Altcoin Newsletter #258

Features analysis on Altcoins such as ENA ETHFI HYPE DEEP TAO FET

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins – specifically:

- Ethena (ENA)

- Ether.fi (ETHFI)

- Hyperliquid (HYPE)

- DeepBook (DEEP)

- Bittensor (TAO)

- Fetch.ai (FET)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

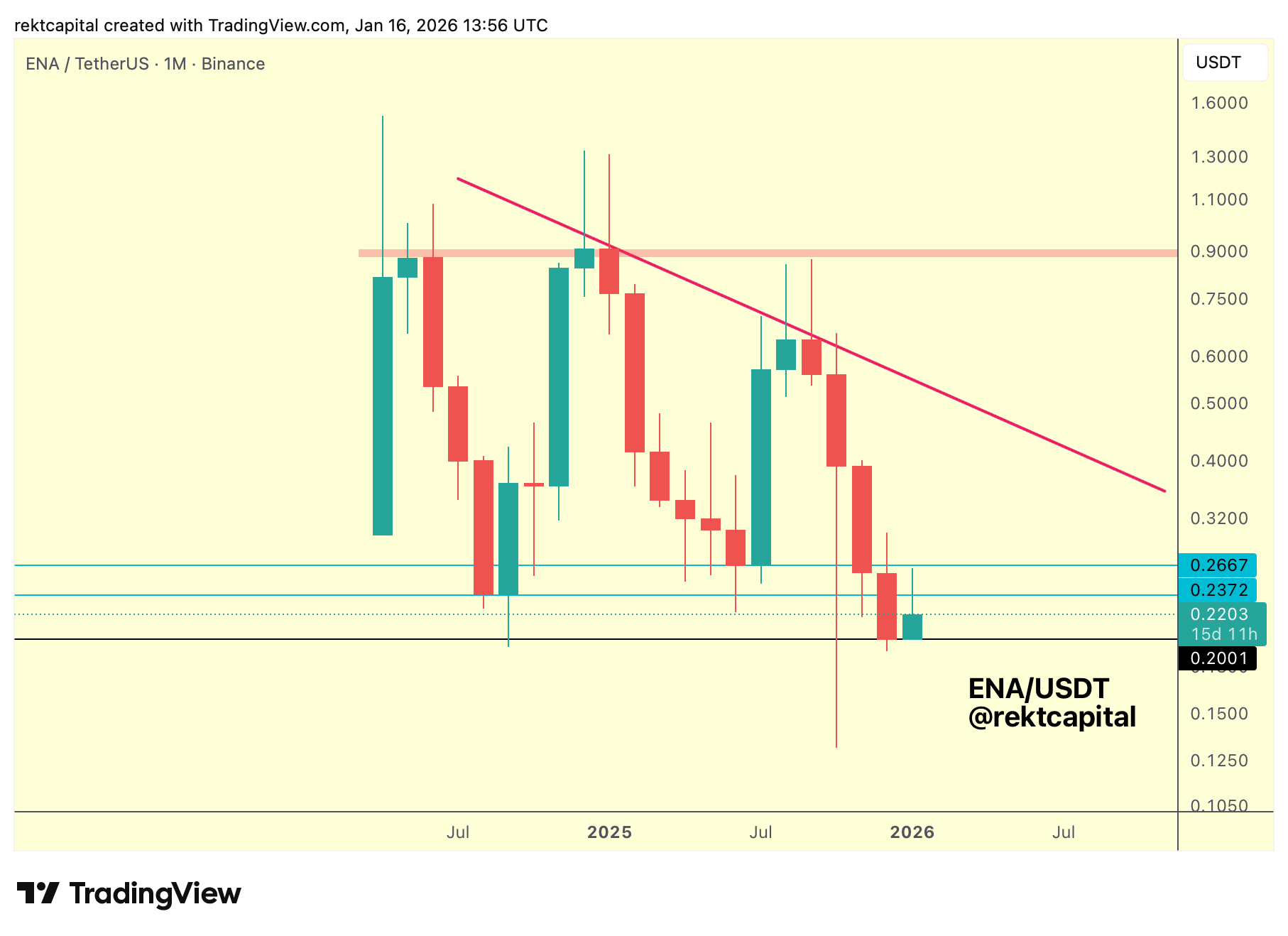

Ethena – ENA/USDT

ENA remains firmly within a Macro Downtrend, with price action having weakened materially over recent months as the market lost multiple historically significant demand levels.

Specifically, the former reversal regions around $0.26 (turquoise horizontal, historical demand) and $0.23 (light turquoise horizontal, historical demand) both failed, with Monthly Closes below each level flipping them into overhead resistance.

This structural shift is important, because both of these levels had previously enabled trend reversals for ENA.

Yet their failure confirms that downside continuation has remained dominant throughout the Macro Downtrend.

However, below these former supports, ENA has now returned to a pre-2025 downside wick region which is currently acting as support, marking the first meaningful attempt by price to stabilise after months of persistent weakness.

On the Weekly, that pre-2025 downside wick region corresponds closely with $0.20 (black horizontal, Macro support), which currently represents the final major region of support for ENA.

Historically, when ENA last traded around this level, price went on to enjoy a strong uptrend.

Though any reversal attempt here would likely be weaker given the prevailing Macro Downtrend and the presence of a multi-week Downtrend (purple trendline) pressing price lower.

As a result, any meaningful upside attempt would first require ENA to break this multi-week Downtrend, before attempting to reclaim former Weekly demand levels overhead.

