Bitcoin - Back In The 90s

The roadmap going forward

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

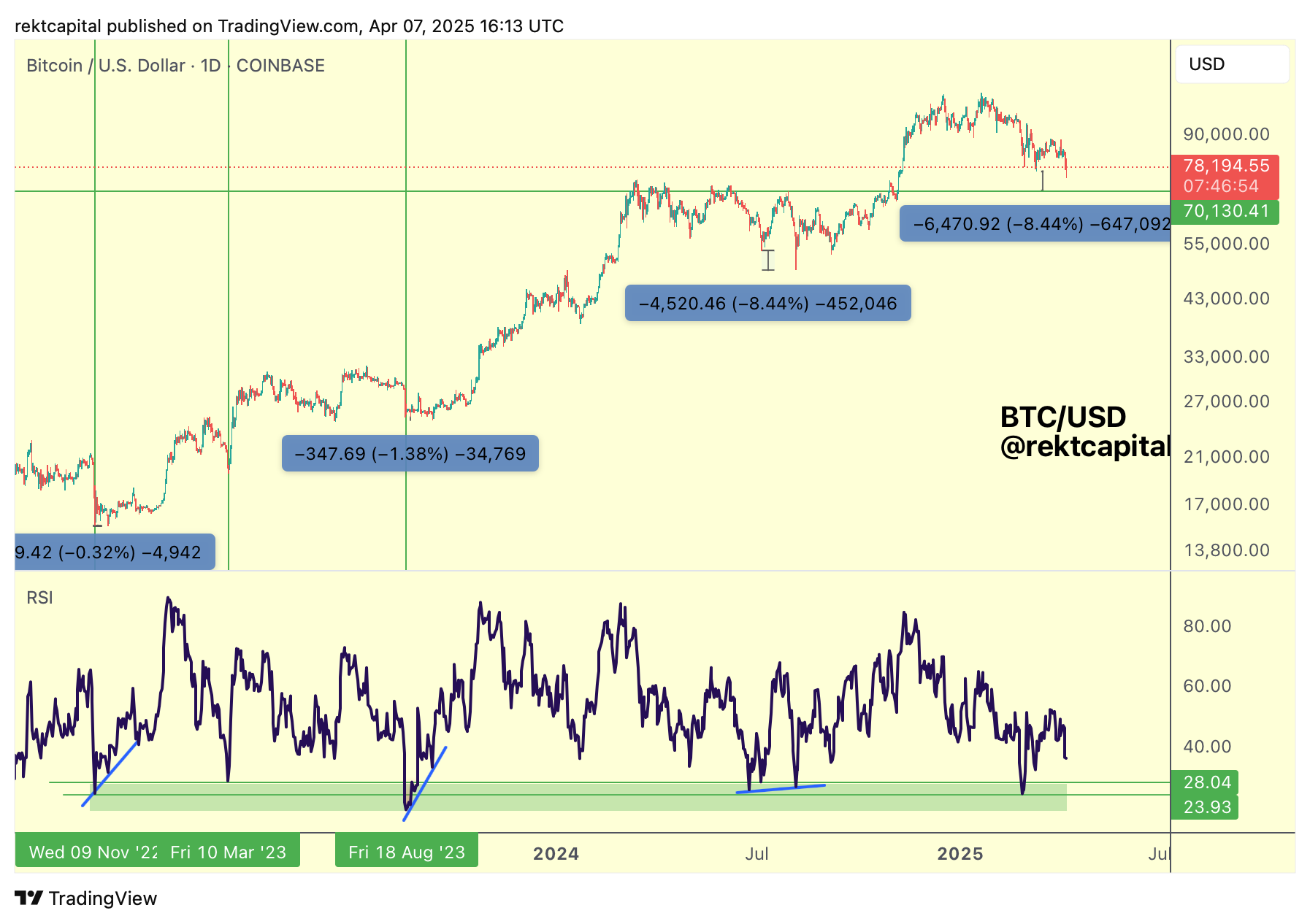

Historical Daily RSI Tendencies

Over the past few weeks, we've been talking about how to use Daily RSI tendencies in association with Bullish Divergences across this current cycle:

After all, these Bull Divs have preceded generational bottoms for Bitcoin

Across time, while the RSI would form Higher Lows, the difference between Price in forming the Price Lower Lows would range from -0.32% to even up to -8.44%.

