Altcoin Newsletter #252

Features analysis on Altcoins such as INJ SOL WIF STRK XMR LINK

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins – specifically:

- Injective (INJ)

- Solana (SOL)

- dogwifhat (WIF)

- Starknet (STRK)

- Monero (XMR)

- Chainlink (LINK)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

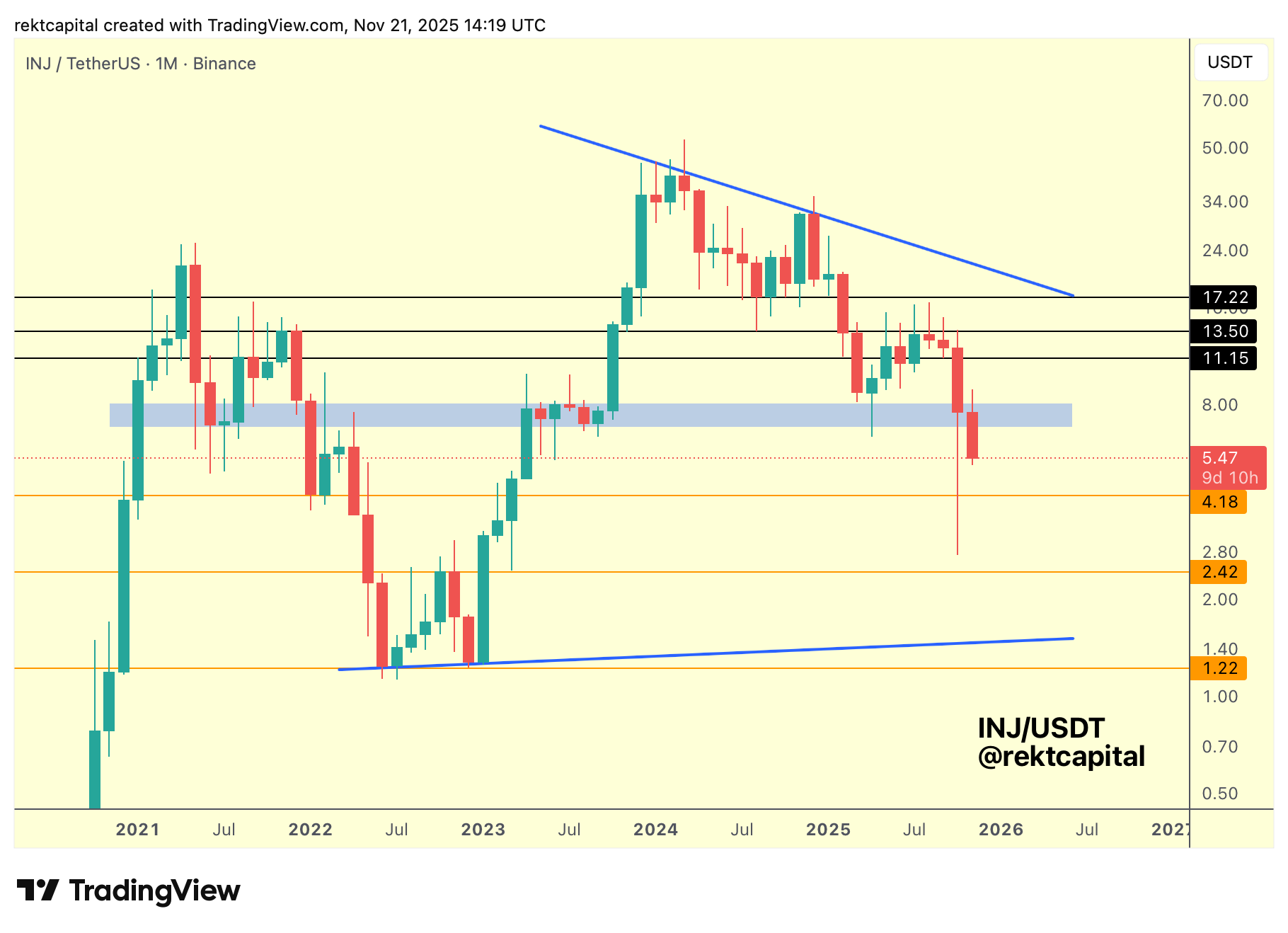

Injective – INJ/USDT

Injective is currently testing a historically crucial Monthly pivot. A region that has repeatedly acted as the mean within this broader multi-year structure, supporting upside deviations above it while catching downside deviations below it.

This level, represented by the $8–$9 demand region (blue), has been at the heart of many of INJ’s major re-accumulation phases across previous cycles.

This time, however, instead of forming another re-accumulation range at the top of that region, INJ has produced a Monthly Close inside the order block and is now turning the upper boundary into new resistance.

That shift alone skews the structure toward weakness, and price is already attempting to press below the blue zone.

Historically, the only mechanism that has preserved bullish market structure at this level has been the emergence of pronounced downside wicks — particularly in mid-2021 and again in early 2023 — both of which developed in distinctly bullish market environments.

