Altcoin Newsletter #237

Features PENGU PENDLE SPX VANRY SEI

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Pudgy Penguins (PENGU)

- Pendle (PENDLE)

- SPX6900 (SPX)

- Vanar Chain (VANRY)

- Sei (SEI)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

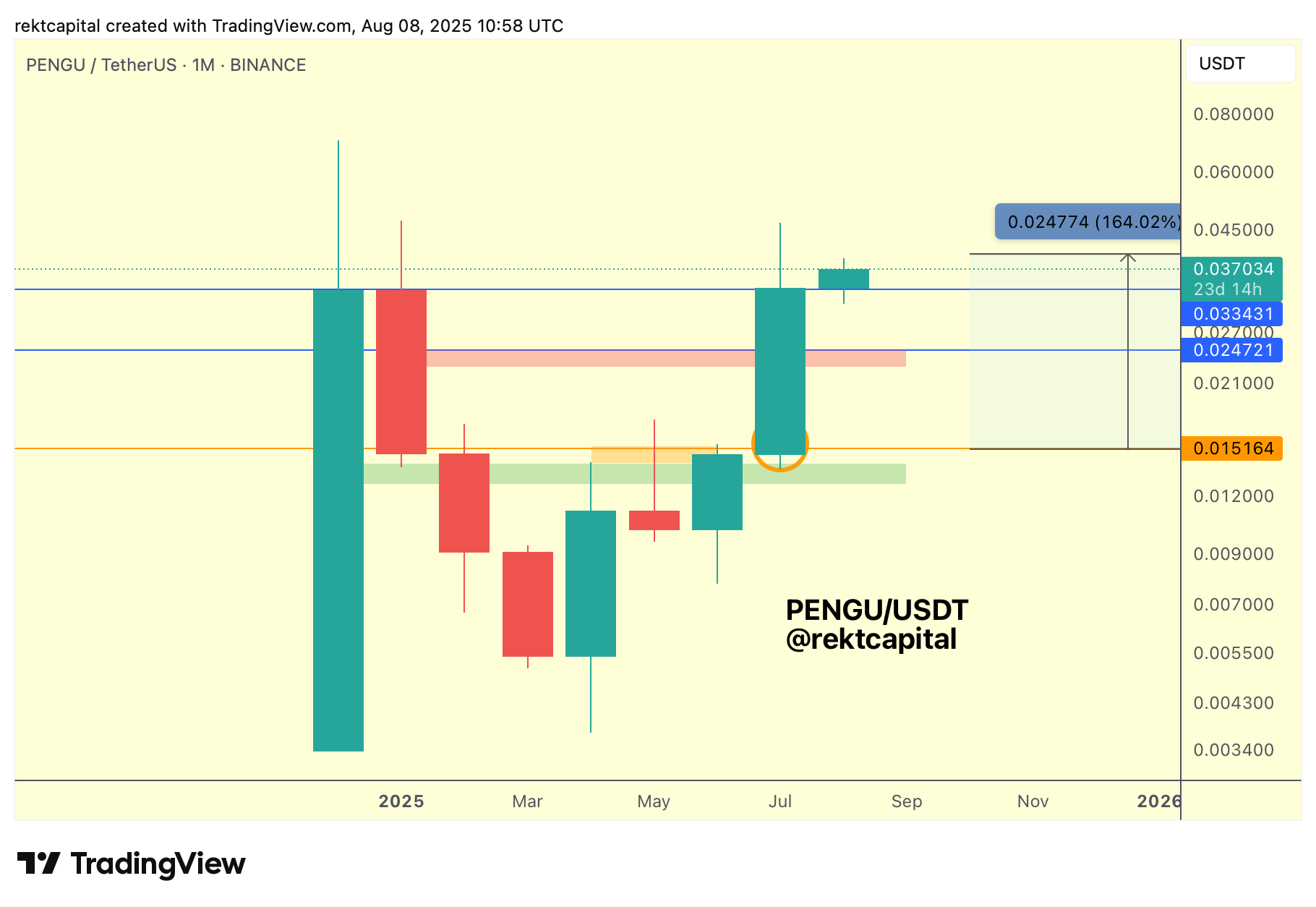

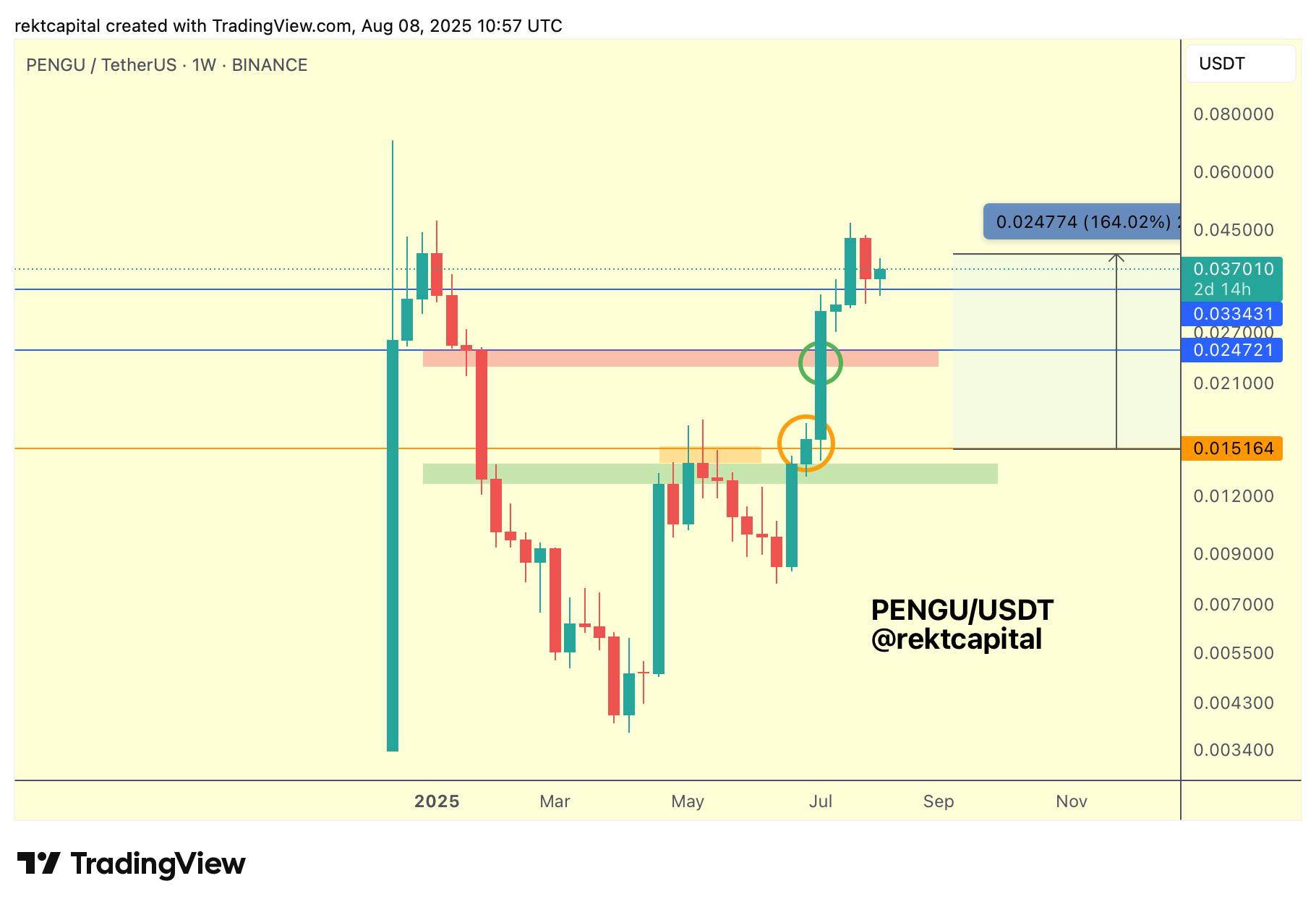

Pudgy Penguins - PENGU/USDT

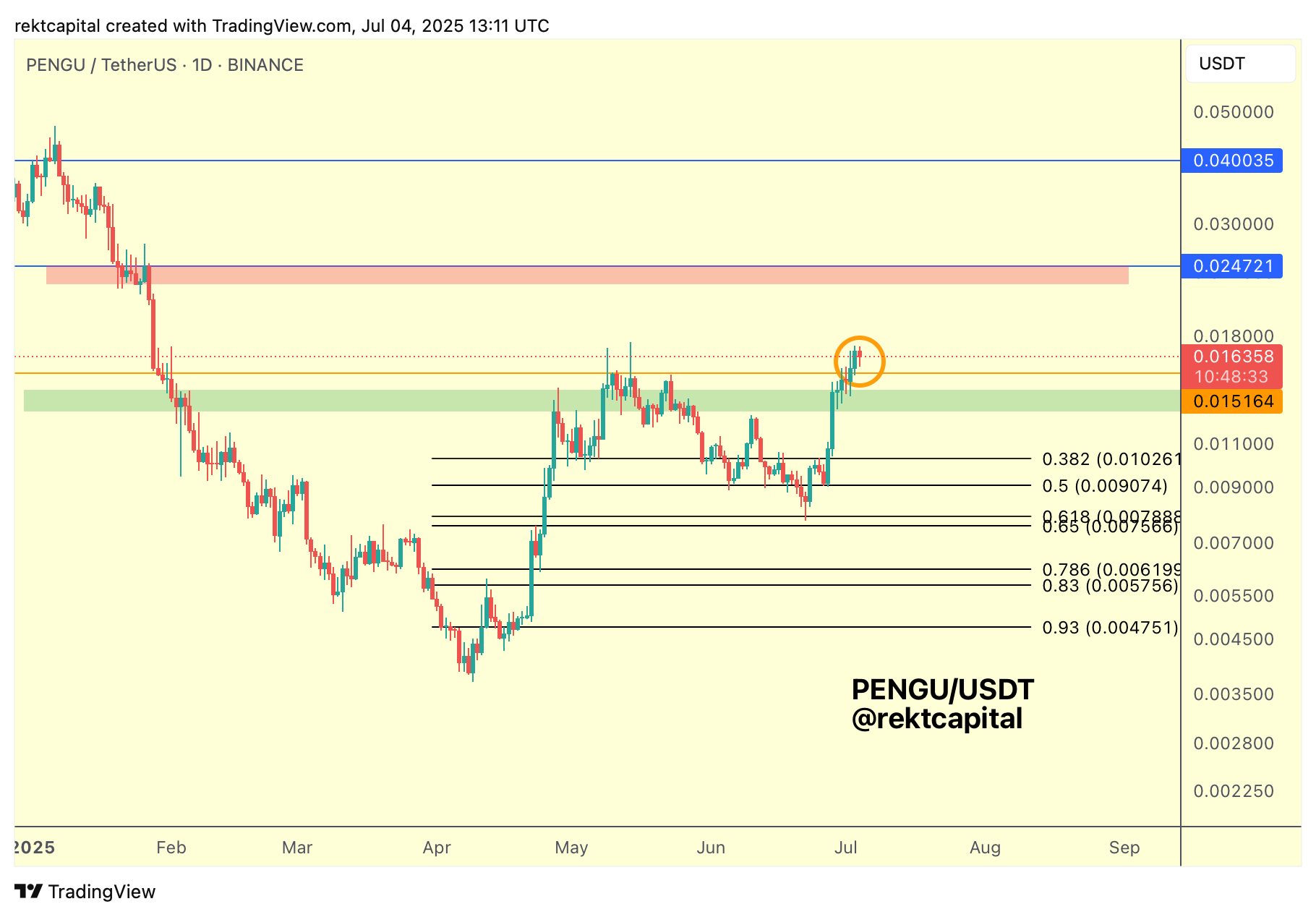

A month ago, we spoke about what PENGU need to do to confirm a breakout to higher levels.

