Bitcoin Correction Over?

The Phases of the Bitcoin Halving - Deep Breakdown & Analysis

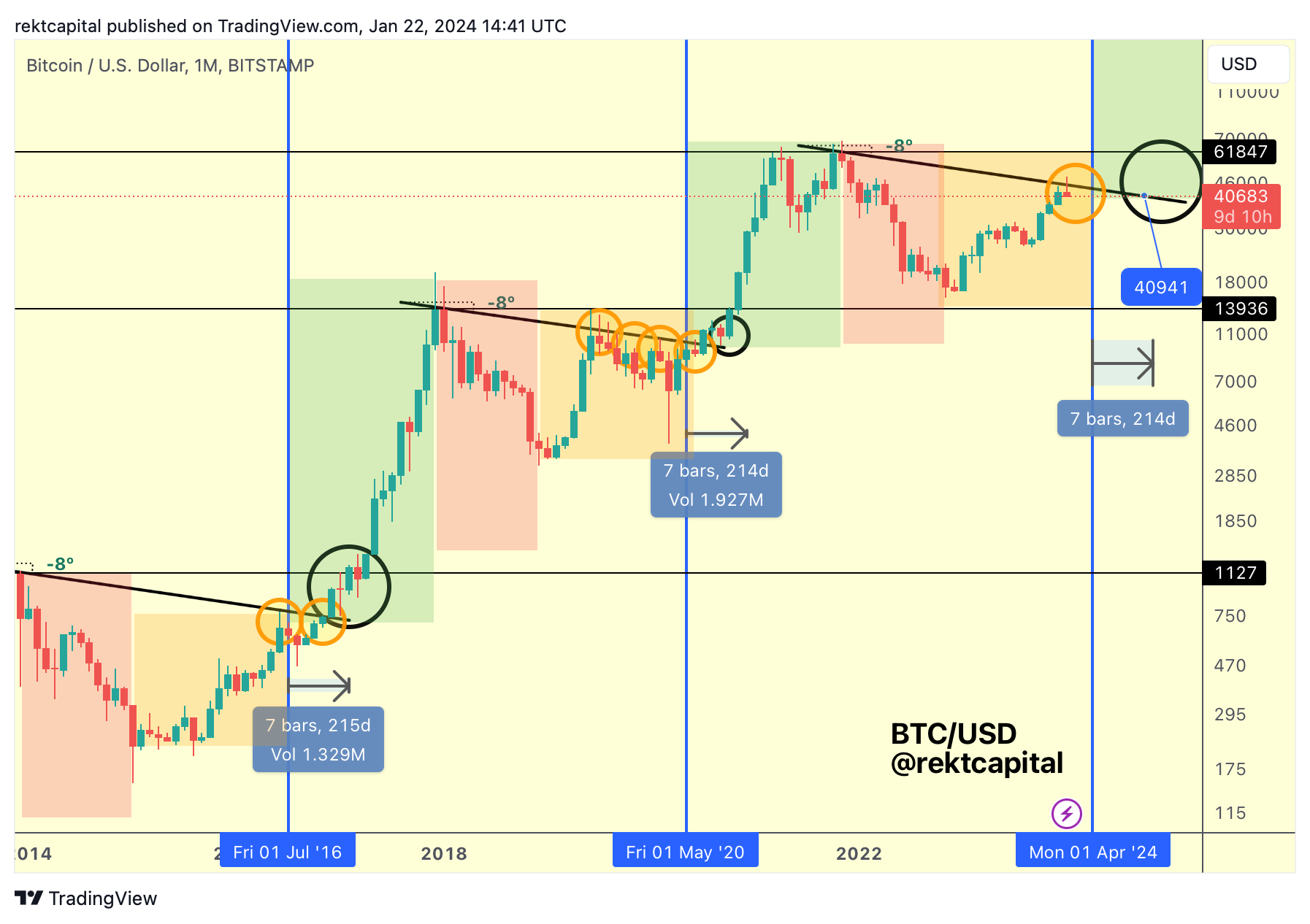

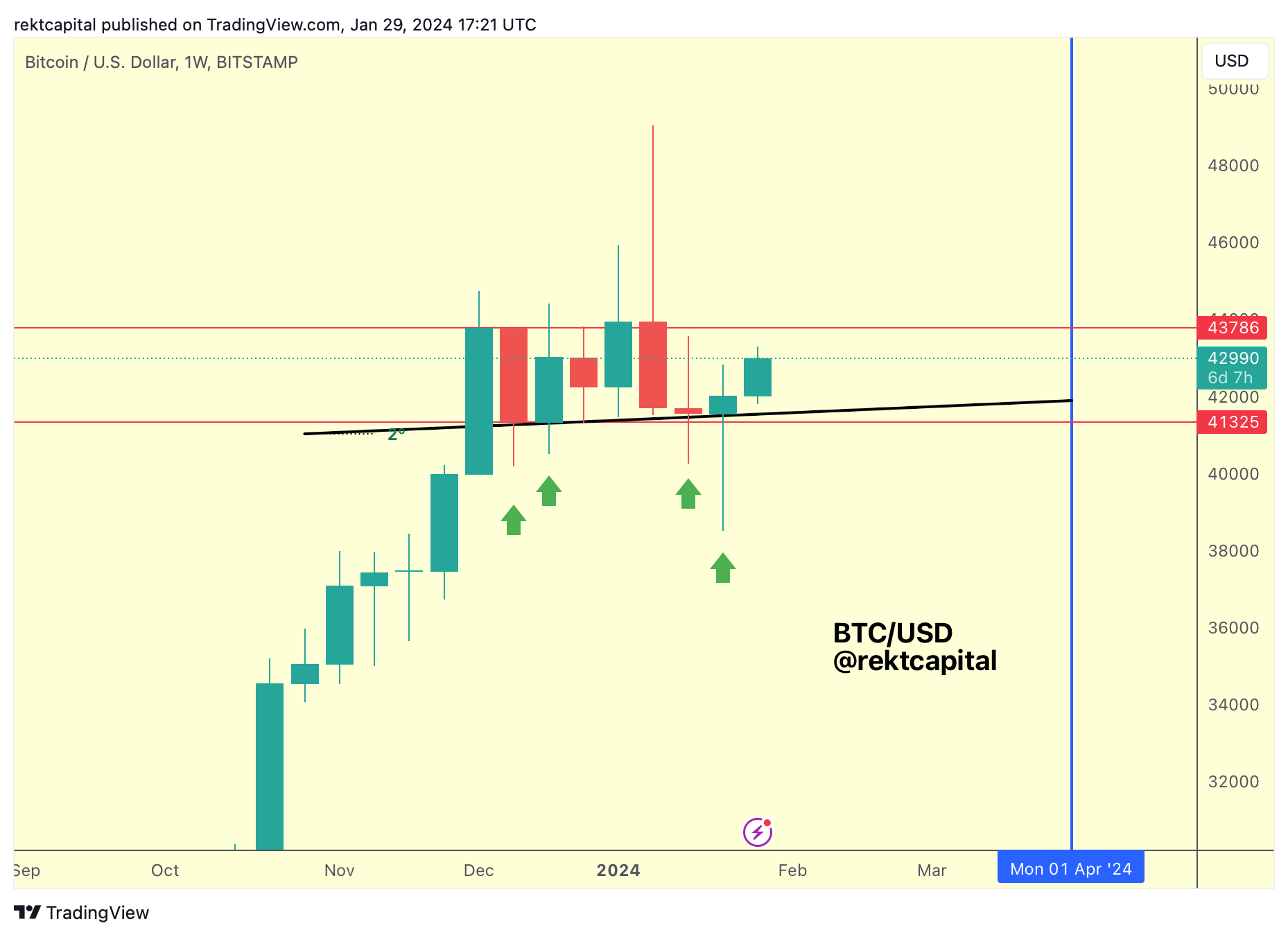

Bitcoin - The Macro Diagonal

Last week, we spoke about Bitcoin's rejection from the Macro Diagonal:

And this week we are seeing Bitcoin's price action actually recover, back into the Macro Diagonal resistance itself:

Still, price remains below it and the upcoming Monthly Close will be very interesting.

Monthly Close above the Macro Diagonal would mean price would go against the grain of history by breaking the Macro Diagonal in the Pre-Halving period.

After all, price tends to break this Macro Diagonal and turn it into new support but only after the Halving itself. Never has this occurred before the Halving.

So a Monthly Close below the Macro Diagonal would likely continue to confirm the Macro Diagonal as resistance, as per historical price tendencies.

