Bitcoin - Is $71,000 Possible?

How different is this cycle, really?

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

The Quarterly

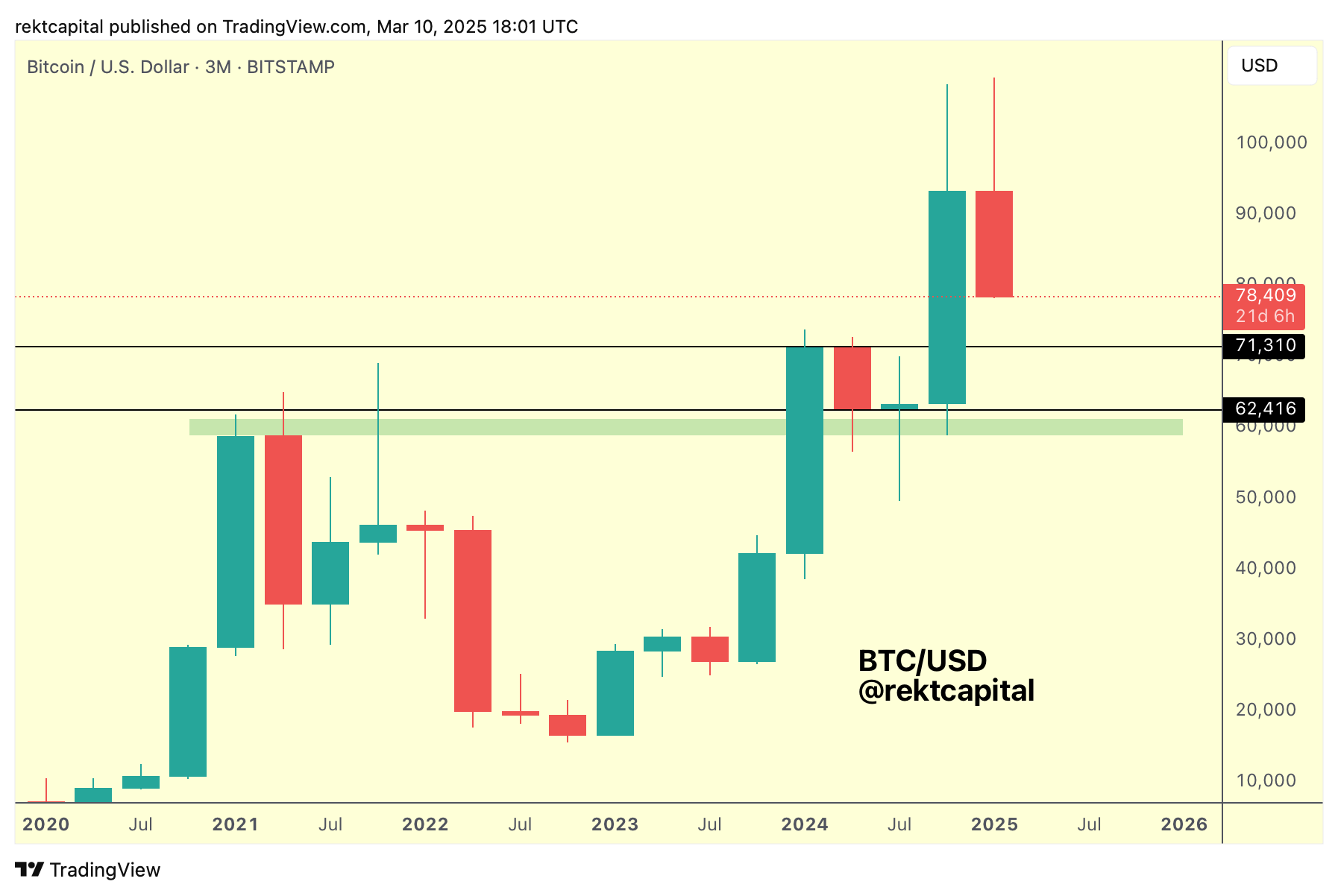

Bitcoin has been retracing all quarter long and has no major support on the Quarterly until the $71310 level (black), which represents the Post-Halving Re-Accumulation Range of ~$60k to $70k.

During consolidation inside said range, BTC would downside wick considerably into the green boxed area which represents the final major Quarterly resistance set in 2021.

If this pullback indeed progresses towards the $71310 level, then that would technically count as a Quarterly post-breakout retest from the Re-Accumulation Range to confirm the breakout as successful.

