Altcoin Newsletter #259

Features analysis on Altcoins such as XLM XRP ROSE VIRTUAL XMR INJ

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins – specifically:

- Stellar (XLM)

- Ripple (XRP)

- Oasis Network (ROSE)

- Virtuals Protocol (VIRTUAL)

- Monero (XMR)

- Injective (INJ)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

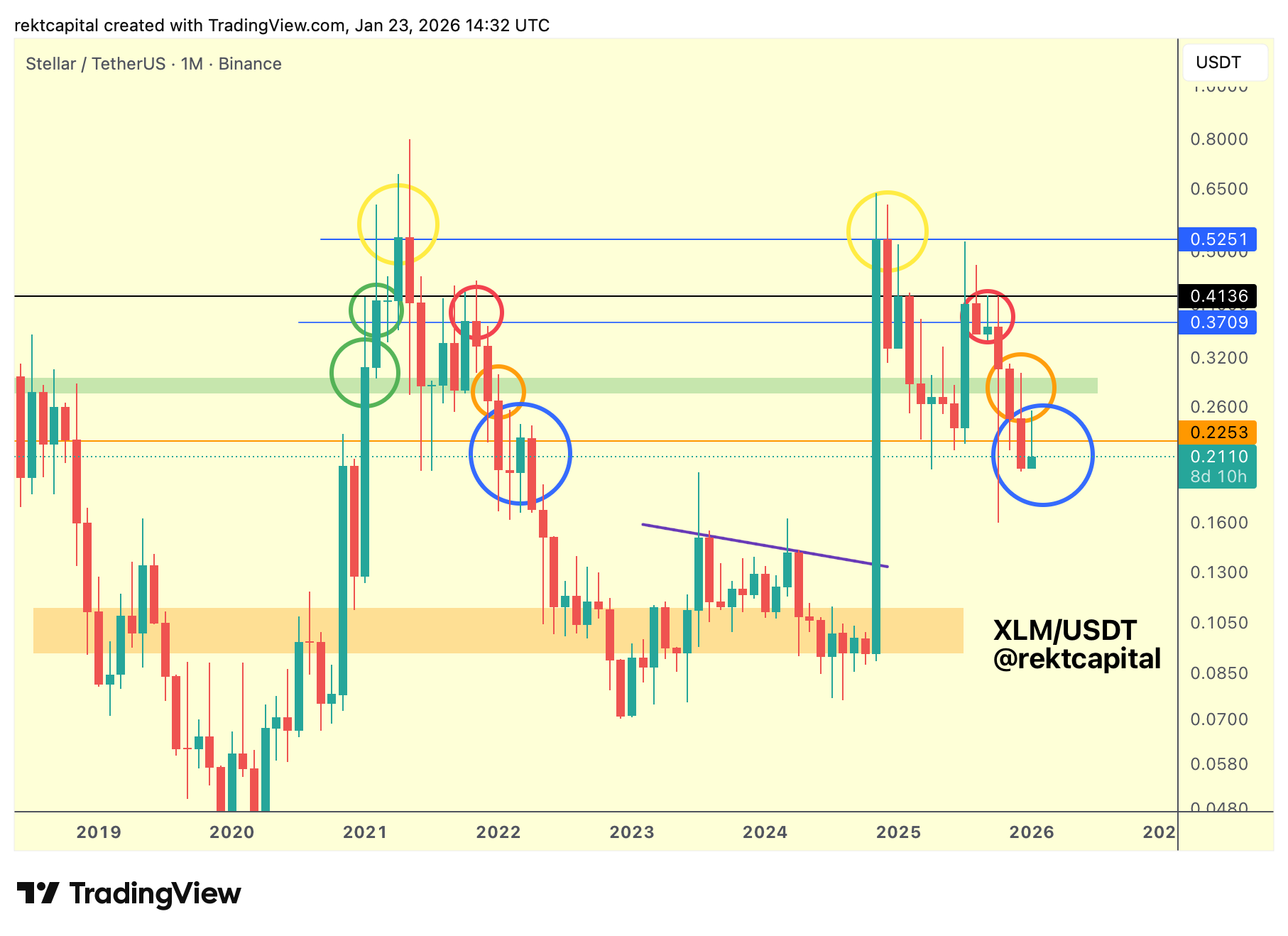

Stellar – XLM/USDT

On the Monthly timeframe, XLM continues to closely mirror its 2021 cycle structure.

Back then, two early upside expansions (green circles) ultimately propelled price into the cycle peak, marked by the yellow circle. In the current cycle, that same sequence has now replayed.

Price has once again topped out at the yellow circled region.

Following that peak in 2021, XLM saw post-breakdown relief (red circle), before rejecting. That same relief-and-rejection dynamic has also occurred in the current cycle.

More importantly, price has continued to upside-wick into the former green support region, marked by the orange circle, only to turn that area into resistance. That behaviour is repeating almost step-for-step.

The most critical parallel, however, lies at $0.225 (orange).

In the prior cycle, XLM Monthly Closed below this level, flipping it into resistance and entering a prolonged distribution phase.In the current cycle, XLM has now also Monthly Closed below $0.225.

Since then, price has been upside-wicking into that level, attempting to reclaim it, but failing precisely as it did during 2022.

