Altcoin Newsletter #241

Features analysis on Altcoins such as NEAR ADA VET WIF OP

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins – specifically:

- NEAR Protocol (NEAR)

- Cardano (ADA)

- VeChain (VET)

- Dogwifhat (WIF)

- Optimism (OP)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

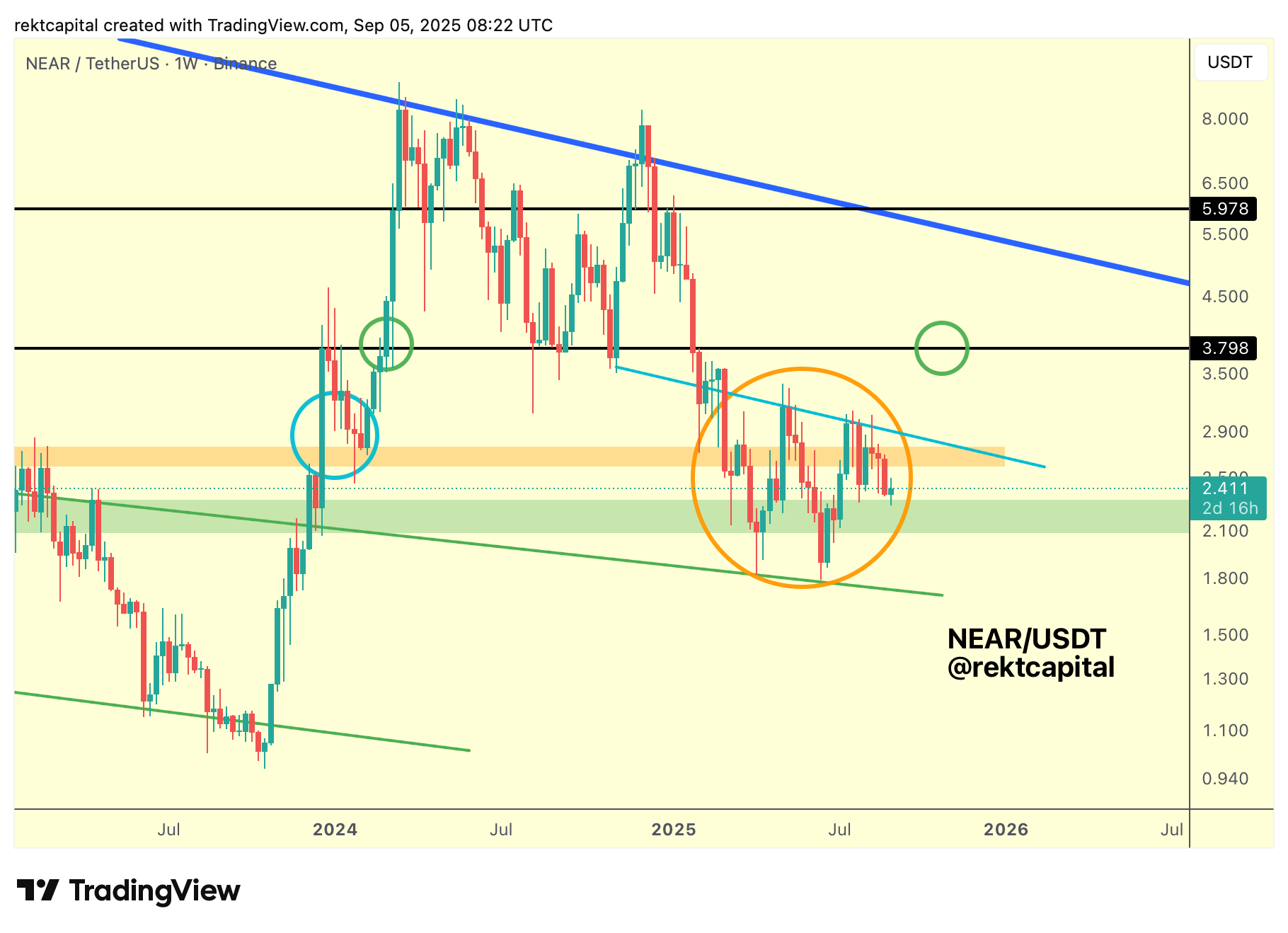

NEAR – NEAR/USDT

In late 2023, NEAR broke out from the green wedging market structure.

That move carried price into the Macro Downtrending resistance (blue), where it rejected, before slipping back to retest the breakout zone (the extended green trendline which represents the top of the green Wedge.)

Since retesting this green trendline as support, NEAR has managed to hold the green boxed region, a historical reversal area that has repeatedly absorbed volatility in prior cycles.

Each downside wick into the long-standing green trendline has actually enabled continued candle body closes above the green boxed region.

As long as higher timeframe candle closes persist above and within this green boxed region, the base for additional upside remains intact.

The orange region, once historical demand, now stands as resistance, effectively trapping price between two critical order blocks.

Continued Monthly Closes inside the green zone will be crucial to determine whether NEAR can build the foundation for another move higher.

On the Weekly timeframe, reclaiming the orange region is essential.

