Bitcoin - Is The Bearish Thesis Over?

Is there scope for downside or will Bitcoin simply break to new highs?

Welcome to the Rekt Capital newsletter, a place for people who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

Monthly & Weekly Timeframe Analysis

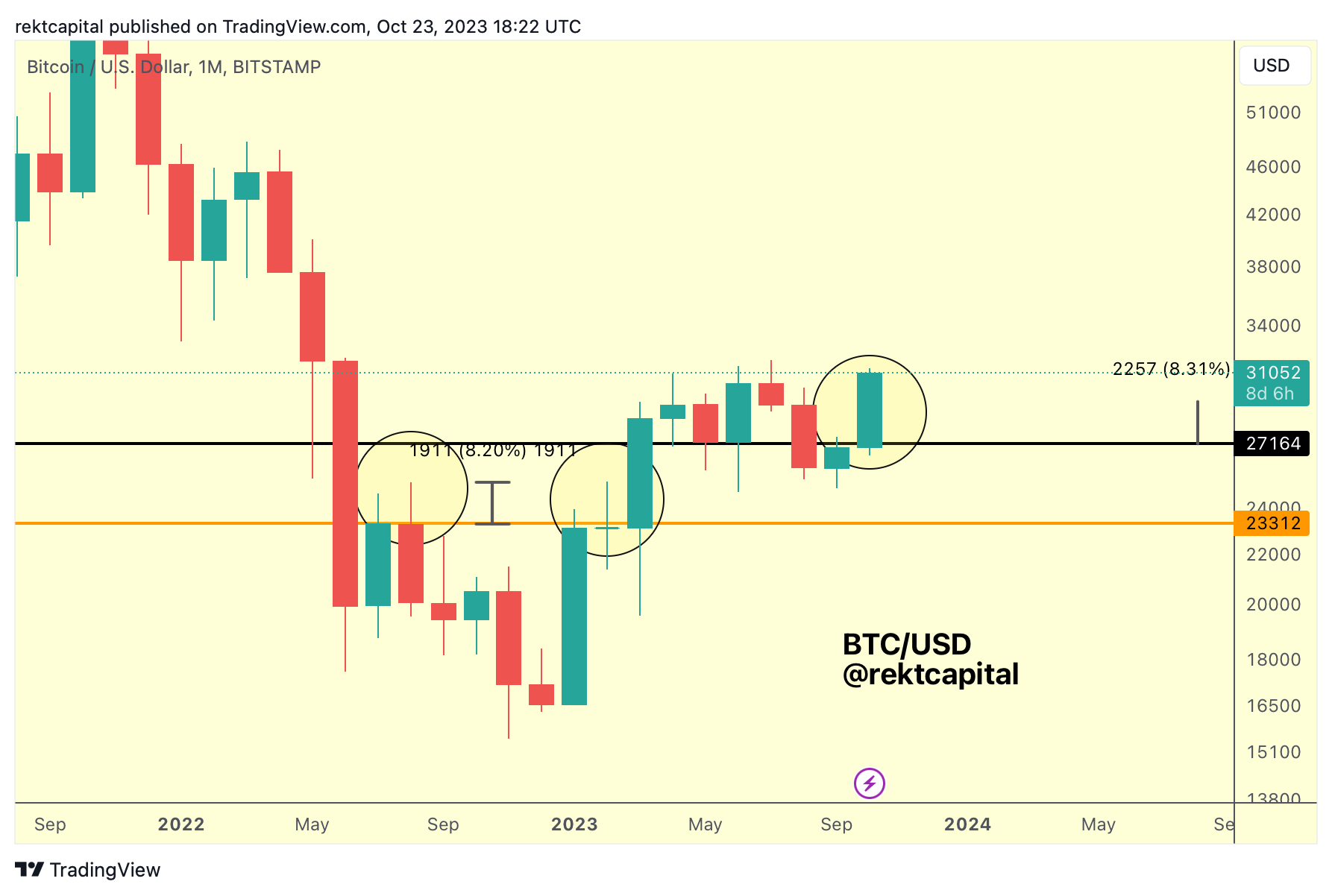

In recent weeks, we discussed the possibility for an upside wick in the month of October, much like we'd seen later in 2022 and earlier this 2023.

Of course, Bitcoin has outperformed and in all likelihood sealed the fate of the October Monthly Candle with a full-bodied candle.

