Altcoin Newsletter #247

Features analysis on Altcoins such as LINK TAO SUI BEAM WU XLM

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

In today’s Altcoin newsletter I cover the following Altcoins – specifically:

- Chainlink (LINK)

- Bittensor (TAO)

- Sui (SUI)

- Beam (BEAM)

- Wormhole (WU)

- Stellar (XLM)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

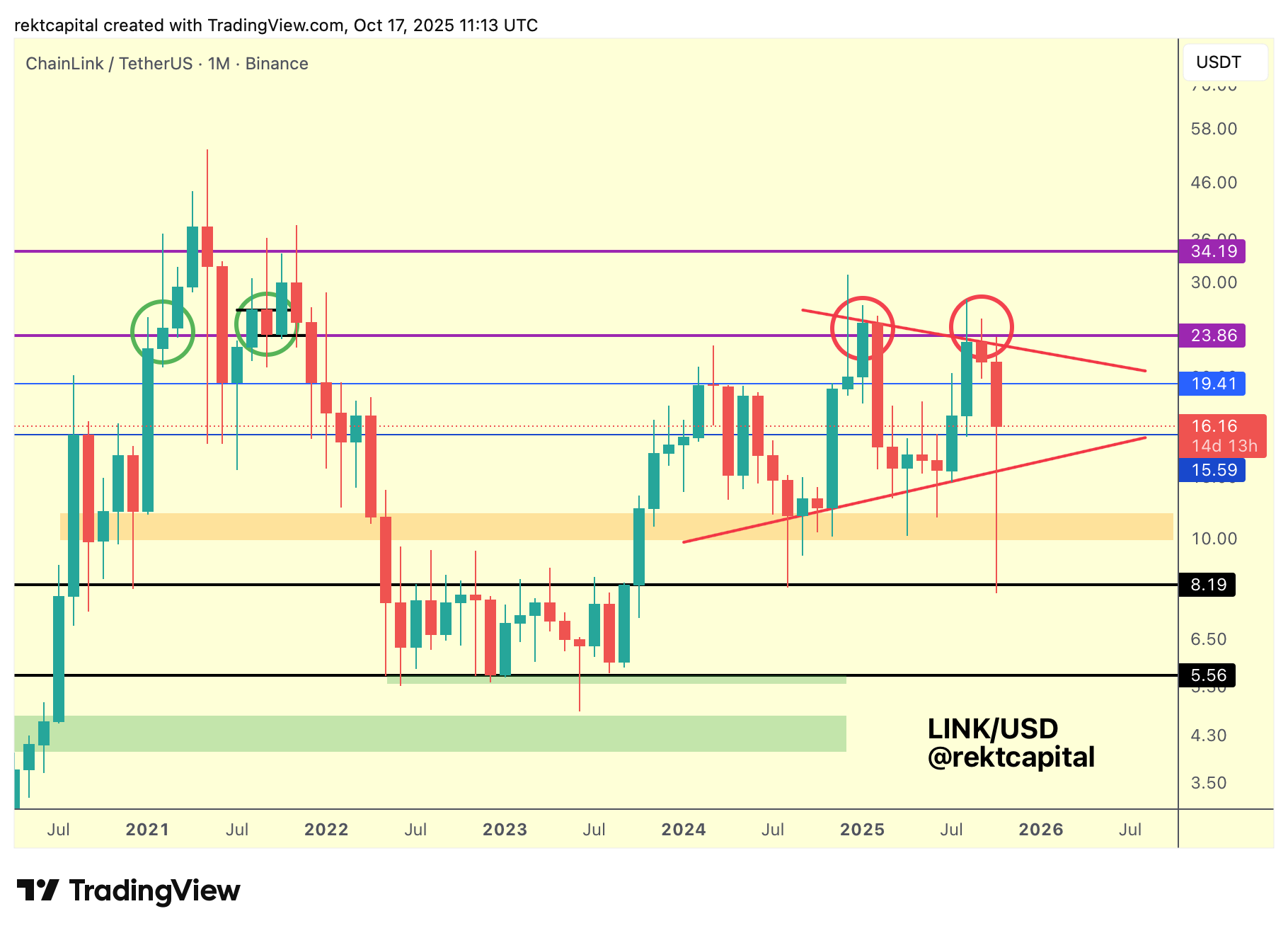

Chainlink – LINK/USDT

LINK has developed a new Macro Lower High, confirming another rejection from $23.86 (purple).

That level has acted as crucial resistance since early 2025, and price has failed to reclaim it as support for more than two months.

Each successive attempt has produced shorter upside wicks, a sign of weakening follow-through, similar to the prior macro peak highlighted earlier in the cycle.

This inability to turn the $24 region into support has reinforced it as new resistance, resulting in downside continuation.

That retrace drove LINK through the demand zone (black line), the same cluster of support that formed across 2022–2023 and previously marked a key accumulation area.

At present, LINK is oscillating within the $19.41–$15.59 (blue) mid-range, a region that historically coincides with the 2020 highs and the 2021 reversal lows.

Despite this, price continues to hold above the Macro Uptrend line (red) that originates from the post-breakout accumulation base which began this entire bull cycle.

Even with a deep wick into that region, higher lows remain intact, keeping the broader uptrend valid.

Looking ahead, the critical question for October’s Monthly Close is whether LINK can reclaim $20 as support.

A Monthly Close above this psychological level could re-open the path toward retesting the Lower High resistance at $23.86. Failure to do so, however, would invite a continuation toward the $15–$16 zone and a potential retest of the rising trendline support.

