Bitcoin – Decision Time At The 50 Week EMA

Could consolidation enable an Altcoin Window?

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

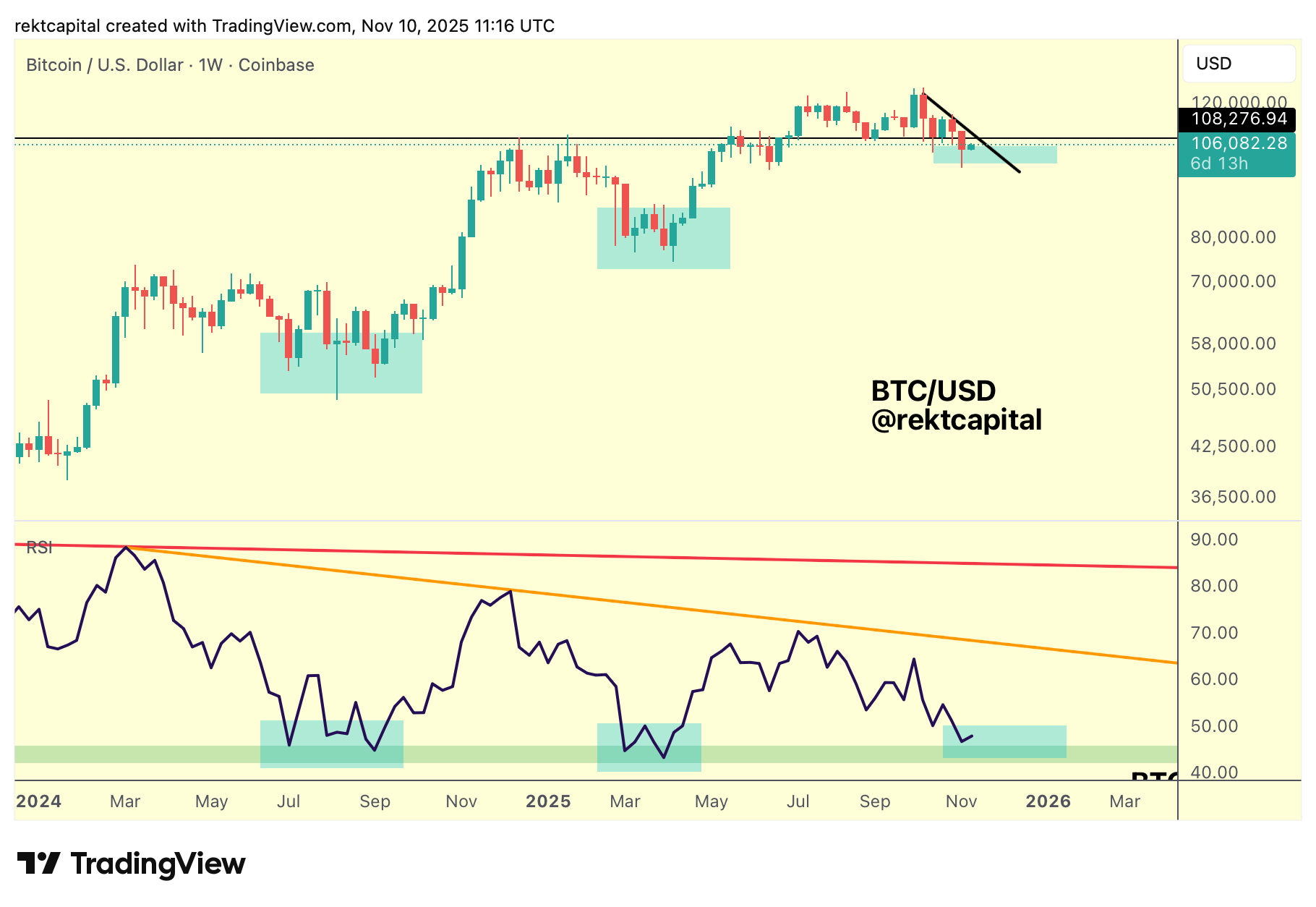

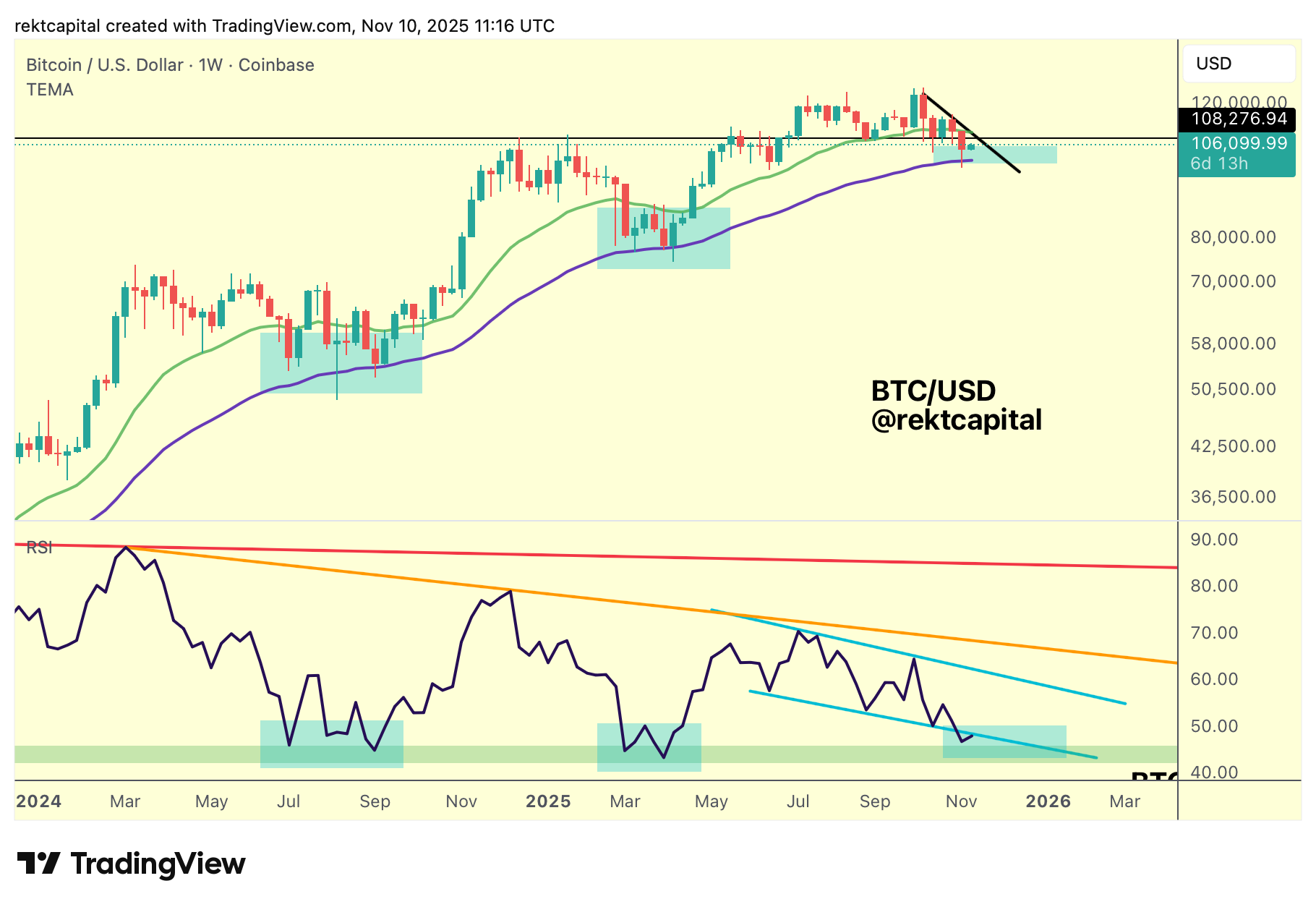

Clustering Around The 50-Week EMA

Bitcoin opens the week by potentially building a similar Lower Low cluster we’ve seen a few times across this cycle.

A sequence of Lower Lows is developing once again, shaping the familiar rhythm of contraction that tends to precede a decision.

This time, however, the process appears faster, the entire formation resolving more quickly with each passing consolidation.

The black diagonal now presses directly against this cluster, gradually reducing the room for sideways drift and forcing an imminent decision; this Lower High is actually a huge part of why this cluster won't last too long, as the LH will force a trend decision sooner rather than later.

Last week, Bitcoin Weekly Closed below $108000 (black horizontal), a loss that temporarily positions that level into new resistance, even though it hasn't been confirmed as one (unless a relief rally rejects from there, that is).

Unless BTC can Weekly Close back above $108.3K (black), any bounce from here will figure as relief rally.

As we approach the intersection between the 50-Week EMA (purple) and the black diagonal, volatility will likely expand, the outcome determining whether this cluster becomes the base of a new advance or the prelude to further downside.

