Altcoin Newsletter #245

Features analysis on Altcoins such as AERO APT AVAX CRO DOT ILV

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

In today’s Altcoin newsletter I cover the following Altcoins – specifically:

- Aerodrome Finance (AERO)

- Aptos (APT)

- Avalanche (AVAX)

- Cronos (CRO)

- Polkadot (DOT)

- Iluvium (ILV)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

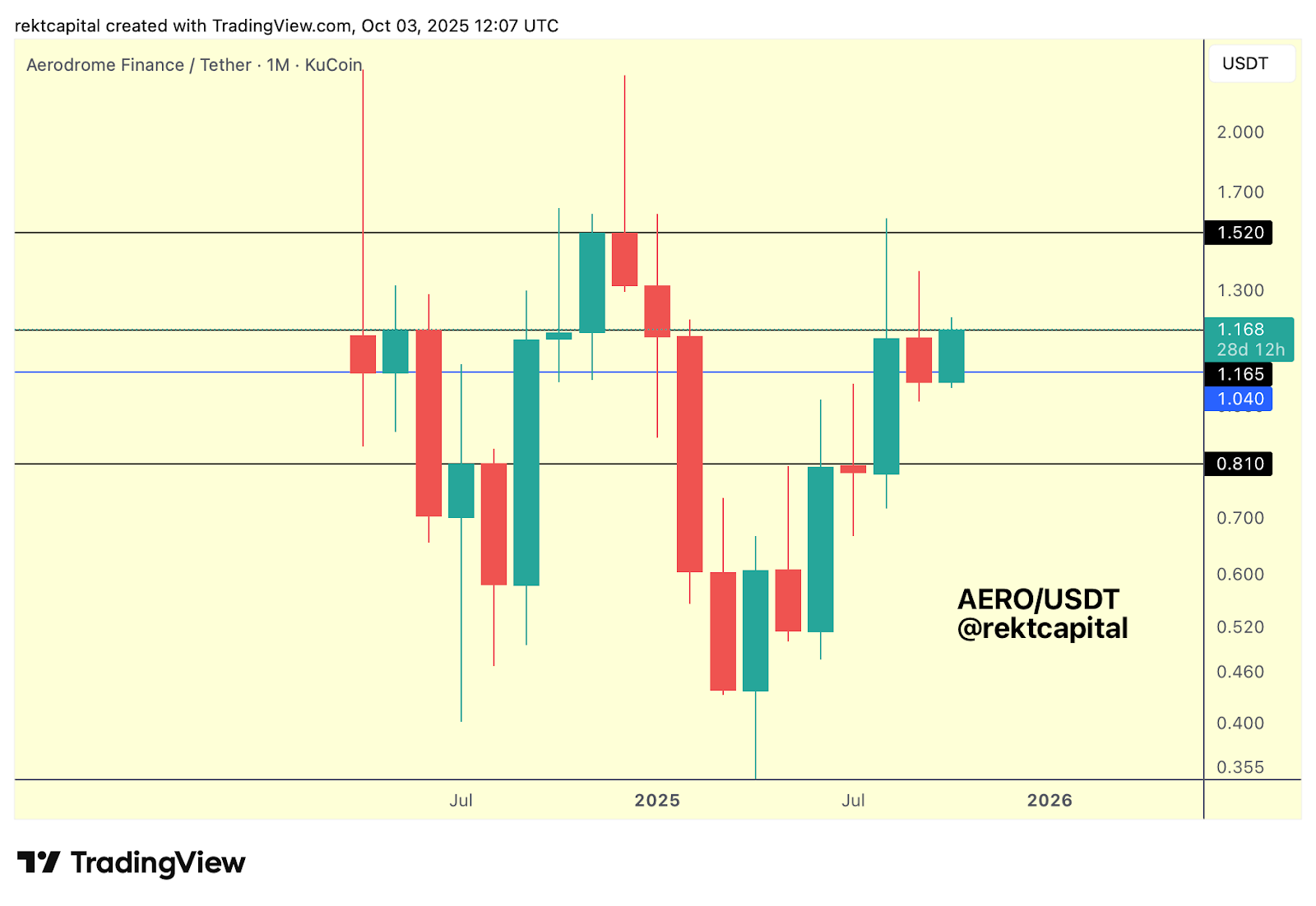

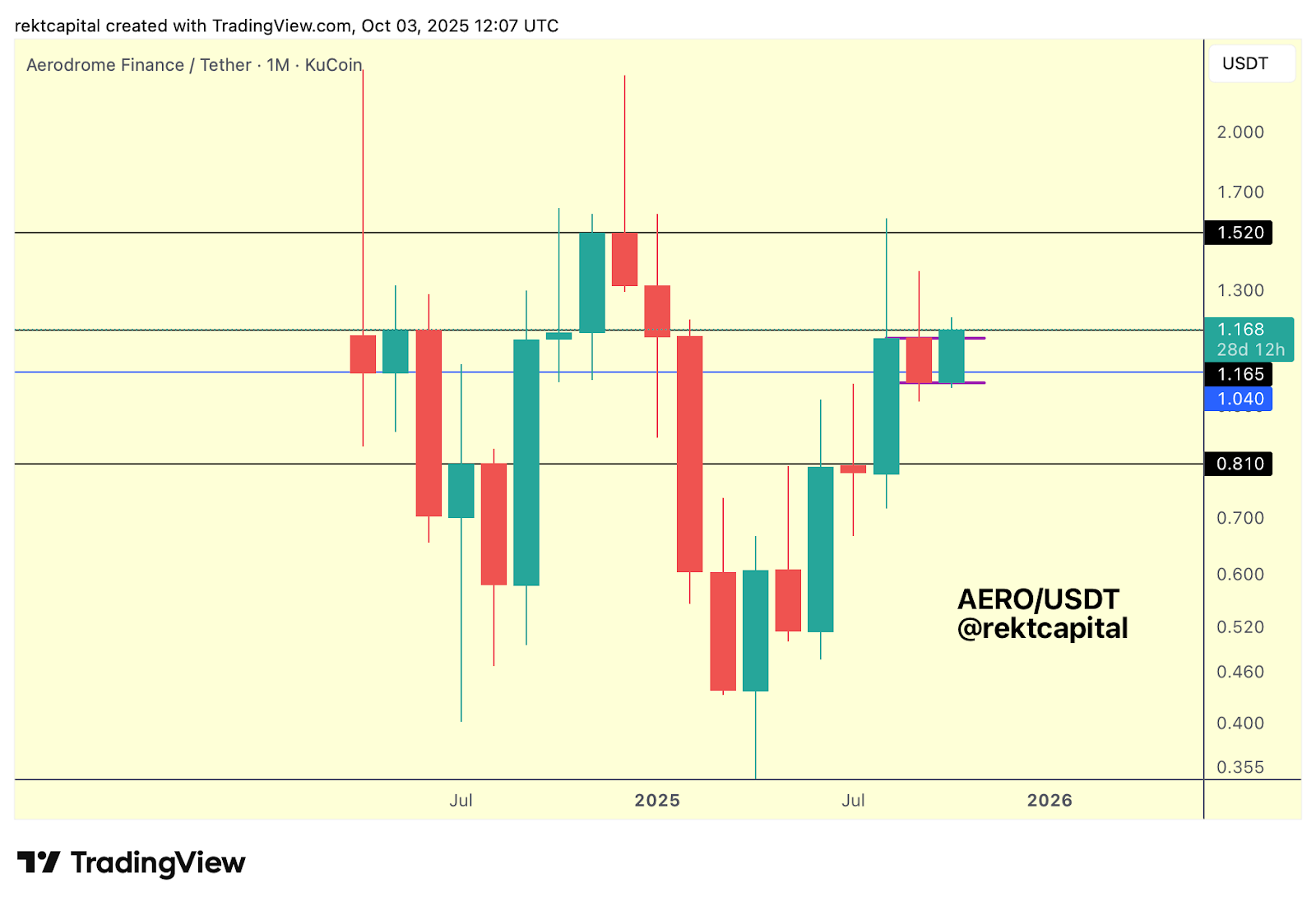

Aerodrome Finance – AERO/USDT

When it comes to AERO’s price action, we are essentially seeing two stacked Macro Ranges.

The first spans from $1.00 (blue, psychological level) to $1.16 (black). The second extends from $1.16 (black) to $1.52 (green).

Turning $1.00 into new support is crucial, because that would build the base for AERO to transition from the $1.00–$1.16 Macro Range into the higher $1.16–$1.52 Macro Range.

One encouraging factor around this psychological level is the market-wide presence of fake breakdowns.

CRO, for example, has displayed similar behaviour. AERO is also showing a downside deviation beneath $1.00 (blue), mirroring this wider pattern across altcoins:

This deviation, however, is developing in the context of a potential Monthly Bull Flag.

Ethereum is attempting to break out from its own Bull Flag, Bitcoin has already confirmed a breakout, and PENGU is still maintaining its flag structure. AERO therefore joins the list of altcoins forming Monthly Bull Flags.

That makes the defence of $1.00 (blue) important, since it aligns with the bottom of the Bull Flag and also functions as a historical demand level from which trend reversals have often taken place — whether full reversals to new highs in bullish conditions or rebounds that later checked resistance in bearish ones like in early 2024.

