Altcoin Newsletter #251

Features analysis on Altcoins such as IOTA RSR ENA VELO NANO LINK

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins – specifically:

- IOTA (IOTA)

- Reserve Rights (RSR)

- Ethena (ENA)

- Velo (VELO)

- Nano (XNO)

- Chainlink (LINK)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

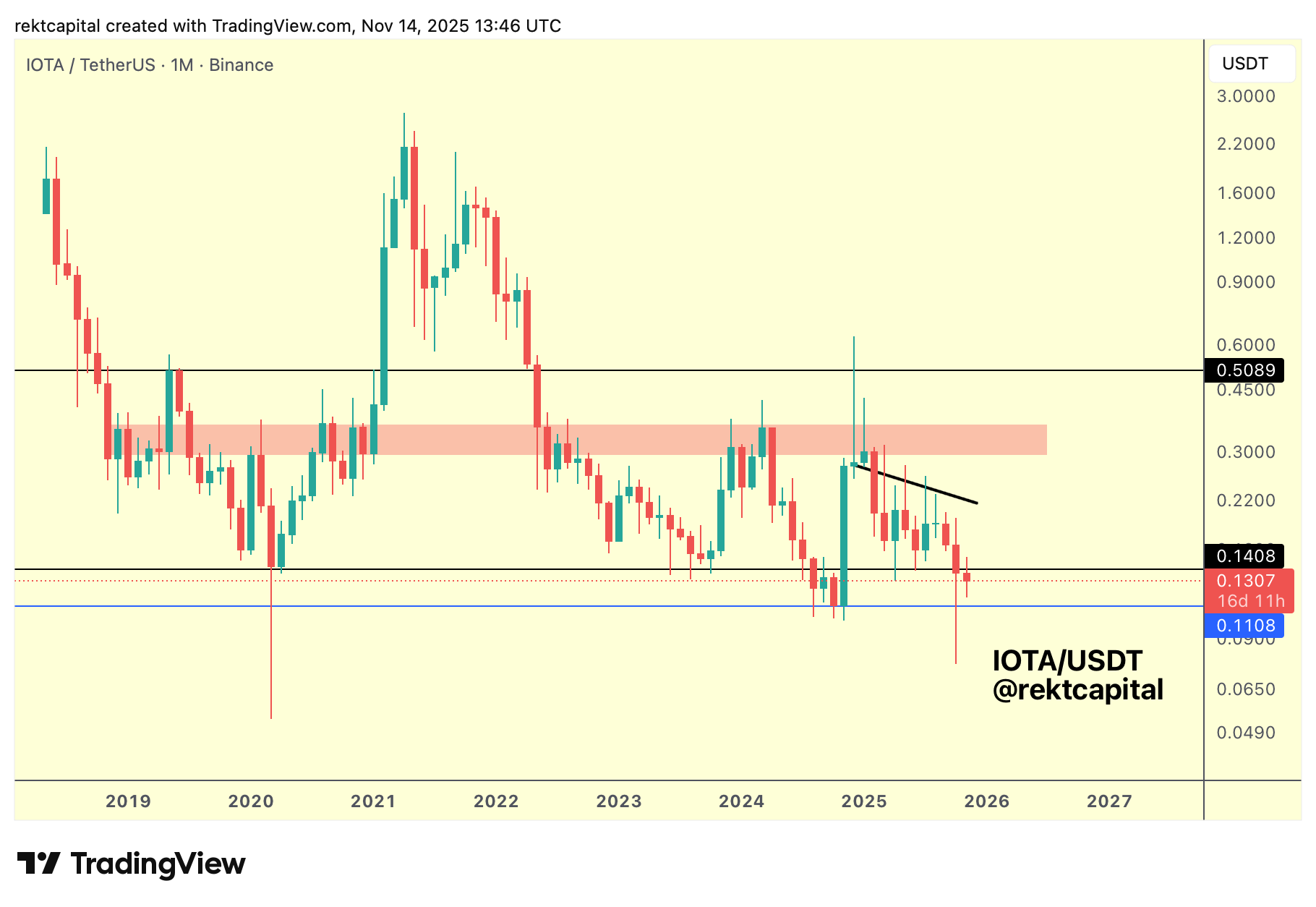

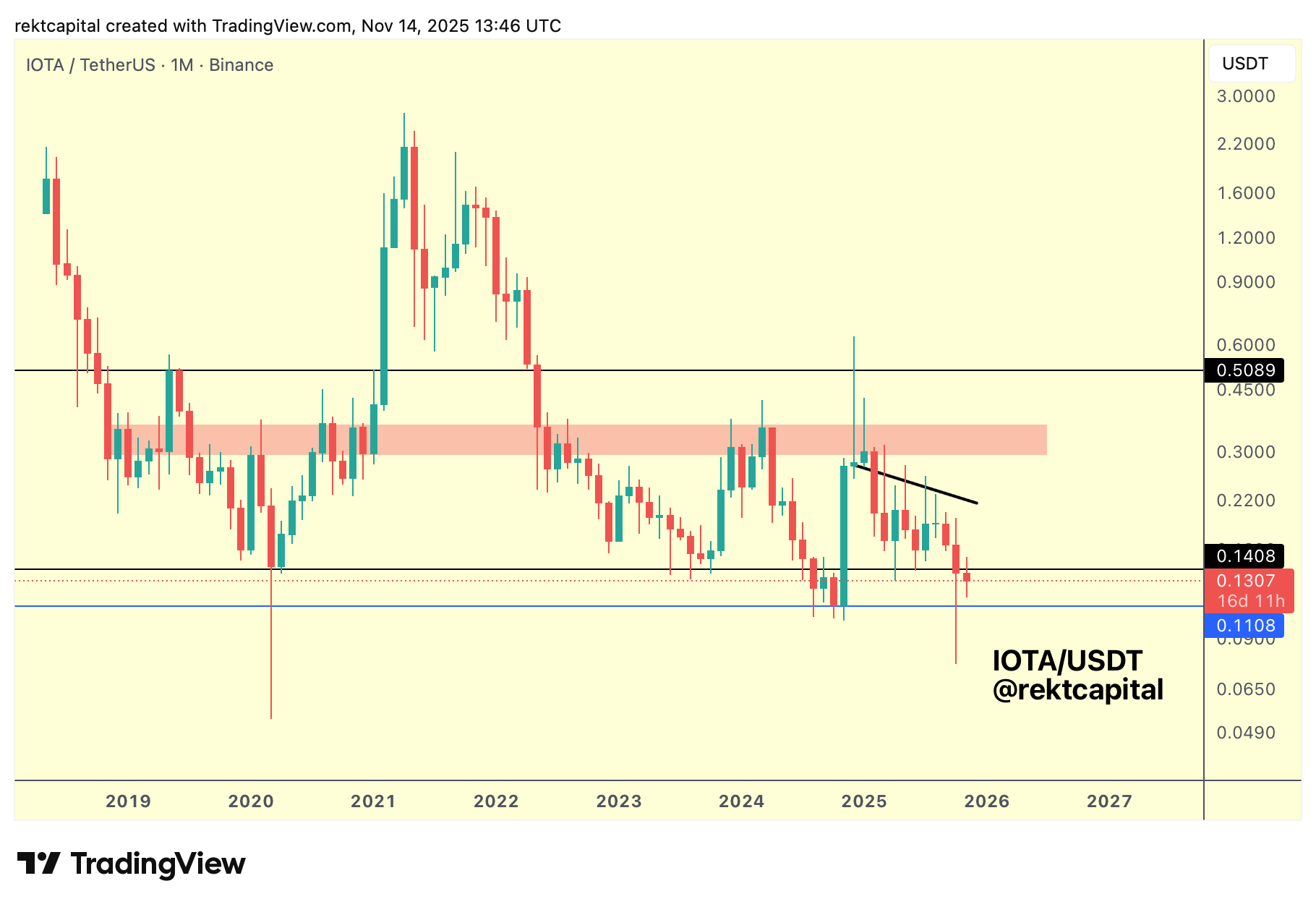

IOTA – IOTA/USDT

IOTA continues to trade within its broader Macro Range, spanning $0.1408 (black) to $0.5089 (black).

Price has spent the majority of this cycle inside the lower half of that range, developing a multi-year Macro Wedging structure that has repeatedly compressed price between declining Lower Highs and flat supports.

Most recently, price has held the Macro Range Low at $0.1408 (black), but has simultaneously turned the bottom of the macro wedge into resistance.

his repeated inability to reclaim the wedging bottom has increased downside pressure and has now led to another deviation below the Range Low.

Sustaining this deviation would increase the probability of continuation to the next major Monthly support.

Given the continued rejection at the bottom of the Macro Wedge, it becomes crucial for IOTA to at least maintain the Macro Range Low at $0.1408, as this remains the most important structural level for preserving the overall range.

Weekly and Monthly Closes above this level are essential for maintaining structural integrity.

If price cannot reclaim $0.1408, IOTA may be positioning for further downside into the next major Monthly support at $0.1108 (blue), especially since price has already Monthly Closed below the Range Low.

Historically, such breakdowns can form deviations — most notably the prior test of the blue level — where price dipped into support before rallying back into the range.

Structurally, IOTA is positioned for downside continuation because we have seen two steps of a standard three-step breakdown: a Monthly Close below old support, followed by a bearish retest.

However, price has not yet produced the final continuation leg.

If IOTA can Weekly Close above the Range Low again, similar to last week, this bearish retest may fail and the current price action could form another deviation instead of confirming a breakdown.

For now, IOTA remains in a touch-and-go phase.

The next Weekly Close relative to $0.1408 (black) will likely determine whether this becomes a deeper continuation move or another deviation that restores the Macro Range.

