Altcoin Newsletter #249

Features analysis on Altcoins such as AVAX INJ NEAR SOL ASTER AERO

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins – specifically:

- Avalanche (AVAX)

- Injective (INJ)

- Near Protocol (NEAR)

- Solana (SOL)

- Aster (ASTER)

- Aerodrome Finance (AERO)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

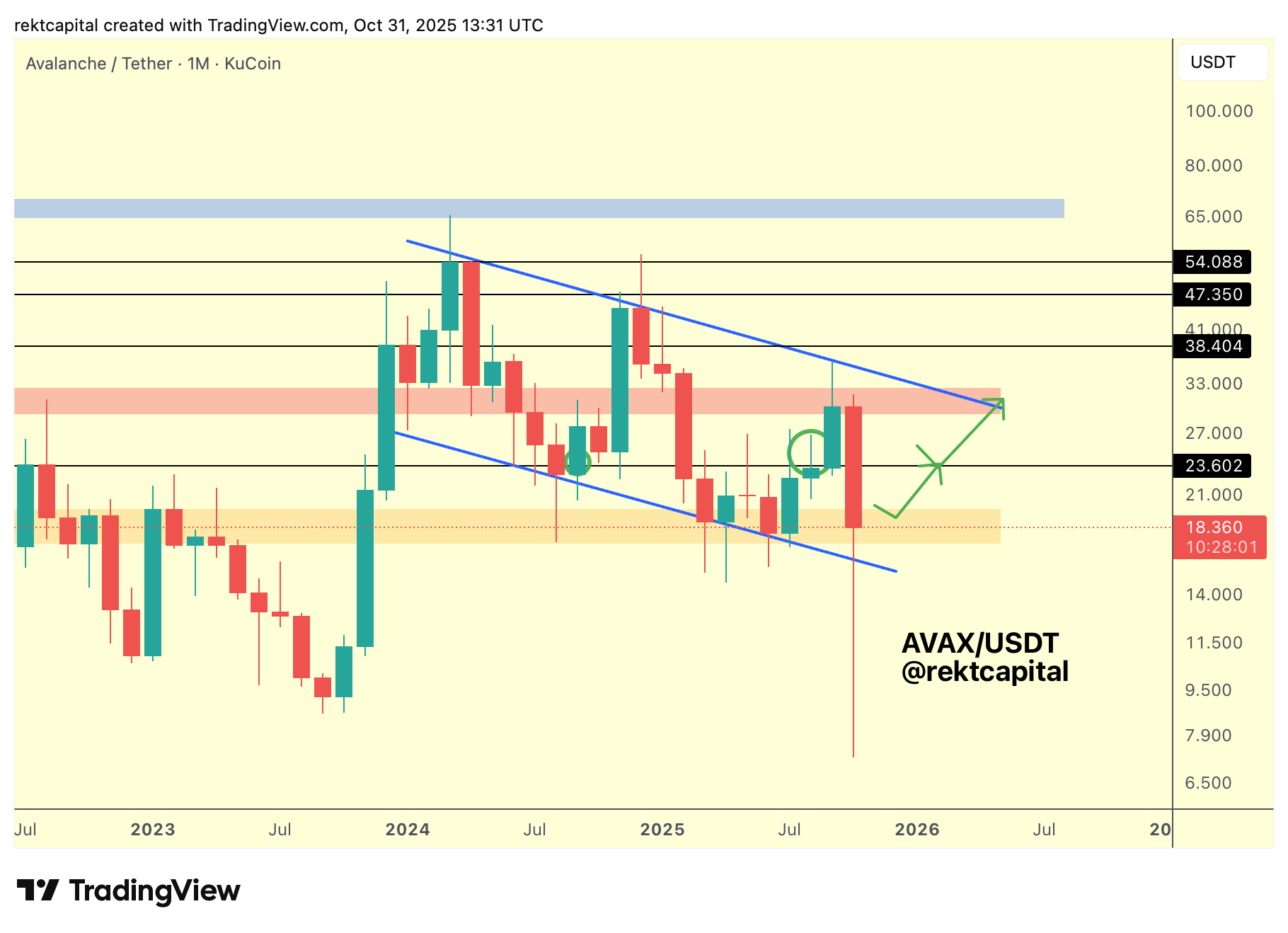

Avalanche – AVAX/USDT

AVAX continues to respect its Macro Wedge (blue).

Price has once again returned to the bottom of the structure, the same region that aligns with the historical demand zone (orange).

This confluence has triggered reversals since mid-2024.

Even through the recent liquidation event, buyers stepped in. Downside wicks reveal strong defence of this area, and price still holds above the wedge floor.

To maintain this stability, AVAX needs a Monthly Close above both the wedge bottom and recent multi-month lows. Building acceptance around $23.602 (black) would further reinforce the base.

A successful hold here could shape a new consolidation cluster inside the wedge, similar to prior patterns that preceded upward continuation.

However, if the confluence fails, price could revisit the underlying demand before rebuilding structure.

For now, the focus is clear.

Hold the orange region, defend $23.602 (black), preserve the wedge floor and the foundation for the next macro move.