Effectively, it was all about price action retesting the general area around the orange level and green region as support on the Daily timeframe:

Why was that important?

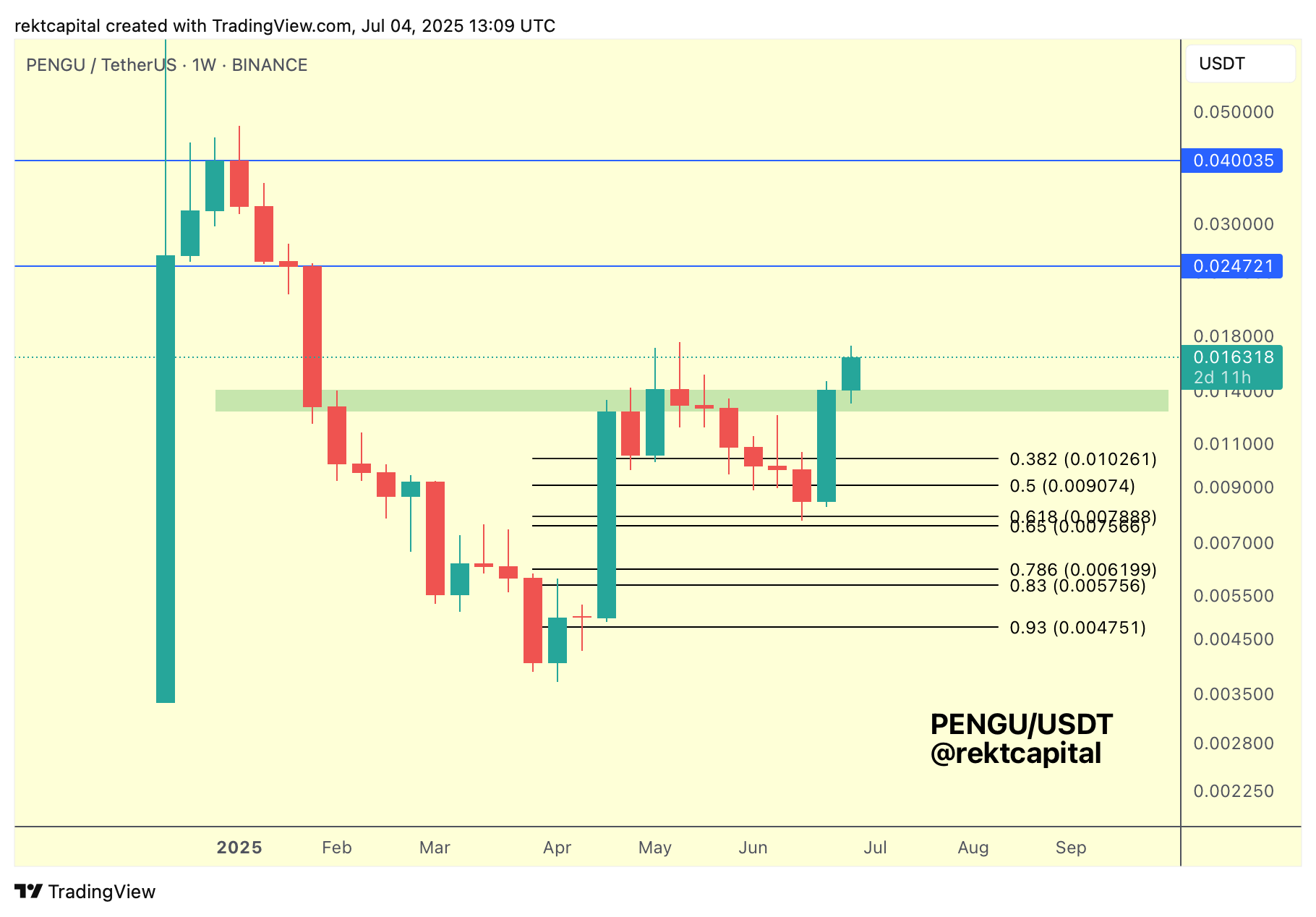

Because that was a Weekly resistance which needed to become a new support:

