Altcoin Newsletter #235

Features XLM HBAR TAO NEAR RENDER TIA

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Stellar (XLM)

- Hedera Hashgraph (HBAR)

- Bittensor (TAO)

- Near Protocol (NEAR)

- Render (RENDER)

- Celestia (TIA)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

Stellar - XLM/USDT

In last week's newsletter we spoke about the journey of XLM rallying +64% since breaking out from its Weekly Downtrending Channel.

But today, we'll talk about its recent rejection and what that means for price going forward.

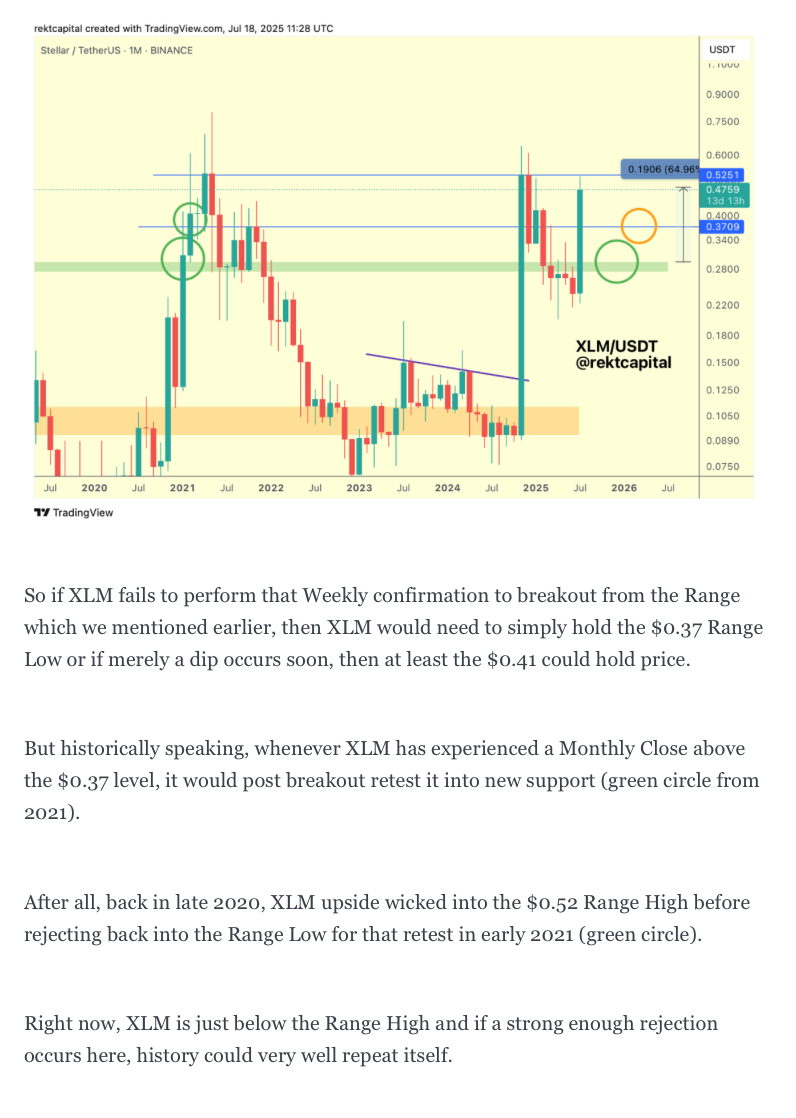

Here is an excerpt from last week's Altcoin Newsletter:

Here is today's update:

