Bitcoin - Macro Higher Lows

The big picture

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

Bitcoin - Macro Higher Lows

Bitcoin has endured one of the largest liquidation events in history but still managed to maintain its macro bullish market structure.

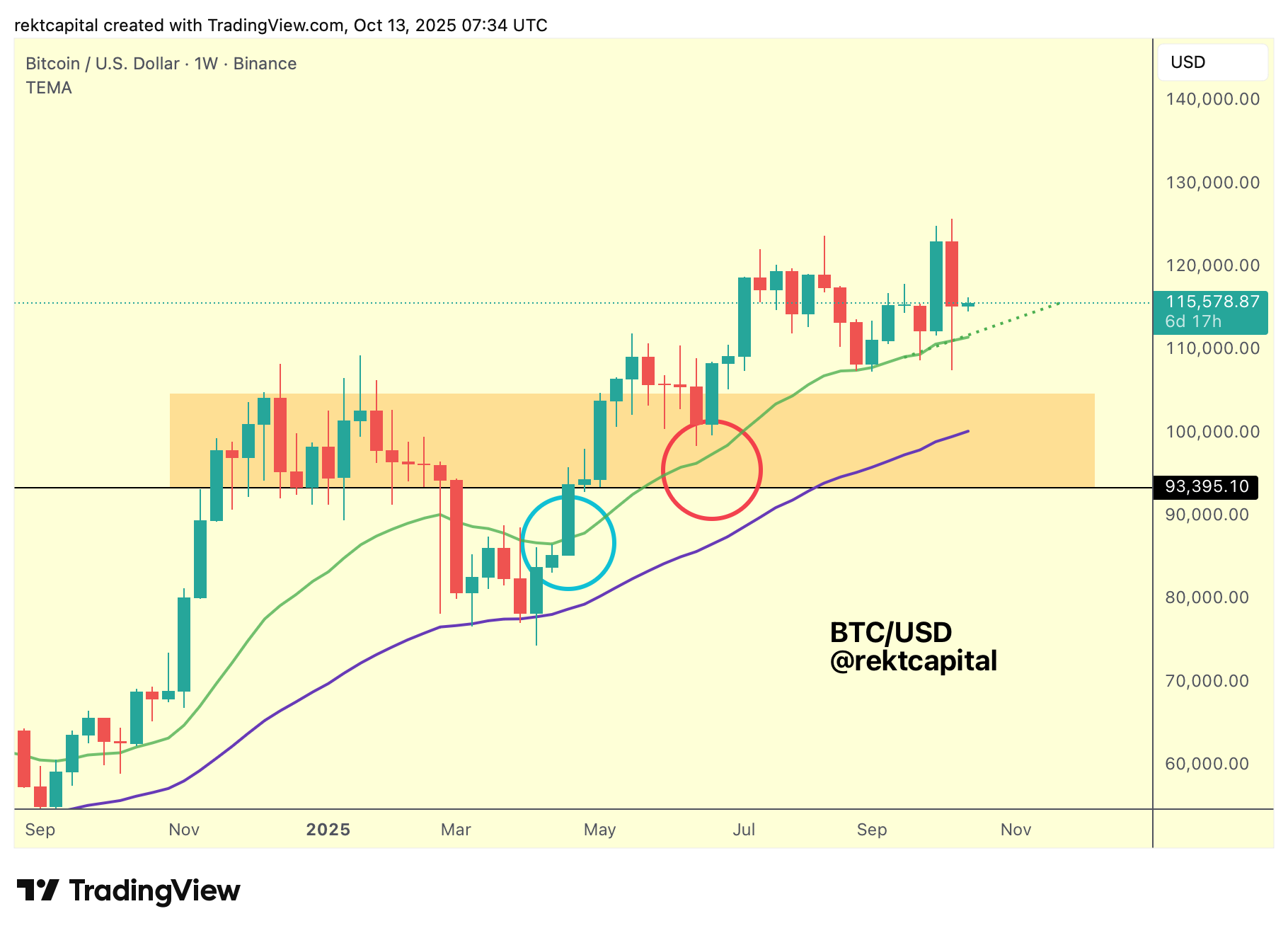

That is, Bitcoin continues to print progressive Higher Lows despite the drastic downside which is a sign of strong continued premium-buying behaviour on price pullbacks.

In fact, Bitcoin has developed a third Higher Low at the same exact trendline where price locally bottomed to precede a move into new All Time Highs.

