Bitcoin - Parabolic Phase Coming Soon?

Will Bitcoin breakout soon?

Welcome to the Rekt Capital newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

The Re-Accumulation Range

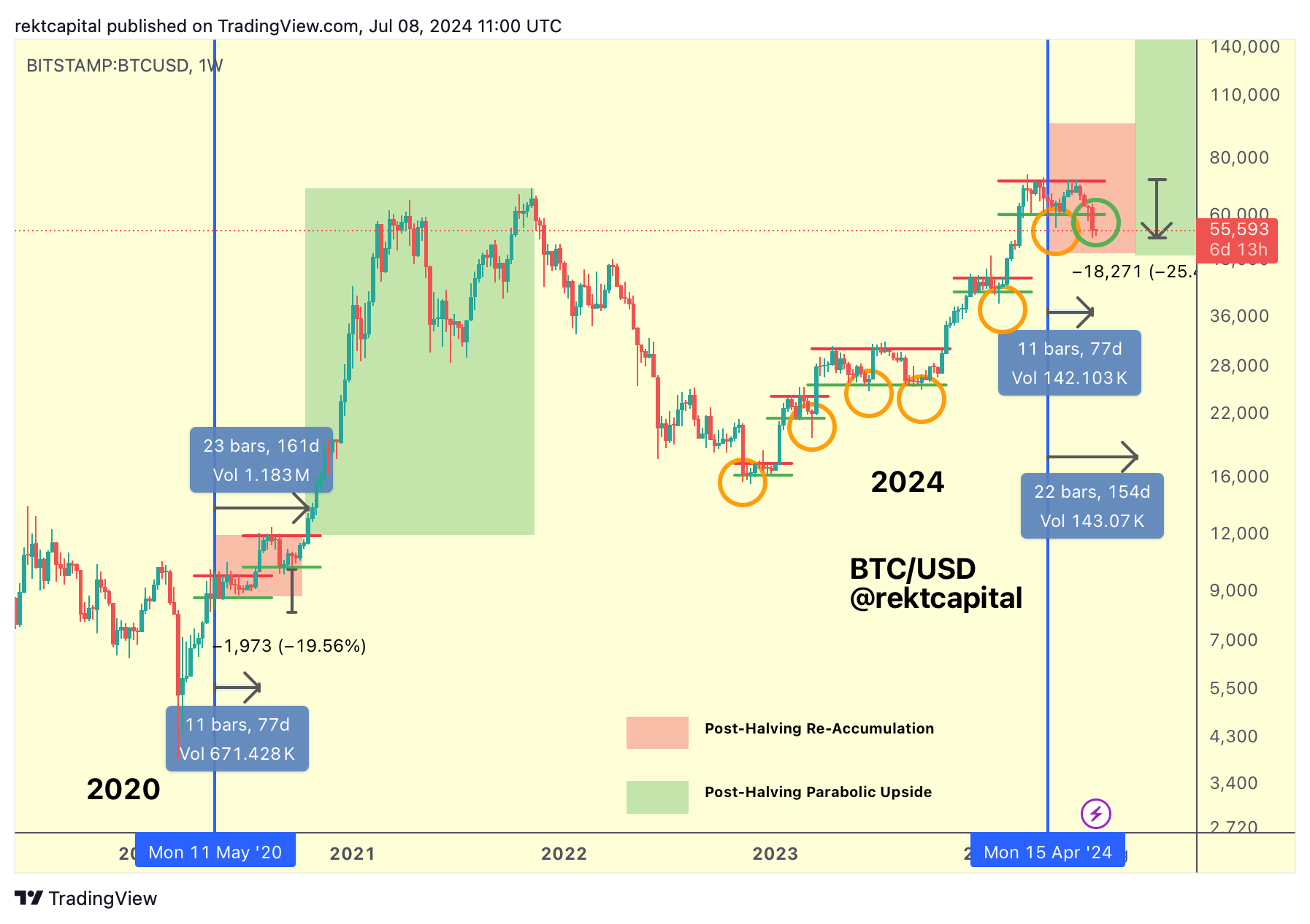

Over the past few weeks, we spoke about how downside deviations below the Range Low of the Post-Halving Re-Accumulation Range tend to signal bargain-buying opportunities:

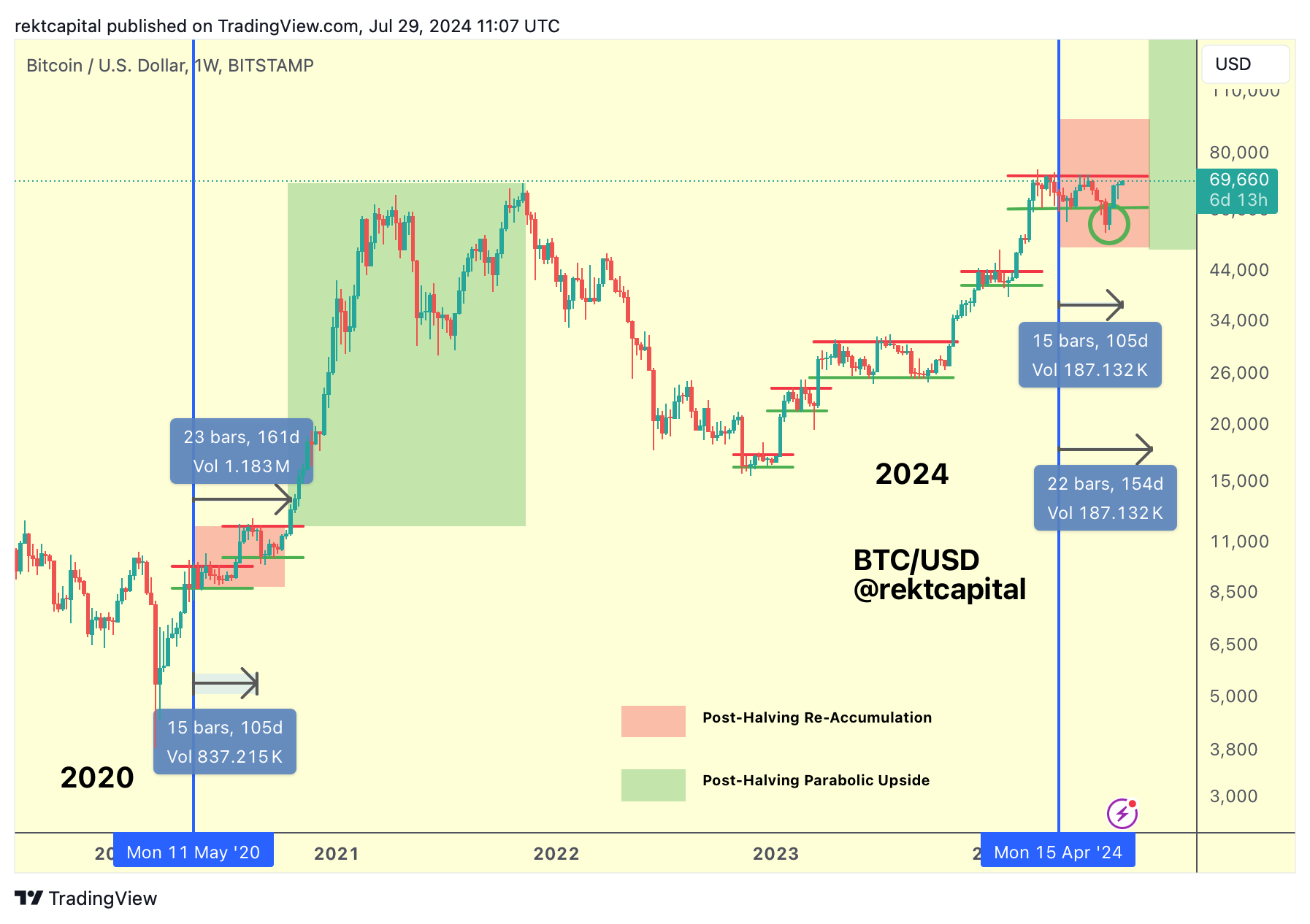

Here is today's chart:

History doesn't always have to repeat itself in picture-perfect manner but history does tend to rhyme and we've seen in recent weeks yet again that price deviations below the Range Low tend to precede moves back to the Range High, over time.

As of this writing, Bitcoin has revisited the Range High resistance.

Every time BTC would revisit this Range High, it would upside wick beyond it on many occasions before rejecting back down into the Range Low (downside deviating below the Range Low) before resuming the process of consolidation from Range Low to Range High to Range Low to Range High etc.

So it's clear - for Bitcoin to breakout from this ReAccumulation Range, it will need to register a Weekly Close above the Range High resistance, preferably followed by a retest of said level into new support to springboard price to new All Time Highs and beyond.

There's a very distinct psychology that occurs when price is at the Range Low and the Range Highs.

When price is at the Range Lows, investors tend to experience pessimism, extreme fear, avoidance, loss aversion, and crucially - aversion to opportunity, avoidance of opportunity.

When price is at the Range High, the opposite is true - investors tend to experience euphoria, extreme greed, overconfidence and overoptimism.

One day, Bitcoin will breakout from this Re-Accumulation Range.

But history suggests we may need to wait for that

Why?

Back in May when price was at the Range High, I shared a tweet stating that history suggests BTC wouldn't be ready to breakout:

#BTC

— Rekt Capital (@rektcapital) May 21, 2024

A Weekly Candle Close above ~$71500 would probably kickstart the breakout from the Re-Accumulation Range

However, history suggests Bitcoin should consolidate inside this Re-Accumulation Range for several weeks more

Extended consolidation here would get Bitcoin closer to… pic.twitter.com/Af0W4MMBTN

And I reiterated this point in early June:

#BTC

— Rekt Capital (@rektcapital) June 4, 2024

Bitcoin is right back at the Range High of the ReAccumulation Range and the outlook remains the same

Bitcoin is just one Weekly Close above the Range High away from entering the Parabolic Phase of the cycle

However, history suggests BTC may not be able to achieve this… https://t.co/Jw7FcQuPSo pic.twitter.com/Zx3W0fAYXR

Those were the last times Bitcoin had revisited the Range High for a potential breakout.

And Bitcoin happens to be back here, at the Range High, right now, with BTC being only 105 days after the Halving.

Historically, BTC tends to breakout from this ReAccumulation Range some 150-160 days after the Halving, which would essentially suggest that BTC needs to consolidate for another 50-days at least, if things are to repeat perfectly.

That could mean BTC would only be ready for a September 2024 breakout.