But such a reclaim won’t come cleanly, it requires price to also break the multi-month technical downtrend (light blue).

Breaking this 2025 downtrend (light blue) would effectively reopen the broader Monthly range (black-black) that NEAR occupied for much of 2024, with $3.80 (black) serving as the first key level inside it.

Until the break of the light blue 2025 Downtrend occurs, NEAR has scope for additional volatility into the green order block.

If this retest establishes a Higher Low, the structure strengthens, and the path towards a reclaim becomes clearer.

A breakout above the light blue downtrend would position NEAR for $3.80 (black).

And a Weekly Close above $3.80 followed by a successful post-breakout retest (as per the early 2024 green circled retest) would stabilise price inside the Monthly range, paving the way for a future challenge of the Macro Downtrend (blue) that has governed price since 2021.

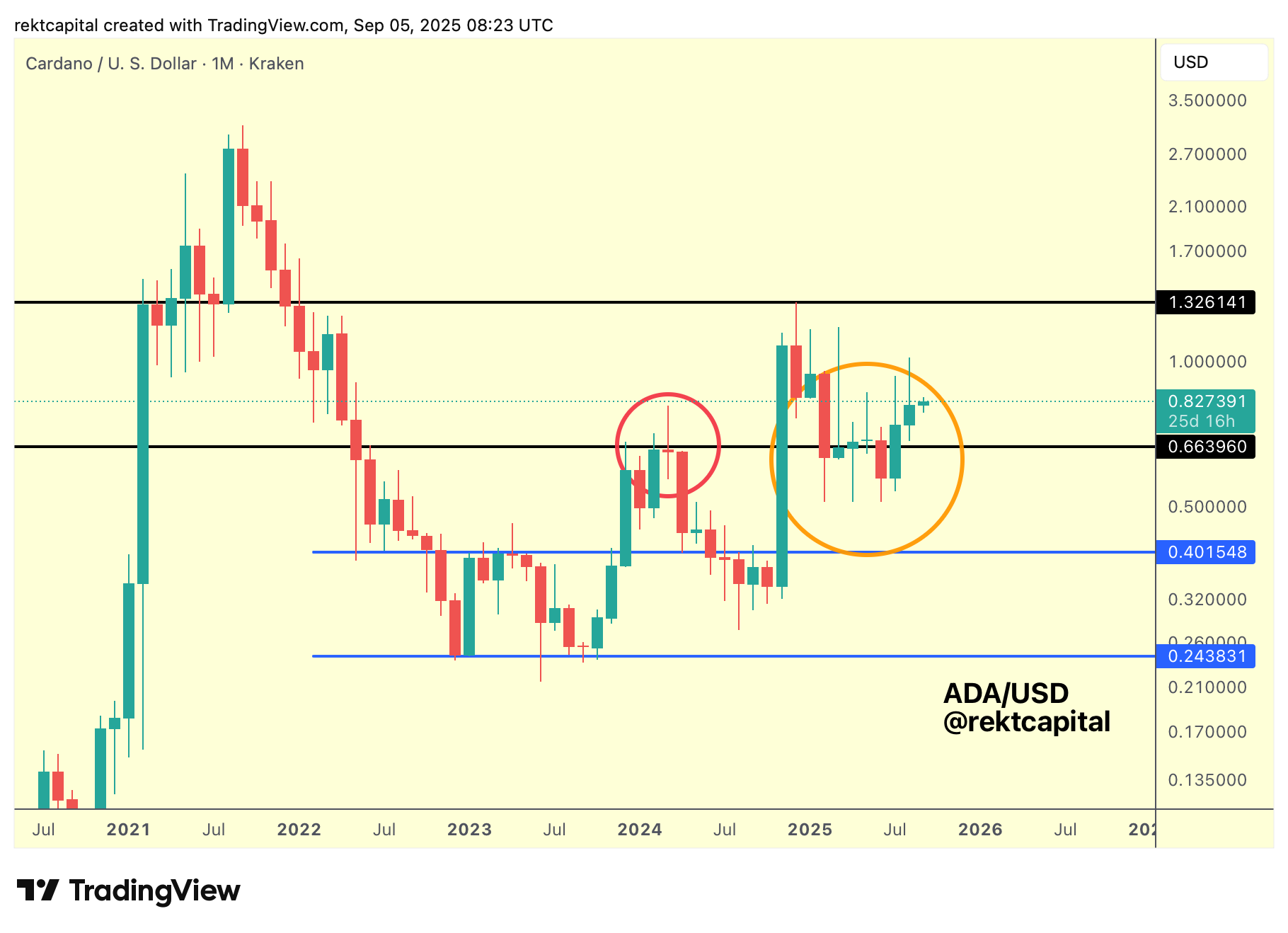

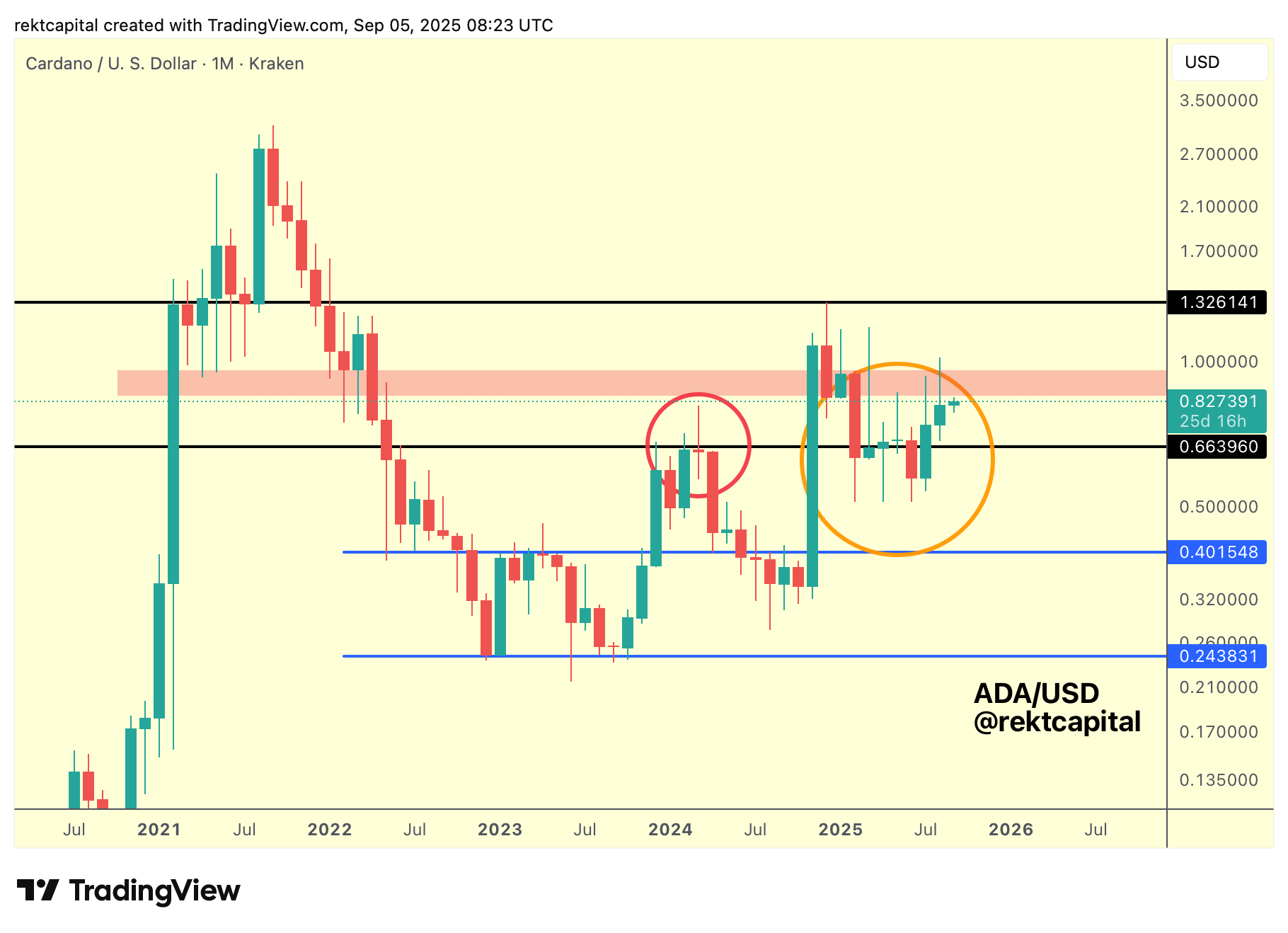

Cardano – ADA/USDT

Cardano has occupied this Macro Range (black–black) for quite some time.

Back in early 2024, price rejected from the Macro Range Low at $0.66 (red circle), only to later that same year break beyond it and rally into the Macro Range High at $1.32 (black).

Since then, ADA has been in a downtrending retest period, repeatedly revisiting the $0.66 level as new support. There were deviations below this level (orange circle) but price has gradually reclaimed it with greater sustainability.

Looking ahead, ADA needs to reclaim the red supply region overhead, which historically acted as major demand earlier in the cycle.

Already, ADA has upside wicked into this red region of supply, confirming it as active resistance.

Historically, volatile retests of the $1.32 level have enabled rallies (e.g. early 2021), and a similar sequence could unfold again if this red region is reclaimed as support.

This red zone also coincides with the midpoint of the Macro Range, making it a crucial pivot for transition. Reclaiming this red region would effectively allow ADA to move from the lower half of the Macro Range into the upper half (i.e. up to as high as $1.32).

Should indeed the Range High of $1.32 (black) get revisited, then a Monthly Close above said level, followed by a volatile post-breakout retest, would likely confirm continuation into $1.50–$1.60, and perhaps even into the $2 region, consistent with historical behaviour after similar pivotal retests.

For now, however, ADA remains range-bound inside the Macro Range (black–black), still meandering in its lower half between $0.66 and the red supply zone.

Further downside volatility into $0.66 cannot be ruled out, especially if rejections persist at this current red mid-point resistance.

But the key milestone remains unchanged — reclaim the red region to enable progress into the upper half of the Macro Range.