Bitcoin - How Deep Could Bitcoin Retrace?

Understanding this pullback

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

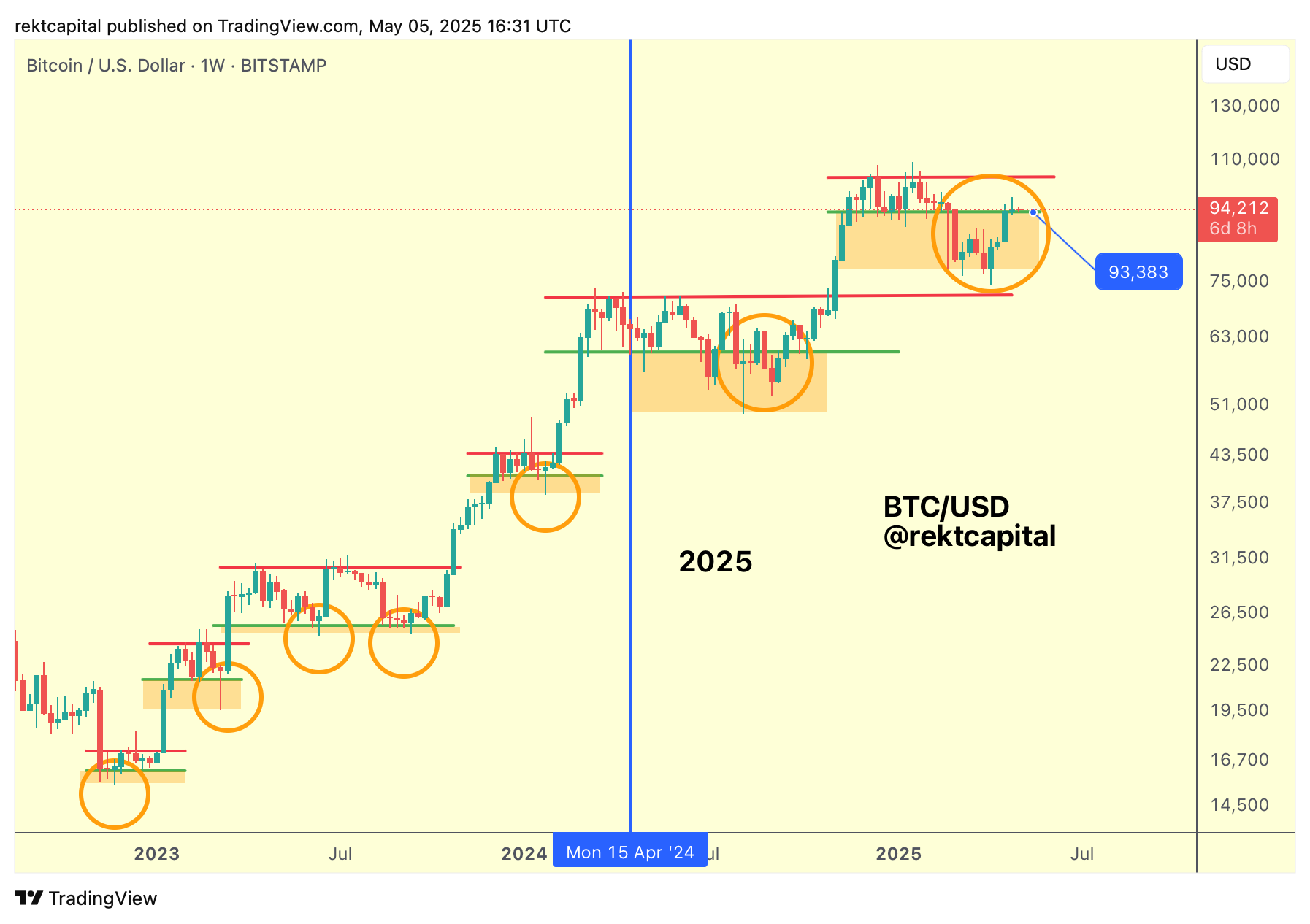

The Range Reclaim Attempt

Two weeks ago, Bitcoin Weekly Closed above $93.5k which represents the Range Low of the Range that Bitcoin downside deviated below.

Last week, BTC demonstrated signs of successfully retesting this Range Low of $93.5k.

