Altcoin Newsletter #246

Features analysis on Altcoins such as APT NEAR LTC TAO METIS FLUID

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

In today’s Altcoin newsletter I cover the following Altcoins – specifically:

- Aptos (APT)

- Near Protocol (NEAR)

- Litecoin (LTC)

- Bittensor (TAO)

- Metis (METIS)

- Instadapp (FLUID)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

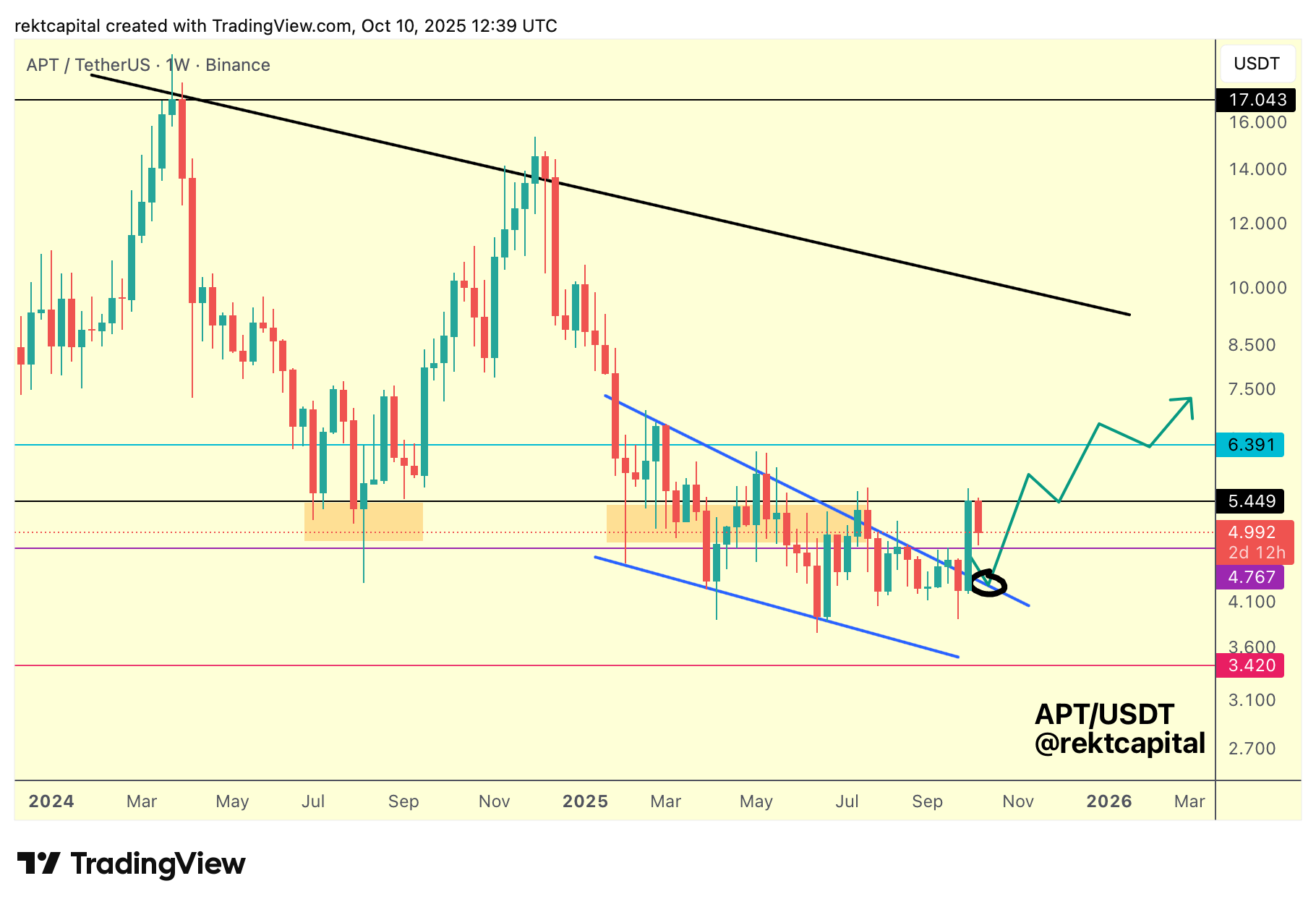

Aptos – APT/USDT

APT has broken out from its Falling Wedge (blue), initiating the first phase of a potential multi-stage upside sequence.

Price rallied into $5.45 (black), which is the key pivot needed to sustain continuation into the next stages of this five-step process.

After rejecting from the black level, APT has retraced towards $4.76 (purple), a Monthly level that historically invites downside wicking and deviation before support is re-established.