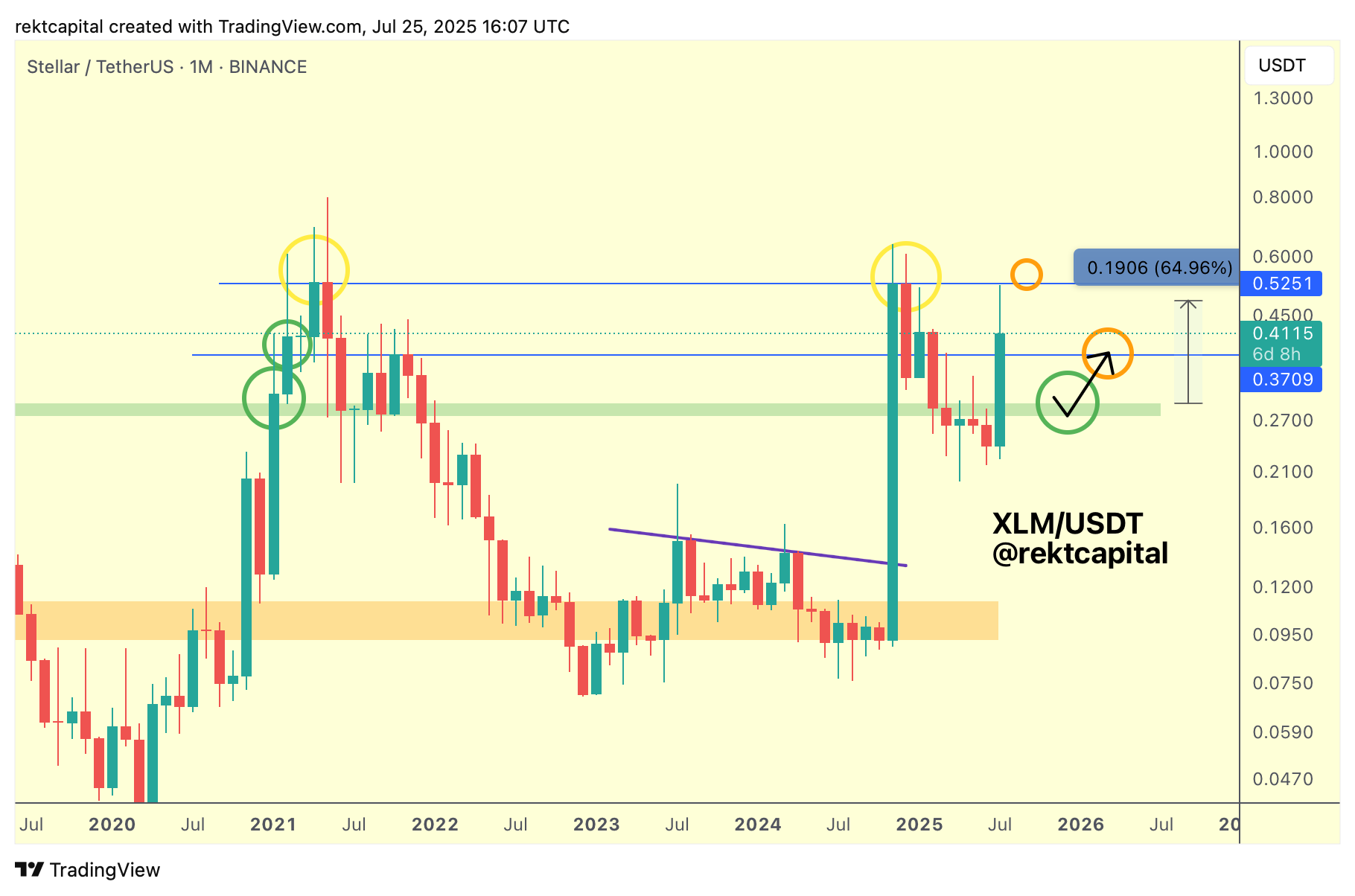

XLM once again rejected from the $0.52 resistance (yellow circle), repeating history.

And so if history continues to repeat, as it has been thus far, that $0.37 level will be important to reclaim as support on this incoming retest attempt.

Late 2024, early 2025 shows that a failed retest could lead to possible deeper downside whereas that late 2020, early 2021 retest (green circle) shows that a successful retest would see XLM re-challenge the Range High at $0.52, even if the retest itself could be a bit volatile to the downside via downside wicks.

Hedera Hashgraph - HBAR/USDT

It's been phenomenal to see but HBAR has been repeating 2021 history almost picture-perfectly, with the only real difference being how extended certain phases have become.

This has been a staple of the Bitcoin cycle for example: extended retests, downside deviations, and the same applies to even Bitcoin Dominance as well.

Back in 2021, when HBAR successfully retested the red region as support (green circle), HBAR initially upside wicked into the black Lower High before rejecting and dropping into the red region for another retest.

Effectively, HBAR was bouncing about between the red area of support and the black Lower High resistance before Weekly Closing above the black Lower High, post-breakout retesting it into new support (blue circle) before confirming the breakout.

For the time being, it looks like HBAR is rejecting from the Lower High resistance as we speak which means that price will likely continue to bounce about between the red region of support and the Lower High, all in an effort to position itself for a Weekly Close above the Lower High to kickstart trend continuation to new highs.

Therefore for as long as HBAR maintains itself below the Lower High, dipping via the blue path would make sense but the confirmation for a breakout is clear: Weekly Close above the Lower High followed by the purple path to confirm the new trend.