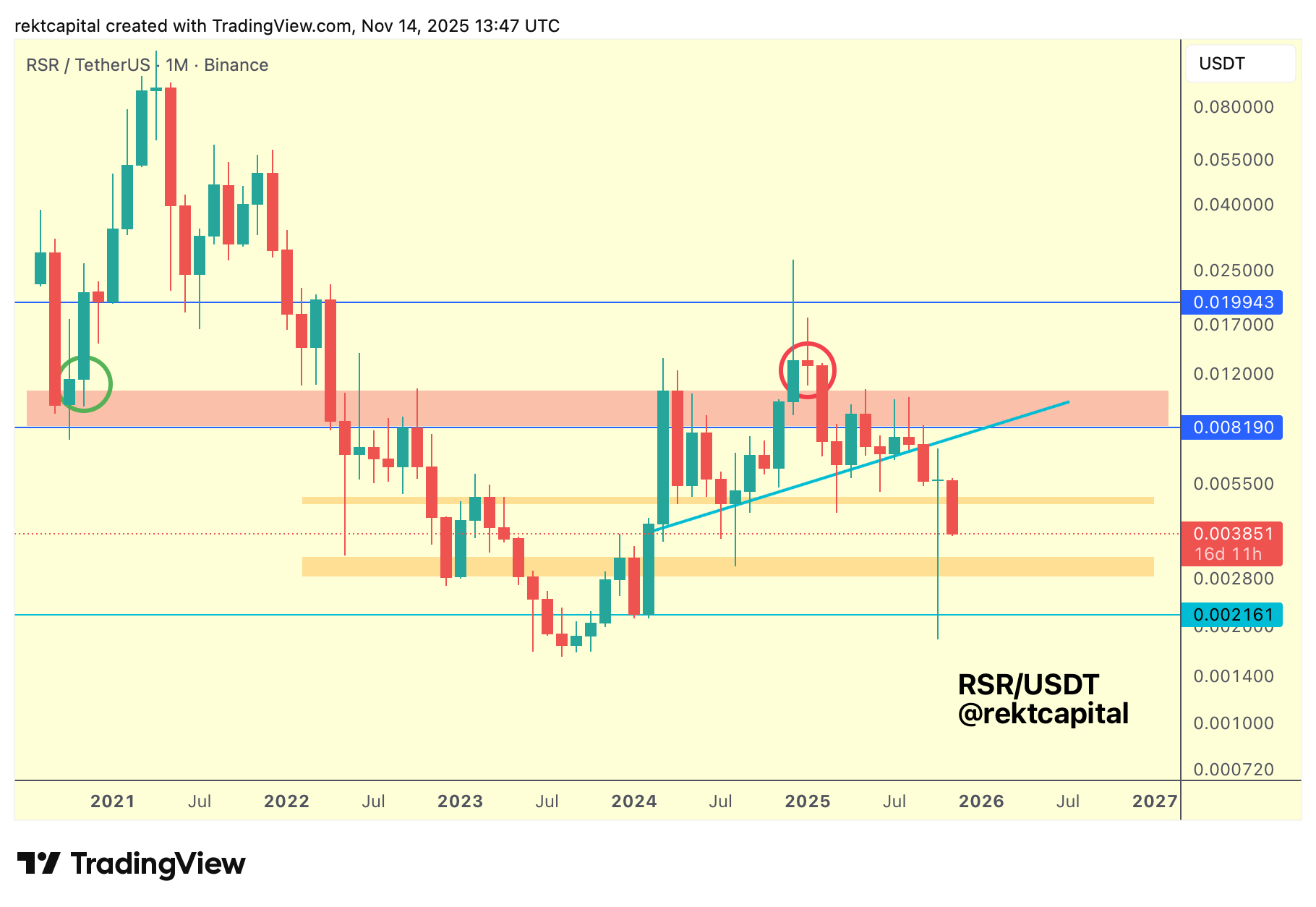

RSR – RSR/USDT

RSR has broken down from its technical uptrend, losing that structure roughly two and a half months ago and dropping into the support region that initially helped facilitate the uptrend.

As the sequence of Lower Highs accumulated, the trend weakened progressively, and the eventual breakdown suggested that the underlying historical demand area (orange) — which played a key role in maintaining the uptrend — would likely begin to weaken as well.

If the trend has deteriorated to the point of collapse, then the supporting structure that sustained it is also at increased risk of failure over time.

Going forward, if RSR re-enters the range between the two orange regions and begins turning the upper orange zone into new resistance from the underside, that rejection could define the next phase.

Historically, whenever price has consolidated inside this range, it has mostly been during bearish retests from the underside before losing the structure entirely, except for the early 2024 breakout, which sliced straight through during the early bull market.

A confirmed return into this range, paired with the orange region acting as resistance, would likely impose significant sell-side pressure on the Range Low.

Such pressure could cause the entire range to lapse, opening the door for continuation toward the $0.002161 (light blue) level and even a potential downside deviation below it, similar to the clustering pattern observed in mid-2023.