Bitcoin - On The Cusp Of A New Uptrend?

What to look out for going forward

Announcement - Easter Holiday Content Schedule

With the Easter holiday period just around the corner, I’d like to briefly talk about how this will affect content on the Rekt Capital Newsletter.

Here is the Easter Holiday schedule:

- Friday 18th of April, 2025 = No Coverage (Good Friday)

- Monday 21st of April, 2025 = No Coverage (Easter Monday)

- Wednesday 23rd of April, 2025 = Everything goes back to normal

Therefore please be advised that there will be no newsletter coverage on the 18.04 and 21.04.

Wishing you a restful, peaceful Holiday season

~ Rekt Capital

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

Historical Daily RSI Tendencies

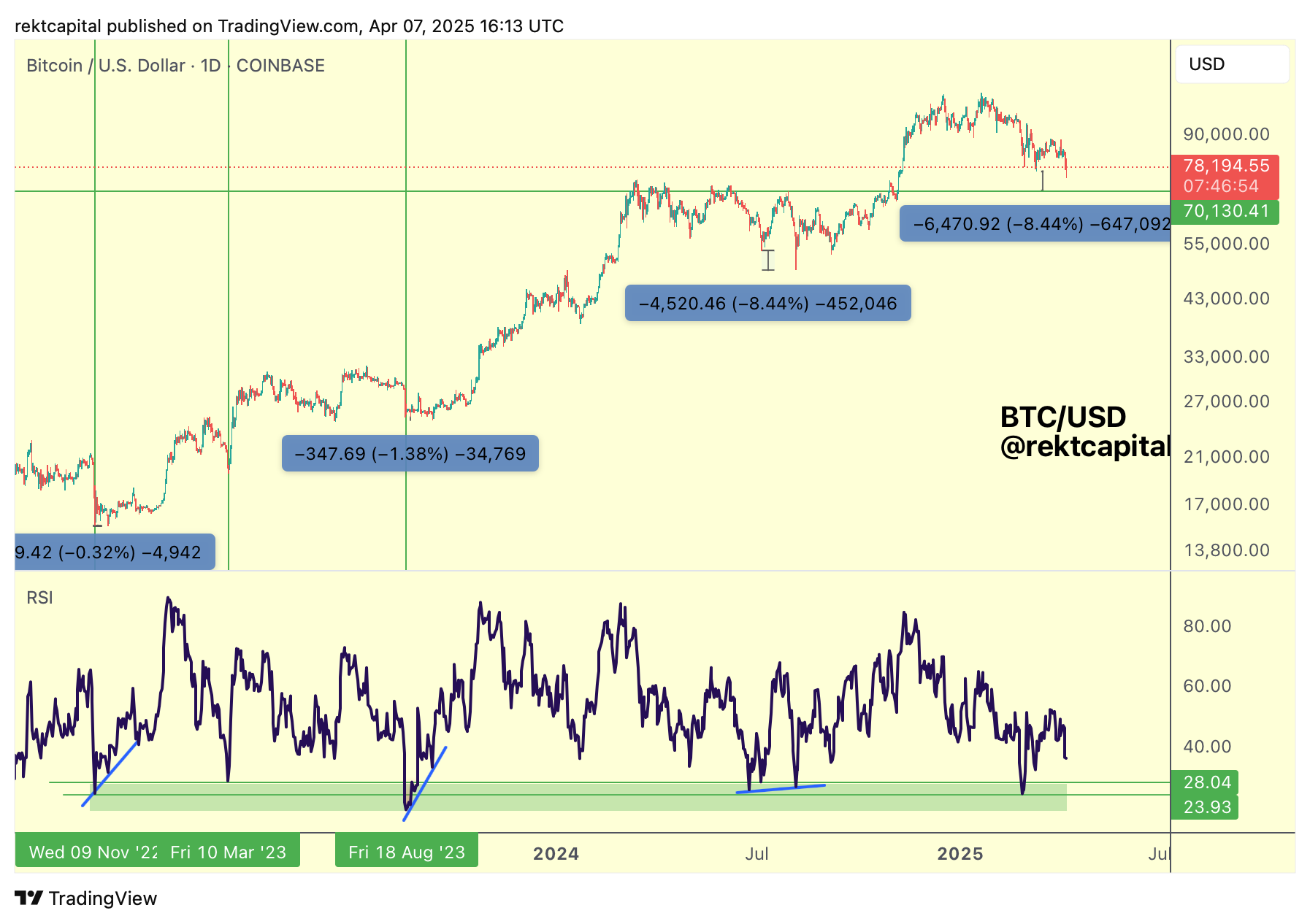

Last week, we looked at historical Daily RSI tendencies and the Bullish Divergences generated by them to deduce generational bottoms:

Across time, while the RSI would form Higher Lows, the difference between Price in forming the Price Lower Lows would range from -0.32% to even up to -8.44%.

