Altcoin Newsletter #256

Features analysis on Altcoins such as SOL XLM PENGU FET FARTCOIN AAVE

🎄 Christmas Holiday Announcement 🎄

As we head into the holiday season, we’ll be closing our virtual doors December 22 - January 5 to give everyone time to rest, recharge, and enjoy some well-deserved moments in the warm company of family, friends, and significant others.

As a result, the last newsletter of 2025 will be published on Friday 19th of December 2025 and the first newsletter after the holidays will be published on Monday the 5th of January 2026.

Thank you for a phenomenal 2025 thus far and I cannot wait to see what 2026 has in store in the crypto markets for us.

Wishing you a Merry, Merry Christmas and a Happy New Year 2026!

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins – specifically:

- Solana (SOL)

- Stellar (XLM)

- Pudgy Penguins (PENGU)

- Fetch.ai (FET)

- Fartcoin (FARTCOIN)

- Aave (AAVE)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

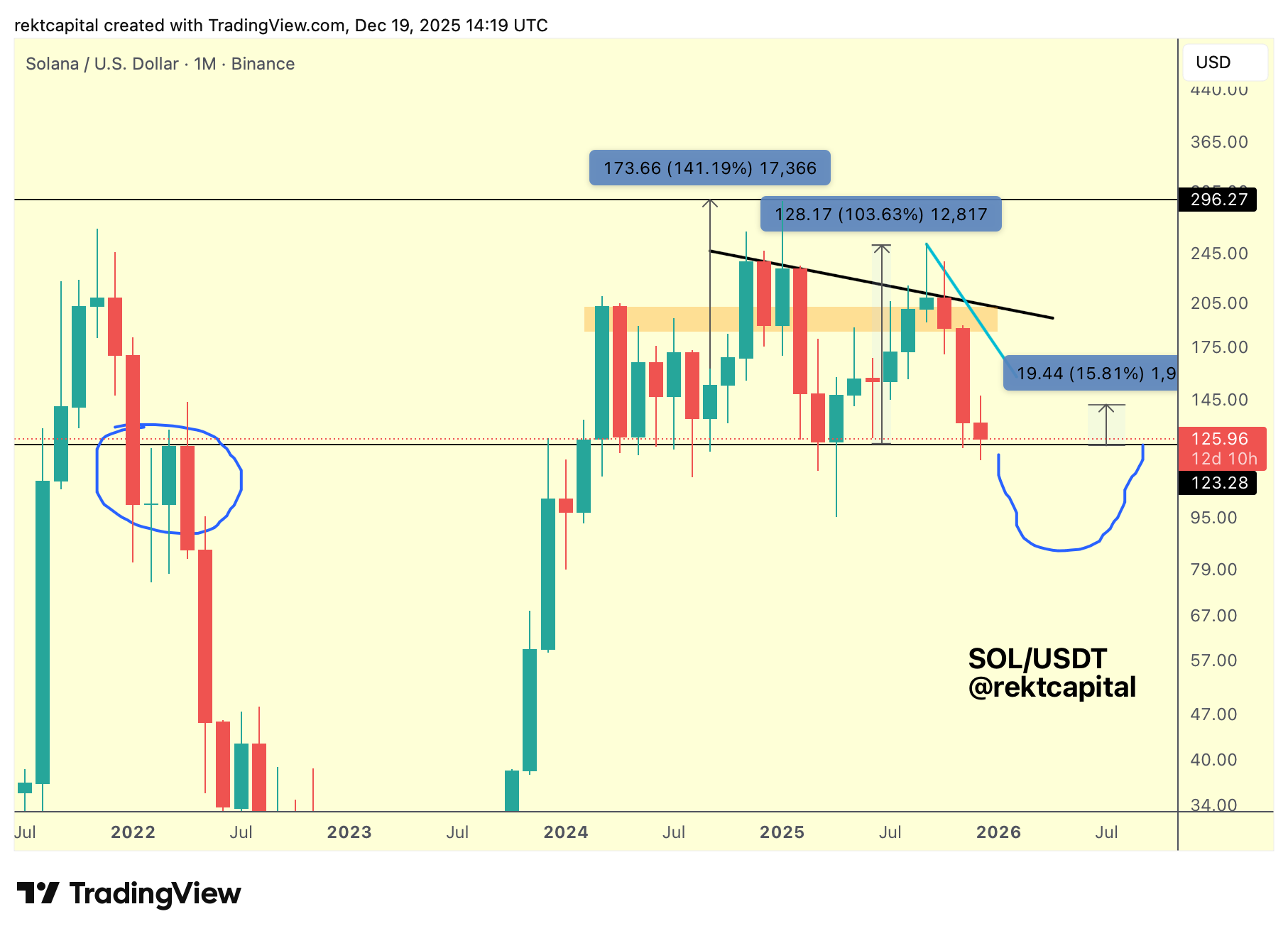

Solana – SOL/USDT

On the Monthly, $123 (black horizontal, major support) continues to be the defining level that Solana needs to hold, as each rebound from this region has become progressively weaker over time.

Historically, rebounds from this support produced outsized upside expansions — first a 140% move, then a 100% move — but the most recent rebound has only managed roughly +15%, signalling a sharp deceleration in upside responsiveness at this level.

That compression in rebound magnitude matters, because it raises the importance of the Monthly Close.

A Monthly Close above the red support would still keep Solana positioned for a weaker rally, but a Monthly Close below $123 would materially change the structure.

If Solana were to Monthly Close below this level, that would strongly suggest distribution is already underway, confirming just how much this support has weakened since the last meaningful rebound that produced a near 2x move earlier this year.

Such a close would also begin to mirror early-2022 price action.

