Bitcoin - Diminishing Returns Across Price Discovery Uptrends?

The sub-phases of Bitcoin's Price Discovery Uptrends

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

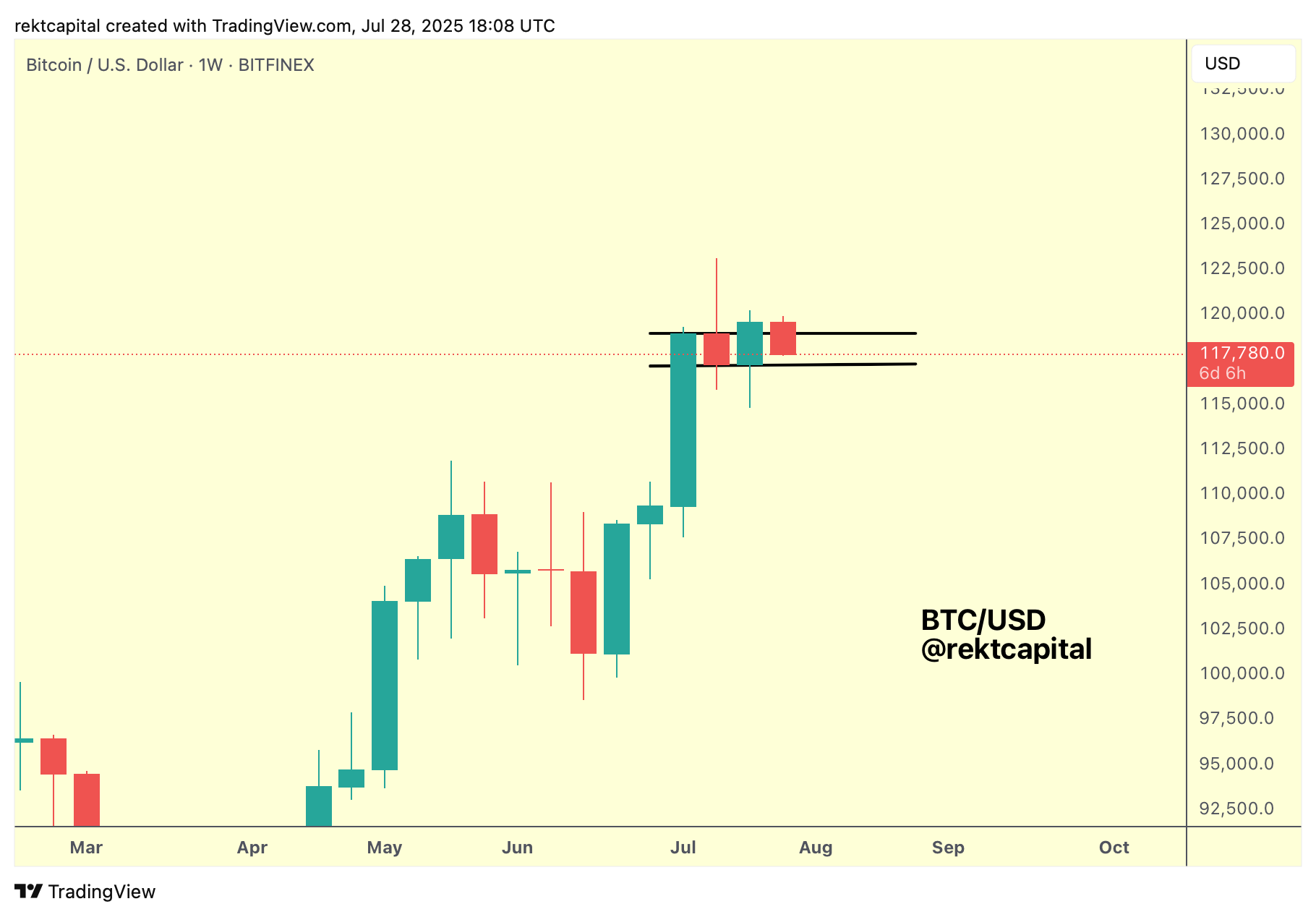

Weekly Bull Flag & Post-Breakout Retest?

Earlier last week, we spoke about about the Daily timeframe showcasing potential weakness but weakness that would play into a potential of a Weekly Bull Flag developing.

Here is the analysis from last week:

Here's today's price action:

In the end, Bitcoin downside wicked below the Weekly Bull Flag bottom and ultimately Weekly Closed above the Bull Flag Top, preparing and positioning itself for a confirmed breakout.