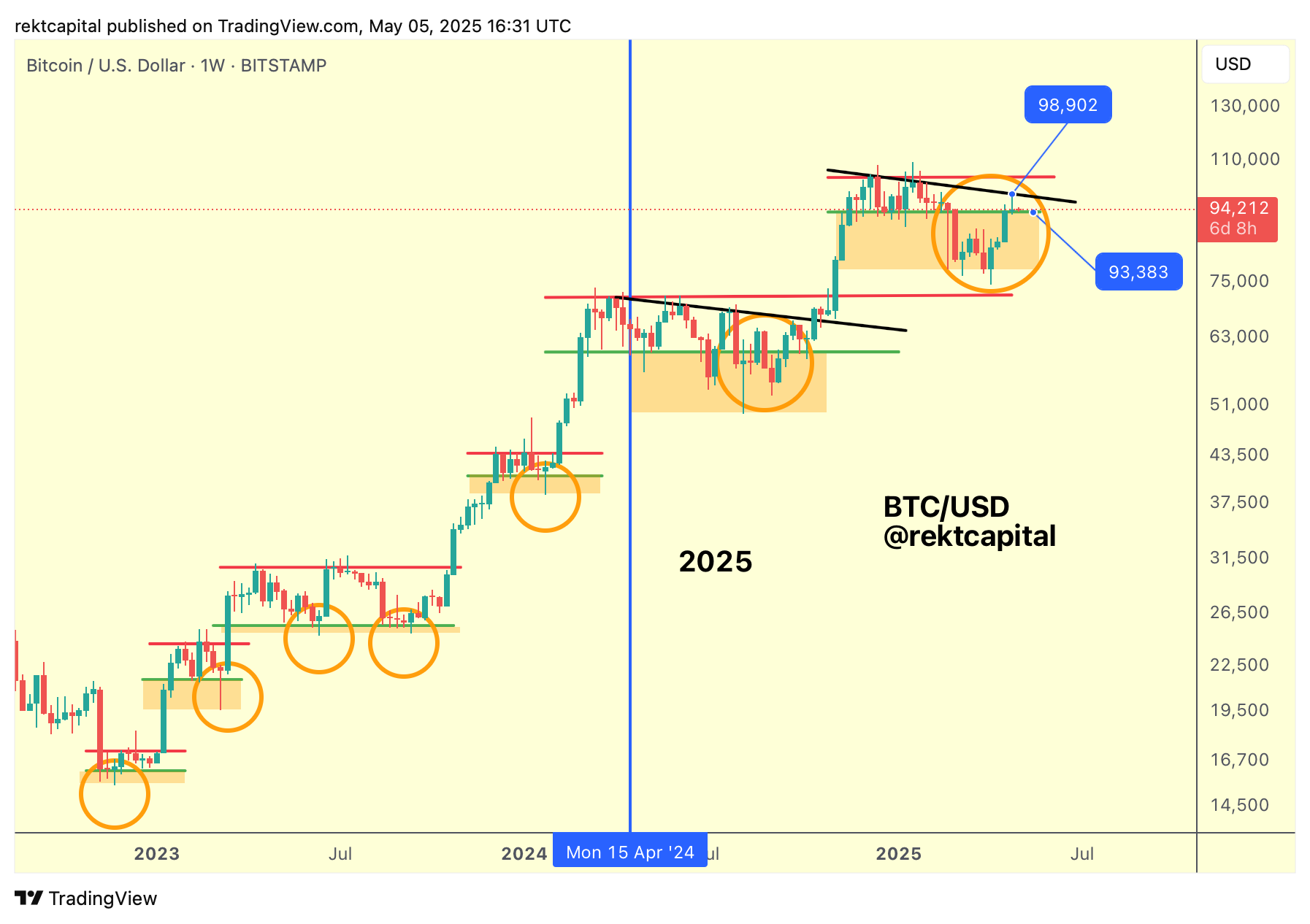

However, last week, Bitcoin also rejected from the Lower High trendline resistance (black) within this Range.

The Lower High resistance last week represented the price point of ~$99k, which is roughly where price rejected from to enter this current dipping period.

And in fact, the Post-Halving Range also had a Lower High resistance within the Range which also initially rejected price.

So this current Range as well as the Post-Halving Range share many similar qualities: the downside deviation itself, the Lower High resistance, the initial rejection from the Lower High resistance...

And on this dip, it will of course be important to retest $93.5k.

However, it is important to note that there is scope for downside volatility below the $93.5k Range Low and here's why...