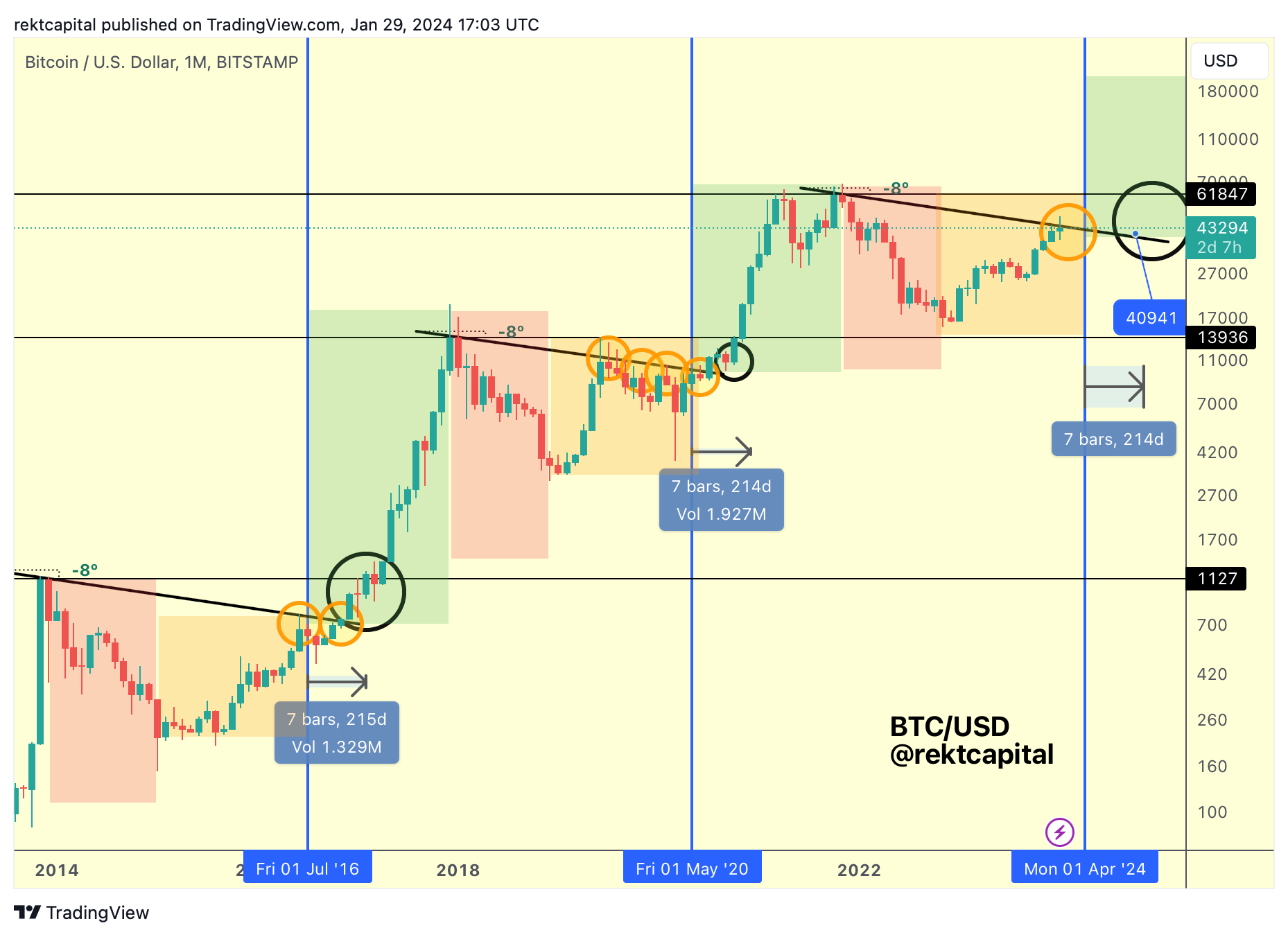

It's not a coincidence that the Macro Diagonal resistance is approximately confluent resistance with the Weekly Range High price is currently consolidating within:

And if history is any indication, Bitcoin may thus struggle to breakout from this sideways range before the Halving.