Interestingly enough, this Higher Low is an approximately confluent with the 21-week EMA (green) which has continued to support price on pullbacks in recent months:

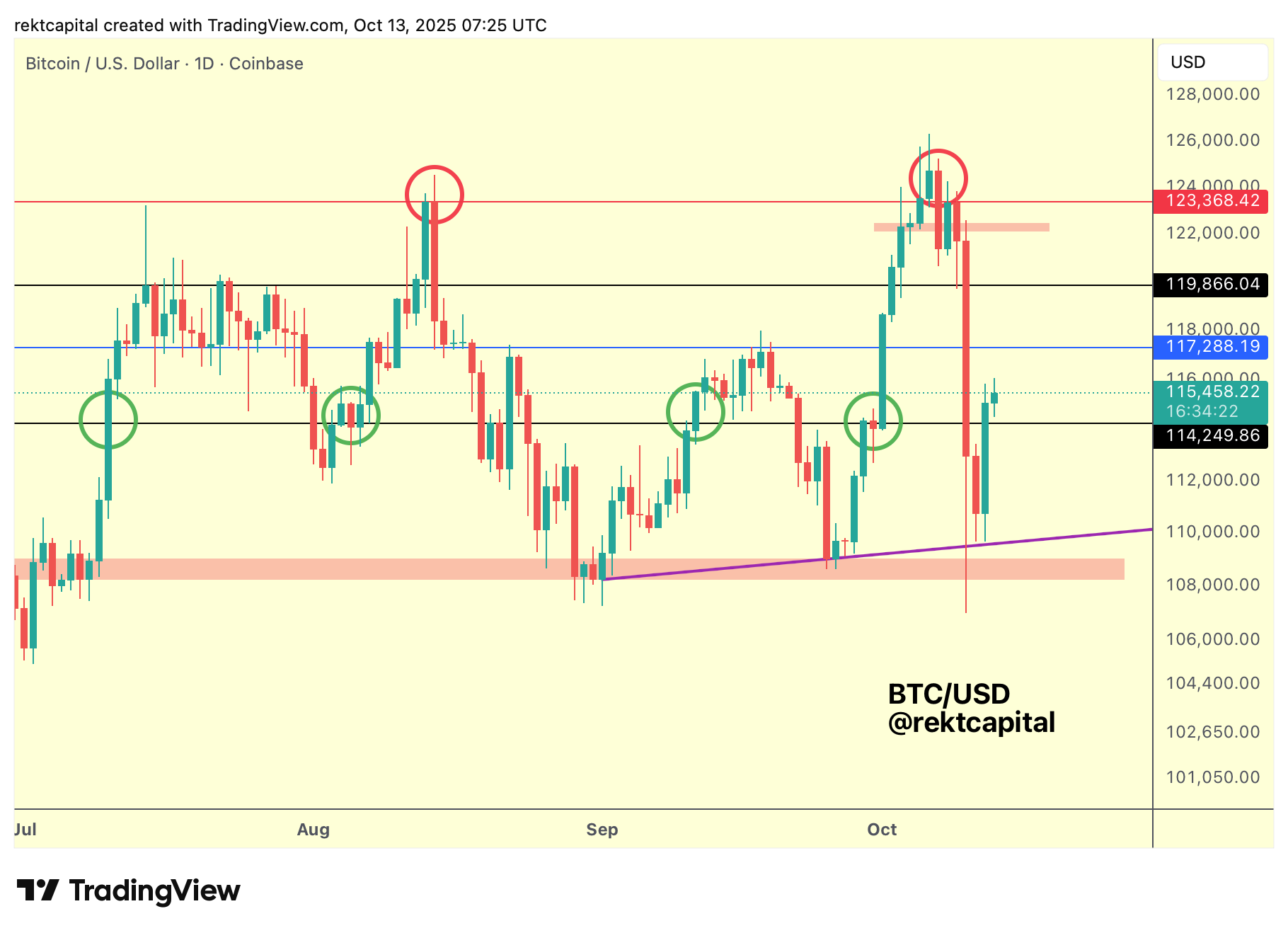

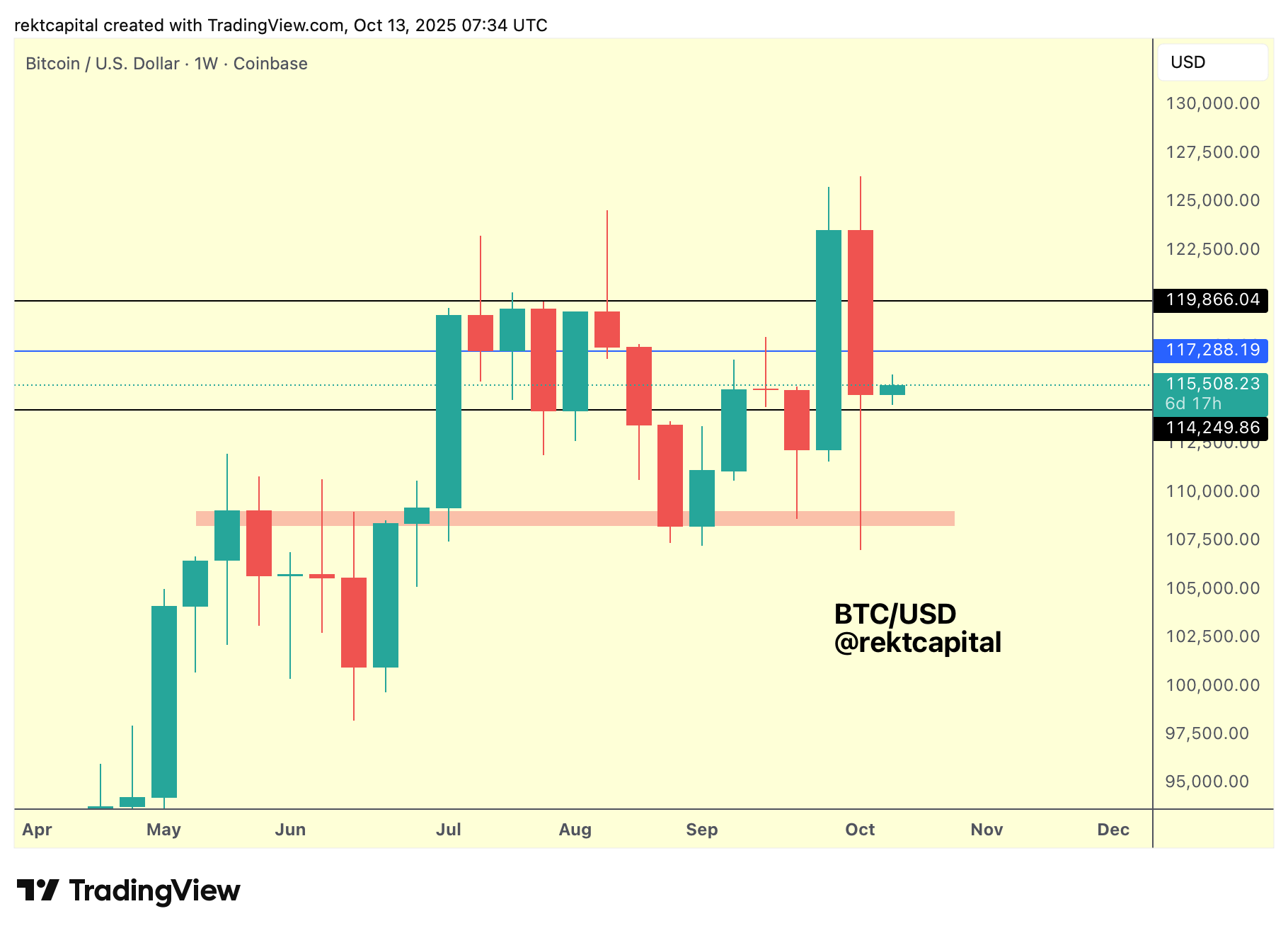

Crucially, Bitcoin’s recent rebound from the 21-week EMA and the formation of yet another Higher Lows has enabled a Weekly Close above ~$114k which has been a pivotal price point for price trends:

Continued stability at ~$114k has historically preceded upside into at least $117.3k.

After all, on the previous 5 occasions that price printed a Daily Closes above $114k (black), Bitcoin was able to rally to at least $117.3k, even if the bounce eventually led to additional downside later on.

This is therefore the 6th time that Bitcoin has Daily Closed above $114k and so price will need to maintain this level to rally to at least $117.3k.

For bullish bias, it’s important $117.3k doesn’t turn into a resistance on this current move and so Bitcoin will need to Daily Close above $117.3k to continue towards $120k over time.