As a result, this current dip may be a post-breakout retest, a volatile one, as long as price Weekly Closes above the Bull Flag Top of $119200.

Price has an entire week to do that; in fact, price could downside wick below the Bull Flag bottom to form a potential Diamond-Shaped candlestick formation in the downside wicks.

That is, Lower Lows in the previous Weekly Candle downside wicks and potentially Higher Lows in this collections of Weekly Candles (i.e last week and this week).

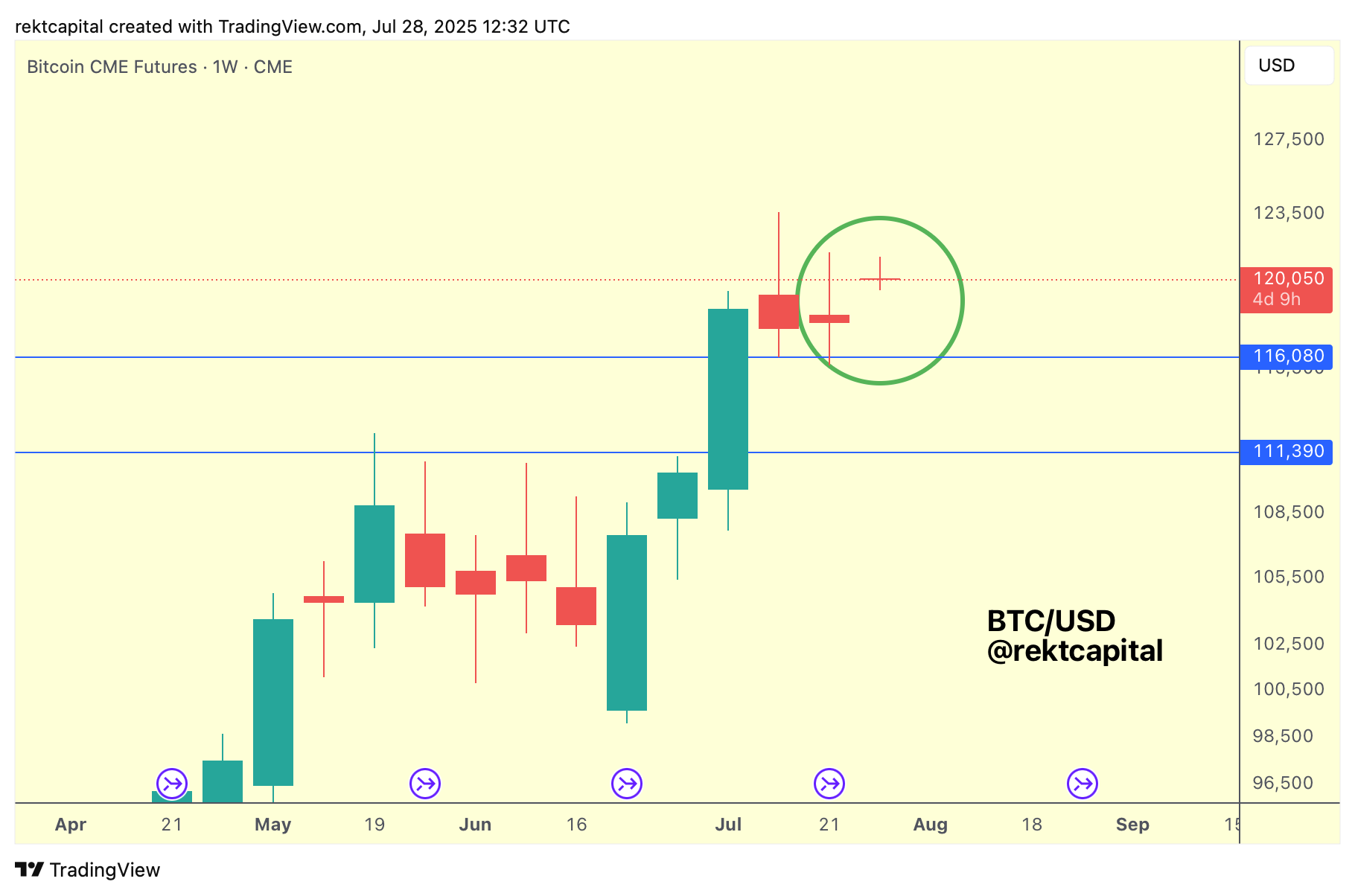

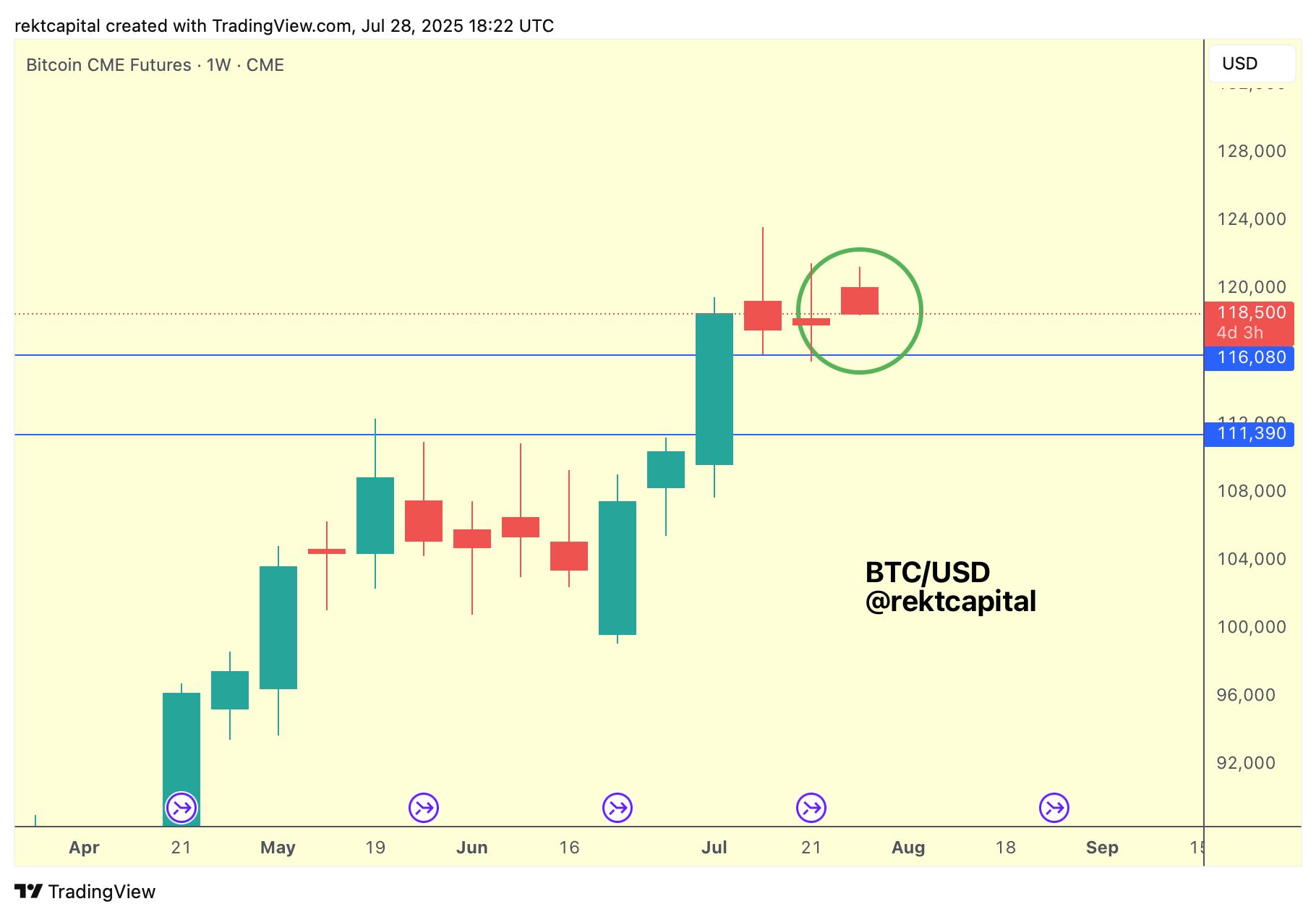

So if that Diamond-Shaped candlestick formation is to be secured via the downside wicks then it makes sense why price needs to dip; it also makes sense for price to dip via the perspective of the newly formed Weekly CME Gap:

This Weekly CME Gap is being filled as we speak:

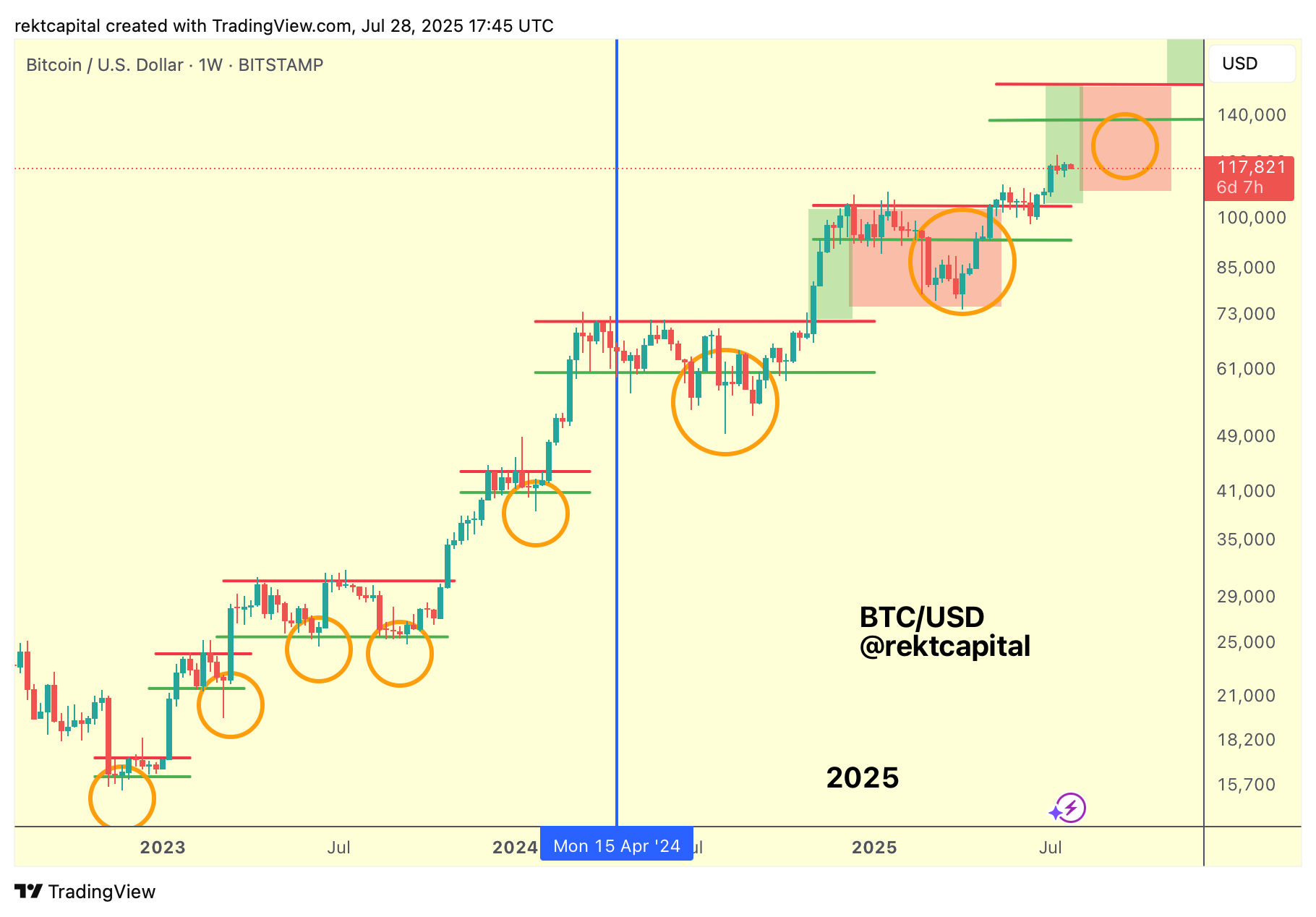

The Bitcoin Roadmap

Bitcoin has just begun Week 4 in Price Discovery Uptrend 2.

And if Bitcoin indeed finds a way to confirm a breakout from the Weekly Bull Flag, then trend continuation in Price Discovery Uptrend 2 would be achieved.

But it's important to note that this Uptrend won't last forever and that it'll be worthwhile considering ways it could fail as we slowly transition into Weeks 5 through 7 of this phase.

After all, the first Price Discovery Uptrend 1 lasted 6-7 weeks before Local Topping; it would be conservative thus to become increasingly cautious as time goes on.

In fact, the strategy mentioned in recent weeks has been to be optimistic and risk-on for Weeks 1-3 and from Week 4 start to become cautiously optimistic with scope for being concerned and (increasingly risk-off ) across Weeks 5-7.

Thus far, the strategy has been working out well.

In the next part of the Newsletter, we'll dive into better understanding the Price Discovery Uptrend phases and looking at them through the lens of potential diminishing returns and how could that affect the upcoming phases going forward.