Altcoin Newsletter #255

Features analysis on Altcoins such as BONK PEPE SEI DOT ADA HYPE

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins – specifically:

- Bonk (BONK)

- Pepe (PEPE)

- Sei (SEI)

- Polkadot (DOT)

- Cardano (ADA)

- Hyperliquid (HYPE)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

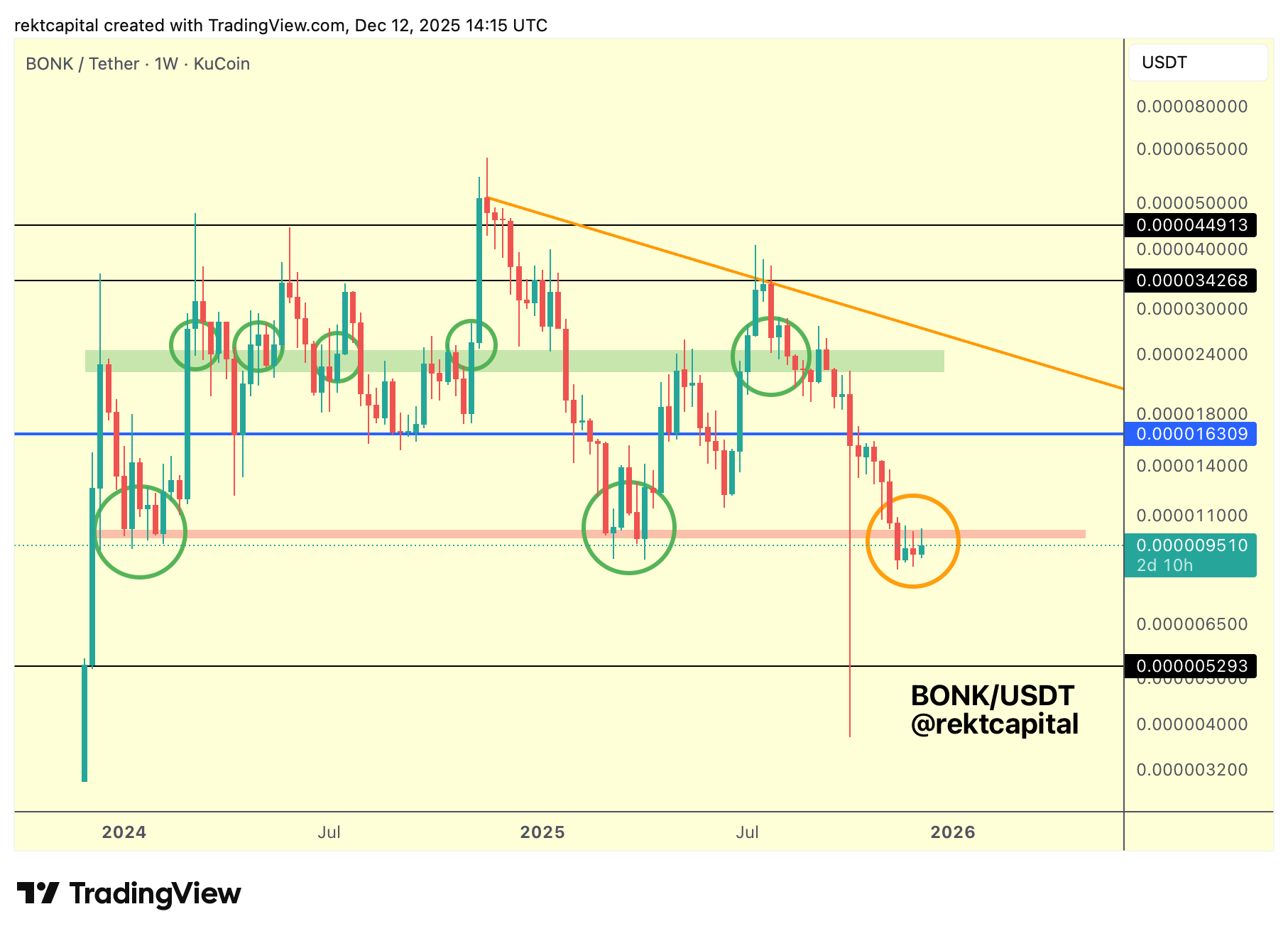

Bonk – BONK/USDT

Historically, the green region has tended to produce temporary upside for BONK.However, that upside has consistently proven unsustainable, with price eventually losing the green region, flipping it into resistance, and rolling over.

On the previous occasion where BONK overextended beyond the green region, that same pattern repeated.

Price failed to hold above it, turned it into resistance, and dropped back toward the final major Weekly support at the red region, which has now produced rebounds on two separate macro occasions.

At present, BONK is once again upside-wicking into the red region.

That behaviour introduces risk.

If BONK fails to Weekly Close above this red region and retest it as support, then the market faces a wide pocket of price action beneath, where new supports and resistances would need to form between the red region and the black level below.

In that case, continued rejection from the red region would likely see BONK transition into this lower range.

Downside continuation would become increasingly probable, especially if the recent three-to-four Weekly Candle supports begin to fail.

However, the alternative remains valid.

Should BONK Weekly Close above the red region and successfully hold it as support, price could begin forming a multi-week cluster at the Range Low.

Whether that structure resolves as a Double Bottom, Higher Low, or even a marginal Lower Low is secondary to the process itself.

If such clustering develops at the Range Low — defined by the red support below and the blue Range High above — then BONK could eventually position itself for a rotation higher across the range.

For now, nothing is resolved.BONK’s next move depends entirely on how price asserts itself relative to the red region in the coming Weekly Closes.

Pepe – PEPE/USDT

A few months ago, attention was drawn to a potential Head and Shoulders formation on PEPE.

While Head and Shoulders patterns are not always reliable and often fail to play out cleanly, the underlying technicals still matter when key structural levels are lost.

In this case, the development of a left shoulder, head, and right shoulder coincided with the loss of a major support that also functioned as a confluent neckline, reinforced by a prior Higher Low.

When PEPE Weekly Closed below that confluent support and turned it into resistance, it marked a structural trigger, regardless of whether the pattern itself is emphasised.

That trigger has already occurred, confirming the broader Head and Shoulders breakdown.

As discussed at the time, even a conservative one-to-one Measured Move implied further downside risk, although a full extension would project substantially lower levels.

Notably, much of that downside expression has already taken place.

PEPE has printed an almost one-to-one Fibonacci extension to the downside via a sharp wick, leaving price trading in what is effectively no man’s land after losing its prior structure.

If PEPE is unable to reclaim this former confluent support — now clearly acting as resistance — then price is likely to continue drifting lower over time, with the Binance listing price emerging as the next major level to watch.

Failure there would expose PEPE to downside beyond the original Measured Move, toward earlier historical price action.

For now, price remains stuck between meaningful levels.

If the Range High resistance above continues to act as a point of rejection, PEPE is likely to gradually drift lower toward the Binance listing price over time.