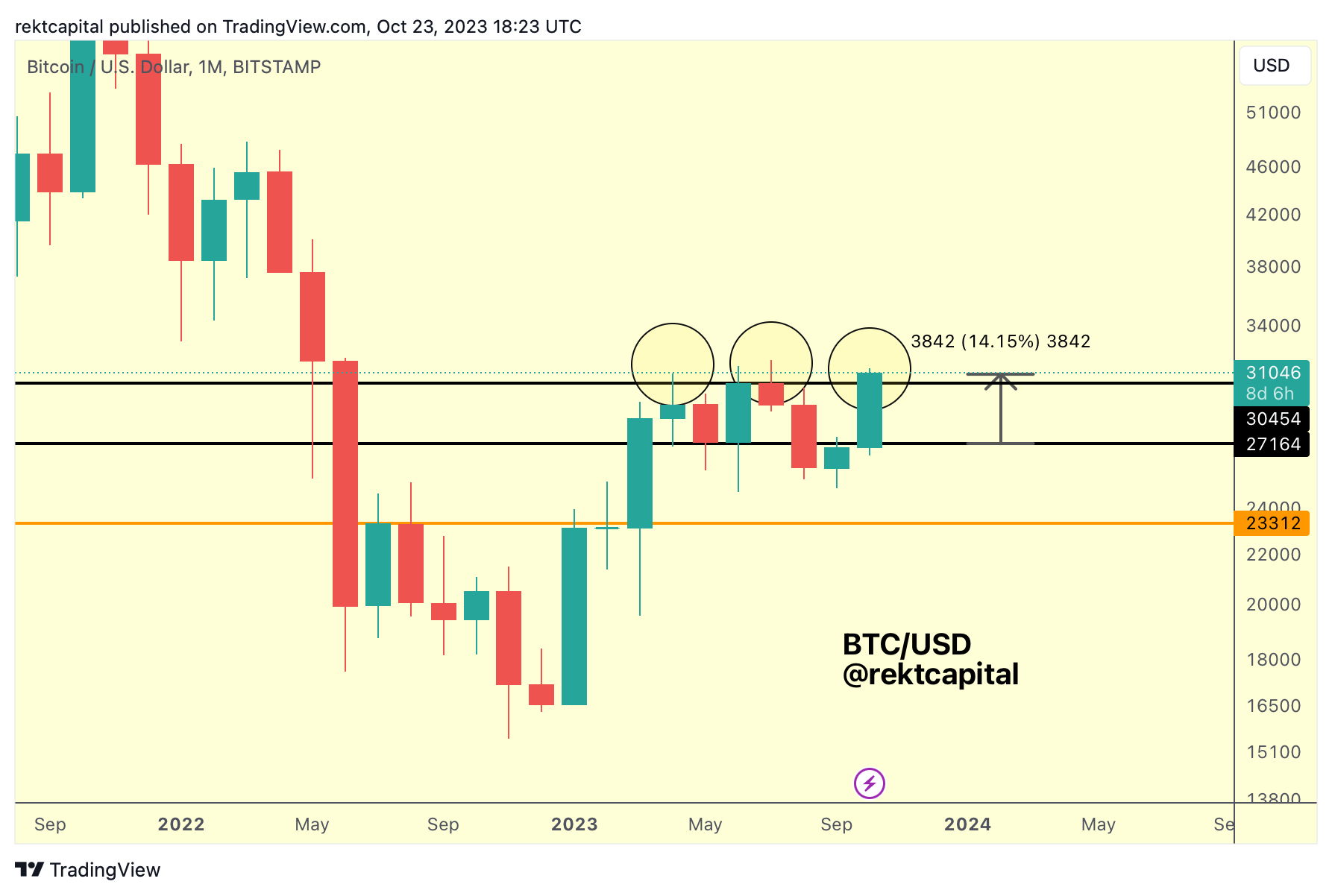

In fact, Bitcoin is up more than +14% on the month:

But it's clear that a Monthly Range may be forming also: ~$27150 to ~$30450.

Upside wicks have happened on the Monthly timeframe a few times before which is why going into the end of the month, it'll be very important whether these FOMO wicks form or not.

Monthly Close beyond the black Range High would be crucial but that just by itself would not guarantee upside; the Range High would need to also be flipped into support as well.

The Weekly timeframe also showcases a Range:

Of course, on the Weekly timeframe the range looks different: $25880-$30630 (green-red).

However the principle remains the same: it's important to be watching out for upside wicks beyond the Range High resistance.

And on the Weekly, this orange area represents that FOMO wick territory.

In the event that BTC isn't able to Weekly Close above the red Range High and/or reclaim it as support, price could drop into the Lower High resistance for a retest attempt.

After all, this Lower High was the reference point for the trend that has since developed in last week's Monday edition.

But this Lower High isn't a macro-trend-shifter.

Because it is the current Range that is the main playground for price right now; the Lower High breach just means that price can continue higher within this range.

But if price cannot break the Range High resistance, then BTC may have to reverse again and drop a bit lower within the range.

Which is where that potential retest point comes in:

If that retest is successful then price would probably reverse back into the Range High again.

If the retest actually fails, then BTC would have the new Higher Low to rely on for support.

And if that fails then there's the Range Low (green).

Generally, BTC is still in macro consolidation mode and this makes sense based on where we are in the market cycle and based on how BTC has behaved at this point in the cycle in the past.