Bitcoin - My Perspective

What awaits us in Q2?

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

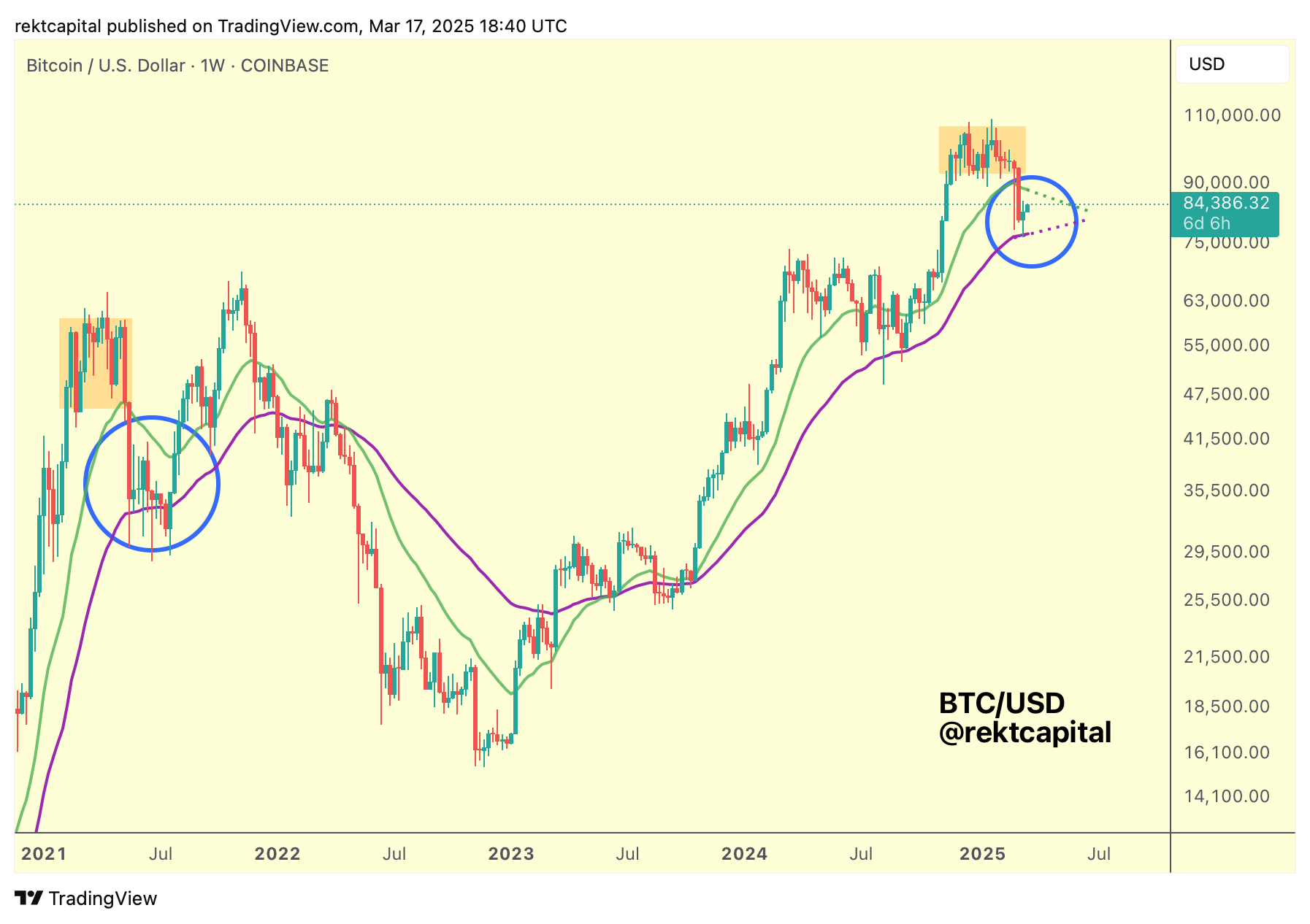

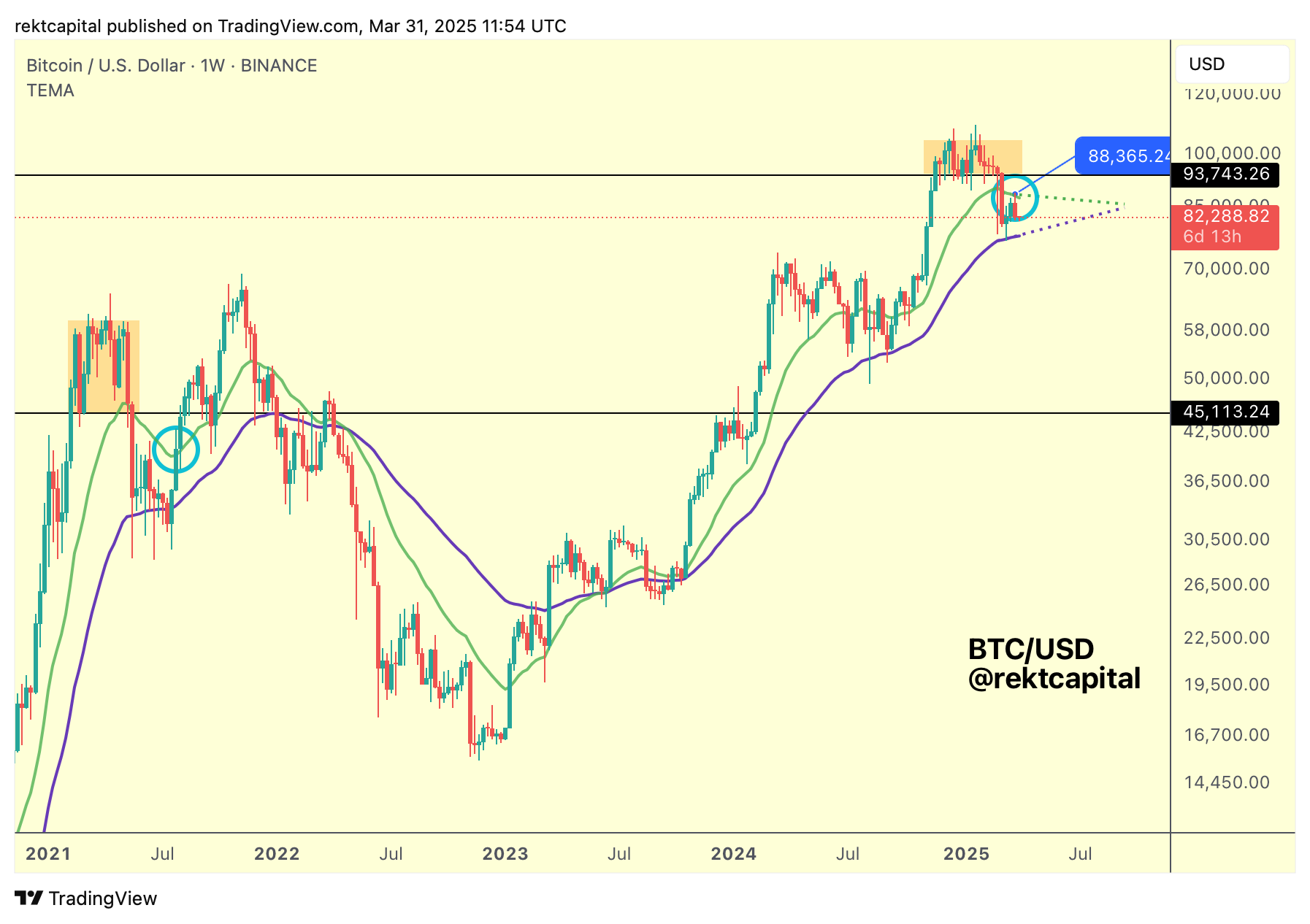

Rejection From The 21-Week EMA

A few weeks ago, I spoke about how Bitcoin was sandwiched between the two Bull Market EMAs (green 21-week and purple 50-week EMAs) , in very similar fashion to mid-2021:

Having rebounded from the purple 50-week EMA, Bitcoin rallied into the green 21-week EMA but rejected from there:

As a result, Bitcoin has failed to confirm a breakout from what is the triangular market structure developed by the two Bull Market EMAs.

In mid-2021, Bitcoin didn't breakout from this similar triangular market structure right away either, upside wicking towards and into the 21-week EMA but ultimately rejecting from there to experience additional consolidation between the two EMAs.

Bitcoin is repeating history in that regard as price has rejected from the 21-week EMA this time and is sentenced to a bit more consolidation between the two EMAs.

However, we know what the Weekly confirmation for a breakout will be: a Weekly Close above the green 21-week EMA followed by a post-breakout retest (light blue circle).

