Altcoin Newsletter #248

Features analysis on Altcoins such as USELESS PENGU XLM SEI SPX DEEP

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins – specifically:

- USELESS Coin (USELESS)

- Pudgy Penguins (PENGU)

- Stellar (XLM)

- Sei (SEI)

- SPX 6900 (SPX)

- DeepBook (DEEP)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

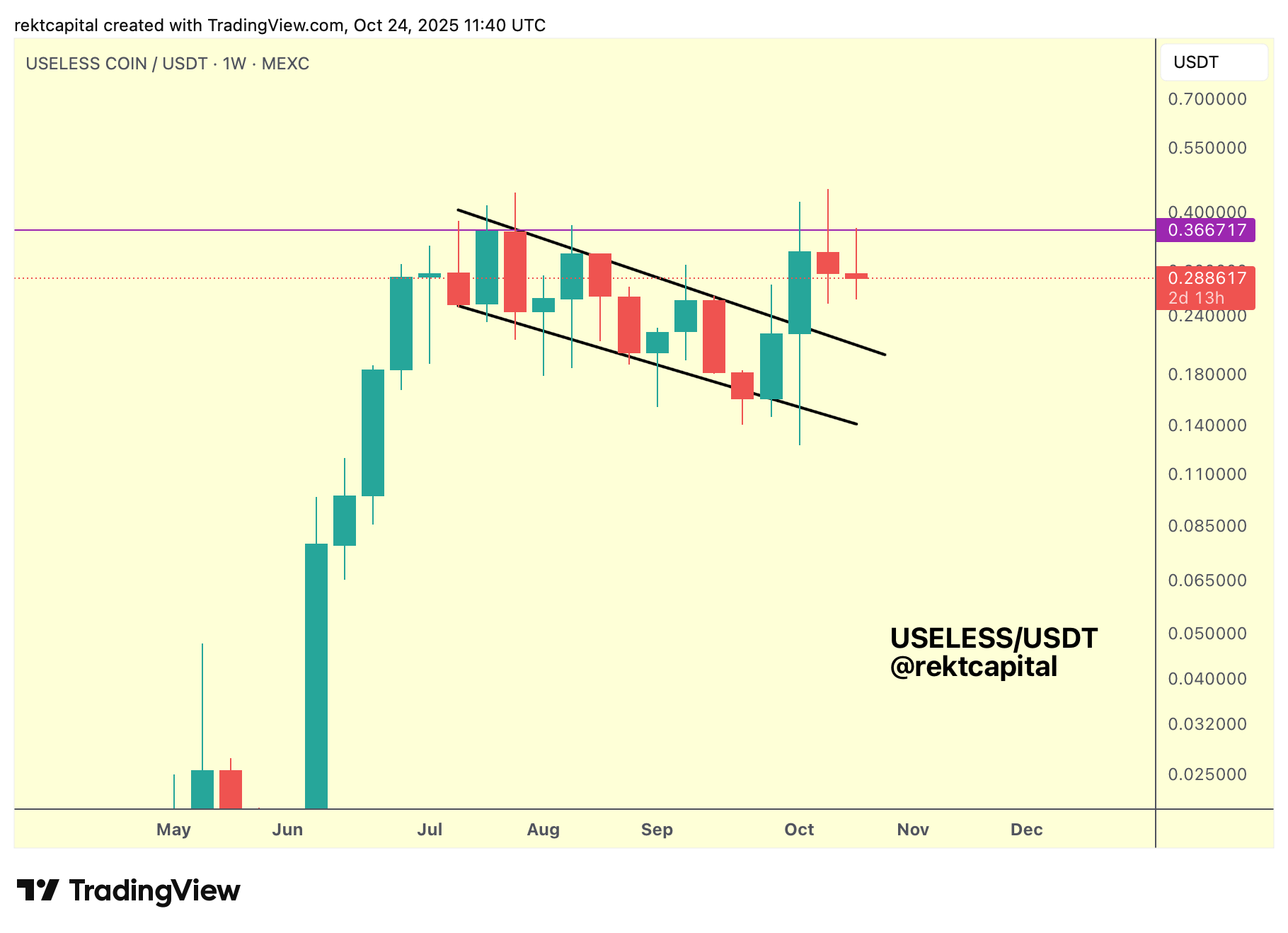

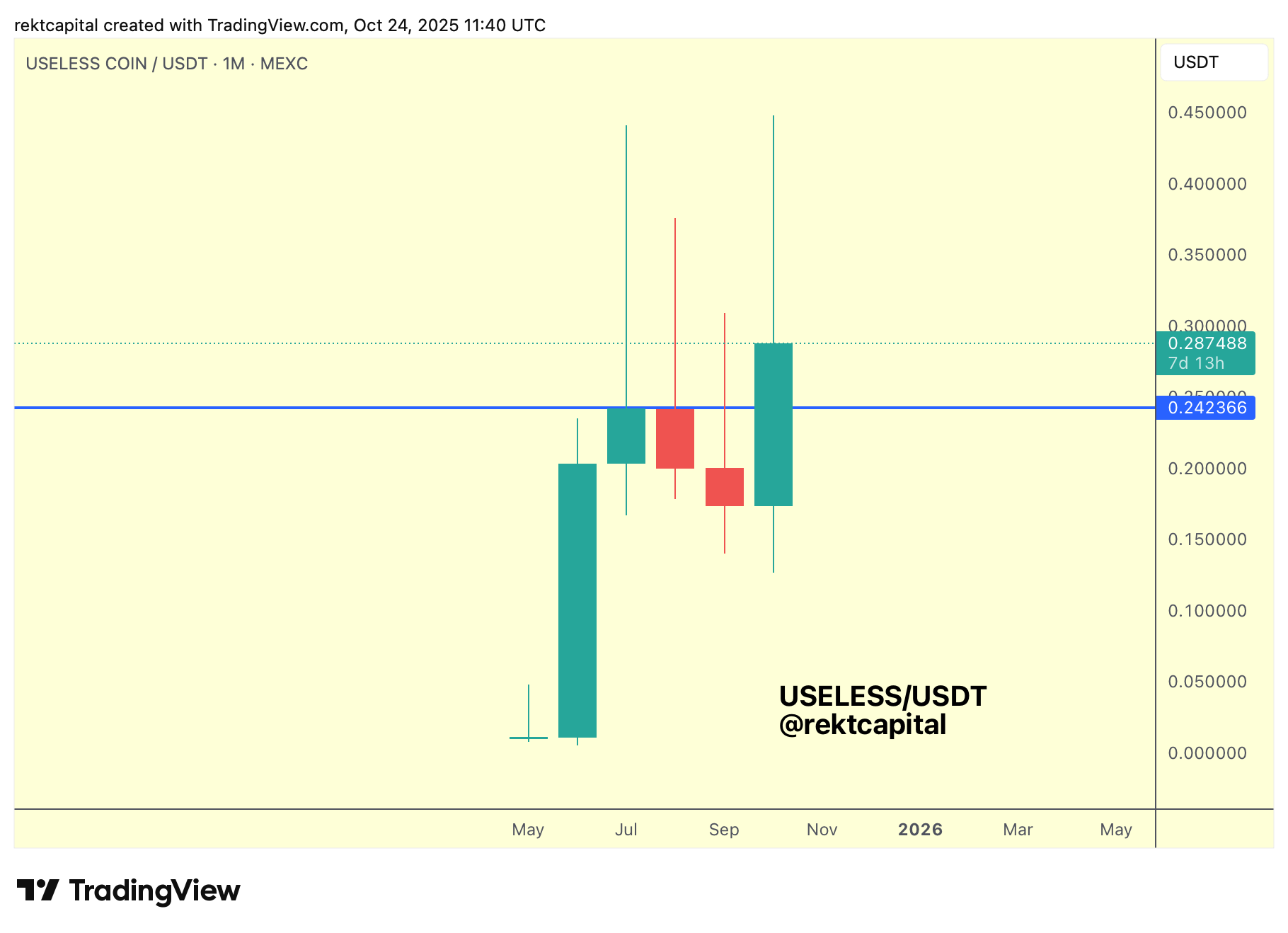

USELESS Coin – USELESS/USDT

USELESS has broken out from its macro downtrending channel (black), becoming one of the better-performing Altcoins in recent weeks.

Following that breakout, price rallied directly into the final major Weekly resistance (purple) — a former All Time High region — and produced successive upside wicks into and beyond this level, confirming rejection from that supply zone.

Unless USELESS can reclaim this resistance as new support, a post-breakout retest toward the top of the downtrending channel (black) appears likely. Such a pullback would validate the breakout and transform prior resistance into a launchpad for continuation.

Adding confluence, the upper boundary of the Weekly channel (black) aligns closely with the final major Monthly resistance at $0.24 (blue) — a level that has capped price action for four consecutive months.

As the new Monthly Close approaches, this region will act as a critical test of structural strength.

A Monthly Close followed by a post-breakout retest into $0.24 would offer a textbook confirmation of new support forming where resistance once stood.

Should that level hold, the setup could establish a confident foundation for the next leg higher.

For now, USELESS is pausing beneath its Weekly supply (purple) while awaiting confirmation that the recent breakout can evolve into a fully validated trend reversal.