From historical context, ENA has previously required a Weekly Close above $0.26, followed by a successful reclaim of that level as support, to confirm upside continuation towards at least $0.40, a sequence that has played out on two separate occasions.

Therefore, the current game plan for ENA is clear but demanding: price must hold $0.20, break the multi-week Downtrend, reclaim the former Weekly demand levels overhead, and ultimately flip $0.26 into support to confirm a more durable bullish momentum shift.

Until such confirmations occur, this region remains a high-risk, high-decision zone, with $0.20 serving as the critical level from which any potential recovery must originate.

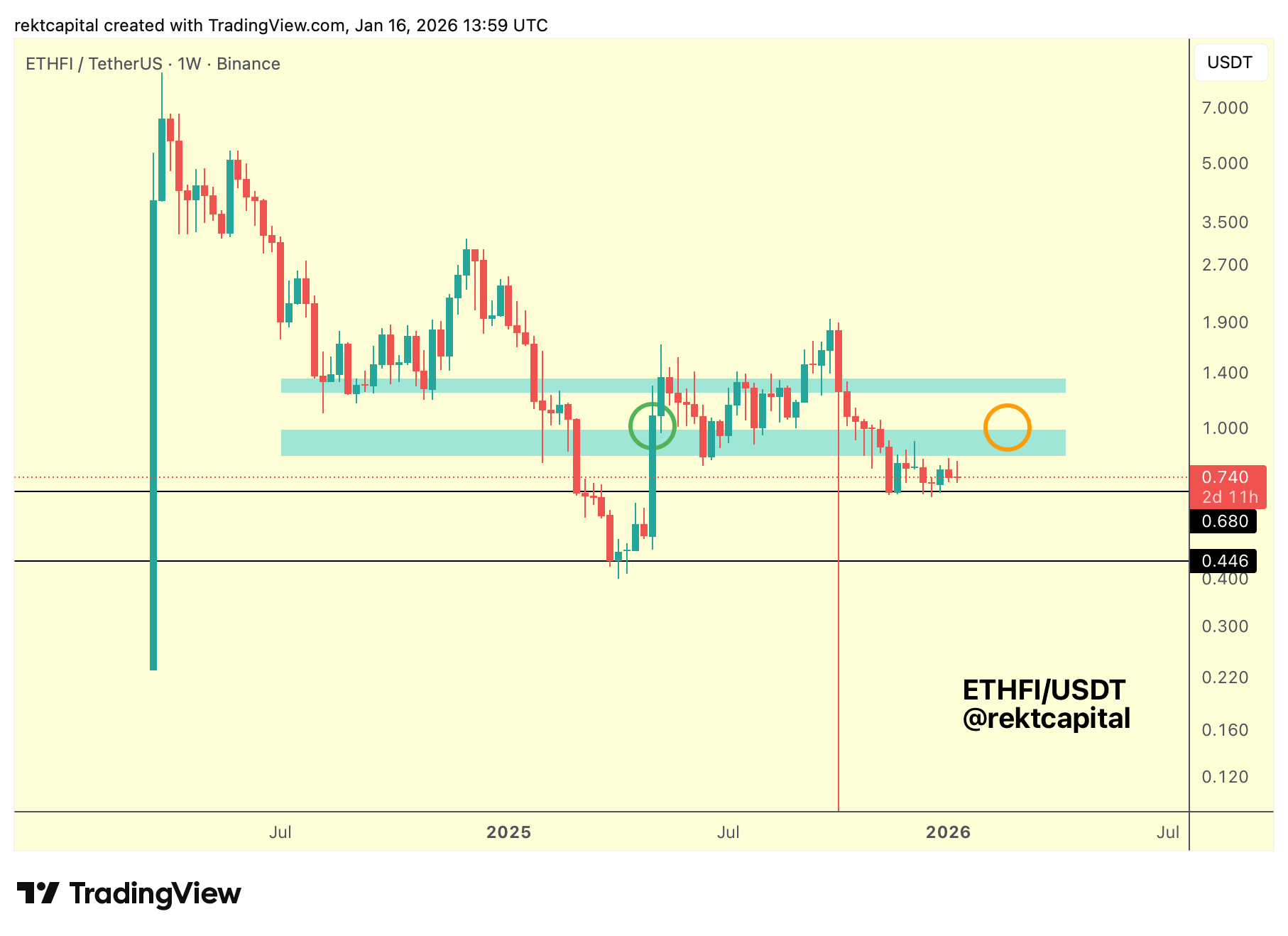

Ether fi – ETHFI/USDT

ETHFI is currently hovering below a prior region of demand that is now acting as new resistance, while simultaneously hovering just above a prior resistance zone, which price is trying to hold as support.

It’s a tight spot.

Historically, there isn’t much price data to inspire confidence in $0.68 (black horizontal, key level) acting as a durable support region, which is why this area needs to be treated cautiously even if price appears to be “holding” for now.

By contrast, the light blue region (light blue demand zone, prior resistance-turned-support) has at least shown itself as strong demand in the past, as it helped enable that 2025 run, even if that run wasn’t particularly strong in the grand scheme of things.

But here is the catch.

As a resistance, we’ve never really seen this light blue region act this way until now, as it previously functioned more as weak support, raising the key question of whether it now becomes a weak ceiling… or a strong one.

So the immediate tell is simple: if ETHFI fails to break beyond the light blue region, and fails to produce Weekly Closes anywhere within it or above it, then that would effectively showcase weakness at these price levels.

And if weakness persists, ETHFI may have to break down into its black-to-black Weekly Range below, between $0.68 and $0.446 (black horizontals).

Because strength cannot build if price fails to even close inside the light blue region.