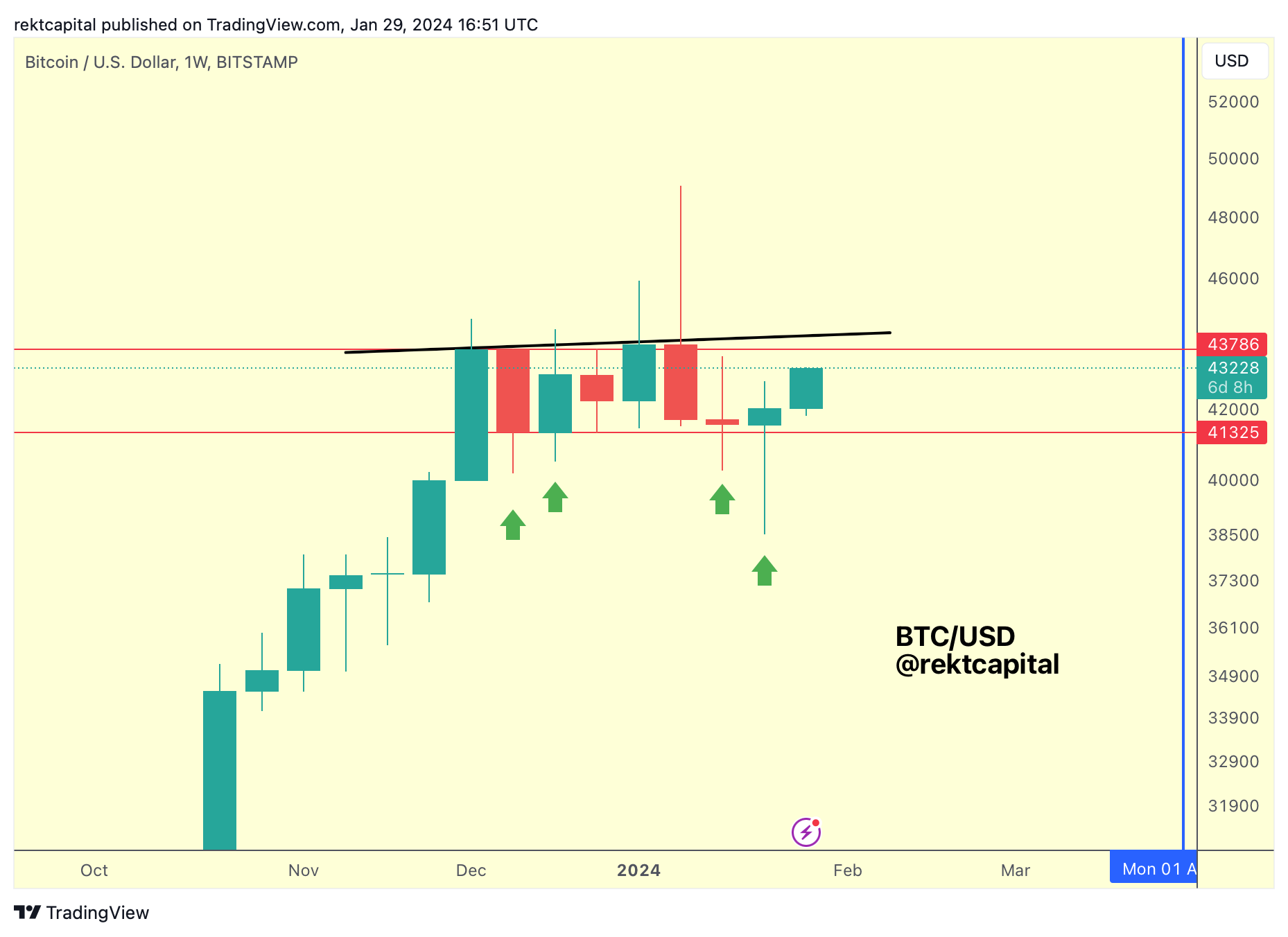

Interestingly, the retrace BTC had performed last week looks to have been a fake-breakdown as price was able to Weekly Close within the range.