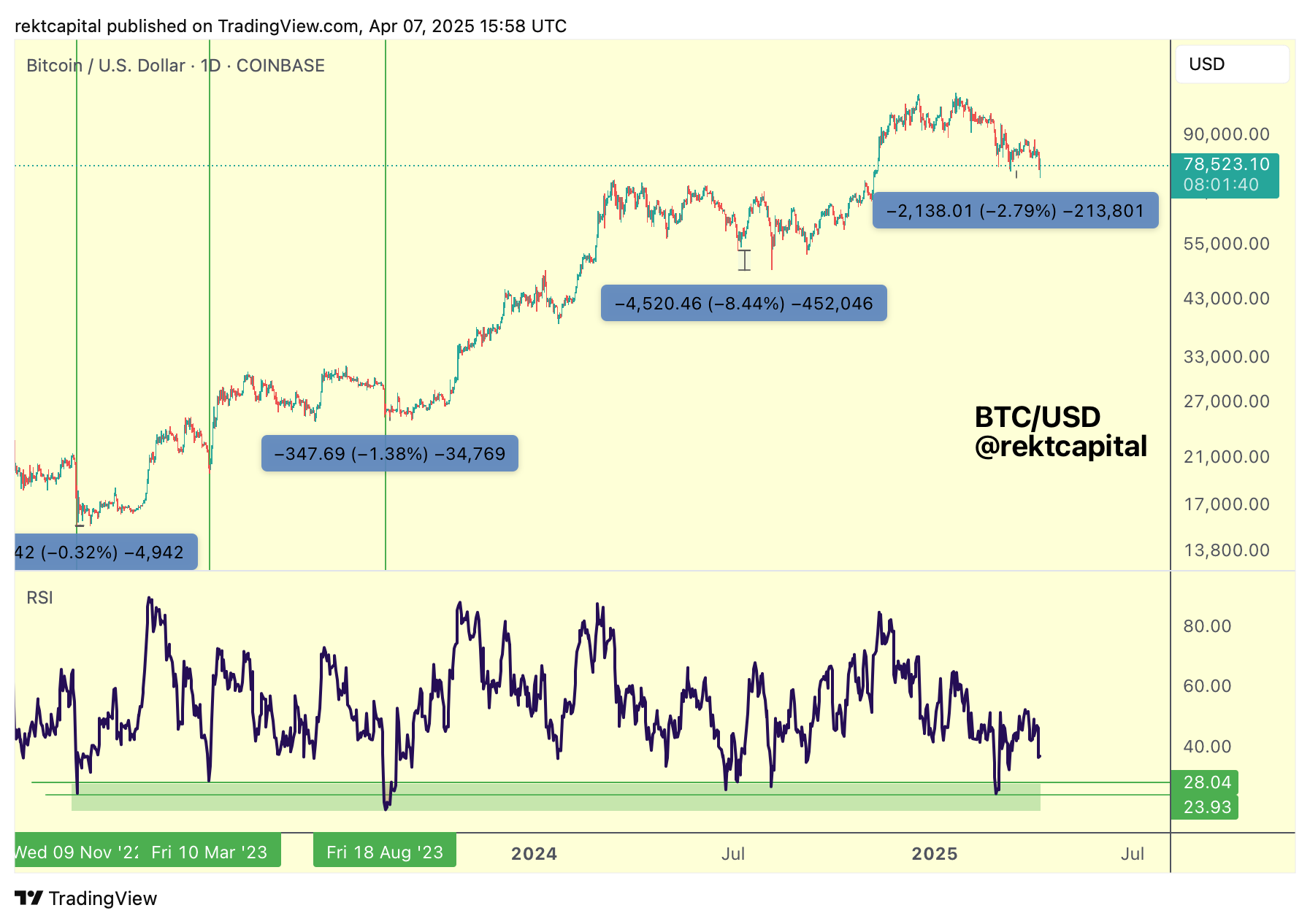

On this recent corrective period, the price distance was -2.79%:

And since then Bitcoin has rallied back into the 90's:

The Bullish Divergence has yet again played out and history suggests that the correction bottom is in.