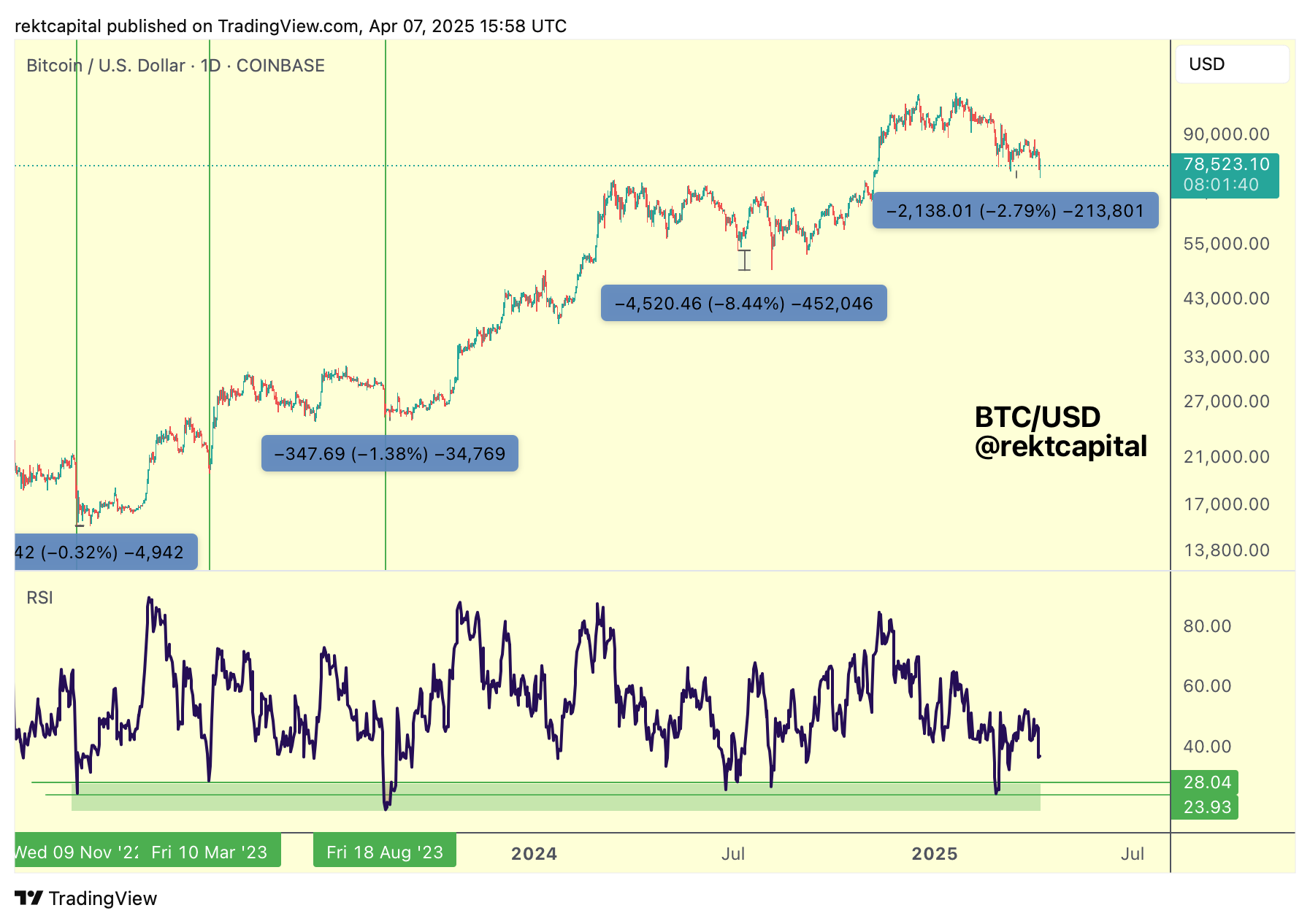

In this cycle, for now it is looking like the price distance was -2.79%:

Because since then and on this recent Bitcoin price rally, BTC appears to have solidified its RSI Higher Low:

Whenever RSI Higher Lows as part of the Bull Divs have formed in this cycle, that would effectively solidify that the price bottom was already in.

Which is why it will be important for Bitcoin to convincingly break beyond its current Price Downtrend as that would transition Bitcoin into a new technical uptrend and most likely ensure that the bottom on this correction is confirmed to be in.

