Altcoin Newsletter #254

Features analysis on Altcoins such as WIF SPX SUI VIRTUAL CAKE FACTION

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins – specifically:

- In today’s Altcoin newsletter I cover the following Altcoins – specifically:

- Dogwifhat (WIF)

- SPX6900 (SPX)

- Sui (SUI)

- Virtuals Protocol (VIRTUAL)

- Cake (CAKE)

- Fartcoin (FARTCOIN)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

dogwifhat – WIF/USDT

WIF continues to occupy its established Weekly range between $0.3331 (red, Range Low) and $0.4753 (blue, Range High), a structure that has historically produced powerful rebounds.

However, each successive rally from the Range Low has weakened considerably, and the most recent reaction from $0.33 has so far failed to generate meaningful upside follow-through.

Price is once again rebounding from the Range Low in a “picture-perfect” manner, but that reaction is immediately confronting two key barriers.

The first is the $0.4753 Range High, which is already rejecting price with the same clarity seen in prior attempts.

The second is the multi-month macro downtrend (blue trendline), a trendline that WIF may revisit if it attempts another escape from the range, and which carries significant rejection risk if not reclaimed via a Weekly Close and successful retest.

For now, WIF remains in consolidation, clustering within this $0.33–$0.4753 band as it has done before.

But in past cycles, attempts to break above this range have produced progressively weaker upside extensions.

That declining rebound strength is becoming more pronounced: each rally has diminished approximately 50% relative to the previous one.

If WIF revisits the macro downtrend again, a rejection from that trendline would represent another 50% decline relative to the preceding bounce.

Even a failure earlier at the Range High would add significant pressure to the $0.3331 support, potentially signalling that this level is weakening as a structural floor.

A breakdown from $0.3331 would expose the historical demand region at $0.2096 (orange).

Losing the Range Low with momentum could transition WIF into a broader macro range between $0.21 and $0.33, a structure that has previously attracted longer consolidations.

Until WIF can Weekly Close above the macro downtrend and retest it as support, or reclaim $0.4753 with successful confirmation, the market will continue navigating weakening reactions within this established range with downside risk increasing if diminishing returns persist.

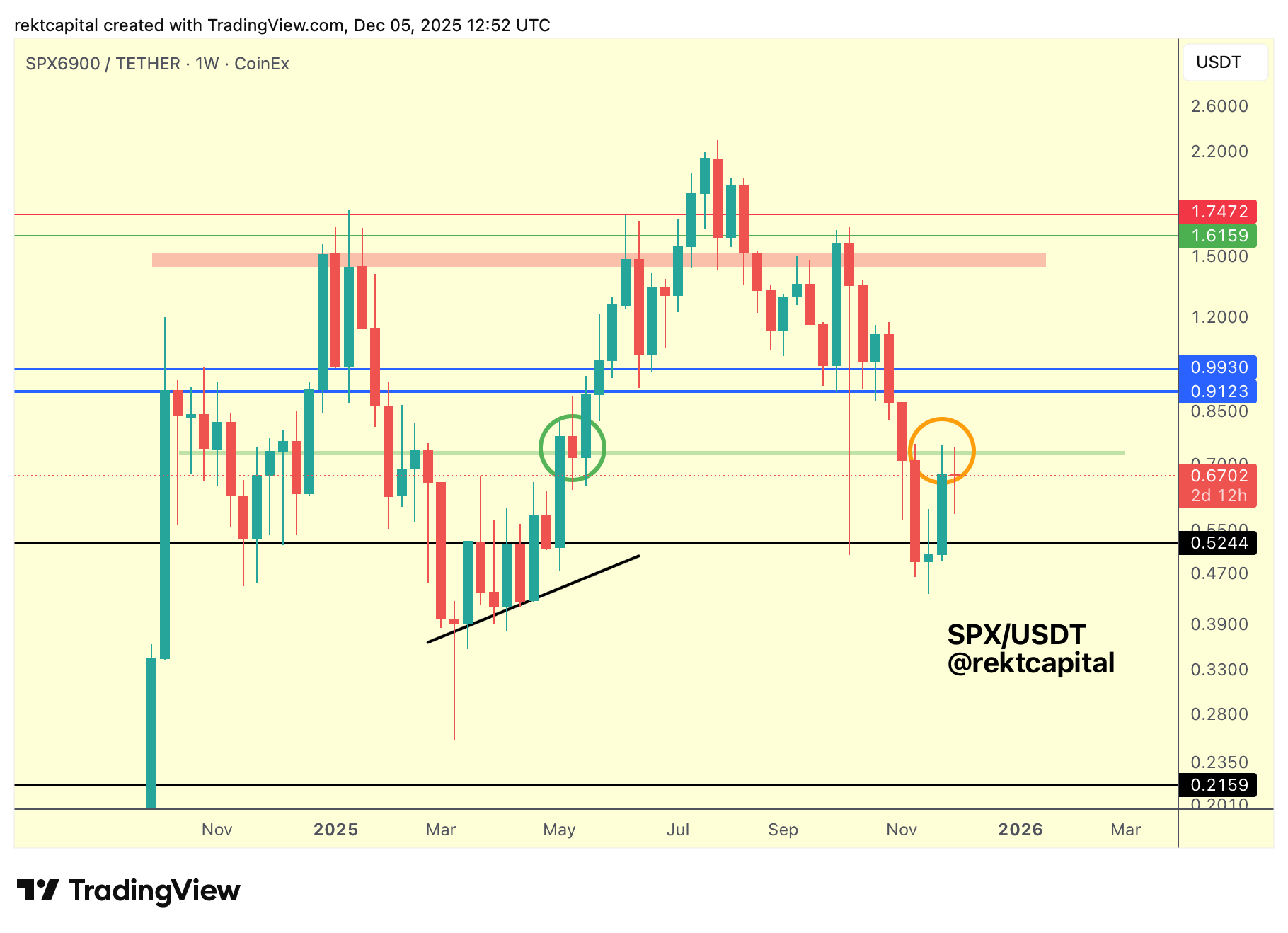

SPX6900 – SPX/USDT

SPX has recently rebounded from the $0.5244 (black, 50-cent region), consistent with its broader behaviour of rallying in $0.50 intervals.

This structural rhythm has been evident across the chart, with reaction zones forming at approximately $1.00 and $1.50, each marking prior inflection points.

Price is now pressing into the green region, a level that has historically acted as resistance, failed support, and even brief re-accumulation.

To break this sequence and enable continuation, SPX requires a Weekly Close above the green region, followed by a post-breakout retest that confirms it as support.

Only then could price attempt to revisit $0.9123 and potentially challenge $1.00, consistent with SPX’s tendency to travel in 50-cent increments.

Continued rejection from this green region, however, would keep SPX confined within its current consolidation between $0.5244 and roughly $0.75, sustaining the existing sideways range.

A rejection here could still produce a positive development if SPX successfully retests $0.5244 as support; such a reaction may form a Higher Low, especially given that price previously deviated below this level.

Establishing that Higher Low could lay the foundation for either an ascending triangle or a symmetrical triangle, depending on whether a corresponding lower-high resistance develops over time.

For now, the market must wait to see whether SPX can reclaim the green region or whether another phase of range-bound consolidation unfolds.