And by mid-July, PENGU had indeed followed through on what it needed to do.

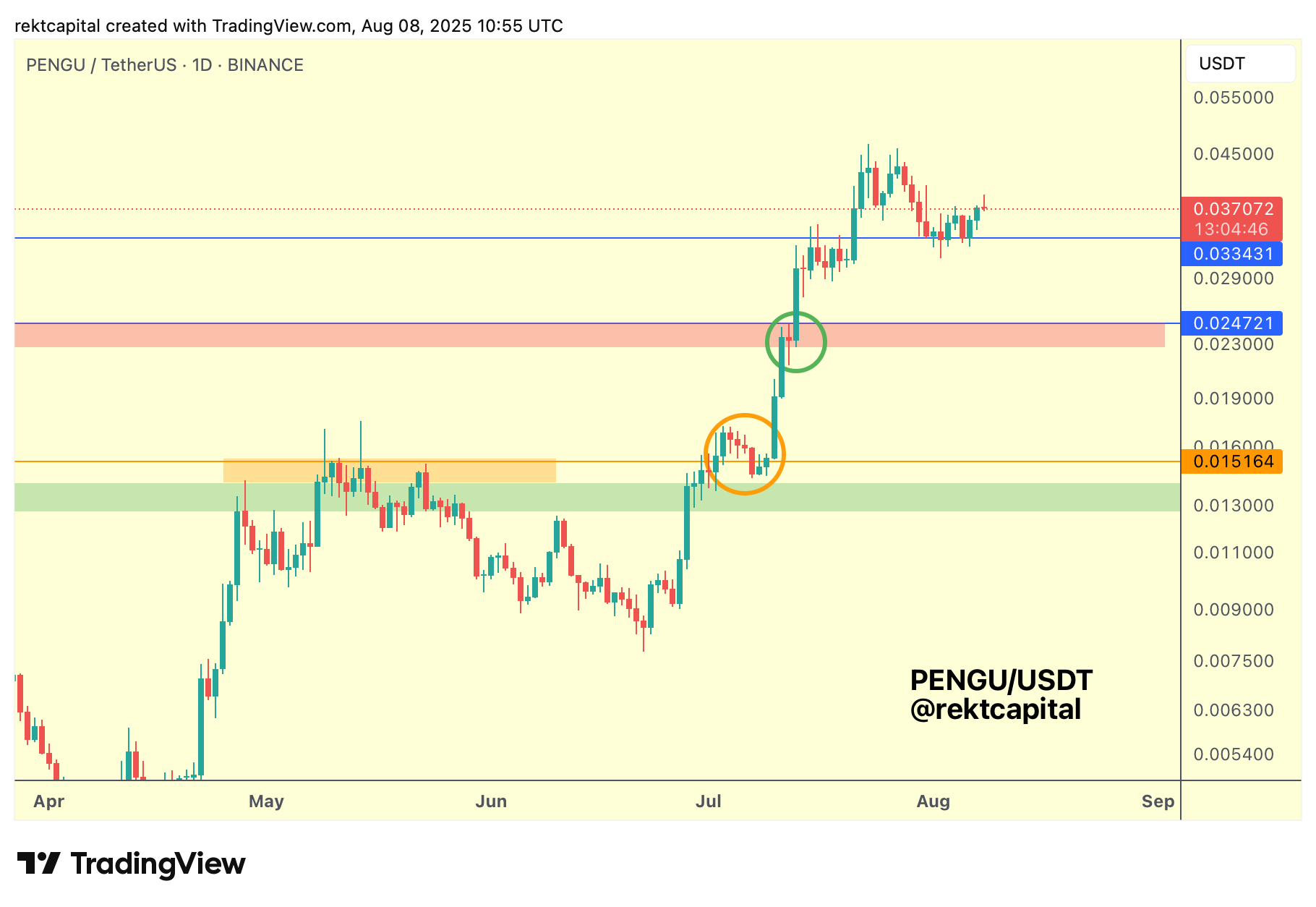

Here's the mid-July analysis:

And since then, PENGU indeed Daily Closed inside that red region, enabling a move all the way to the blue $0.04 resistance above:

In fact, price broken beyond this blue level and is now in the process of turning this blue level into support.