Today’s behaviour is very different: this is no longer an early-cycle backdrop but a late-cycle, potentially bearish one, and the downside wicks that once supported the region are not materialising in the same way.

If INJ cannot maintain support within the blue region, price may begin tagging the underside of this zone as resistance.

That would represent the initial phase of a post-breakdown relief rally.

And in a less favourable scenario, price may not even retest the underside, instead accelerating directly toward the next Monthly support at $4.18 (orange).

A Monthly Close below $4.18, followed by any upside wicking into that level, would place INJ at risk of further downside continuation into the deeper interior of the range between $4.18 (orange) and $2.42 (orange).

Historically, this lower band has absorbed multi-month retraces during more developed bearish sequences.

For now, INJ is fighting to preserve the blue region, but the diminishing strength of rebounds from this area and the recent Monthly Close below its upper boundary indicate that support is weak and growing weaker.

A Monthly Close beneath the blue zone would mark the earliest stage of a potential breakdown from this major demand area.

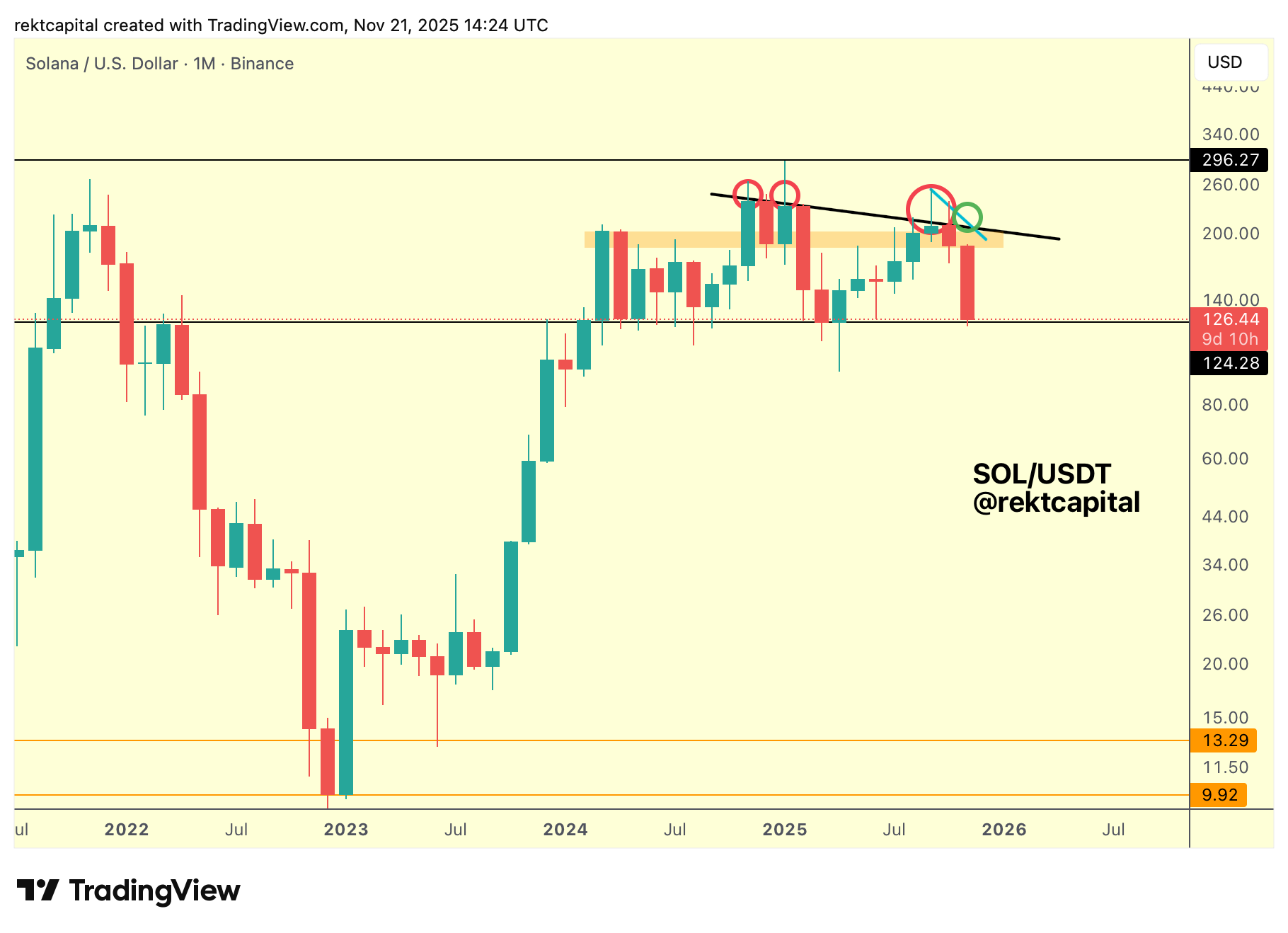

Solana – SOL/USDT

Solana has been showing sustained weakness for a long time, forming a major price cluster directly at the crucial Monthly support of $124.28 (black).