Because after every Bull Div like this played out, price would rally to new highs over time.

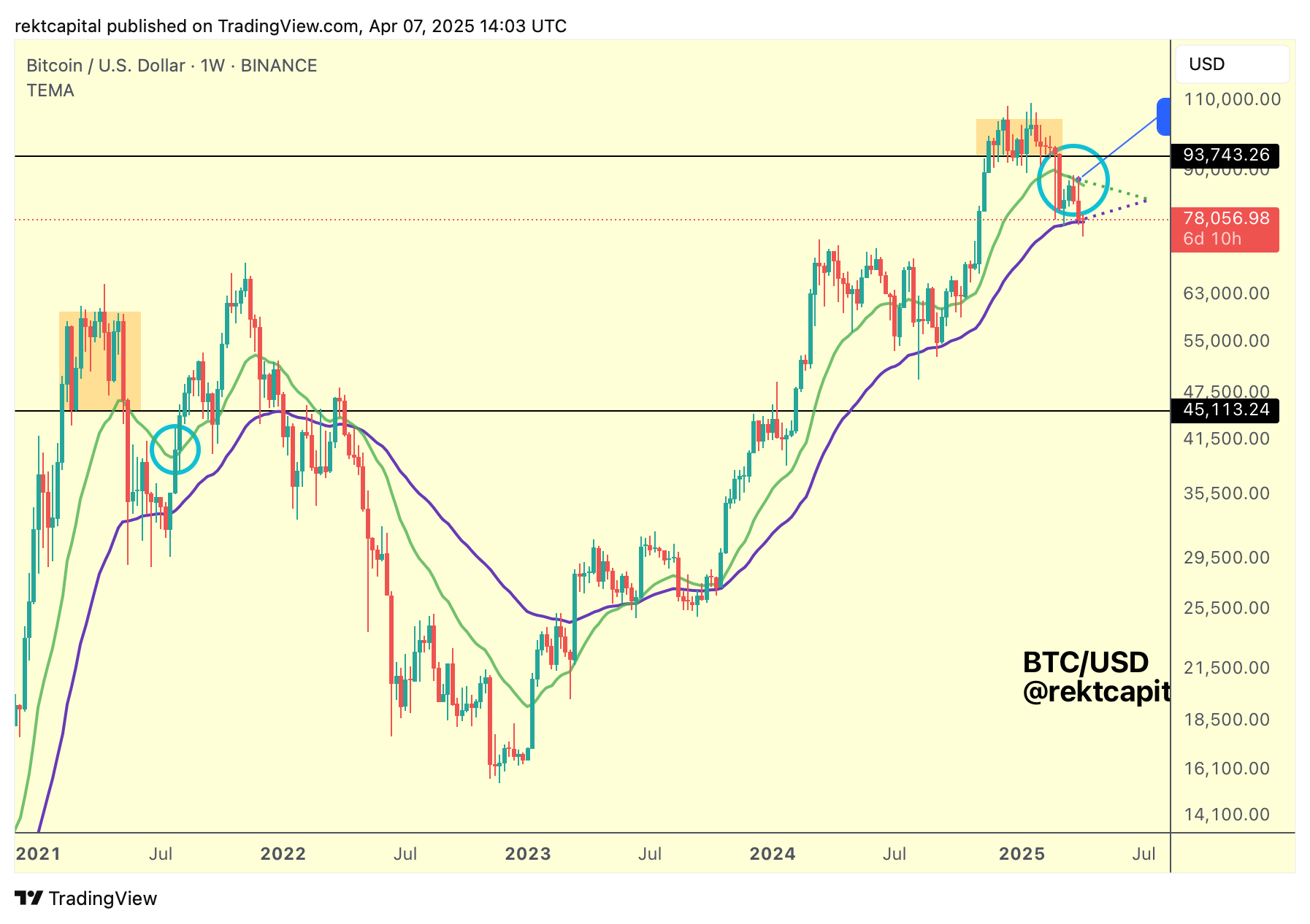

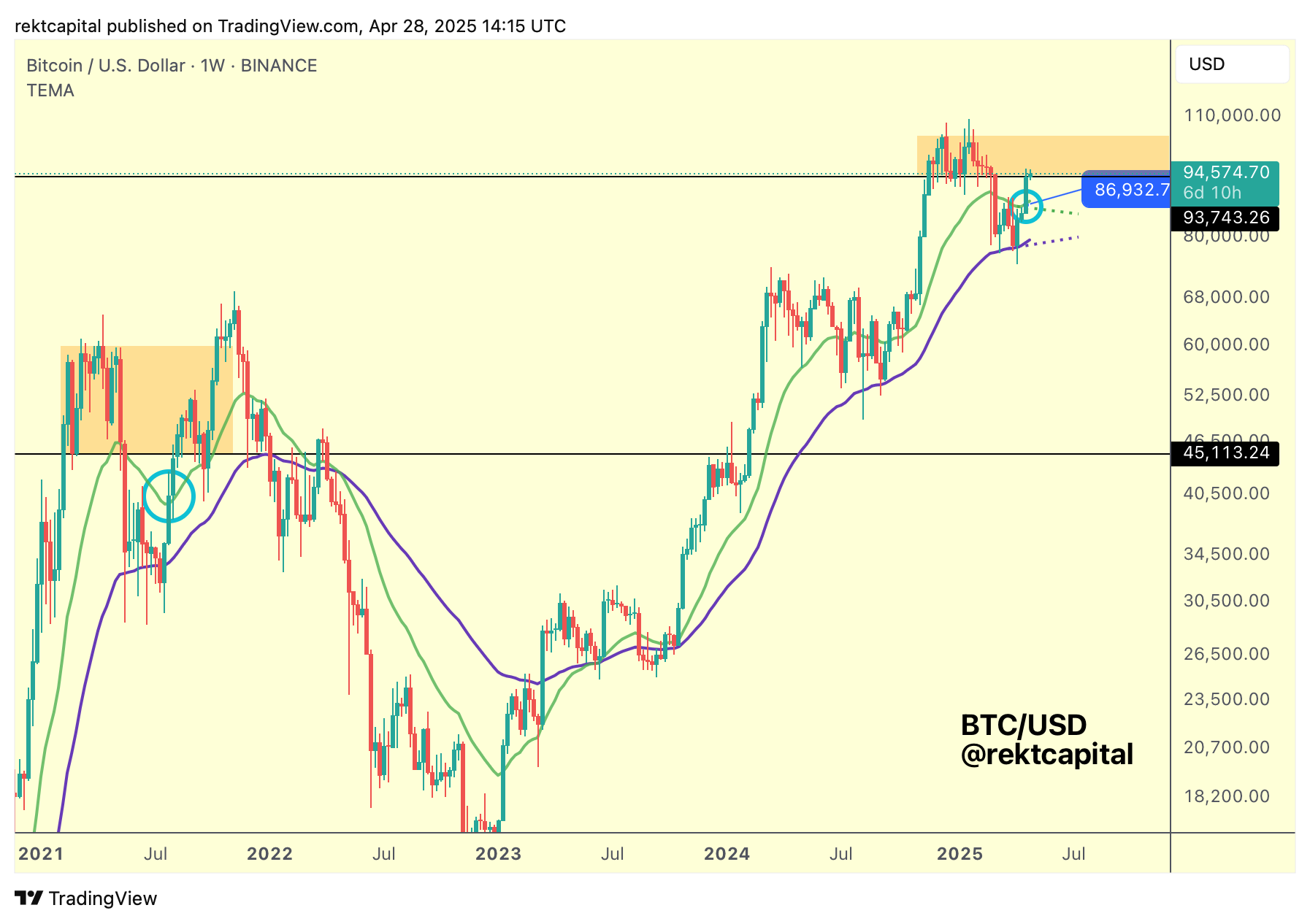

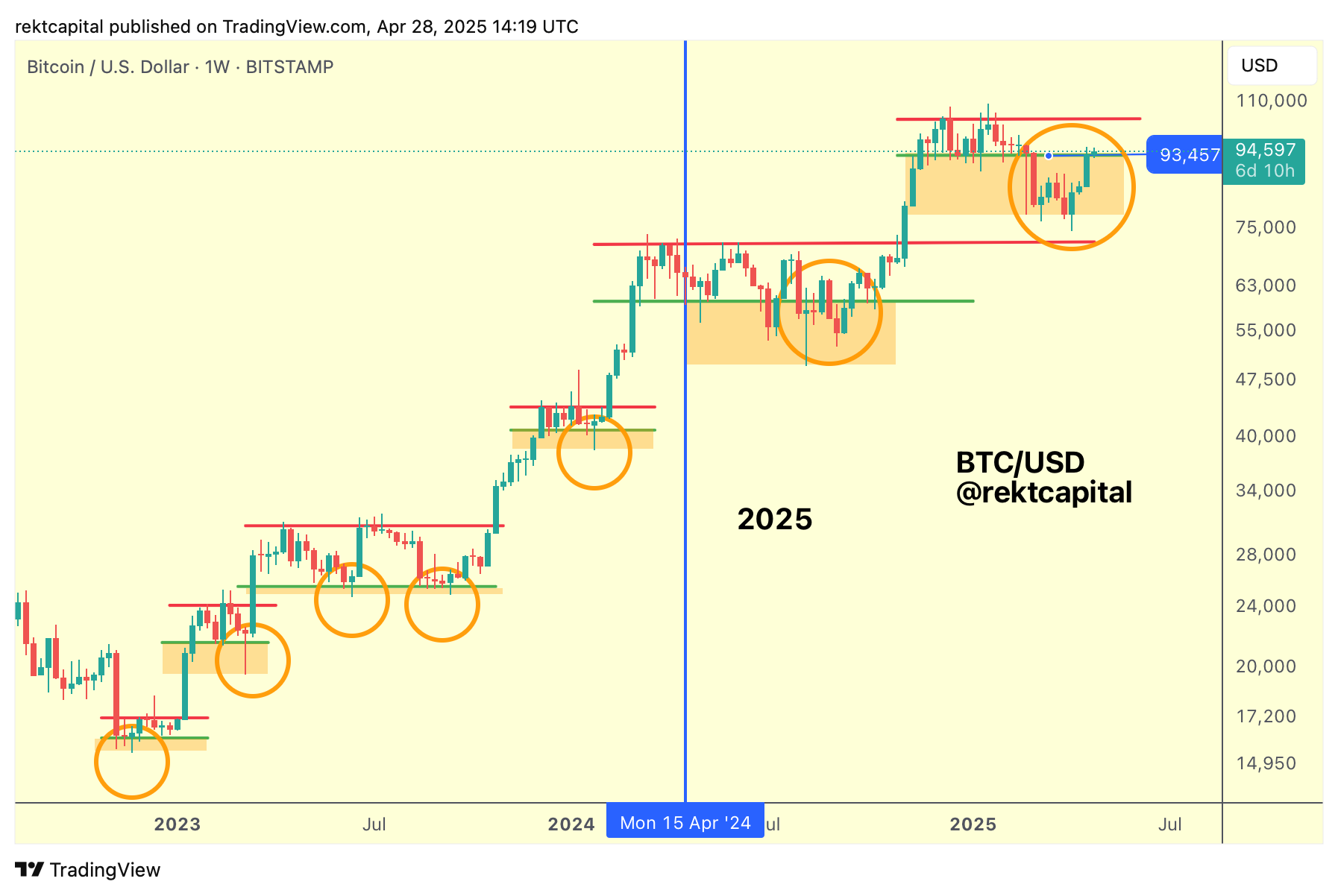

Bull Market EMAs

Bitcoin isn't just repeating the history of this current cycle.

It's also repeating mid-2021 cycle history.

Because over the past few weeks, we've been examining the perspective of price developing a range between two notable Bull Market EMAs: the green 21-week and purple 50-week EMAs:

Earlier this April, BTC was holding the purple 50-week EMA as support.