But since covering PENGU here in the newsletter, price has rallied an extraordinary +160% to the upside:

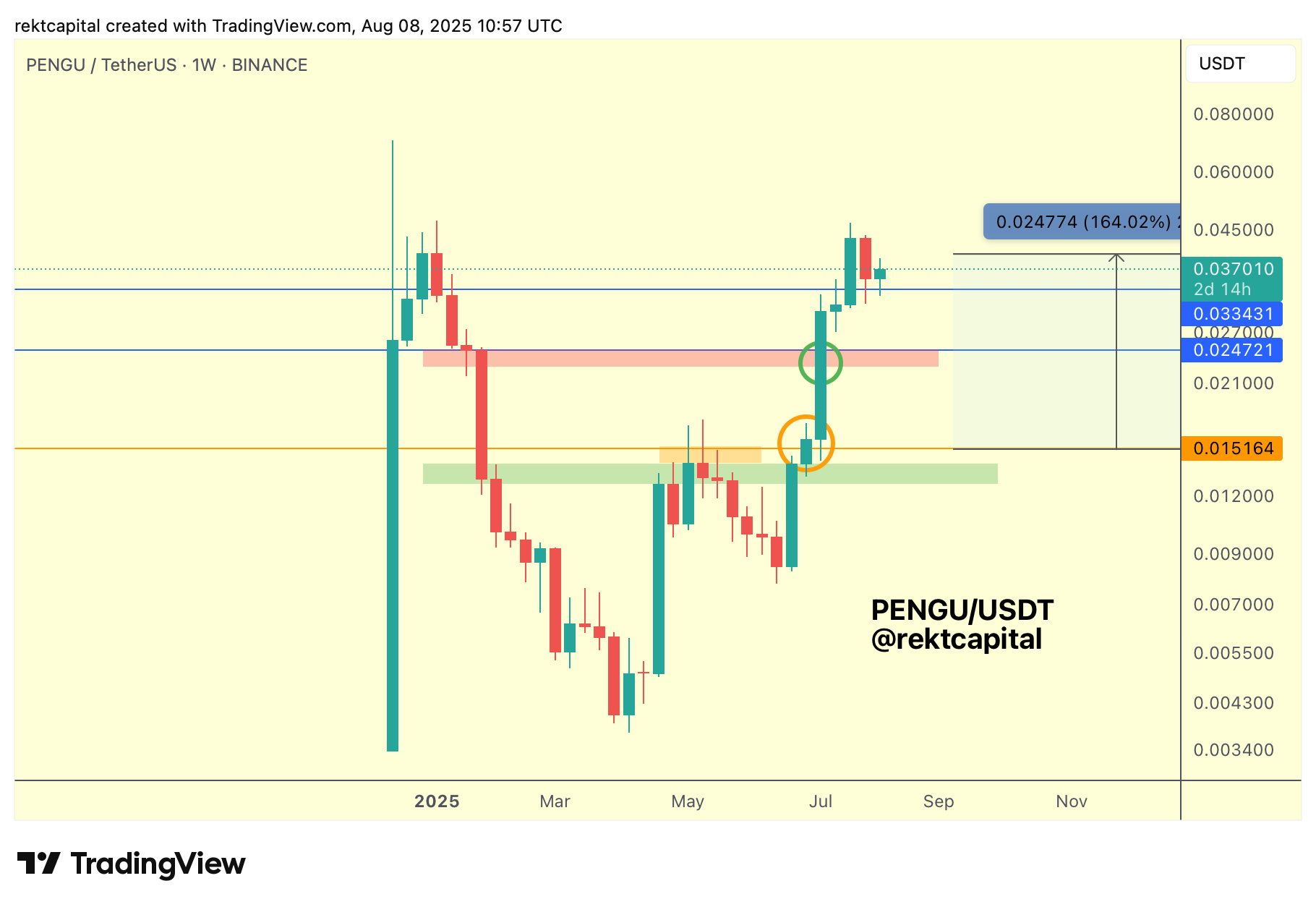

And right now, PENGU is trying to turn the blue level into new support; but where does the significance of that level come from?

It is the final major Monthly resistance:

Months ago, PENGU would reject harshly from this blue Monthly resistance, the final major resistance before new All Time Highs.

Whereas now, PENGU is trying to hold this same level but as support.

To continue positioning itself for a challenge into new All Time Highs, all PENGU needs to do is simply hold this blue level as support.