That rejection lasted roughly two to three months during the previous cycle.This current rejection marks the first month of a similar process and could extend further if history continues to rhyme.

As long as $0.225 continues to reject price from above, the broader structure remains unfavourable for bulls.

XLM is currently producing a sequence of macro Lower Highs, while former support levels are repeatedly being lost and converted into resistance.That is the structural definition of continued downside distribution over time.

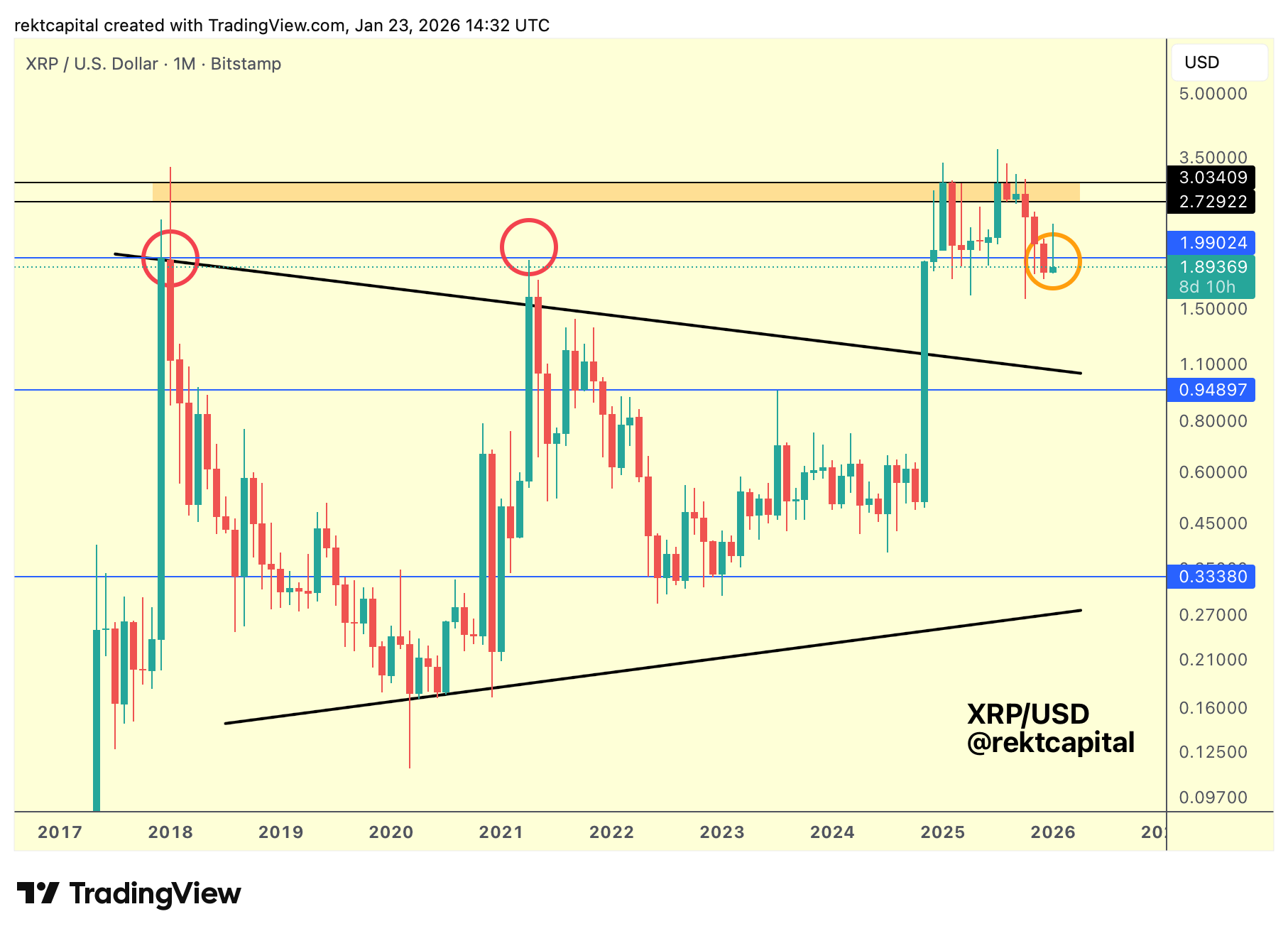

Ripple – XRP/USD

The $2.00 psychological level has historically been a major problem area for XRP.

Back in 2017 and 2018, rejection from $2 sent price into a deep and prolonged downtrend, while a similar rejection in 2021 also capped the cycle high, albeit leading into a shallower but still meaningful downside phase.

Since then, XRP had managed to hold $2 as support for an extended period.

That changed last month.

Price Monthly Closed below $2, and in doing so, has begun to turn this former support into new resistance from the underside, placing XRP back at a structurally vulnerable inflection point.

This is not a level that has ever offered particularly convincing support, and history suggests that failure to reclaim it tends to resolve bearishly rather than stabilize.

If XRP continues to reject from $2 in the manner currently developing, then the existing bearish divergences on the Monthly timeframe are likely to continue playing out, reinforcing broader macro weakness rather than invalidating it.

In that scenario, downside continuation becomes the higher-probability outcome.

As such, it is critically important that $2 does not fully cement itself as resistance, because once that transition is confirmed, XRP would be positioned for further downside over time rather than recovery.