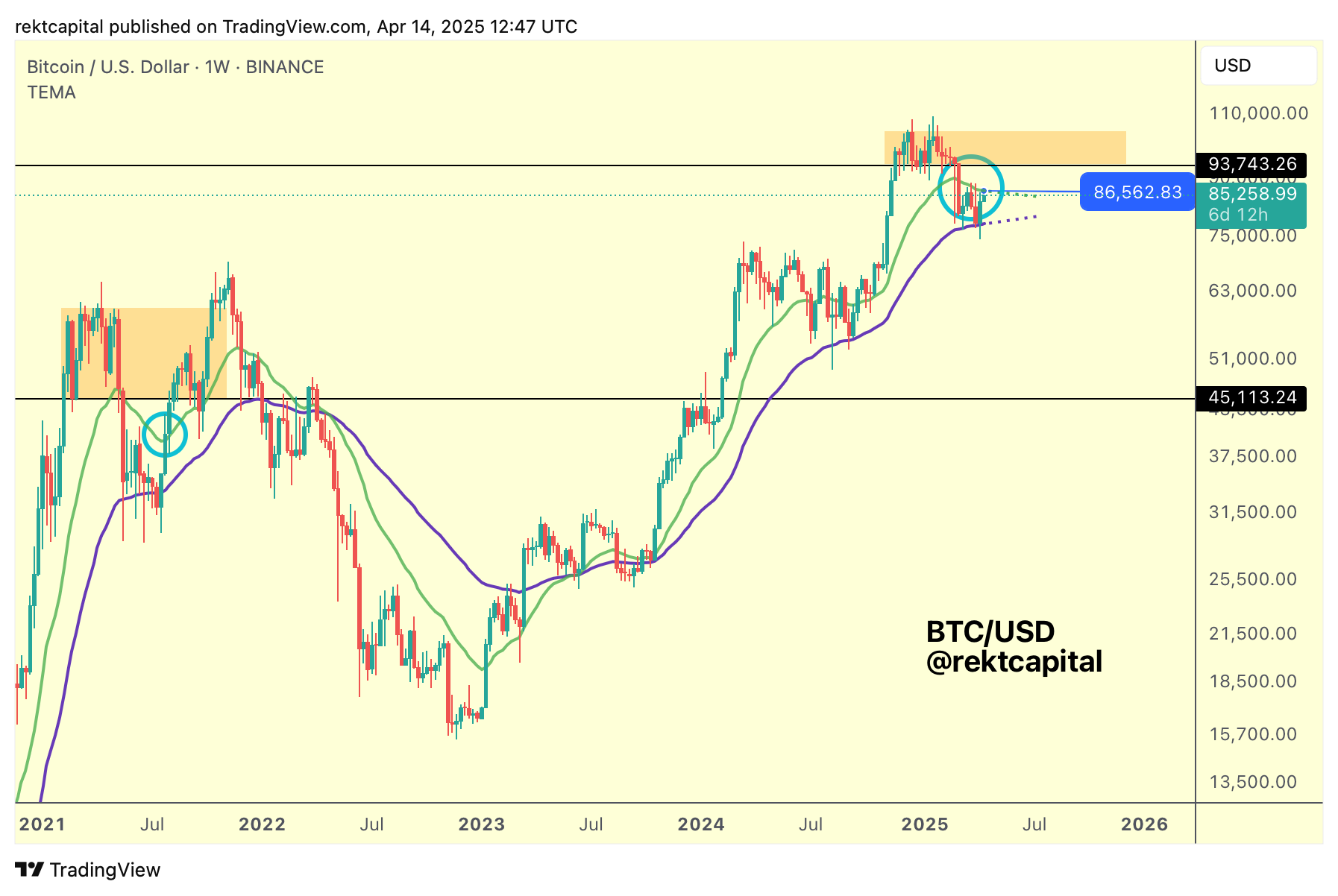

And then mid-April, BTC was back at the green 21-week EMA resistance:

Bitcoin has broken out since from these Bull Market EMAs:

Mid-2021 history has repeated in that respect.