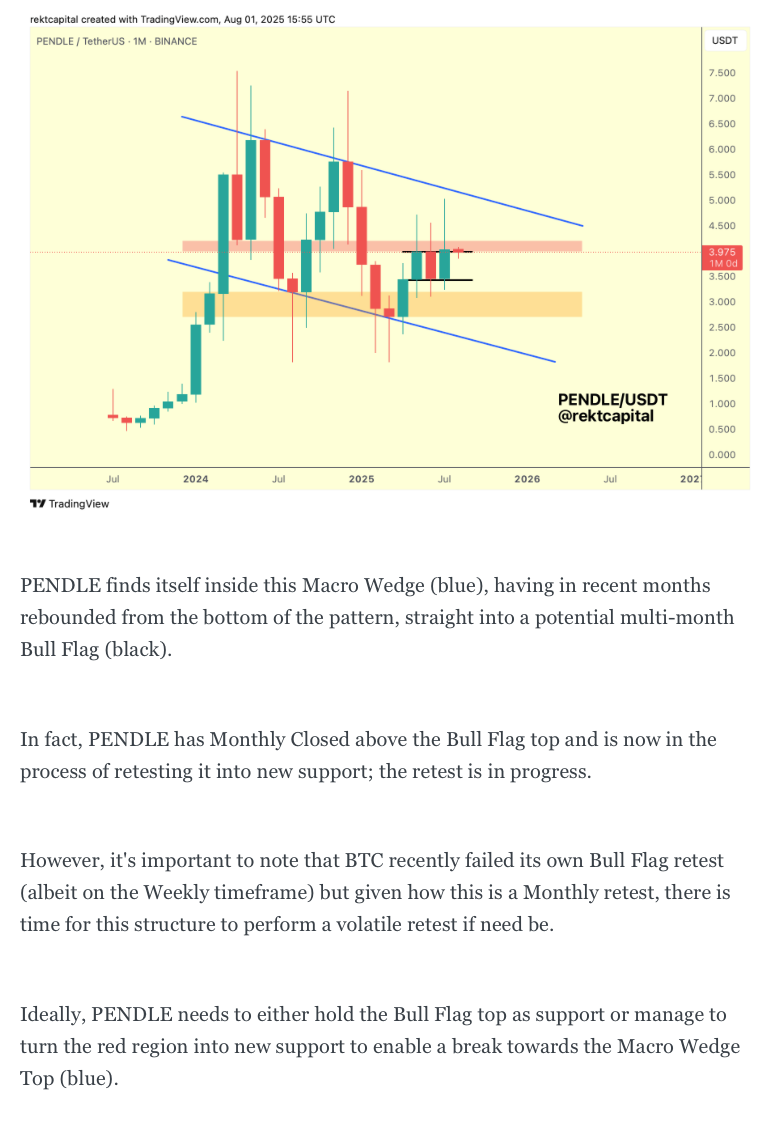

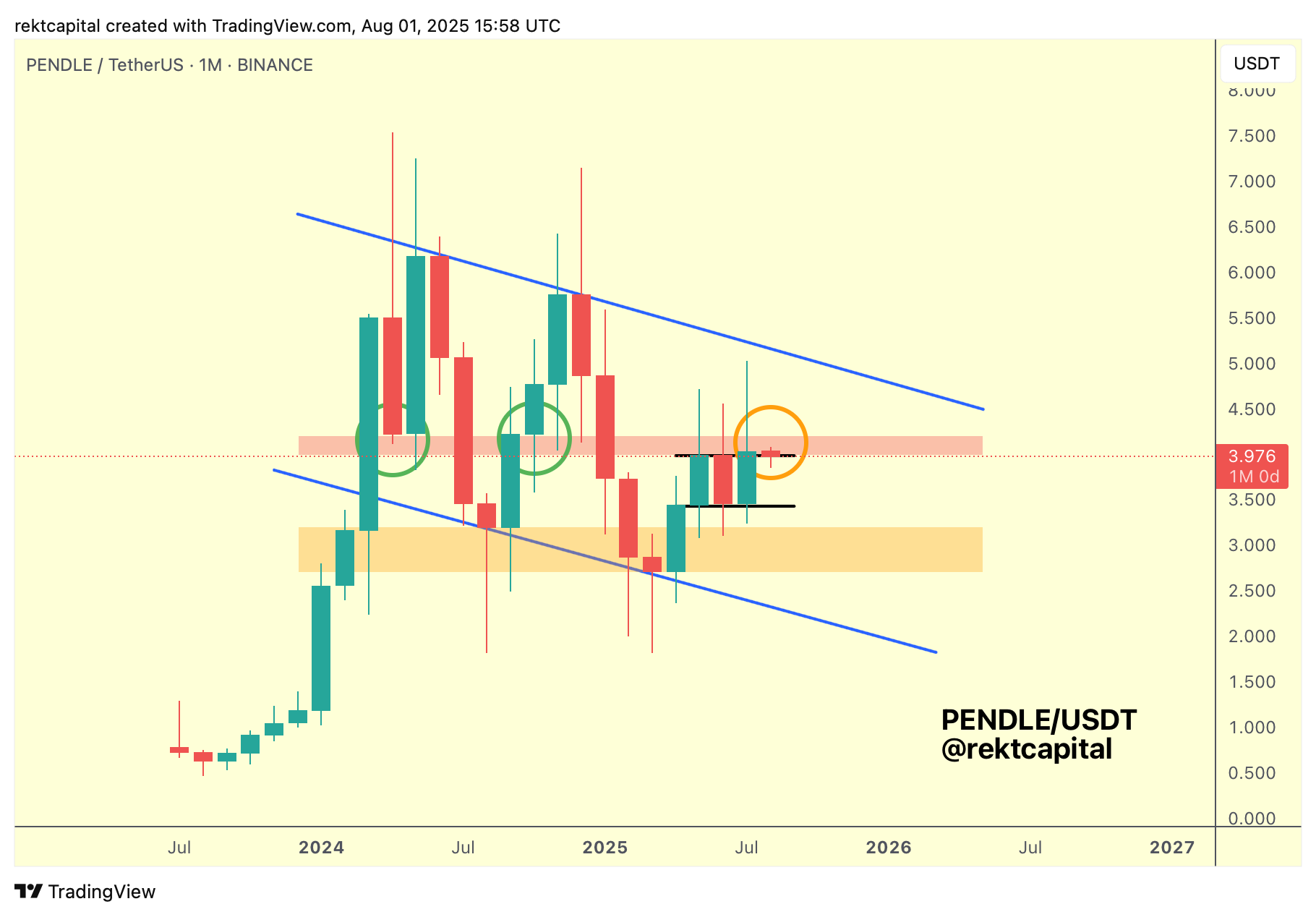

Pendle - PENDLE/USDT

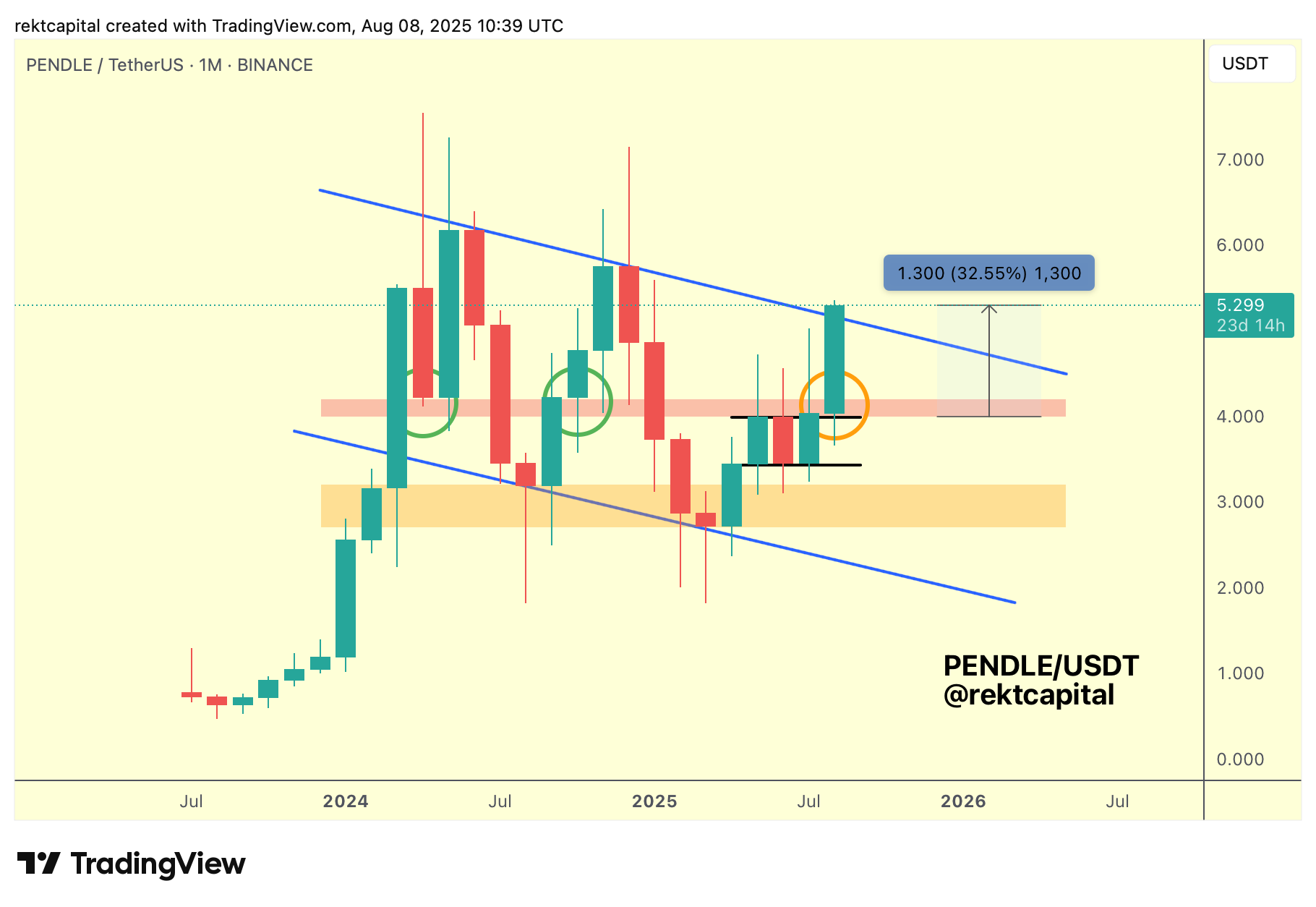

Just last week, we covered PENDLE's price action which was on the cusp of confirming a breakout from its Bull Flag, trying to turn the top of the pattern into new support.

Here is last week's analysis:

More, the Bull Flag top retest was a confluent historical pivot point for price, as per the circles outlined below:

Here's today's update:

PENDLE fulfilled all the key technical milestones needed to reach the top of the Macro Wedge (blue).