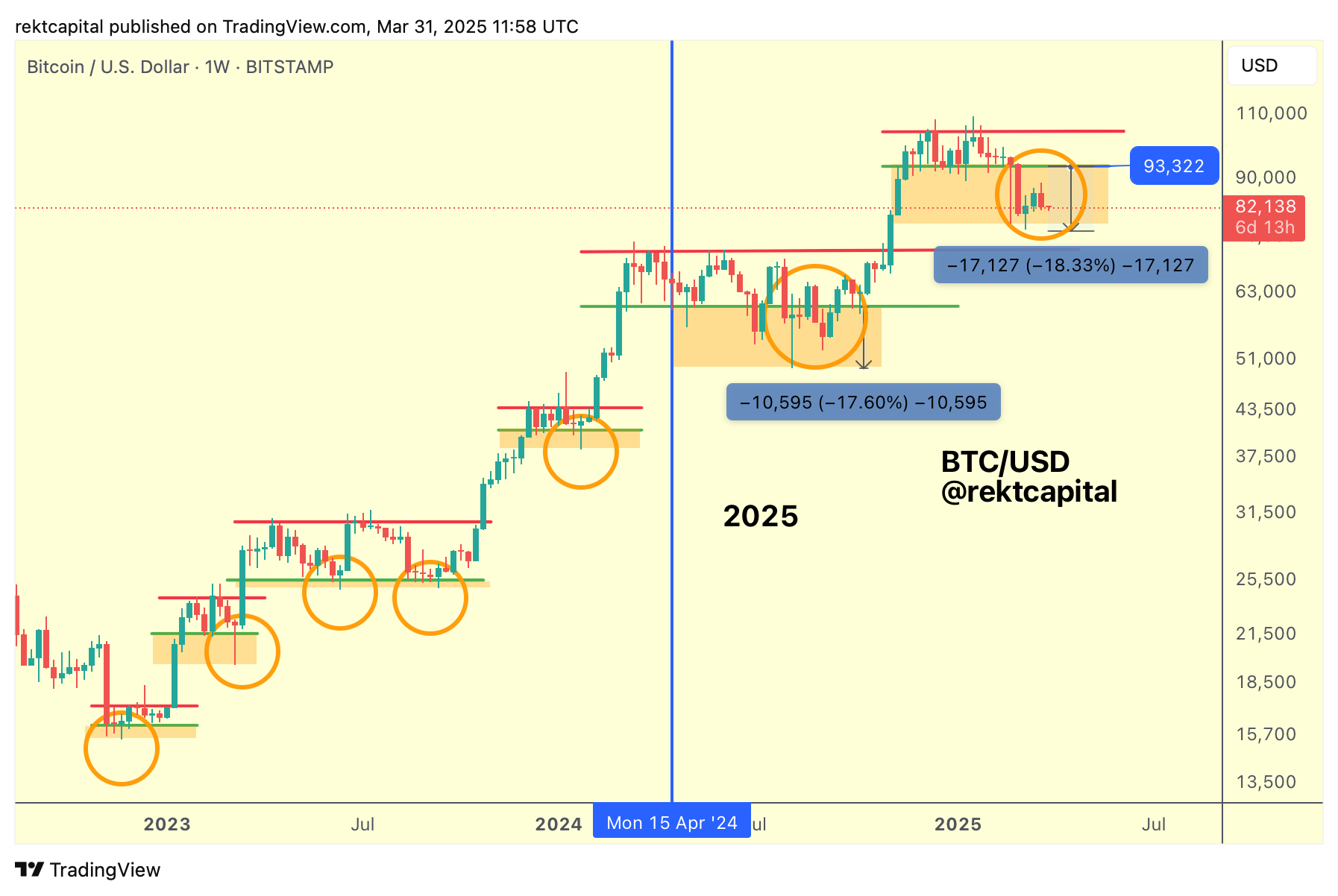

The Downside Deviation

Bitcoin continues to occupy the space of the -18% downside deviation (orange box), clustering below the previous ReAccumulation Range.

Bitcoin developed a similar cluster below the ReAccumulation Range in the Post-Halving period (orange circle) so it'll be interesting to see if this current cluster continues to maintain these highs in an effort to build a base from which price could springboard from to reclaim the ~$93300 Range Low of the previous Range above.

The RSI Downtrend vs Price Downtrend

We know that the Daily RSI broke its Downtrend dating to November 2024.

And right now, the RSI is trying to post-breakout retest its Downtrend into new support.

A successful retest here would be positive because that would demonstrate emerging strength in the market.

Meanwhile, Bitcoin's price action Downtrend has still not been broken so if the RSI Downtrend gets retested, then there's a good chance the price action Downtrend would be able to get broken.