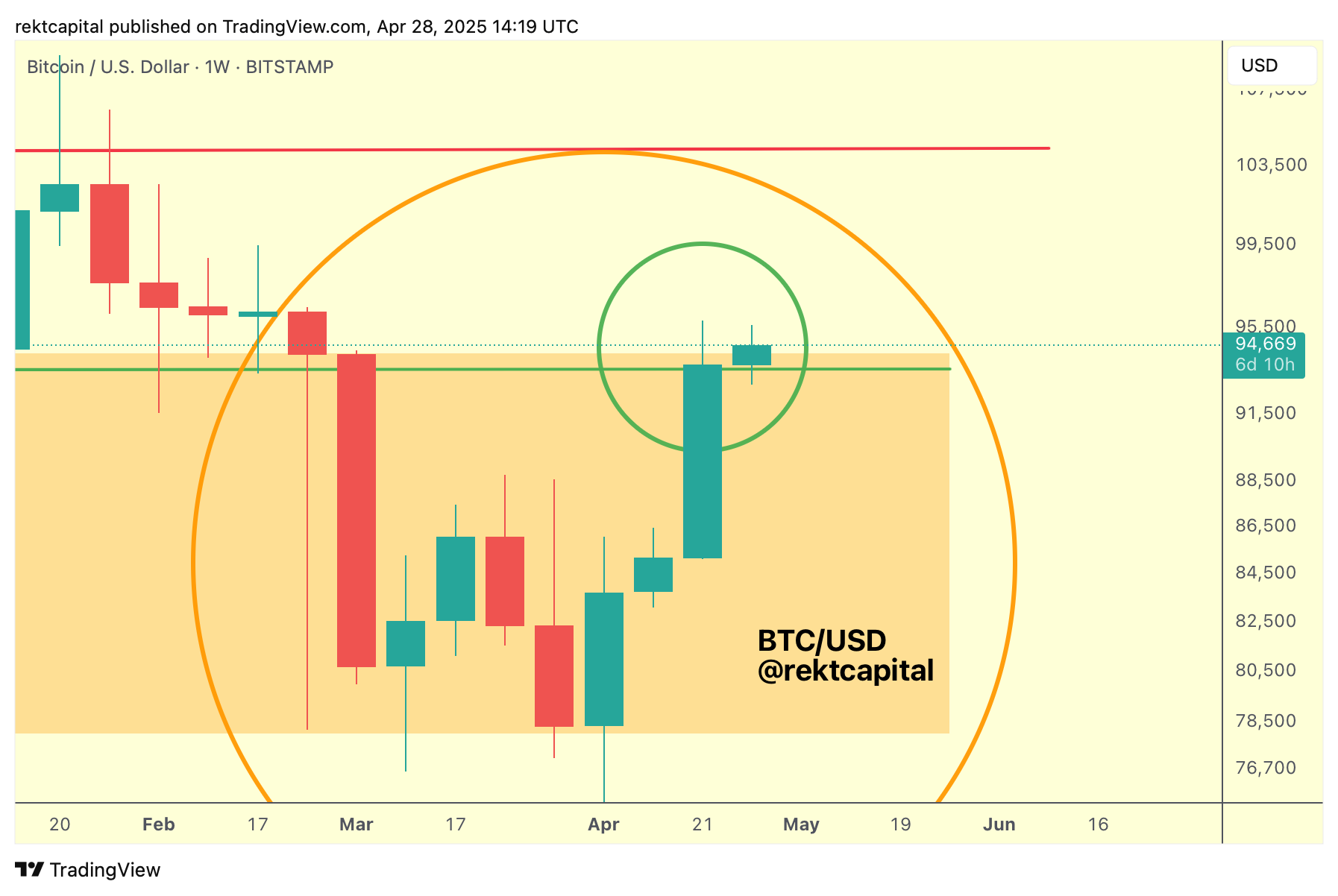

And thanks to this breakout, Bitcoin is now one step closer to reclaiming the previous Re-Accumulation Range to end the downside deviation:

In fact, Bitcoin has Weekly Closed above the Range Low of $93500 and is already in the process of retesting this level into new support (green circle):

Therefor the retest of $93500 is now in progress.

Of course, the best-case scenario would be that Bitcoin successfully retests $93500 as support and rallies across the range to fully resynchronise with this range.

But how often does the best-case scenario actually occur?

In today's newsletter, we'll be looking at how to strategically approach this current reclaim and what to watch out for going forward.