The Downside Deviation

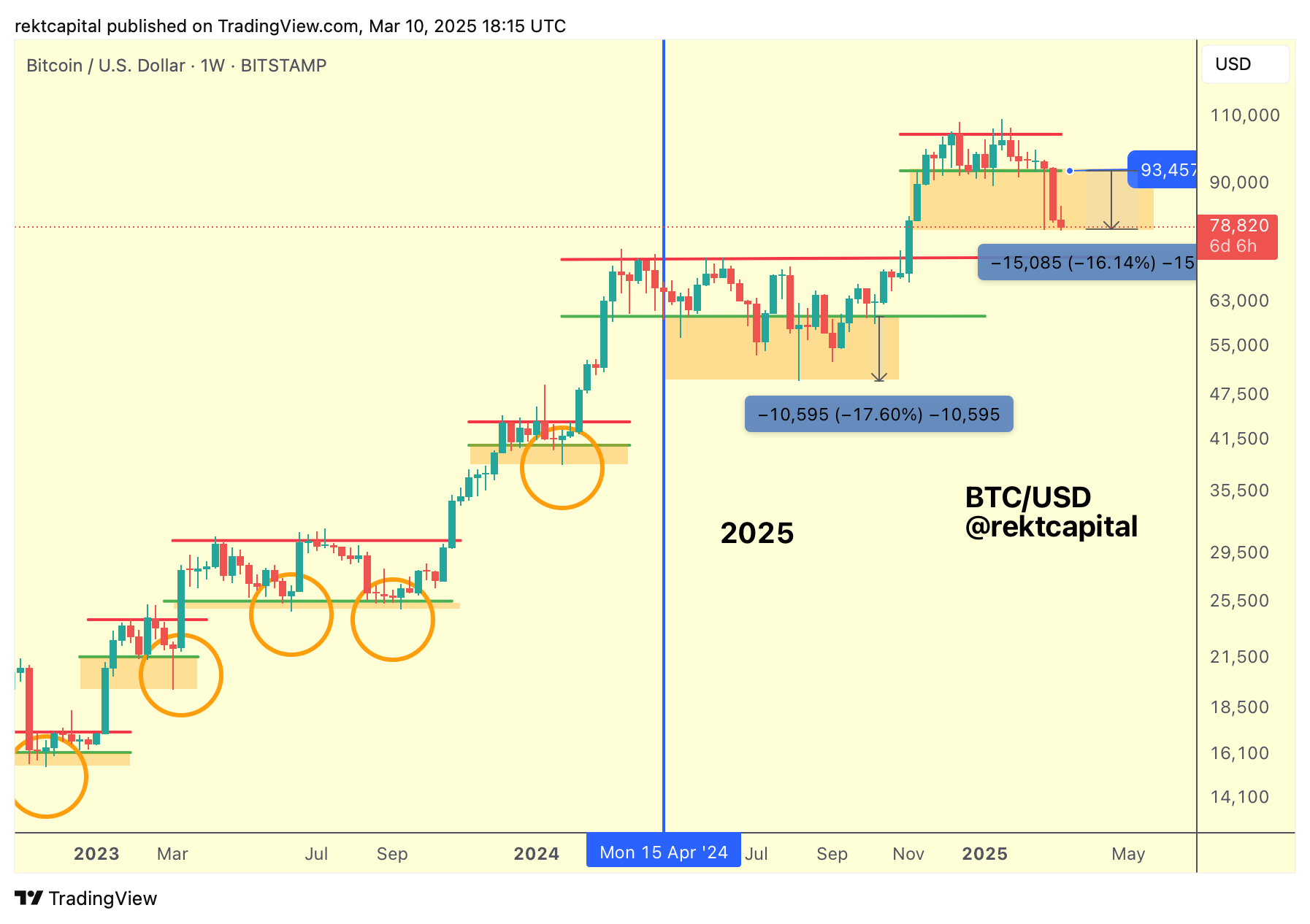

Bitcoin has Weekly Closed below the Range Low of the ReAccumulation Range, confirming that this is now a candle-bodied downside deviation.

In the Post-Halving period, Bitcoin also produced a candle-bodied downside deviation but that flash downside wick into new lows acted as an anchor to which a Higher Low developed.

In this case, the "flash wick" has turned into an entire candle body and there are no signs of a Higher Low developing at the moment.

That said, the magnitude of both of these downside deviations are very similar, of around 16-17%.

Additional downside from BTC would spell deeper downside deviation, heading towards the Re-Accumulation Range High at ~$71000 which is a confluent Quarterly level for what would technically be a mid-term post-breakout retest from the Post-Halving ReAccumulation Range.

We've only seen a Post-Halving ReAccumulation Range post-breakout retest once before and that was in 2017 but it occurred within weeks of breaking out, now months like what we're seeing now.