Overall, AERO is shaping up as a continuation structure around historical demand, with the next technical step being a reclaim of $1.16 (black, confluent with the Bull Flag top) as support to enable entry into the $1.16–$1.52 Macro Range.

Aptos – APT/USDT

APTOS is a coin we’ve been monitoring for a while now.

Back on August 22nd, price was still progressing inside its Falling Wedge structure, rejecting from the top of the channel. That rejection made the outlined pathway crucial for enabling the next upside attempt.

Since then, Aptos has finally produced movement, breaking out of the Falling Wedge.

Technically, however, this is not yet a confirmed breakout. Confirmation will require further development.

One method of confirmation would be a Weekly Close above $5.44 (black), followed by a successful post-breakout retest of this level.

That would resynchronise price with its Macro Range spanning from $5.44 to $17.04 (black). Breaking back into this Macro Range would confirm the breakout and establish a foundation for trend continuation.

The alternative scenario is a dip into the post-breakout structure, where retesting would serve as confirmation of the breakout attempt. In that case, downside would provide the base before any renewed upside can occur.

Encouragingly, Aptos is now showing early signs of strength as it tries to break out and position itself for continuation.

But overall, APT will need to Weekly Close above $5.44 to reclaim it as support to provide confirmation for post-breakout trend continuation and in the absence of such a Close and rejection from $5.44 as resistance, then the top of the Falling Wedge would be as scenario worth considering for a post-breakout retesting.