Bull Market EMAs

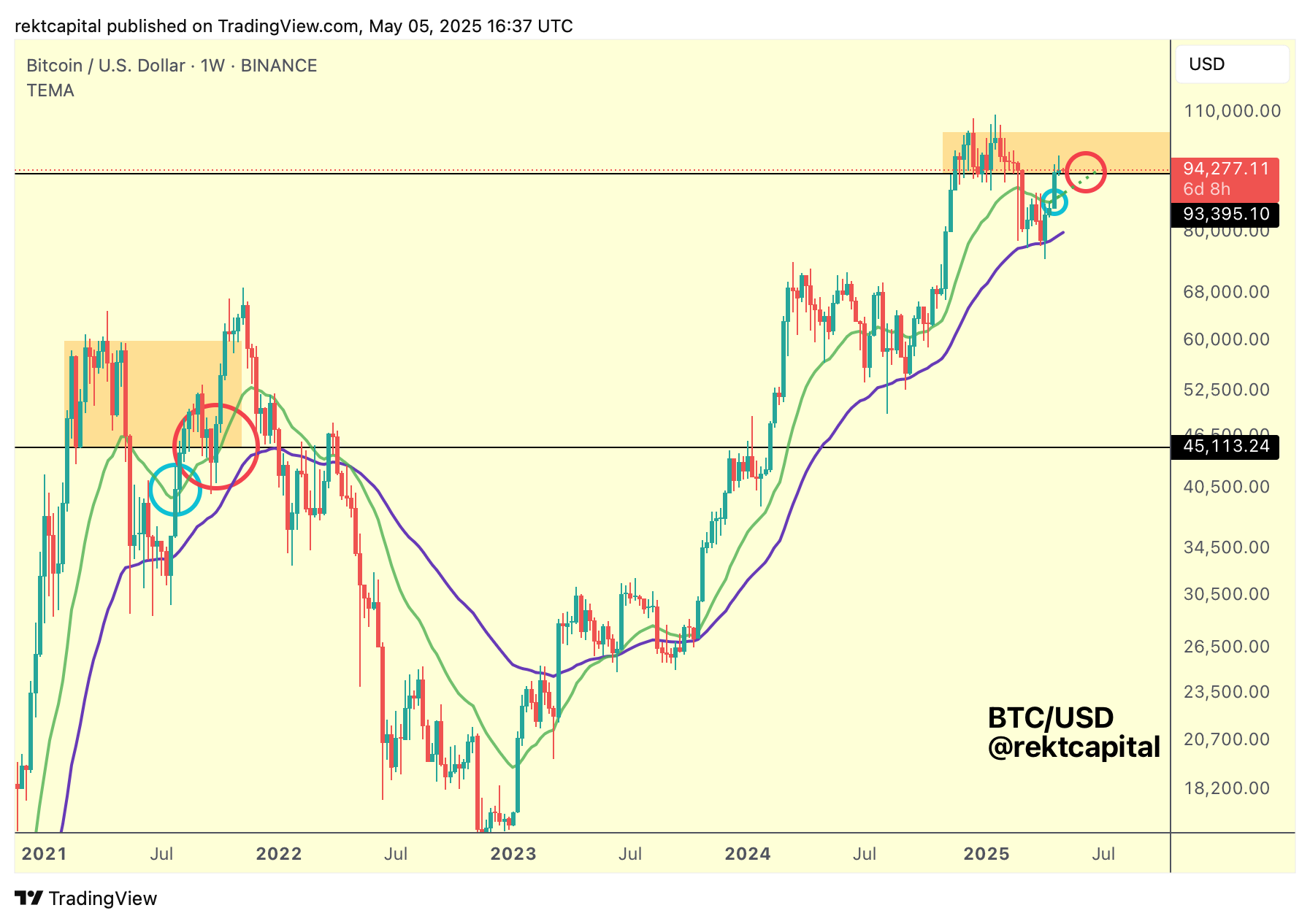

We've compared the current Range to the Post-Halving Range but now let's compare this current period to the mid-2021 tendencies relative to the Bull Market EMAs.

Back in mid-2021, BTC broke out from between the two Bull Market EMAs (green 21-week EMA and purple 50-week EMA) to rally back into the orange boxed area (representing the previous Range).

BTC has repeated this behaviour in this cycle and price has since reclaimed the $93.5k level.

Back in mid-2021, BTC initially reclaimed the $93.5k level successfully but then there was a shaky, volatile retest of $93.5k (red circle) later on.

If BTC were to repeat history perfectly right now, BTC should be able to retest $93.5k and rally higher across the $93.5k-$104.5k Range.

But because of this historical downside deviation (red circle) from mid-2021, it does leave you wondering if another potential downside deviation towards the green 21-week EMA could take place to successful reclaim the EMA into new support first before properly finalising a reclaim of $93.5k to ascend higher across the range.