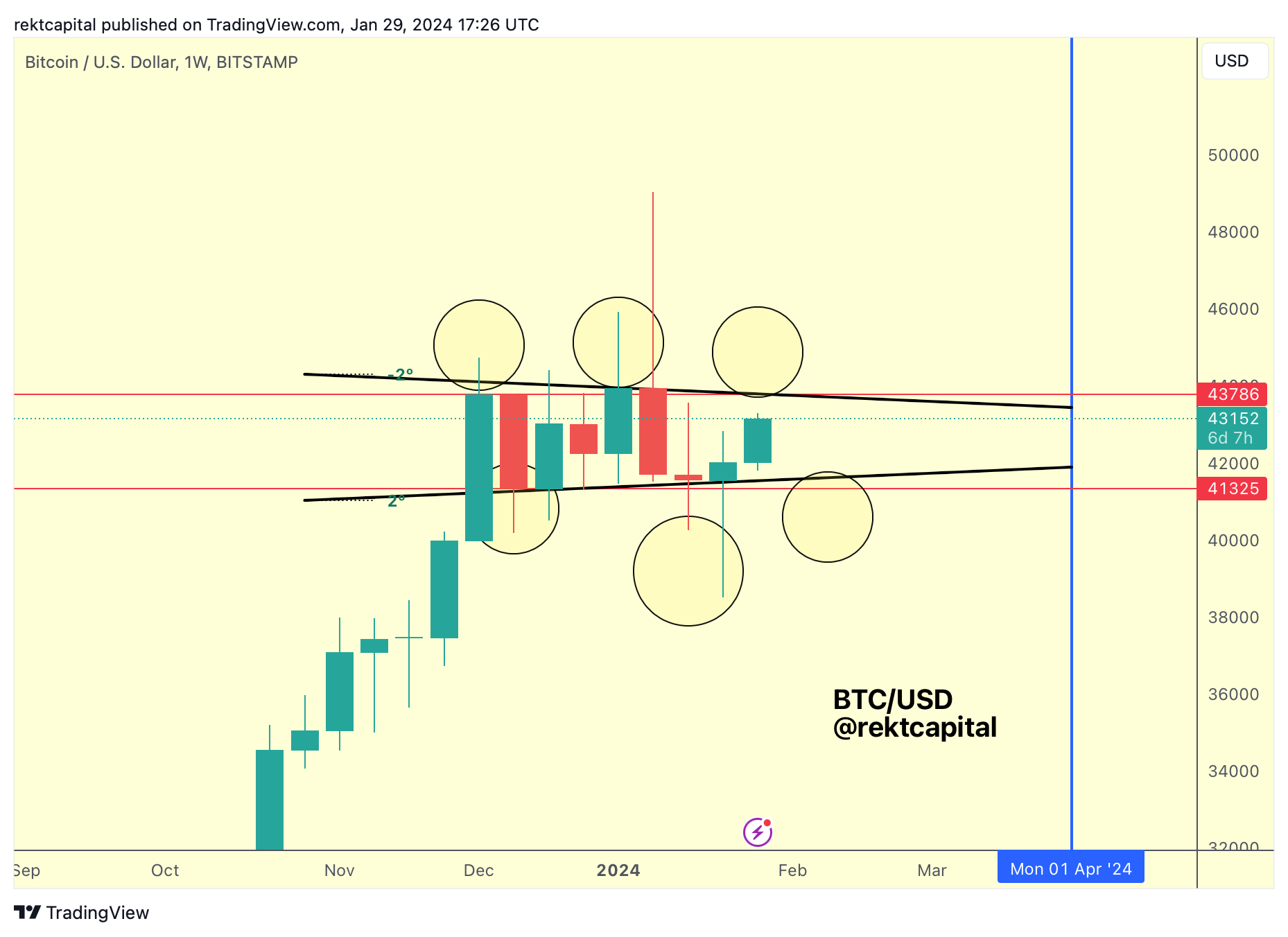

Generally, it's been a very volatile range, producing long upside wicks and long downside wicks.

In fact, a lot of volatility could await on the upside going into the end of the month.

Which is why it is important to watch for that ultimate Monthly Close relative to what has come down to a key resistance around the $43700 region.