For now, LINK is consolidating within its broad triangular structure, a mid-range equilibrium phase following rejection at a pivotal macro level.

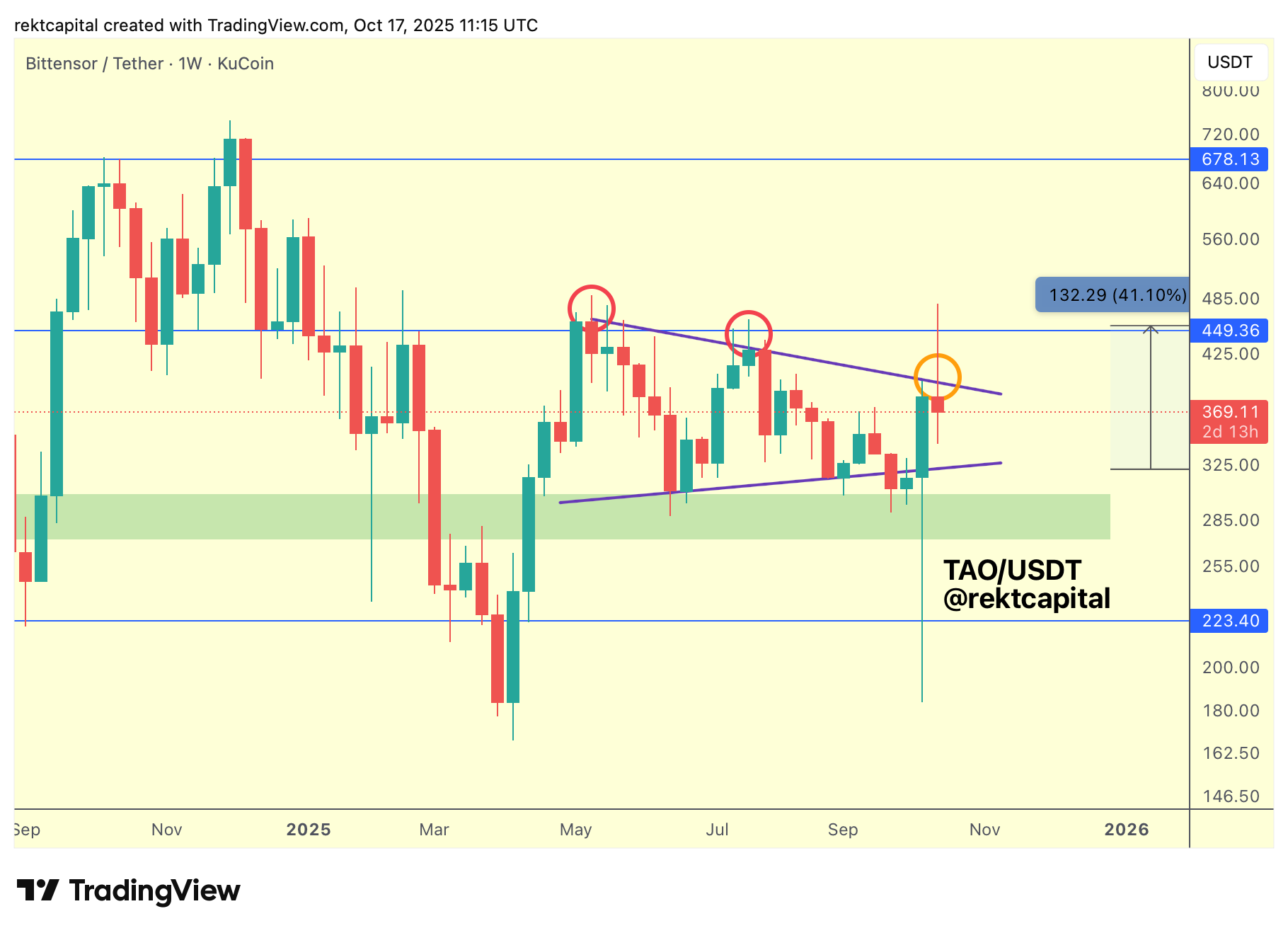

Bittensor – TAO/USDT

TAO has been one of the few Altcoins to register meaningful rallies during this broader phase of market-wide valuation depletion.

Price has rebounded strongly from the green demand region, reaffirming it as a historically reliable area of buy-side pressure. Sustained reactions from here remain essential to prevent weakening momentum at this foundational support.

Following that rebound, TAO has rallied into two key resistances — the diagonal trendline (purple) and the horizontal resistance at $449.36 (blue) — but currently trades just beneath both.

To confirm a breakout into the next macro range, price would need a Weekly Close and post-breakout retest above these resistances.

So far, neither condition has been met.

Historically, similar attempts have failed when Weekly Closes occurred below this diagonal, leading price to re-enter the structure for additional consolidation.

If the same behaviour repeats, TAO could continue oscillating within the triangle, fluctuating between the upper and lower boundaries until a decisive breakout develops.

A successful Weekly Close and retest above $449.36 would open the pathway toward the macro expansion range between $449.36 (blue) and $678.13 (blue).

However, if rejection persists, TAO may revisit the green demand region, where occasional downside deviations have historically absorbed sell-side pressure and reset the trend.

For now, the market remains at equilibrium beneath diagonal resistance, awaiting confirmation of whether this recent rally transforms into a full breakout or another swing within the prevailing consolidation pattern.