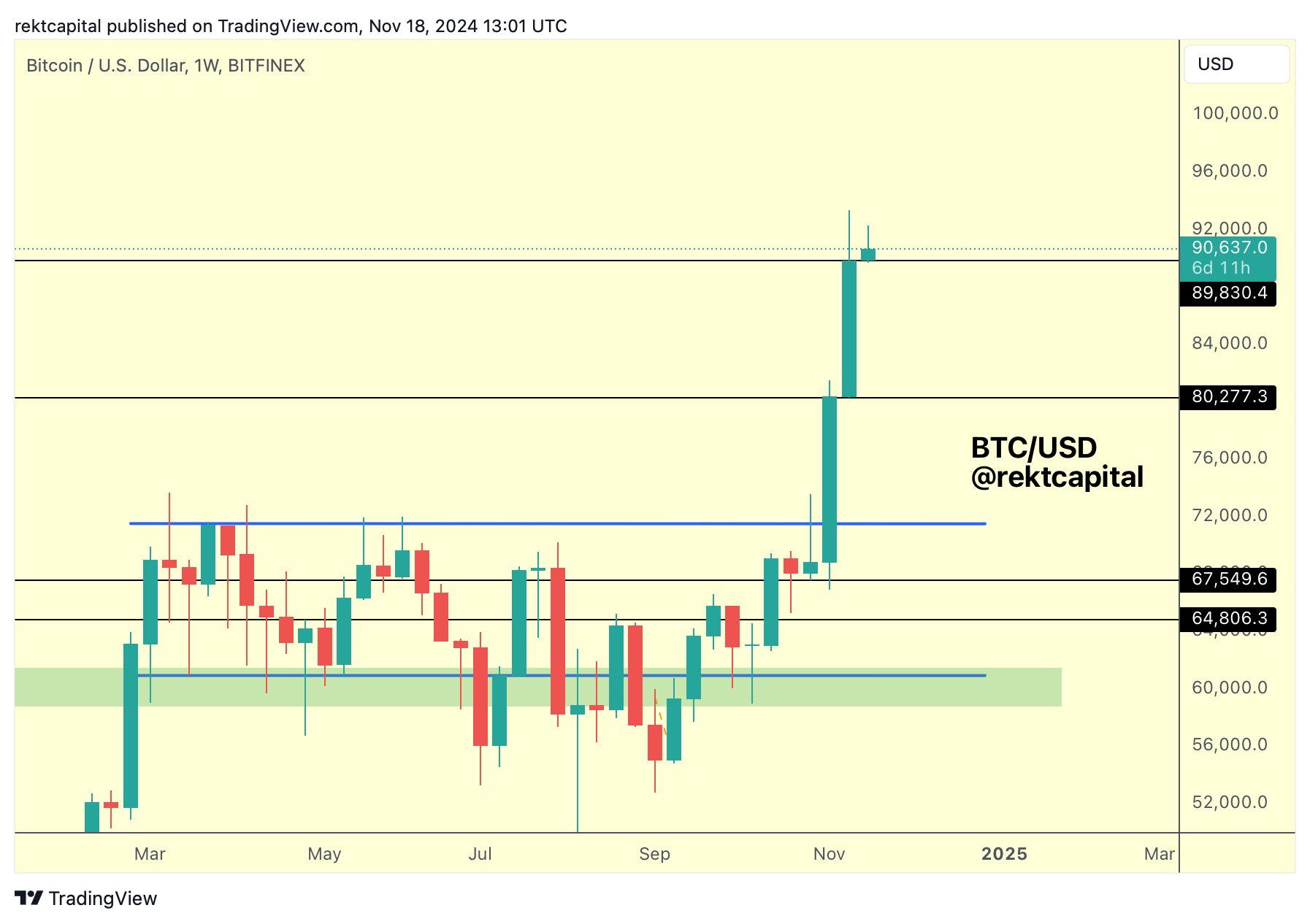

But short-term view aside, it's always important to map out Weekly levels as BTC ascends into Price Discovery.

New Weekly Levels & CME Gap

Here they are:

There is the ~$89800 level which is approximately confluent with the Daily Range Low and there is also the ~$80200 level which is approximately confluent with the CME Gap that was formed on this ascent to Price Discovery.

