Bitcoin - Is It All Over, So Soon?

How to think about this pullback

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

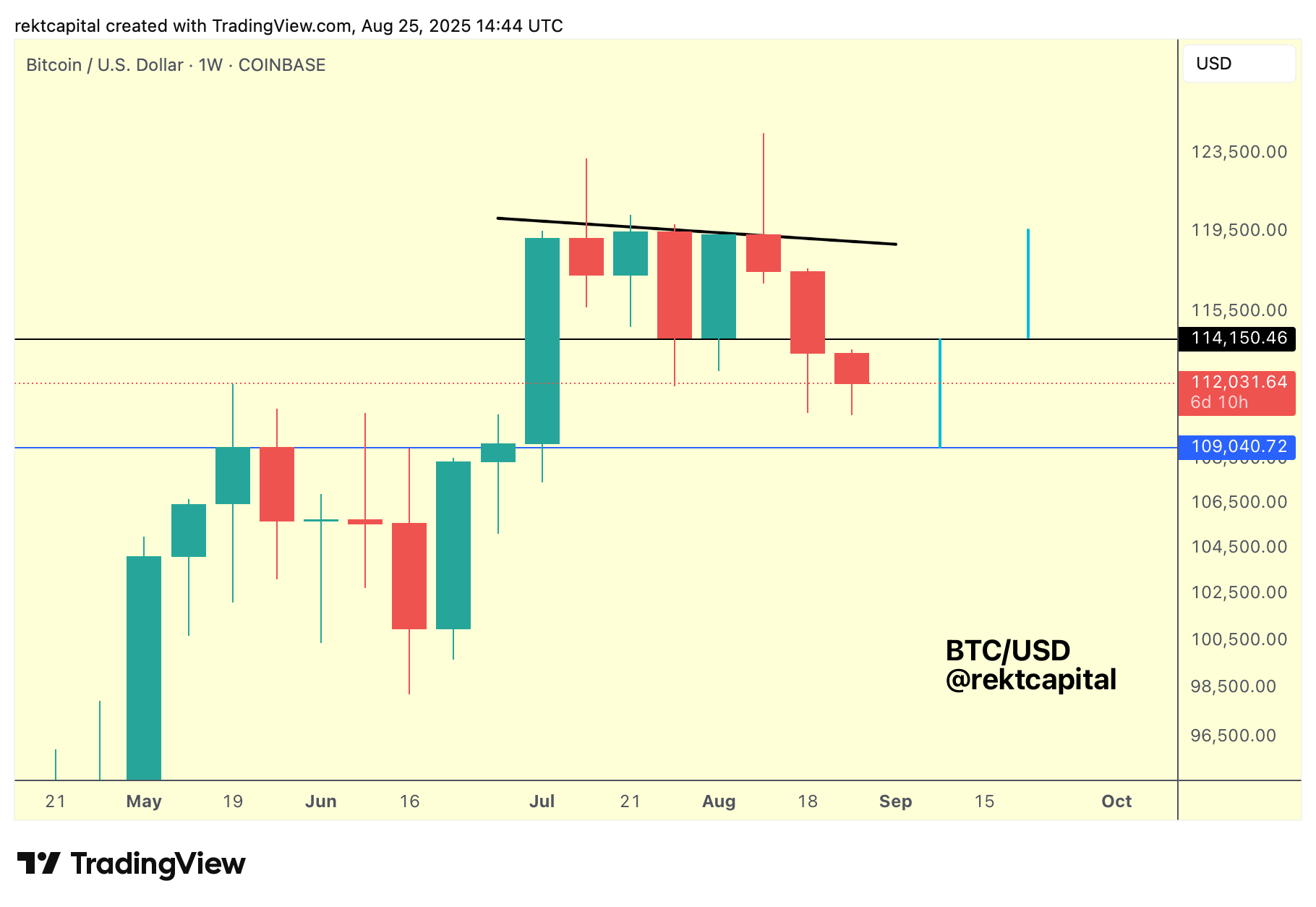

Macro Range Breakdown?

Last week, we looked at how Bitcoin could be developing a new bearish trend reversal formation in the guise of a Double Top hybrid; not your classical M-Shaped-looking Double Top, but one at a Lower High resistance.

The Measured Move for a Double Top was applied last week (light blue vertical line) and here's today's update:

Bitcoin has performed the majority of that Measured Move already, getting very close to $109k by tagging $110.5k.

But the more important technical development is that price has Weekly Closed below the ~$114k (black) level, which technically represents the validation point for a Measured Move.

Technically, the Double Top-like pattern validates on confirmed breakdown, which then sets off a Measured Move for price, whereas BTC hasn't fully confirmed a breakdown but has already see the Measured Move take place to a great degree.

After all - technical breakdowns come in three stages:

- Weekly Close below the level ($114k, black) which has occurred.

- Bearish retest of said level to turn it from support into resistance (hasn't happened, nor has it been attempted as of this writing).

- Downside continuation following confirmed rejection from the new resistance, confirming the breakdown entirely.

So while BTC has taken an important step in beginning a breakdown from $114k, price hasn't yet fully confirmed that breakdown.

And it's important to emphasise that, especially since this cycle has been a cycle full of downside deviations and false breakdowns.

Turn $114k into resistance however and reject strongly from there however and there would be a very good chance that the Measured Move would play out to full completion.