PENDLE has broken out into a more than +30% rally, now challenging the top of the blue Macro Wedge for an attempt to exit the macro pattern.

Going forward, to perform an overall exit from this Macro Wedge, PENDLE will need to simply hold the blue diagonal as support.

A Monthly Close above the blue diagonal would be best, but we'd need to wait almost an entire month for that Close.

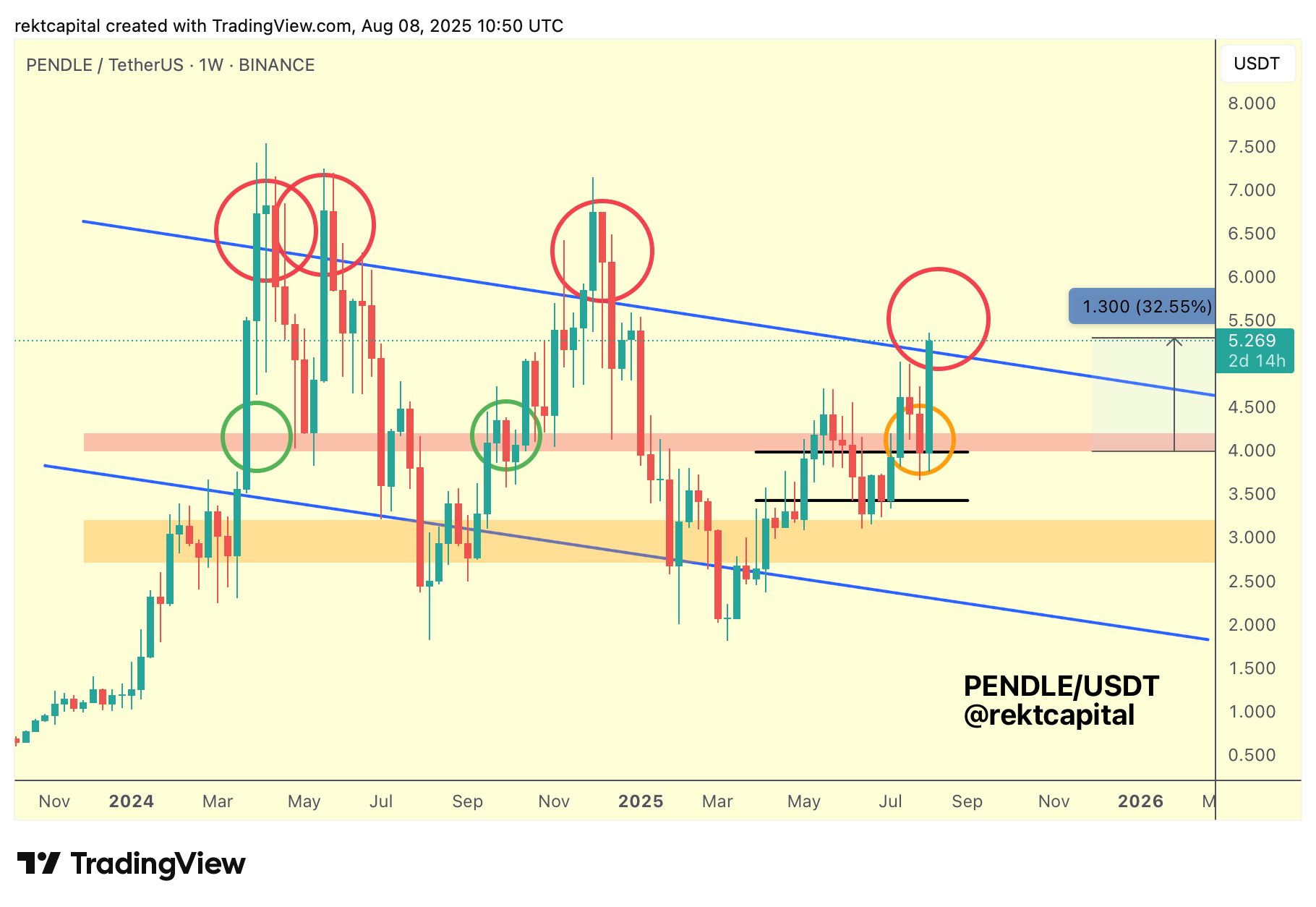

On the Weekly timeframe however, the Weekly post-breakout retests have been unreliable:

Weekly Closes above the trendline would occur but the post-breakout retests, though sometimes initially successful in stabilising price, would ultimately unfortunately fail; price would Weekly Close back below the blue diagonal and upside wick into the trendline to flip it back into resistance.

Which is precisely why the Monthly Close would be the best higher timeframe confirmation.

In the meantime however, PENDLE will need to make do with Weekly confirmation instead and somehow manage to go against the grain of history by holding above the blue diagonal in the event of a post-breakout retest.

So in a nutshell:

PENDLE needs a Weekly Close above the blue diagonal followed by a successful post-breakout retest to confirm a breakout from the Macro Wedge.

Historically, PENDLE has always failed its post-breakout retest on the Weekly timeframe so should price indeed Weekly Close above the blue diagonal this week, PENDLE will need to go against the grain of history and somehow muster a successful post-breakout retest in the weeks that follow.