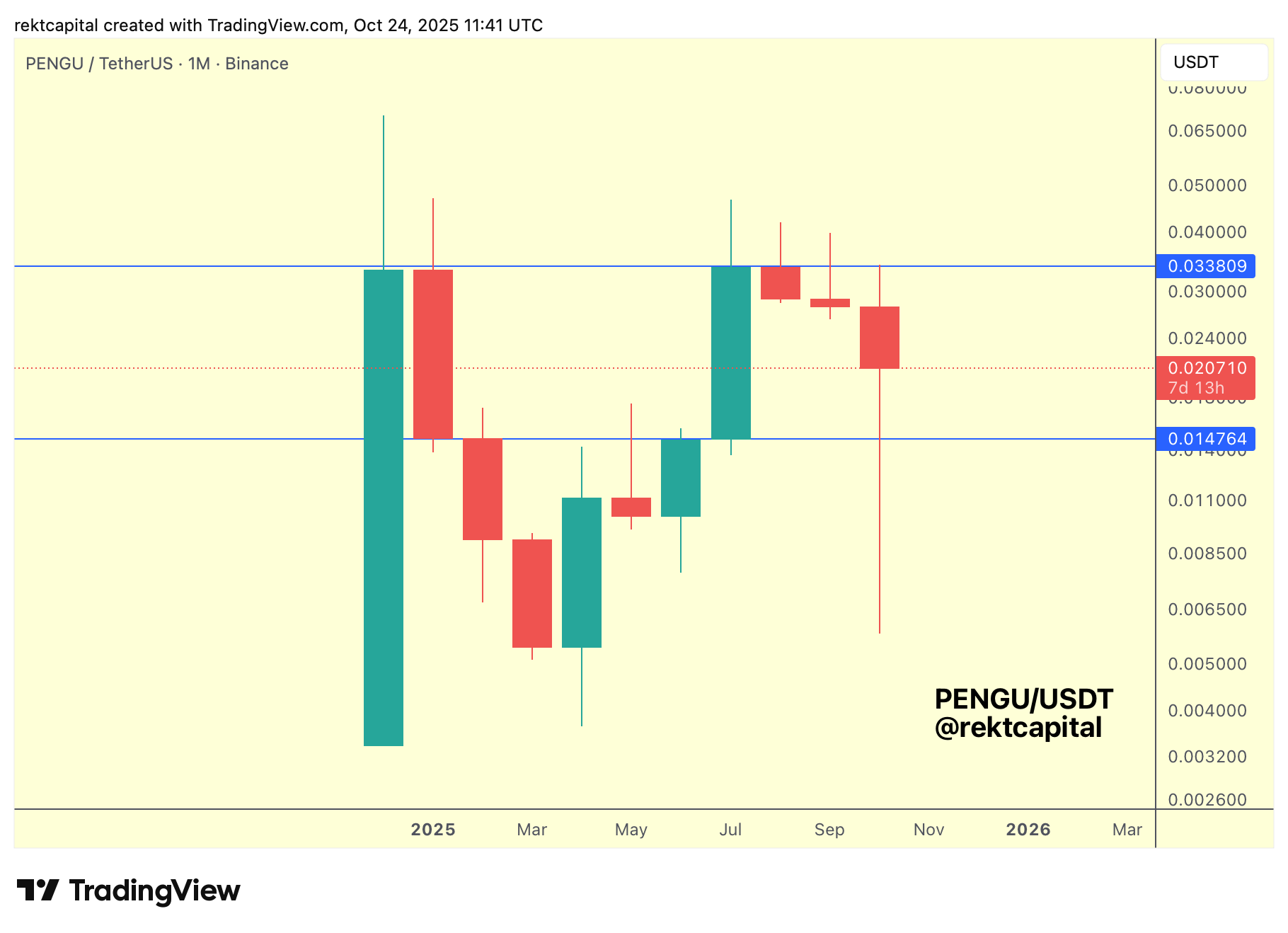

Pudgy Penguins – PENGU/USDT

On the Monthly timeframe, PENGU continues to move within its macro range (blue levels), having once again rejected from its final major Monthly resistance at $0.0338 (blue), the same region that capped price during its first cycle.

This marks the second rejection in price history from that upper boundary.

And over the past four months, PENGU has been forming progressively lower highs and lower upside wicks, signalling strengthening sell-side pressure and diminishing buyer follow-through.

Earlier in the cycle, upside wicks briefly pierced above resistance. Now, price is rejecting directly from it, a sign of tightening supply at lower and lower levels.

Given this sustained rejection behaviour, the resistance remains firmly intact, leaving scope for a continuation toward the lower boundary of the range ($0.0147, blue) should weakness persist.

On the Weekly timeframe, price has now lost the orange region, a prior trend continuation zone that acted as support in mid-2024 and resistance earlier this year.

Following the recent Weekly Close below this level, PENGU is attempting to retest it from below, an early signal of potential support-turned-resistance (orange) behaviour.

While a clear upside wick rejection has yet to materialise, the structure is showing bearish intent.

If this region fully confirms as resistance, downside continuation toward the range low ($0.0147, blue) becomes increasingly probable.

This level is significant not only as the macro range low but also as one of the few major Monthly levels available at lower valuations, making it a likely zone of interest for potential accumulation.

However, a Weekly Close back above the orange region could negate this scenario, re-establishing short-term support and opening the possibility for a breakout above the multi-month downtrend, which has defined the market since PENGU’s prior cycle highs.

For now, the trend remains bearish within the macro range, and only a confirmed reclaim of that Weekly level would signal early evidence of reversal strength.