Monthly Timeframe

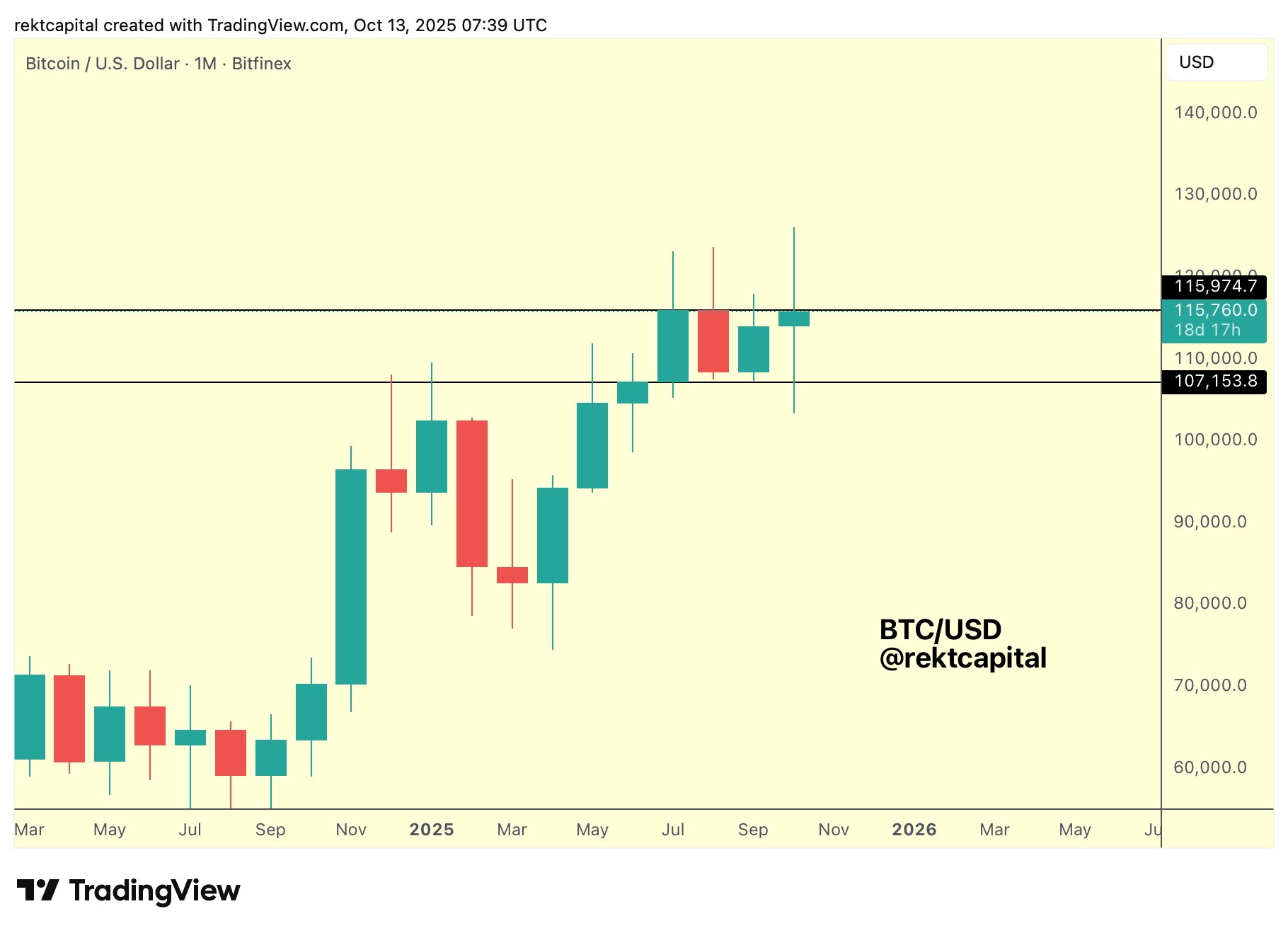

Macro-wise, Bitcoin is simply consolidating inside its $108k-$116k Monthly Range, upside wicking beyond the Range High and downside wicking below the Range Low.

The fact that price has downside wicked below the Range Low is a positive aspect to price as it signifies a liquidity grab a lower price levels that could add the necesssry fuel to attempt a Macro Range breakout.

As a matter of fact, Bitcoin has been upside wicking beyond the $116k Range High far more frequently in recent months compared to the downside wicking below the $108k Range Low which is a testament to the Range Low’s role as a stable higher timeframe support.

In saying that, it was inevitable Bitcoin would finally produce a downside wick below the Range Low as price hadn’t experience such downside volatility in months; the past three month’s worth of downside wicks have actually been vastly shorter compared to the downside wicks of the past 12-15 months, a tell-tale sign we described a few weeks ago.