Altcoin Newsletter #261

Features analysis on Altcoins such as AAVE TAO BNB ADA HBAR FARTCOIN

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins – specifically:

- Aave (AAVE)

- Bittensor (TAO)

- Binance Coin (BNB)

- Cardano (ADA)

- Hedera Hashgraph (HBAR)

- Fartcoin (FARTCOIN)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

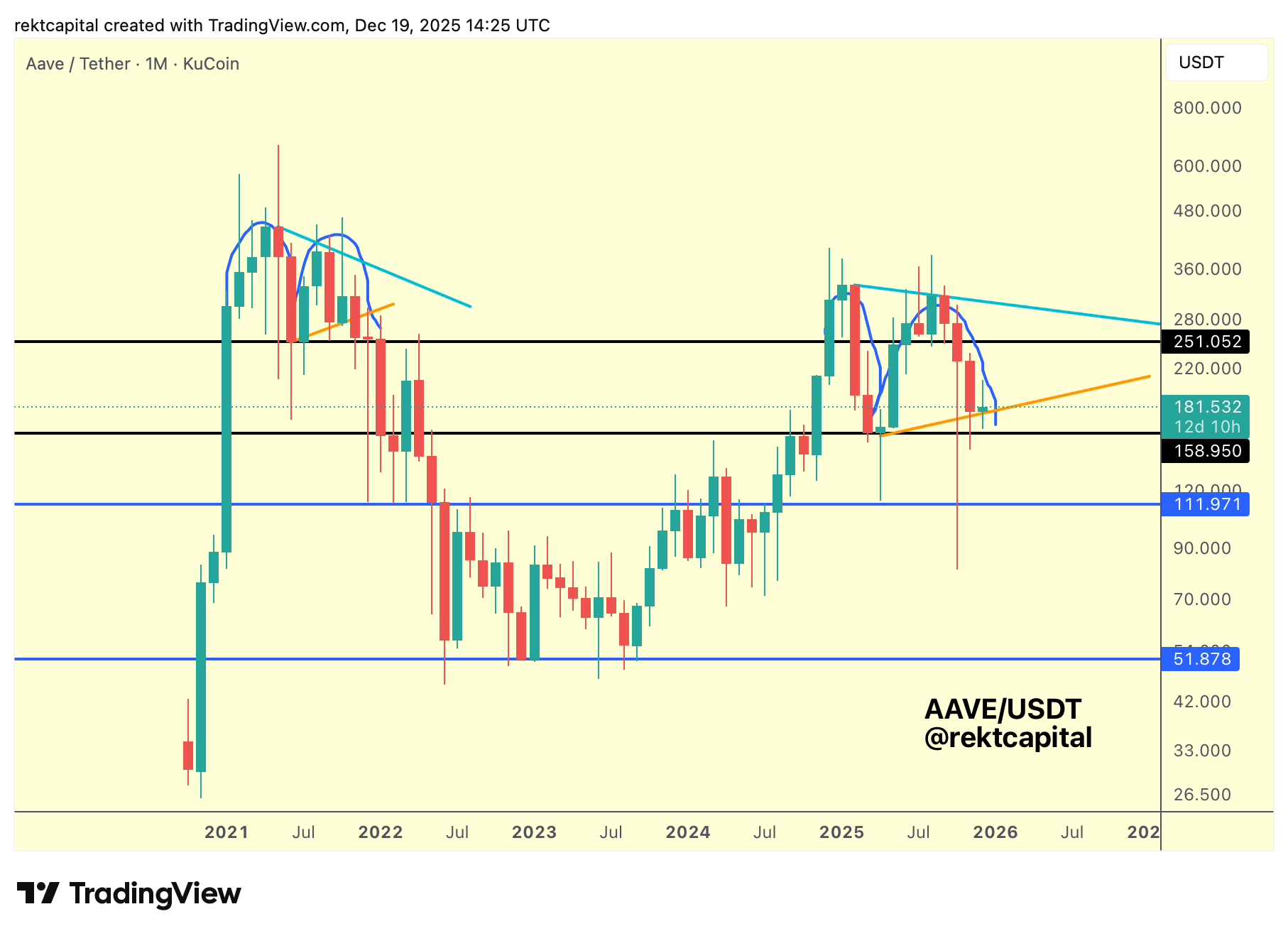

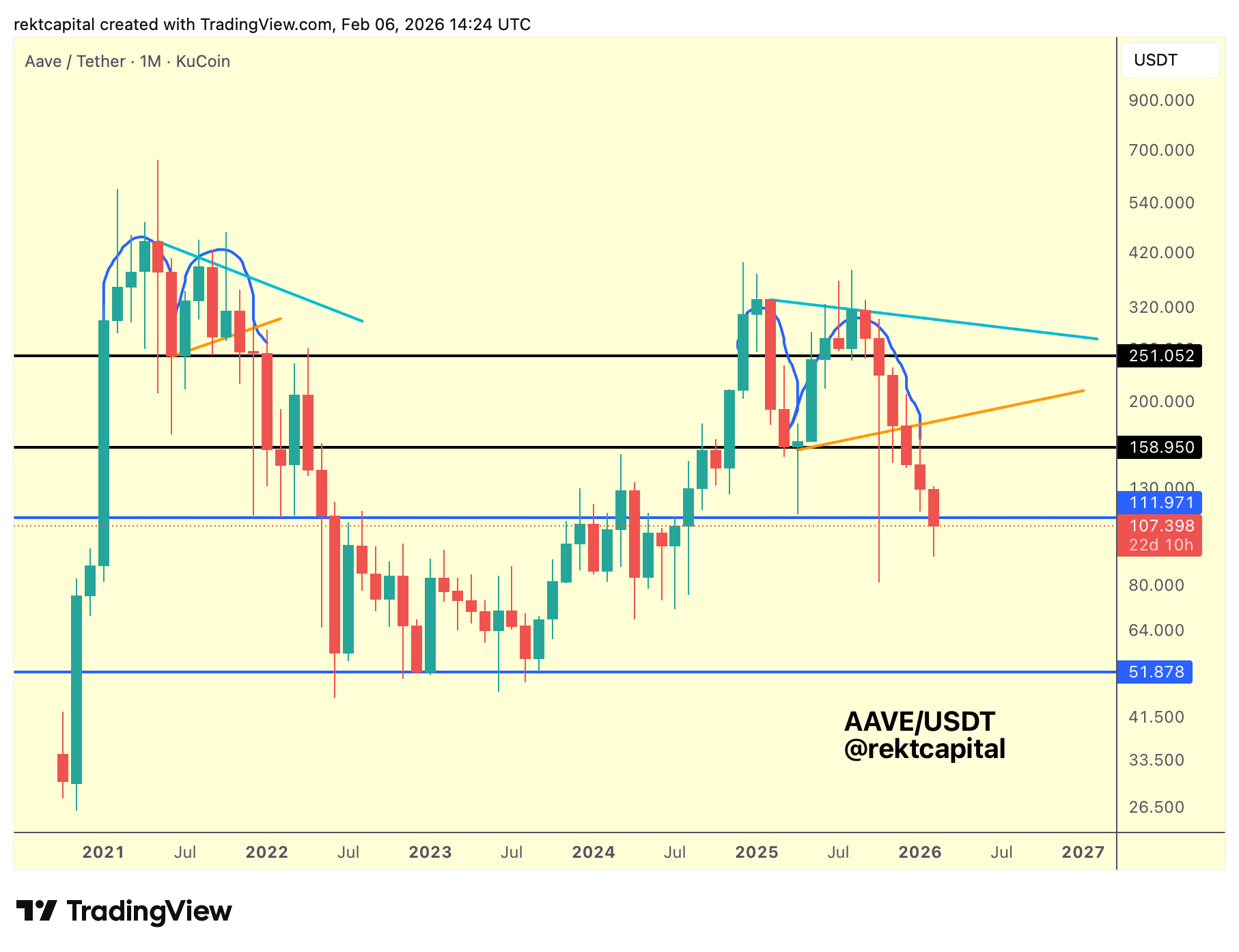

Aave – AAVE/USDT

Just before Christmas, we discussed AAVE in the context of a bearish fractal developing near cycle highs, a structure that historically tends to emerge around major tops and often precedes meaningful downside.

The primary downside trigger within that structure was the loss of the Higher Low and its subsequent turn into resistance, a condition that has now been met, with price distributing since that failure.

As a result, AAVE has been repeating historical tendencies rather closely, mirroring prior cycle behaviour where similar structural losses led into prolonged distribution phases.

With price now attempting to rebound from $111.971 (blue horizontal support), it is worth anchoring this move within historical context rather than viewing it in isolation.

In the prior cycle, AAVE repeatedly failed to reclaim key levels, most notably turning $158.950 (black horizontal resistance) into resistance, a behaviour that has reoccurred multiple times and is once again visible in the current structure.

If this cycle were to see a similar magnitude of downside as previously observed, that would technically imply scope for a move into the low $30s.

However, it is important to note that this is not necessarily the immediate expectation, because structurally AAVE typically first drops into the $51.878–$111.971 range to attempt to develop support.

This region has historically functioned as a Macro Accumulation Range, and the way price behaves here will be critical in determining whether further downside would need to be entertained later.

For now, AAVE appears to be in the early stages of a breakdown from the topping-out formation.

Meaning rebounds from $111.971 may occur, but continued distribution within the broader structure suggests additional downside pressure remains possible over time.