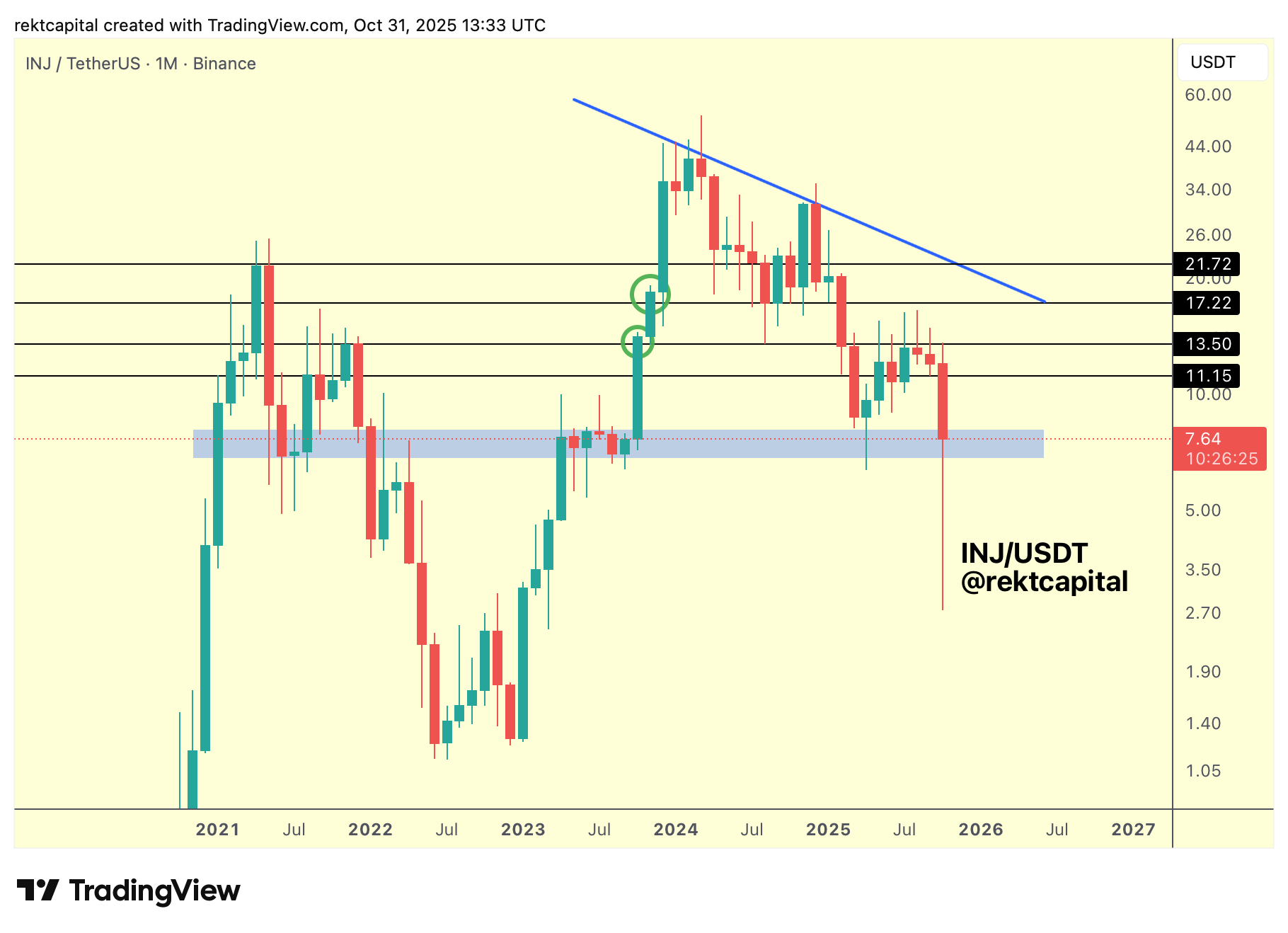

Injective – INJ/USDT

INJ has been forming consecutive Lower Highs for nearly two years.

The first major one occurred in early 2024, since then, every rebound has produced diminishing follow-through.

Price now sits at a historical demand region (blue) that has repeatedly defined market direction across multiple cycles.

In mid-2021, it acted as a reversal zone to the downside.

In early 2022, it became a major resistance.

By 2023, it flipped into a Re-Accumulation cluster that supported a rally toward $21.72 (black). That same region is being tested once again.

INJ already rebounded from here earlier in 2025, and it’s now trying to stabilise within this zone once more.

A Monthly Close within the blue region would preserve structural support and allow buyers to defend the current range.

However, the longer price struggles to produce higher highs, the more this demand could weaken, as it did before the 2022 breakdown.

A Monthly Close below the blue region, followed by upside wicks into it, would risk transforming it into new resistance and potentially accelerate downside continuation.

For now, this remains a make-or-break level.

Holding the blue zone could enable another rebound toward $11.15 (black) and possibly beyond $13.50 (black).

Losing it, however, could re-ignite the broader macro downtrend.