Altcoin Newsletter #238

Features RSR ARB NEAR NPC XMR IOTA

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Reserve Rights (RSR)

- Arbitrum (ARB)

- Near Protocol (NEAR)

- Non-Playable Coin (NPC)

- Monero (XMR)

- Iota (IOTA)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

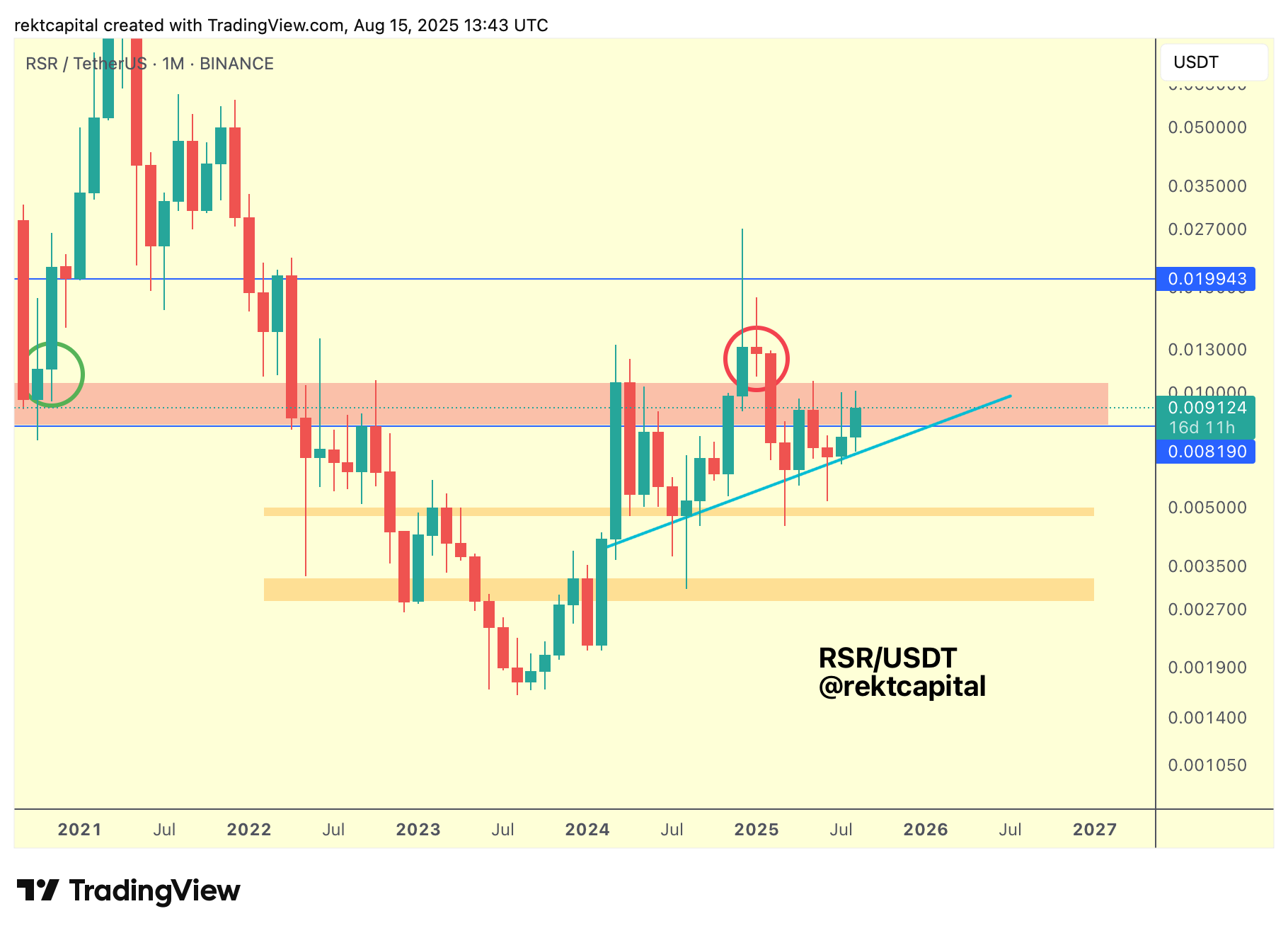

Reserve Rights - RSR/USDT

RSR has been in a technical uptrend for the past year or so, maintaining the year-long Higher Low as support (light blue).

The red resistance however has been a key point of rejection but as long as the technical uptrend continues to hold and price is able to Weekly Close above and/or retest the top of the red resistance, RSR will be able to revisit the blue Range High resistance at $0.019.

Pre 2021, the green circled area showcases how turning the top of the red area into support has been a key technical moment for RSR to springboard to the blue resistance above.

The technical uptrend line will be a critical support in enabling that potential upside.

Arbitrum - ARB/USDT

Arbitrum has successfully protected its Macro series of Lower Lows (blue) and is now trying to break back above the green region so as to challenge the Lower High resistance above (red).

The green region has historically figured as a key pivot point that has enabled ARB to transition from the lower half of the Wedge to the upper half of it; more, the green region represents the Binance Listing Price, and these Listing Prices tend to be Mean Reversion levels for most coins.

However, what's interesting about the green region right now is that it has become increasingly confluent with the red Wedge top, meaning that the most important confirmation going forward will have to be the Weekly Close and/or post-breakout retest of the Wedge Top diagonal (red).

At the end of the day, the Lower High here is the most important resistance to breach and by reclaiming the green region as support, ARB would be one step closer to breaking that diagonal

But here's another piece of the puzzle:

ARB is trying to not just break its Price Diagonal; it also wants to exit and completely breakout from its RSI Macro Channel (blue).

In the past, first rejections from the RSI Channel have translated into limited pullbacks, but if the RSI would then go on to form a Lower High, then that would be a sign of weakness which would precede price and the RSI to drop deeper.

If the RSI breaks out from its pattern, that would be a bullish signal because that would evidence emerging strength in the RSI which would translate favourably into the price action as well.

But if the RSI rejects on this upcoming attempt, that would be the first High in, which may not be a grave signal if the RSI is able to breakout on the second time of asking; the RSI needs to avoid rejecting from the RSI Channel Top and forming a Lower High, as that has historically confirmed Macro weakness for price action.