Such behaviour implies that price could briefly dip beneath $4.76, revisiting the top boundary of the former Falling Wedge for a post-breakout retest.

The crucial question now is whether APT can maintain Weekly Closes above $4.76 (purple) without deeper deviation.

While this level hasn’t been the most reliable short-term support — given past wicks below it — it remains the key region around which post-breakout support must ultimately form.

Holding above it would confirm the retest and enable renewed follow-through towards $5.45 (black) and potentially beyond, to $6.39 (blue) later in the sequence.

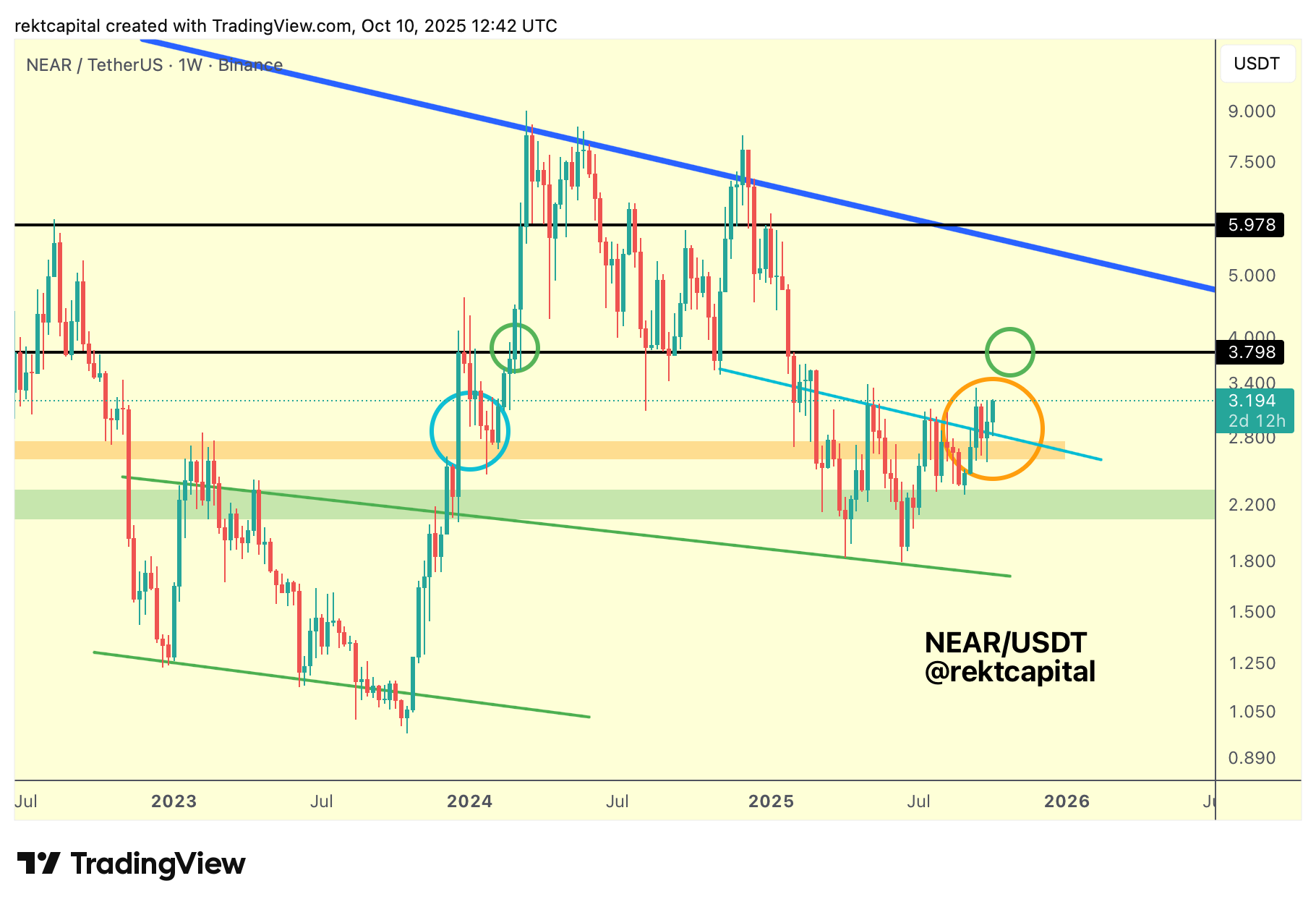

Near Protocol – NEAR/USDT

Earlier, we discussed how NEAR had been testing the Downtrend resistance (light blue), a trendline that has defined price action throughout 2025.