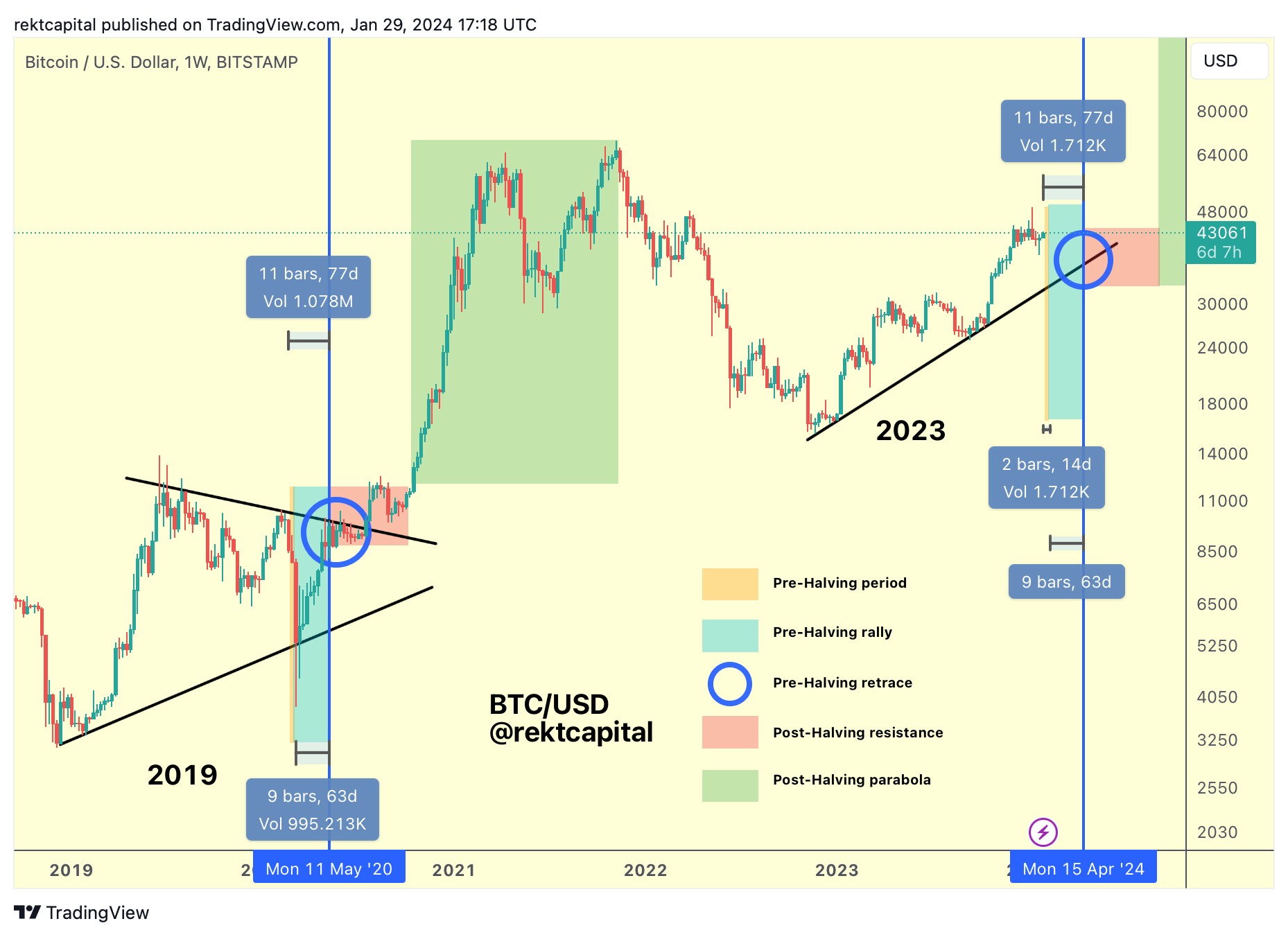

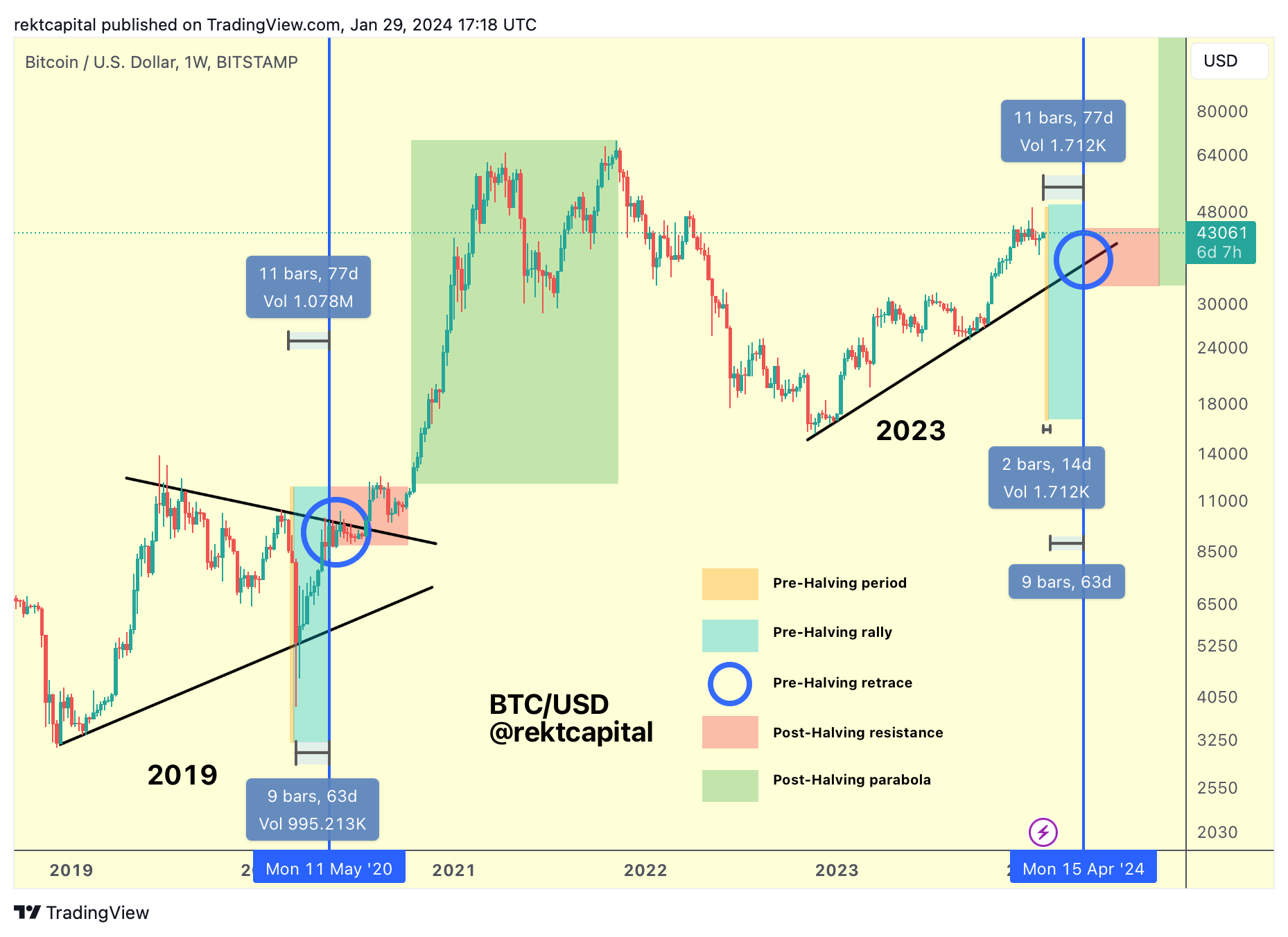

It Is Still Technical "Retrace-Season"?

That being said, Bitcoin is still technically in its "Pre-Halving Retracement" period (orange).

But as you can see, that period is getting very very narrow at this point in the cycle.

In fact, there are ~2 weeks left in this period.

That suggest a few things:

- Bitcoin could still technically retrace over the next two weeks

- If Bitcoin were to retrace over the next two weeks, price could reject either at the Range High resistance/Macro Diagonal OR reject at a new Lower High of some sort