Meanwhile, RSI has briefly lost its downtrending Channel (light blue) but is now flicking back into the underside to potentially try to reclaim it into new support (at the moment, it is a resistance but it is also too early in the week to say this will continue to persist.)

If this reclaim succeeds, RSI would resynchronize with its own Channel, opening room for short-term price continuation toward $108000 (black) and potentially beyond on reclaim of $108k.

This renewed alignment would mirror prior recoveries where early RSI strength preceded price rebounds inside the price cluster around the 50-week EMA.

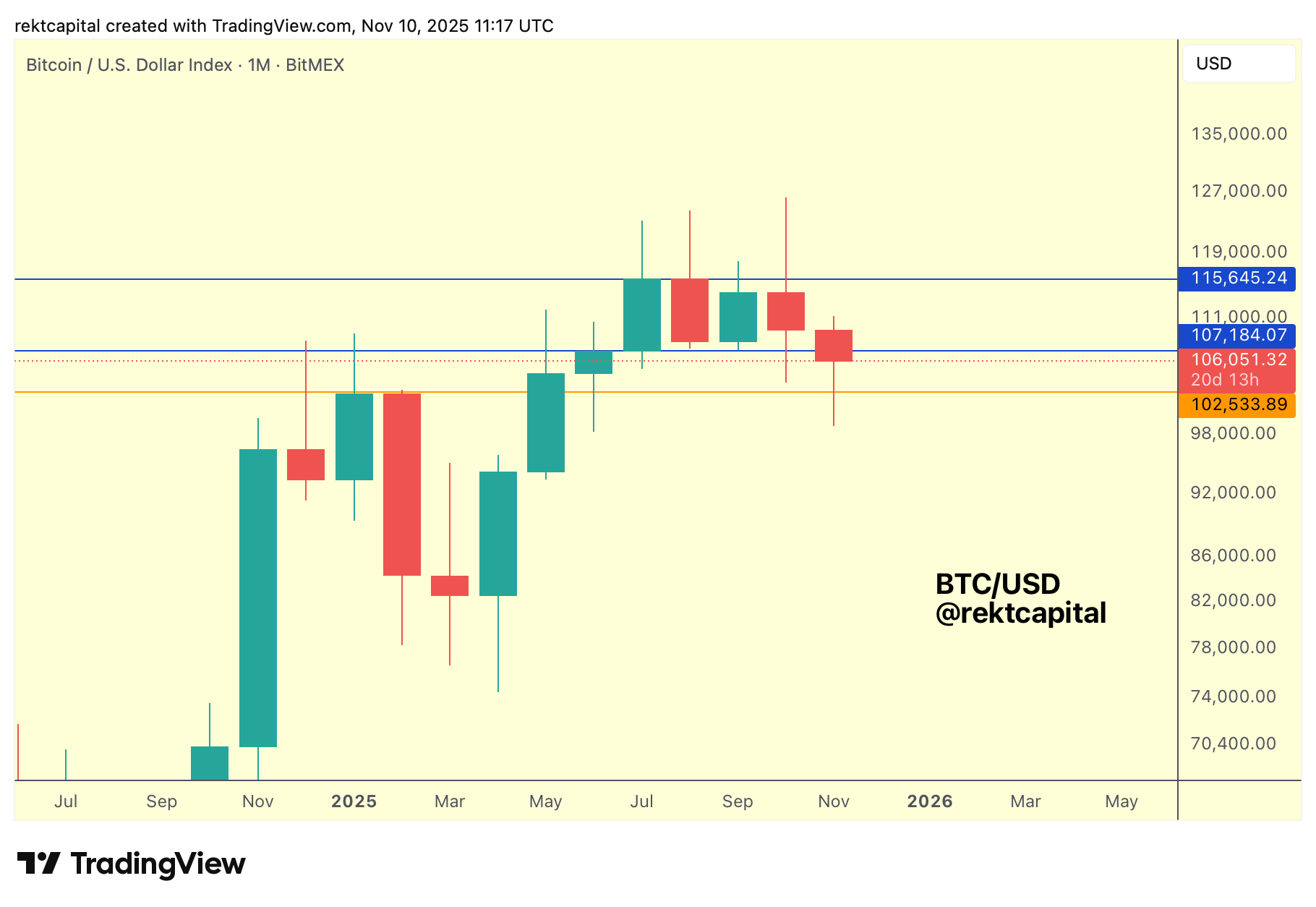

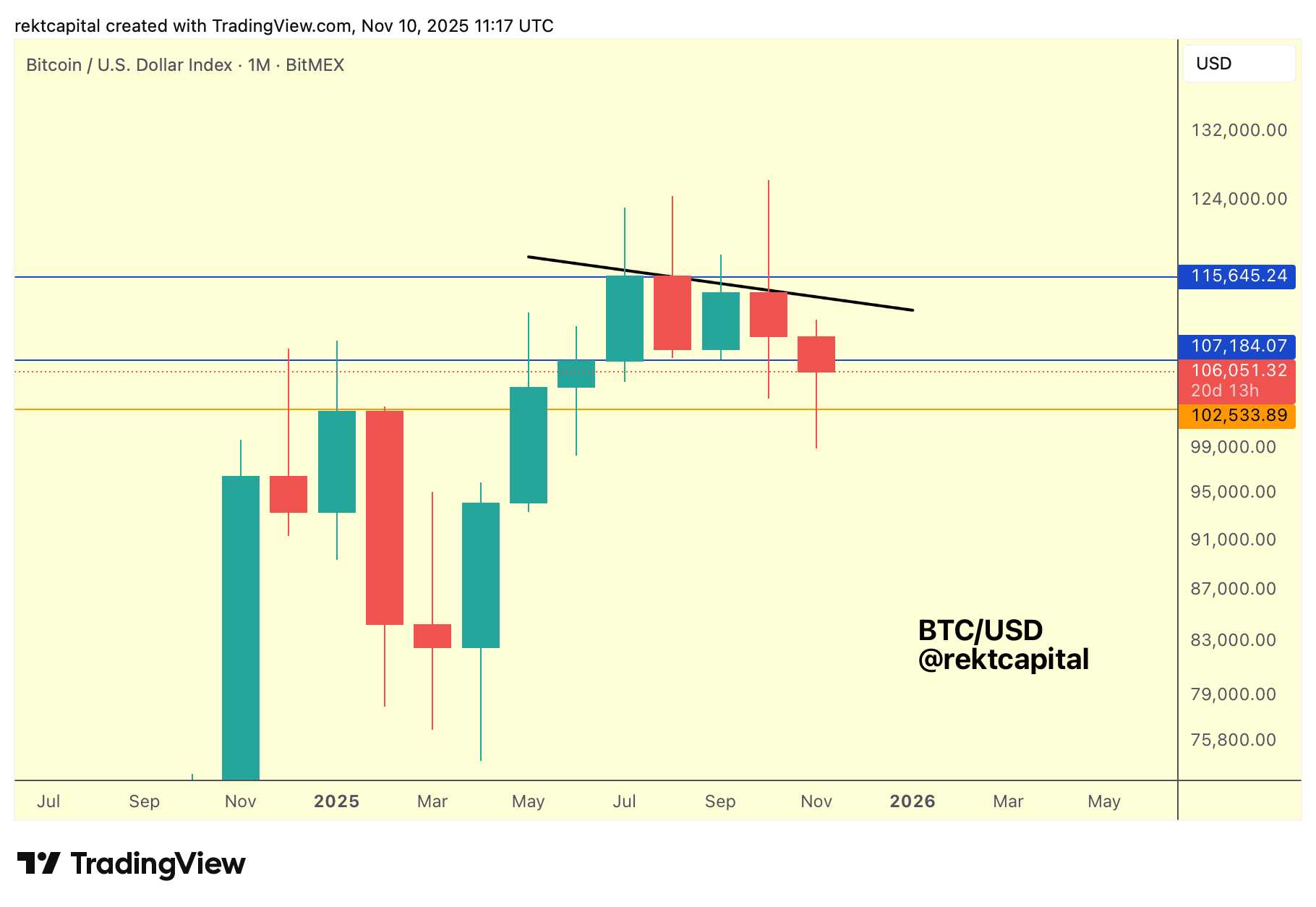

BTC Retest Key Monthly Demand at 102.5k

On the Monthly timeframe, Bitcoin has produced its deepest downside deviation in this cycle, wicking into $102.5 k (orange historical demand).

This same level acted as resistance in late-2024 and later flipped into support through mid-2025, a key reference point for the current reaction.

BTC is once again responding there; a Monthly Close and reclaim above $107 k (blue Range Low) would re-establish the broader Macro Range and keep the structure intact.

However, a macro Lower High (black diagonal) looms above, and that resistance could limit any rebound before any sort of challenge for higher levels in the range occurs.