When a similar Monthly Close below support preceded macro relief moves during the opening phase of the Bear Market, including the decisive breakdown that occurred at the turn of that year.

The key question is whether Solana can continue to hold above $123 into the Monthly Close and sustain some rebound positioning, or whether a breakdown below this level accelerates distribution sooner rather than later.

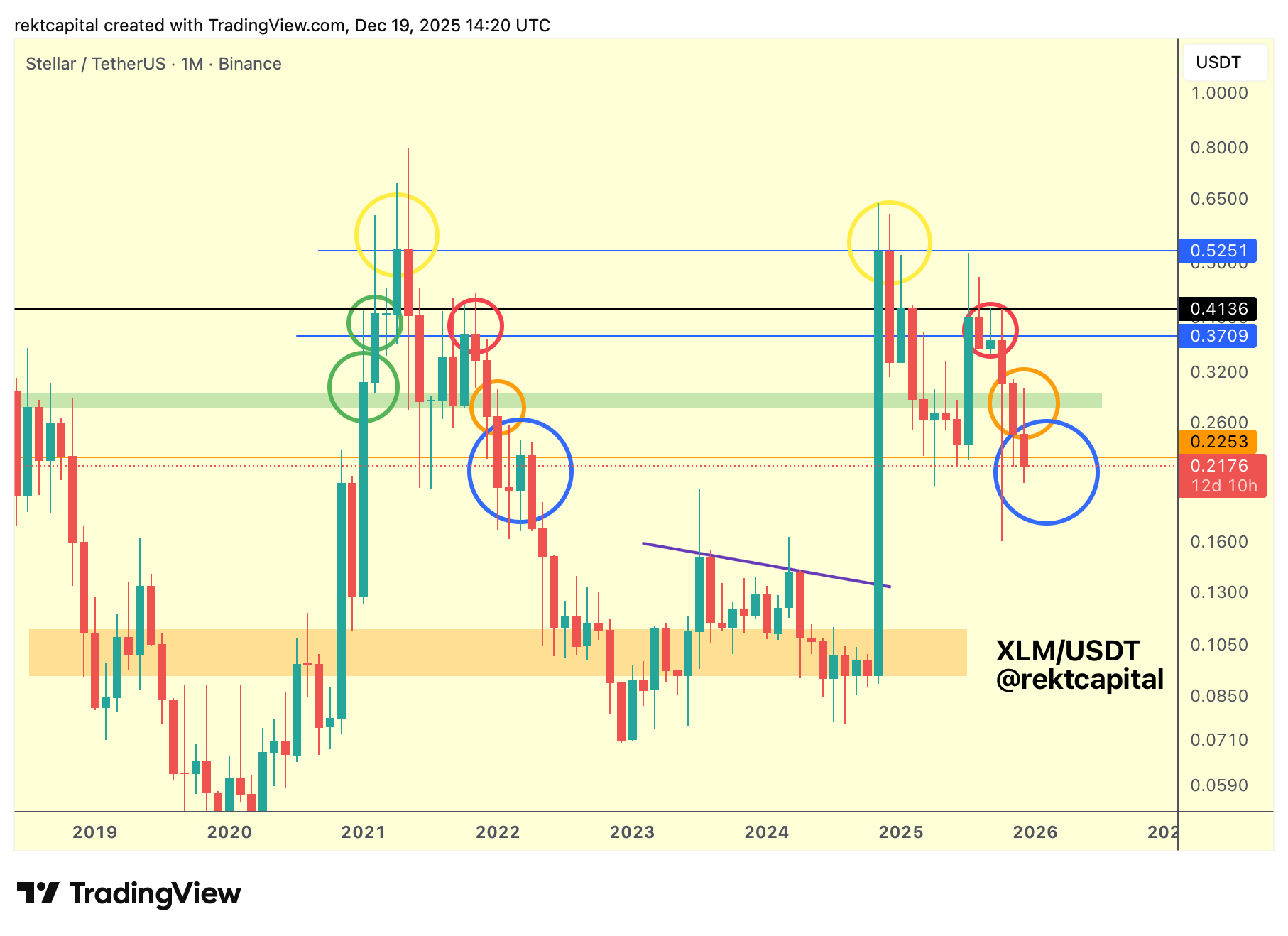

Stellar – XLM/USDT

On the Monthly, XLM is approaching another highly consequential Monthly Close, with price action continuing to replicate the 2021 structure with striking precision across multiple key levels.

In this cycle, XLM has rejected at the $0.5251 (blue horizontal, Range High resistance) in a manner similar to 2021.

Before losing the $0.4136 (black horizontal, former support) and the $0.3709 (blue horizontal, mid-range support), both of which have since flipped into resistance, as highlighted by the red circled rejections.

Beyond that, the former green demand zone has also transitioned into resistance, with price rejecting from it again around the $0.2253 (orange horizontal, higher timeframe support), reinforcing the broader structural similarity to early-2022 price behaviour.

As a result, the Monthly Close relative to $0.2253 now becomes decisive.

A Monthly Close below this level would likely trigger a familiar process:

Where price closes below a higher timeframe support and then spends the following quarter or so repeatedly turning that former support into resistance, echoing the early-2022 distribution phase.

If, instead, XLM manages to Monthly Close above $0.2253, there would still be scope for price to attempt a reclaim of the green region above, or at the very least continue rejecting from that zone as the market transitions into Q1.

However, a Monthly Close below the ~$0.22–$0.225 area would firmly position XLM for early-2022-style distribution, especially given how closely this cycle has tracked 2021 so far.

Notably, this fractal alignment is not isolated.

Solana is exhibiting a very similar structure, and Bitcoin’s behaviour near its cycle highs is also closely mirroring 2021, adding further context to why this Monthly Close matters so much here.