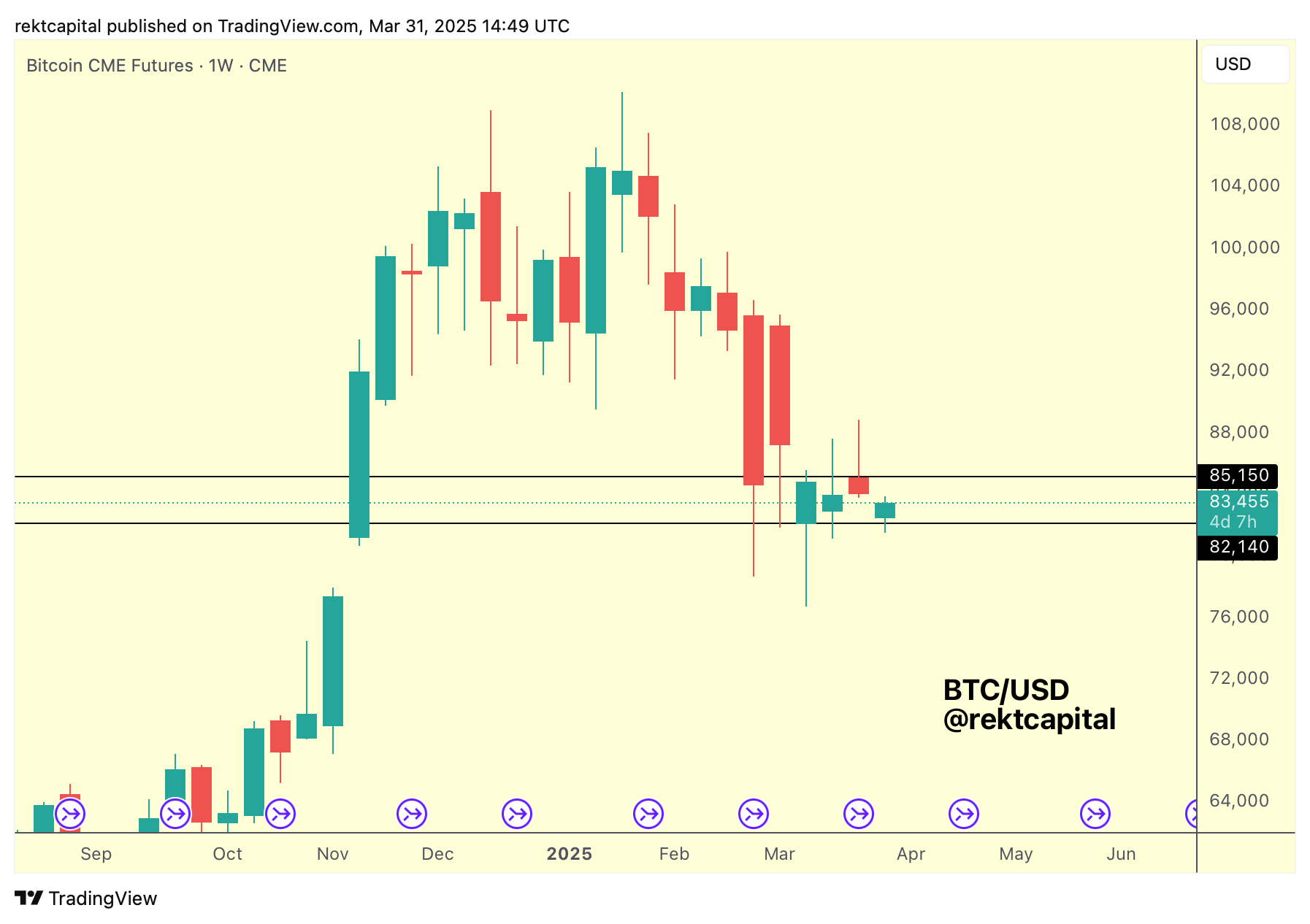

Consolidation Fuelled By CME Gaps

Bitcoin has filled yet another CME Gap but price has also formed a brand new one as well.

At the end of the day, price is located between the $82140 and $85150 (black-black) range, creating and filling CME Gaps at will within this sideways range.

This brand new CME Gap is probably going to get filled, meaning that a move to at least $84k is on the cards in the short-term, but this isn't really a macro-significant move; it's just consolidation within the Weekly range.

In other words, filling the CME Gap will just inspire additional consolidation from the Range Low of $82140 to as high as the $85150 Range High above.

But if price is able to reclaim the $85k Range High, then that will be a more macro-significant move; filling the new CME Gap is effectively an essential requirement for Bitcoin to try to get closer to a potential macro trend shift via range breakout.