Altcoin Newsletter #260

Features analysis on Altcoins such as SOL ADA BNB AXS ALGO SPX

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins – specifically:

- Solana (SOL)

- Cardano (ADA)

- Binance Coin (BNB)

- Axie Infinity (AXS)

- Algorand (ALGO)

- SPX6900 (SPX)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

Solana – SOL/USD

We've been discussing Solana for a while, speaking about how it has been producing lesser and lesser rebounds from the historical demand level of $123 (black).

And indeed, the recent rebound of just +15% really emphasises the stark contrast of mounting weakness in this historical support zone, compared to the prior 100-140% rebounds from the same level.

In fact, price appears to be slipping from this $123, and a Monthly Close below $123 followed by a turning of it into new resistance would likely kickstart the breakdown process from what has become a likely distribution cluster of price action at highs.

More, together with the Macro Lower Highs (black trendline), the historical inability to successfully turn the orange major resistance area into new support, and the weakening of the historical support at $123...

All point to a portrait of Solana struggling to not just cover additional ground in making new highs, but simply also struggling to try to stand its ground and maintain its stability at $123.

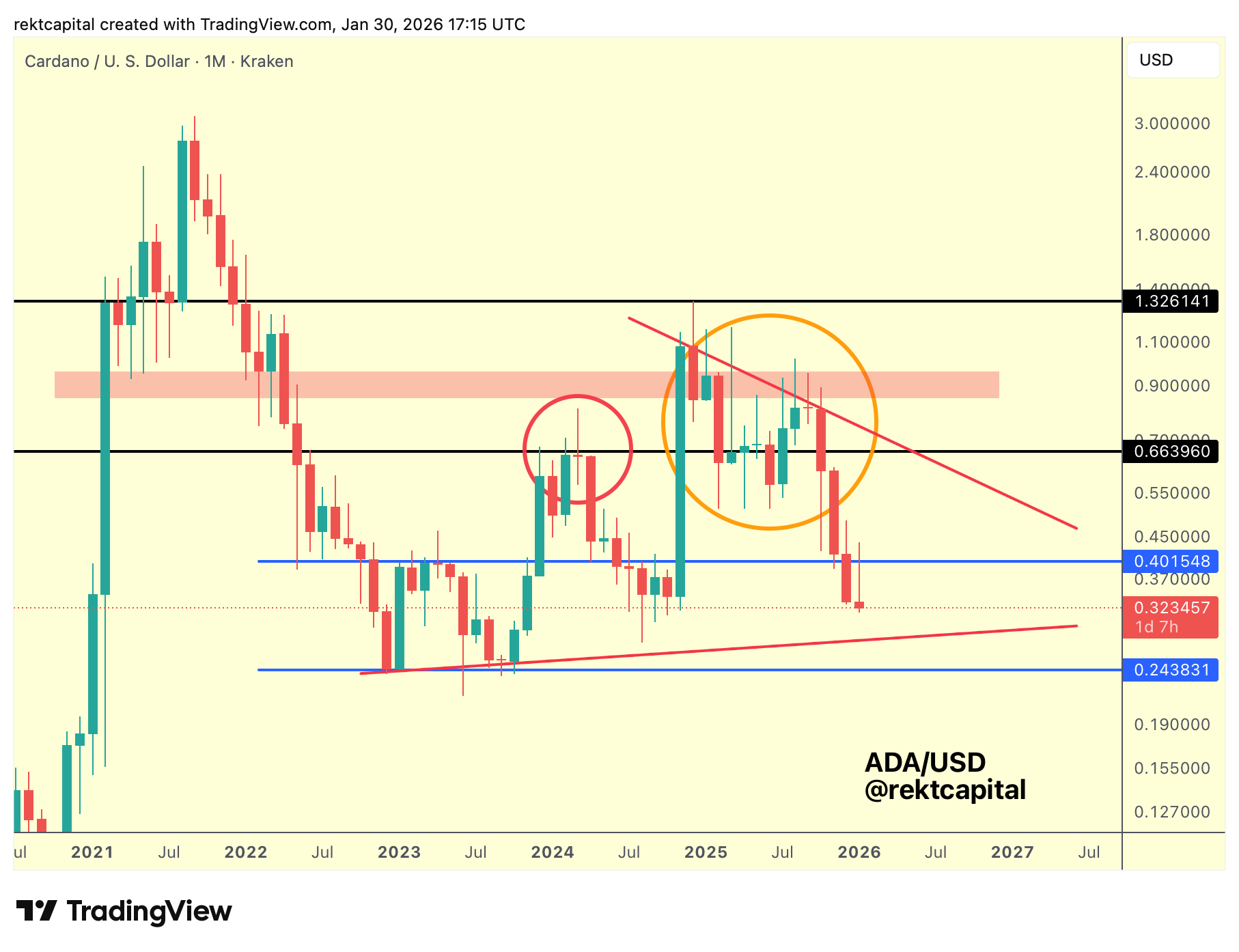

Cardano - ADA/USD

Cardano occupies this Macro Triangle (red) and ever since price rejected from the Macro Lower High resistance, the chances of a revisit of the Macro Higher Low to establish this structure became quite high.

In fact, it looks like ADA is on its way to this Higher Low, especially if it continues to turn the blue $0.40 level into new resistance.

If this confirms as resistance, then ADA may very well pullback towards the red Higher Low.

However, if BTC is indeed in an early stage Bear Market (and more signals point to that vs Bull Market continuation), then ADA actually has a very tough battle ahead of it if it wants to keep this Macro Triangle.

After all, not much additional downside is needed for ADA to drop into the Higher Low but if BTC itself breaksdown into Bearish Acceleration, then ADA will follow doubly, triply, even moreso.

By turning the $0.40 old Range High level into new resistance, it therefore positions itself for a drop deeper into the Range where the Higher Low (red) indeed resides, but also the Range Low of $0.24 resides also; those will be the two key support areas ADA will need to try to demonstrate strength at.

It's just that in a market with mounting macro weakness, ADA may struggle to find stability at either of these levels.