We'll talk about the crucial Downtrends, both Daily and Weekly in just a moment.

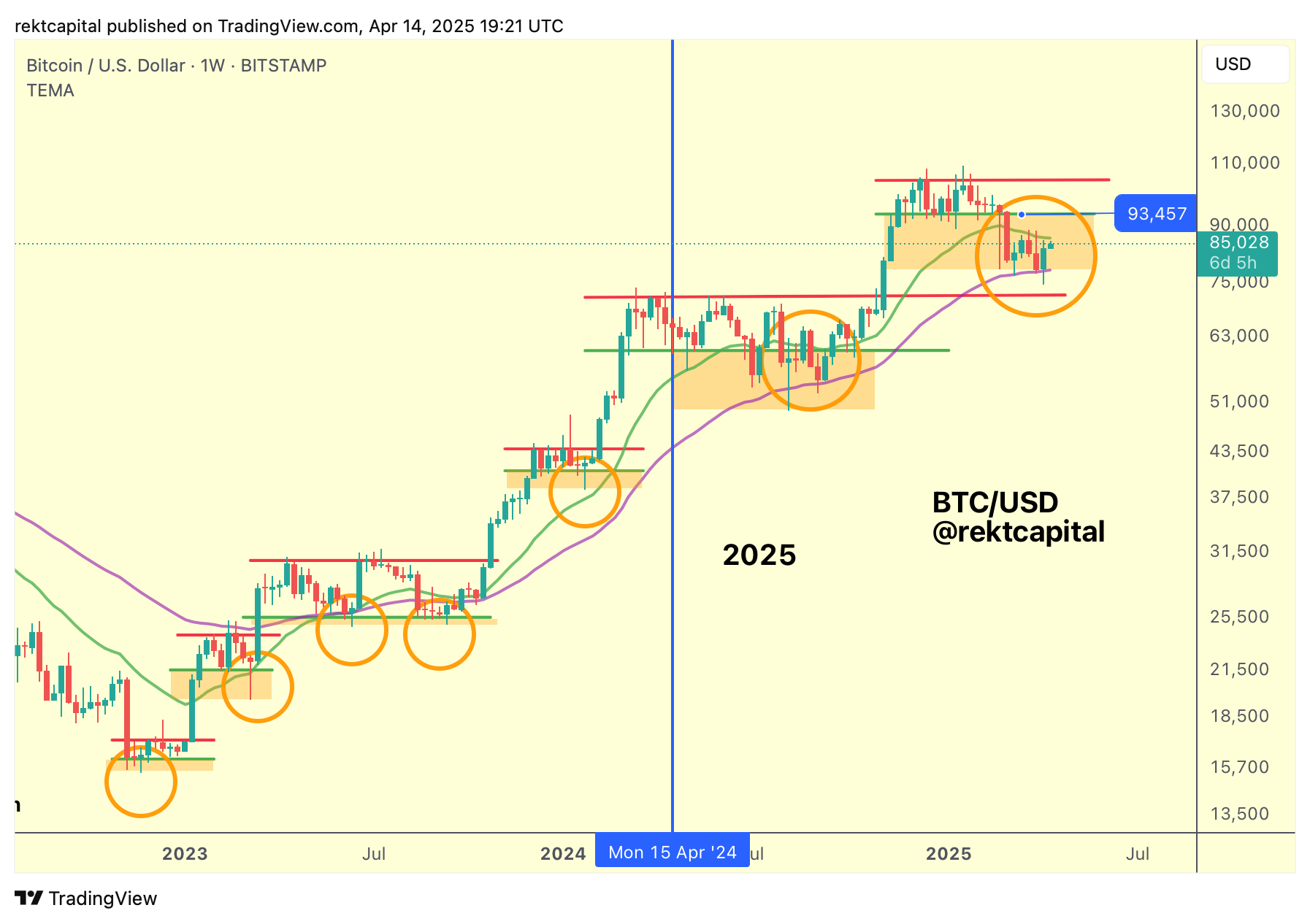

Bull Market EMAs

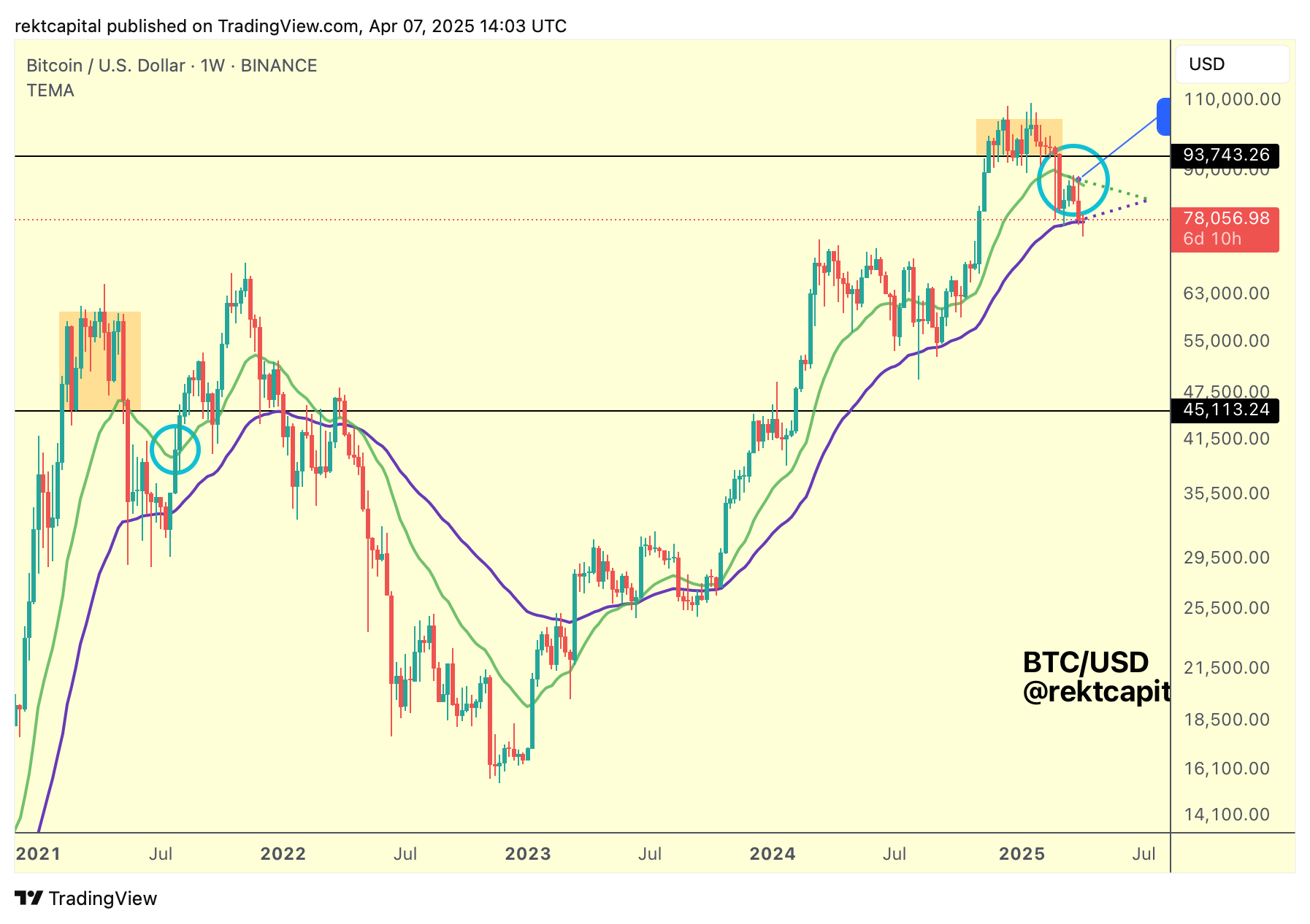

Last week, Bitcoin tested the very bottom of the 50-week EMA as support:

And this week, price is pressing into the green 21-week EMA resistance:

Generally, Bitcoin is consolidating inside the triangular market structure developed by these two Bull Market EMAs.

And the key confirmation signal for a breakout from here would be a Weekly Close above the green 21-week EMA followed by a successful post-breakout retest, much like was the case back in mid-2021 (light blue circle).

The green 21-week EMA now represents the price point of ~$86500 and so this will be the level to break above and reclaim.

Because ultimately, that key breakout beyond the 21-week EMA resistance is what would likely enable price narrow the gap between the all-important $93500 reclaim area:

After all, cycle analysis emphasises that Bitcoin is in a downside deviation moment below the previous ReAccumulation Range and so the Range Low of $93500 will need to be reclaimed in the future for price to resynchronise with the range overall.