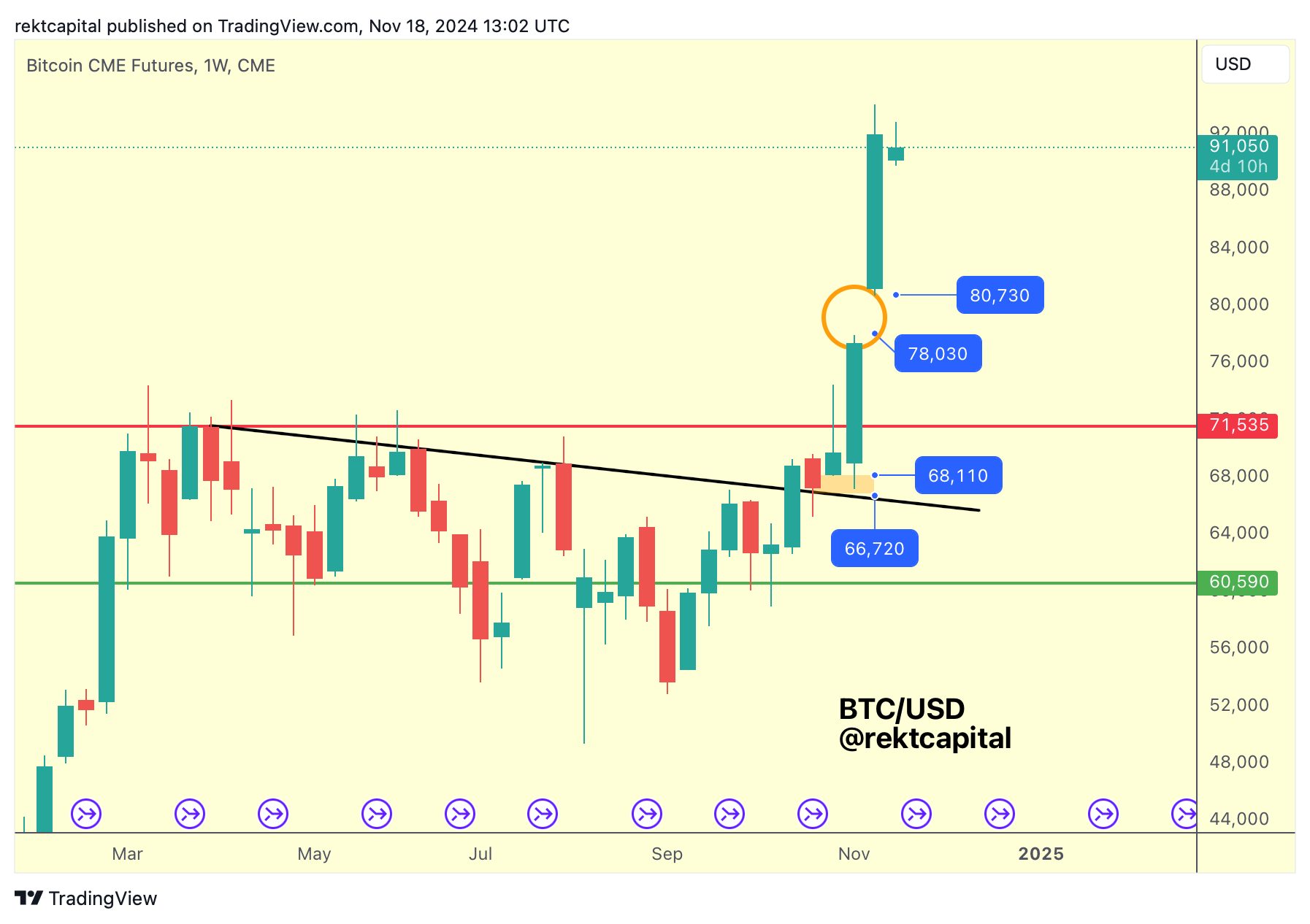

The CME Gap is located between $78000 and $80700 (orange circle).

And while the past 8-month of price action within the ReAccumulation Range from $60600-$71500 saw all CME Gaps which formed get filled, BTC filling in Price Discovery is a bit of a different beast.

That is, it is easier to fill CME Gaps in a sideways range rather than in a Price Discovery uptrend which has no resistance blocking the ascent to new All Time Highs.

Therefore it's worth noting there is a CME Gap but the probability of filling it is much lower than when BTC was moving sideways between $60k and $70k.

In fact, depending on when the first Price Discovery Correction occurs, that CME Gap may get filled only in the Bear Market in 2026.

But the Price Discovery Correction isn't due for another few weeks, as per history, which means that BTC could still continue it upside or at the very least move sideways for a few more weeks.