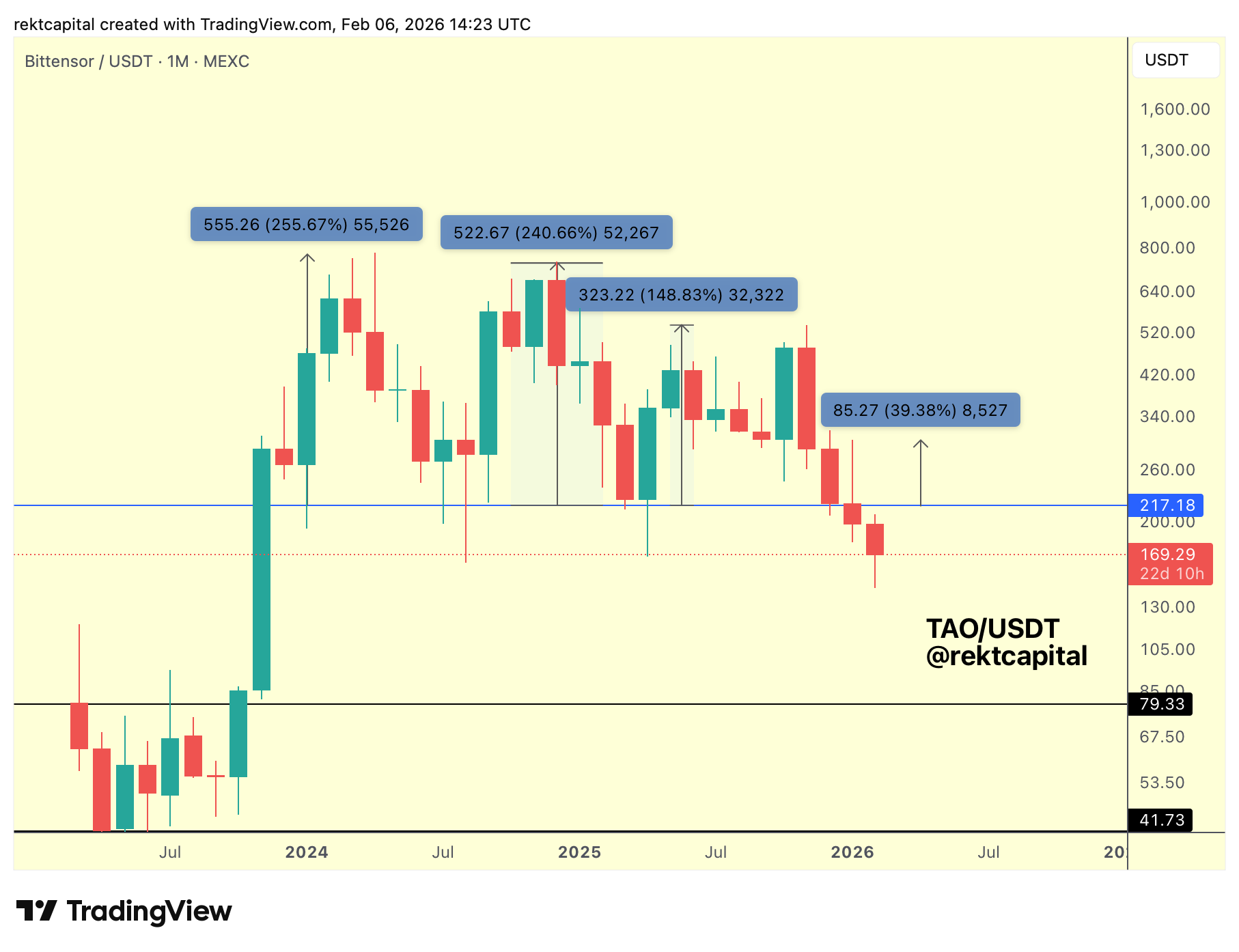

Bittensor – TAO/USDT

We spoke about TAO almost a month ago in the newsletter, highlighting how rebounds from the key support at $217.18 (blue horizontal, major support) have been getting progressively weaker with each passing reaction.

Historically, TAO produced rebounds of roughly +250%, then +150%, and most recently just a ~+40% move, a clear sign of diminishing demand and a developing distributive structure rather than accumulation.

That steady reduction in upside follow-through is the primary warning sign here, as it shows that each reaction from support is exhausting faster than the last.

Structurally, TAO has already broken down from this region, with a Monthly Close below $217.18, which completes the first step of the breakdown process.

Since then, we have seen retesting intent, but ideally this process would be confirmed by an upside wick into $217.18 to clearly establish former support as new resistance before downside continuation resumes.

At present, TAO sits somewhere between steps two and three of that staircase.

Because the retest has occurred to a degree, but not cleanly enough to provide perfect confirmation, which is why the signals here lack sharp clarity.

However, the broader message remains intact: the former support has clearly weakened and is increasingly behaving as resistance, even if the role reversal is not yet textbook.

Whether TAO formally tags $217.18 from below to confirm it as resistance or continues distributing without a clean retest, the higher-probability outcome over time is a move into the $79.33–$217.18 range, an area where price previously moved too quickly to build any meaningful structure.

That range represents a market inefficiency, and historically such zones tend to get filled later in the cycle, potentially even revisiting the mid-2024 cluster if broader Bear Market conditions persist.