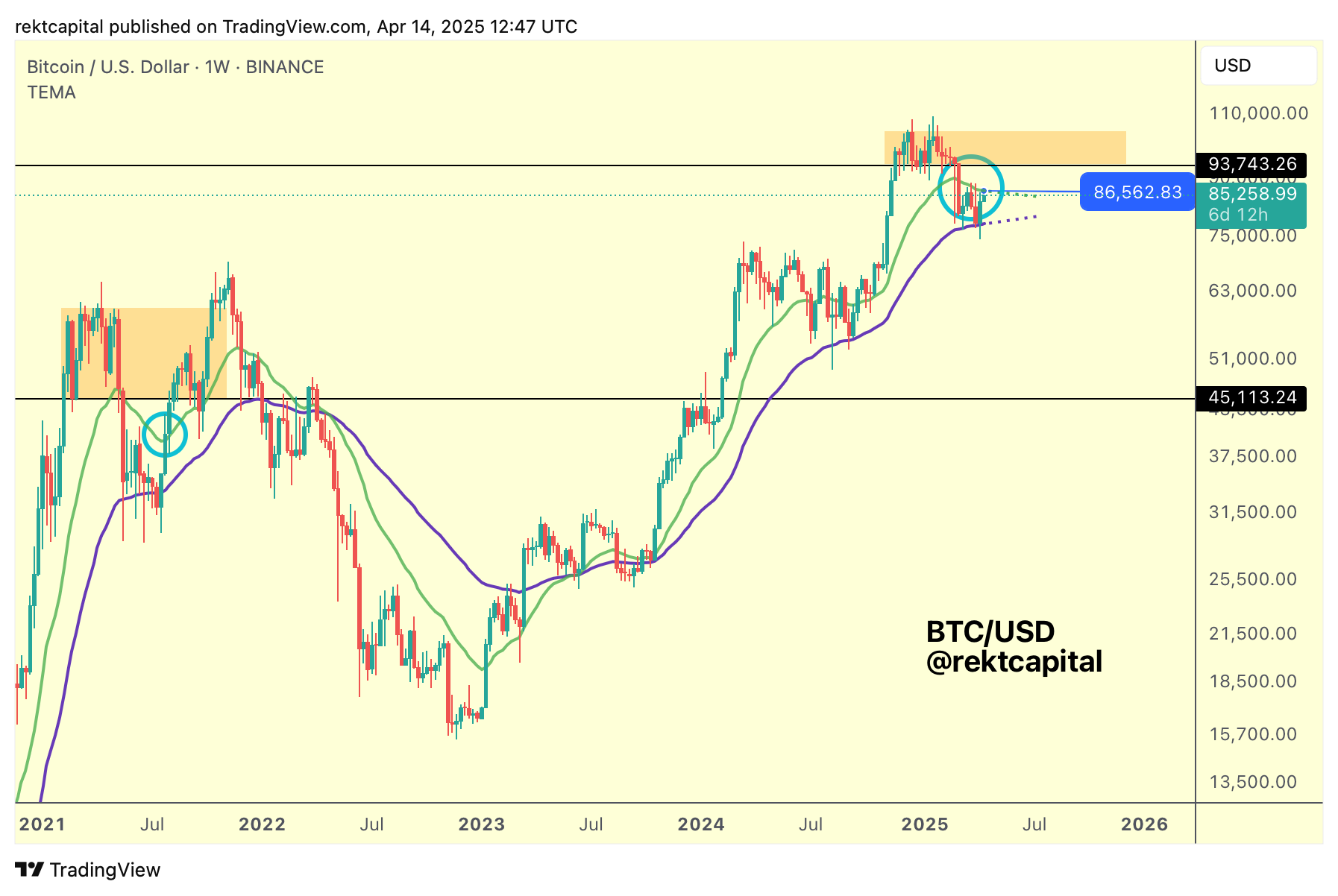

But it is not just the 21-week EMA that is the complication here:

This 21-week EMA also showcases how confluent of a resistance area this currently is.

For one, the 21-week EMA is a resistance here.

Two, there is the Weekly Downtrend (red).

And three, there is the Weekly horizontal resistance from a few weeks back (blue).

Together, this is a confluent triple-resistance area that Bitcoin will need to try to break beyond and stabilise above.

But what if BTC rejects from this triple-resistance?

Then it would be possible for price to drop into the $80,500s seeing as those are the early March lows which acted as support, got lost as support, but were never technically reclaimed as support; price just shot up to the upside passed it, without a reclaim.

Generally, on rejection that $80500 level would make sense, and just below it is the 50-week EMA (purple as well).

In any case, their confirmation is clear: BTC needs to reclaim the triple-resistance as support and a Weekly Close above the 21-week EMA would be the major confirmation signal of a breakout.

Until then, price is at resistance.

And in the meantime, BTC will need to continue to hold its Daily Downtrend as support:

After all, Bitcoin has Daily Closed above the Daily Downtrend and successfully retested it as support for the first time.

This post-breakout retesting of the Downtrend is essential to avoid price playing into a rejection from the Weekly triple-resistance.