A Monthly Close below this level, followed by bearish retesting from the underside, would confirm downside continuation and end this entire multi-month cluster as a completed distribution range.

This level has been the structural floor maintaining Solana’s broader range, and losing it would shift the macro bias decisively toward deeper retrace territory.

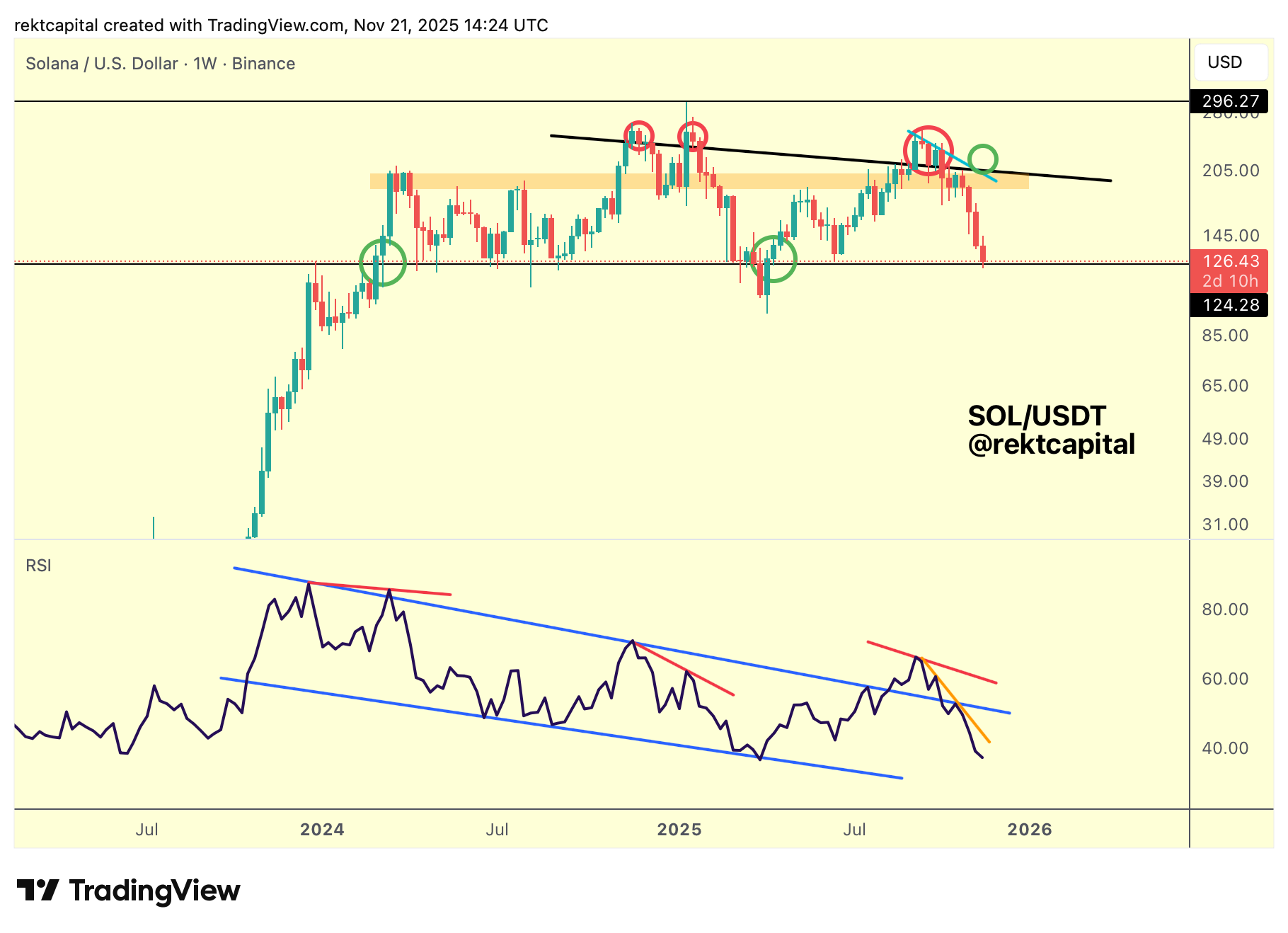

On the Weekly timeframe, weakness is even more evident.

SOL failed its Monthly downtrend retest on the Weekly, forming a multi-week Lower High trendline as part of that failed retest.

Price continued to print lower highs, while RSI also developed persistent lower highs, a multi-month pattern that reinforces declining momentum.

Solana has now turned its macro downtrend line into new resistance and has been distributing beneath it.

The only way to preserve the range is a Weekly Close back above $124.28 (black).

Historically, reclaiming and retesting that level allowed rallies toward $200 in more bullish climates, but this cycle is different: Solana is up more than 14x, and market conditions are turning more bearish.

This Monthly support is the final major structural level.

Losing it would likely confirm a deeper distribution phase, making both the Weekly and Monthly confirmations critical going forward.