Initially, this retest failed, but shortly after, NEAR managed to reclaim the light blue trendline as support.

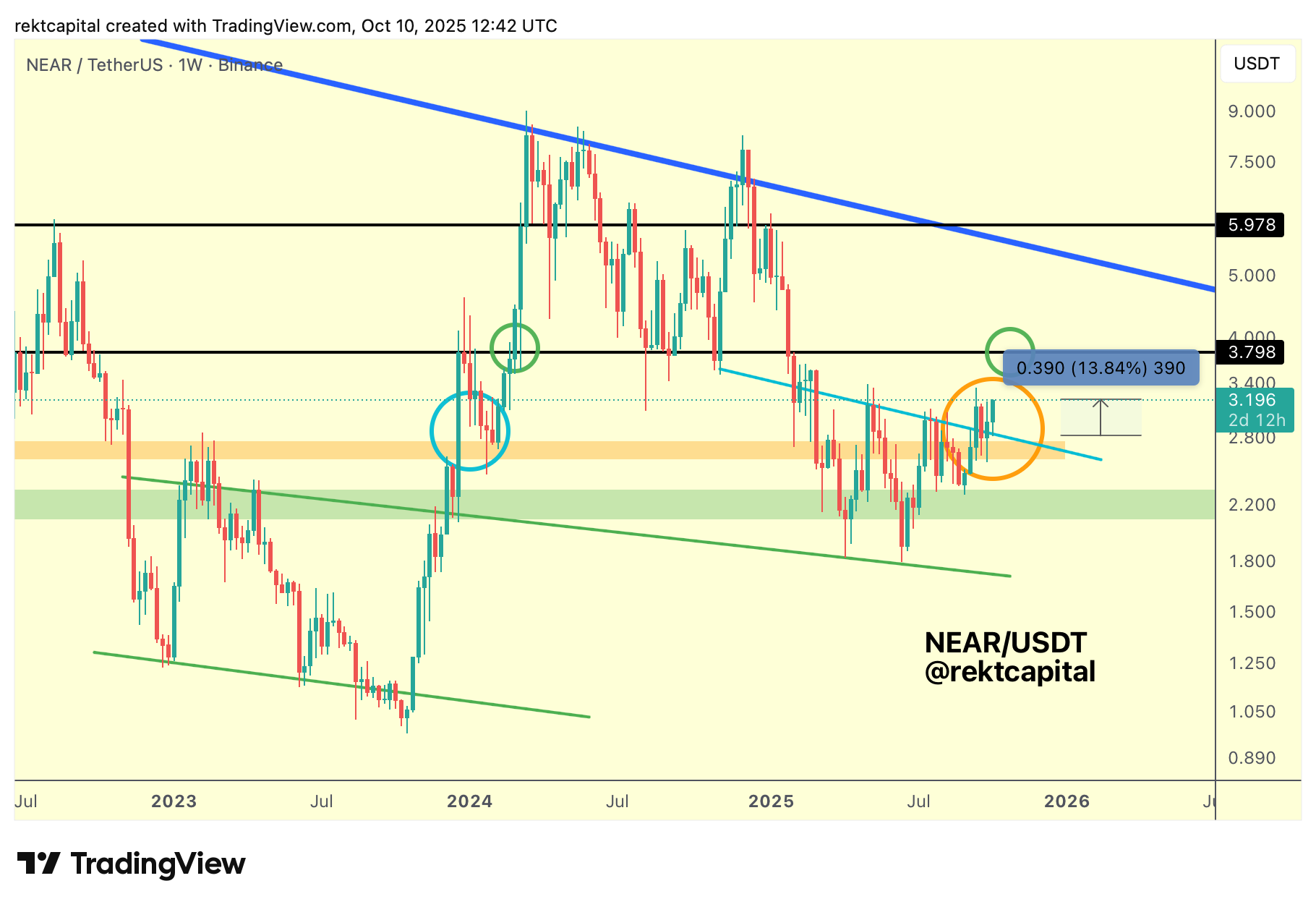

Since that successful reclaim, price has rallied approximately +14% to the upside.

Going forward, the key objective is a Weekly Close above $3.79 (black). Reclaiming this level as new support would effectively break NEAR back into the black-to-black range between $3.79 and $5.9.

Such a move would also allow NEAR to challenge the Macro Downtrend (dark blue) that has capped upside since early 2024, potentially positioning price for a structural trend shift into a new technical uptrend.

However, continued stability at the light blue trendline remains crucial.

This 2025 Downtrend has acted as the primary resistance all year; maintaining it as reclaimed support will be essential for trend continuation and for resynchronising NEAR’s price action with the higher range above.