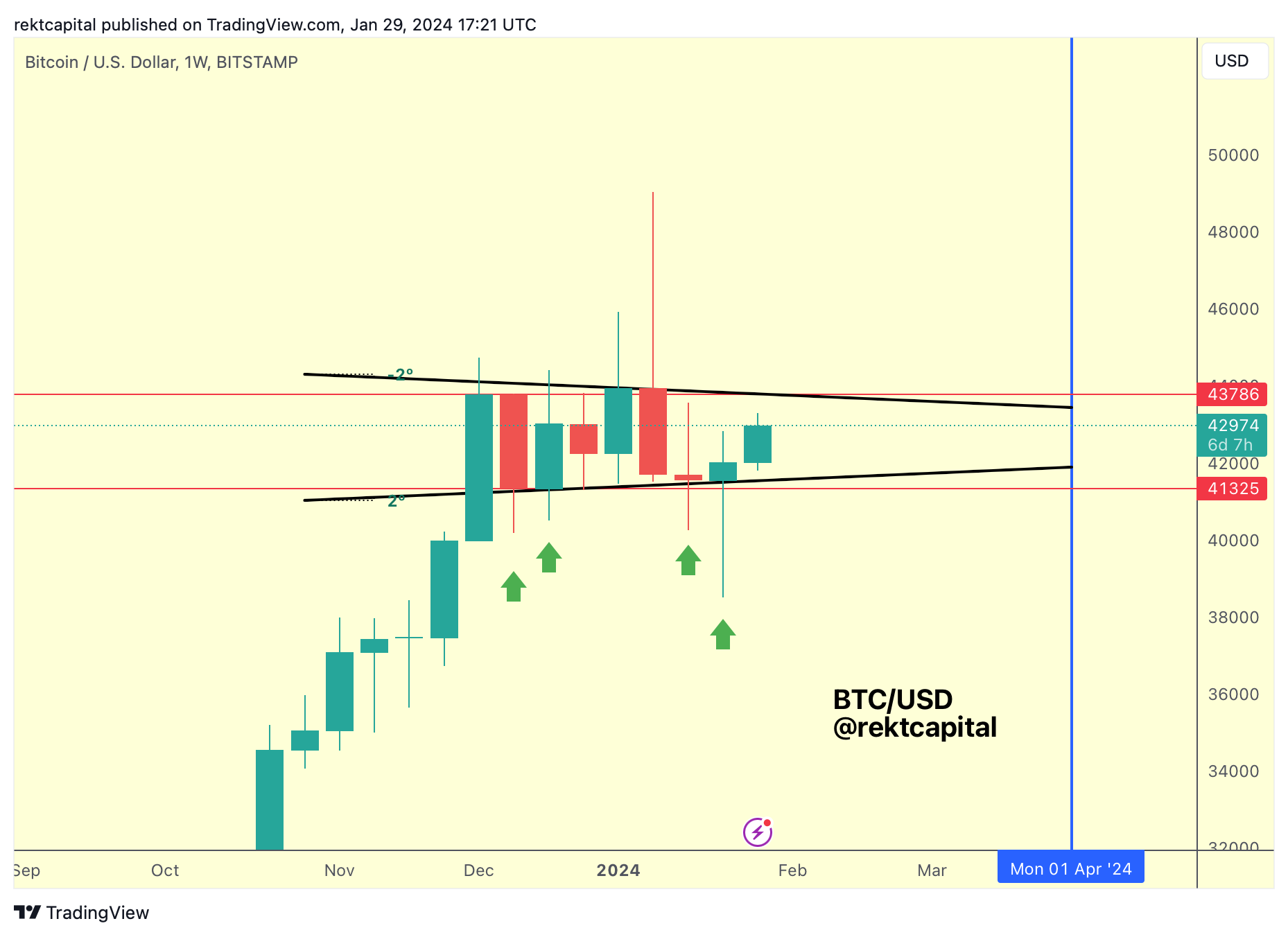

Because Bitcoin has formed a Higher Low within its Weekly Range, a 2-degree angle:

So if Bitcoin were to reject at a Lower High, then price would develop a Bull Flagging structure heading into the Halving (black; assuming the Lower High replicates the 2-degree angle of its Higher Low):

So in sum...

History suggests Bitcoin shouldn't be able to break its Macro Diagonal before the Halving.

The Macro Diagonal is approximately confluent resistance with the Weekly Range High at ~$43700.

However, upside wicks beyond that point are possible, but it's important to watch out for the Monthly Close relative to the Macro Diagonal to confirm the ultimate direction going into next month.

History suggests we could still see a bit of downside in early February.

And if a rejection occurs at Macro Diagonal/Weekly Range High area, then price could revisit the Weekly Range Low, with scope for downside wicking below the Weekly Range.

Generally, it comes down to this:

There's scope for upside and downside wicking still within this Weekly Range, which could be transitioning into a Bull Flagging market structure (black).

But Bitcoin has only two weeks left, historically-speaking, to pullback towards its Weekly Range Low area:

Because after that two-weeks, history suggests Bitcoin should begin its Pre-Halving rally (light-blue).

Pre-Halving rallies tend to begin two months before the Halving event.

But because Bitcoin has had an extensive rally prior to the Halving already (in large part due to the ETF catalyst), it's unclear how much upside could BTC really muster in this Pre-Halving period.

Especially since there are some clear parameters that may be stifling the Pre-Halving rally.