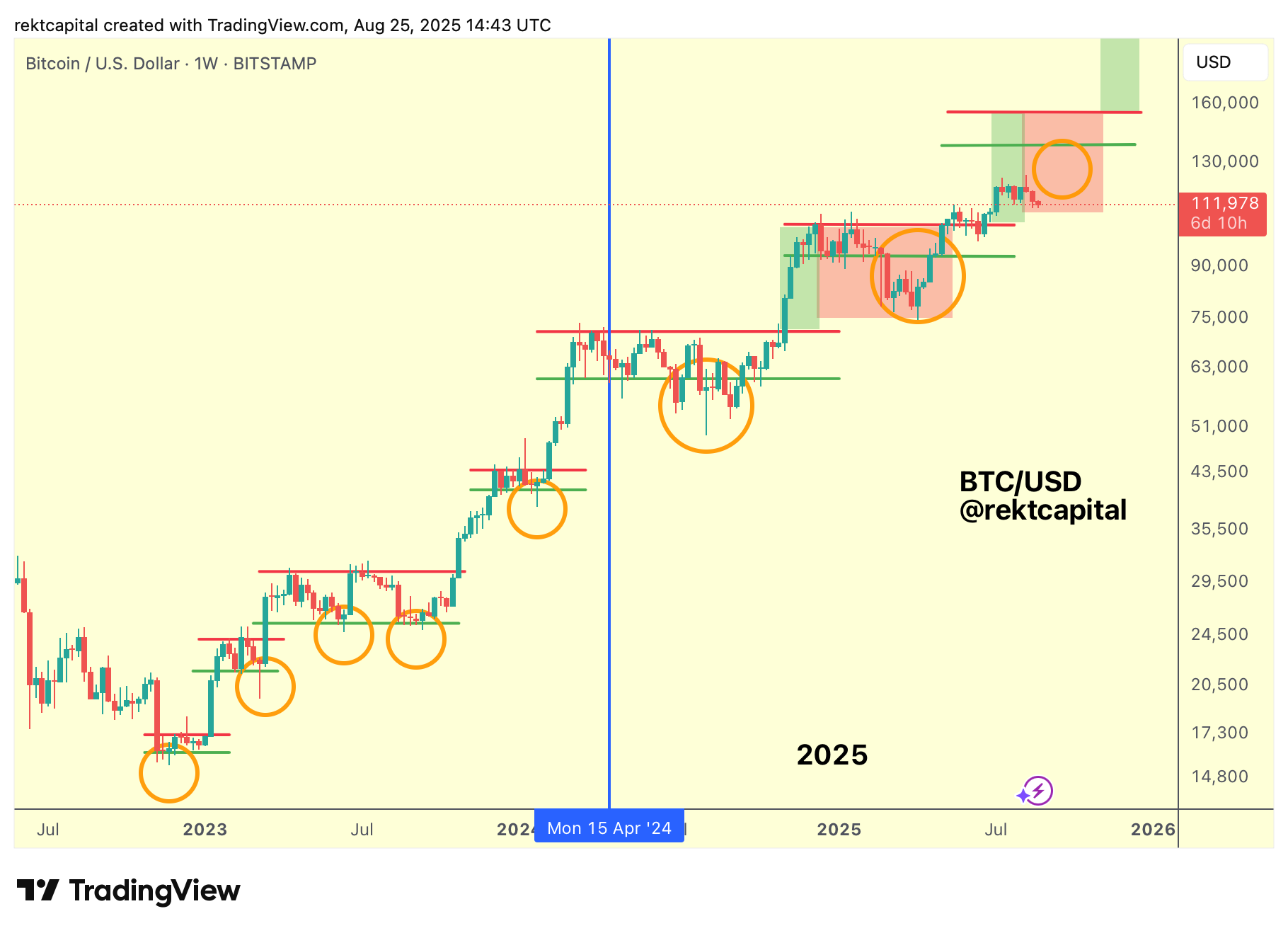

The Bitcoin Roadmap

Historically speaking, Bitcoin Price Discovery Corrections have begun after 5-8 weeks of upside in Price Discovery.

In this phase, Bitcoin produced a Price Discovery Correction in Week 6.5, falling in line with history.

Ever since the local top, BTC has been pulling back and has retraced -11% thus far.

Historical second Price Discovery Corrections have been around -25% deep so of course -11% is still far off the mark in that respect, but the goal of a second Price Discovery Correction is to be shallower and faster in its resolution.

Throughout the cycle, BTC has experienced -32% downside of a couple of occasions, with the general Pre-Halving pullback being on average -22% to -25%.

So if pullbacks are supposed to become shallower and resolve quicker, then that renders a -30% retrace in this phase of the cycle highly unlikely, with -25% probably being the deepest price could go, and -20% being a general "safe average".

However, it if turns out that BTC doesn't even pullback -20%, that would only be a good sign satisfying the historical tendency of shallow pullbacks at this phase in the cycle.

After all, at this same moment in the cycle Bitcoin performed a 3-week pullback that was -25% deep back in 2021 and a -29% pullback that lasted only 1 week in 2017.

In both cases, these pullbacks were shorter and shallower by standards of the previous corrections in the respective cycles.

Thus far, this current pullback is -11% deep and 11 days long, so technically there's still room for both a bit more downside and a bit more time spent in "pullback mode".