Altcoin Newsletter #233

Features ETH PENGU XLM SPX XRP

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Ethereum (ETH)

- Pudgy Penguins (PENGU)

- Stellar (XLM)

- SPX6900 (SPX)

- Ripple (XRP)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

Ethereum - ETH/USD

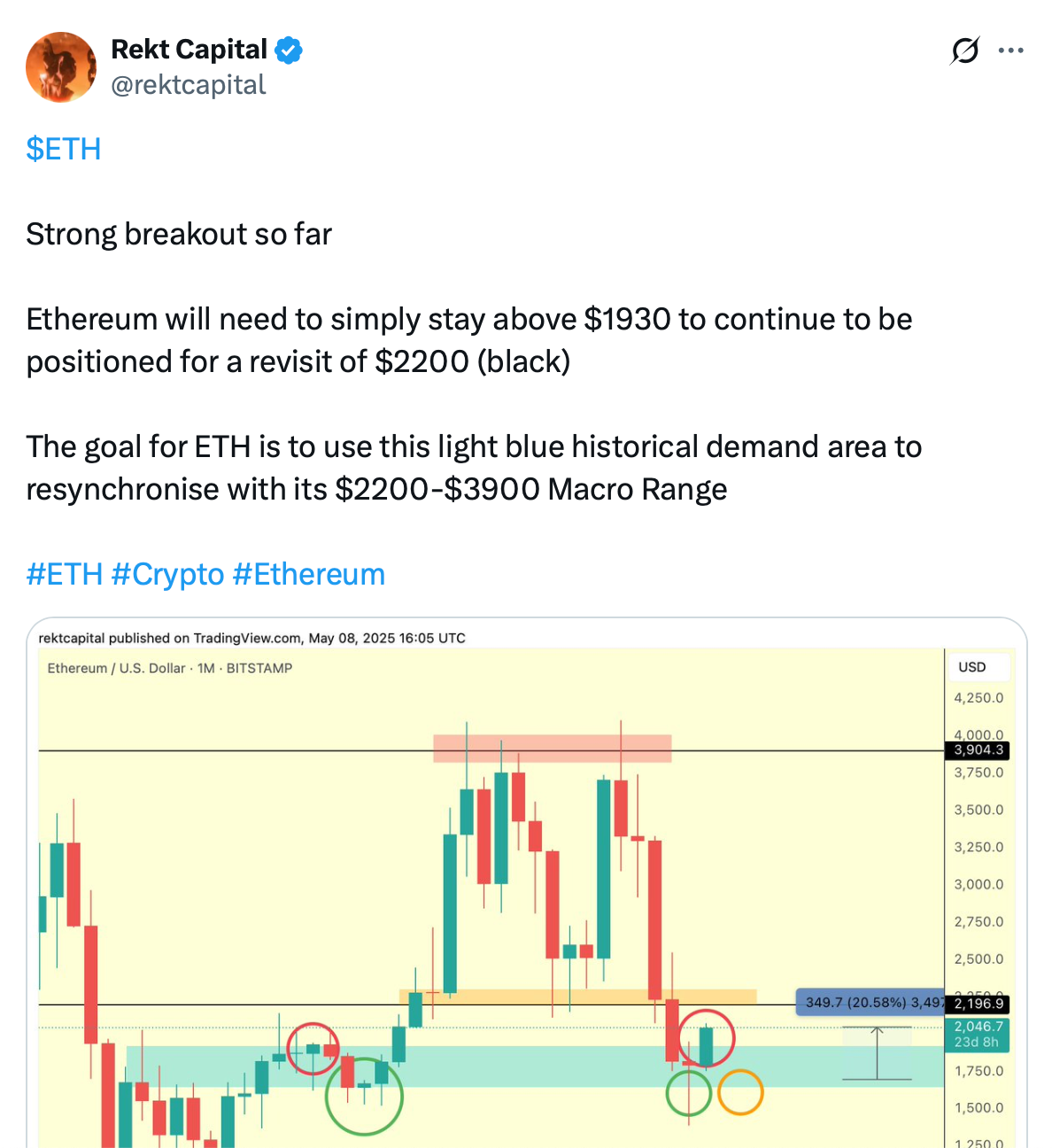

Back in mid-April 2025, Ethereum had dropped into its historical demand area and needed to evidence price stability for a chance at upside:

And over the weeks since, ETH slowly started to show signs of strength:

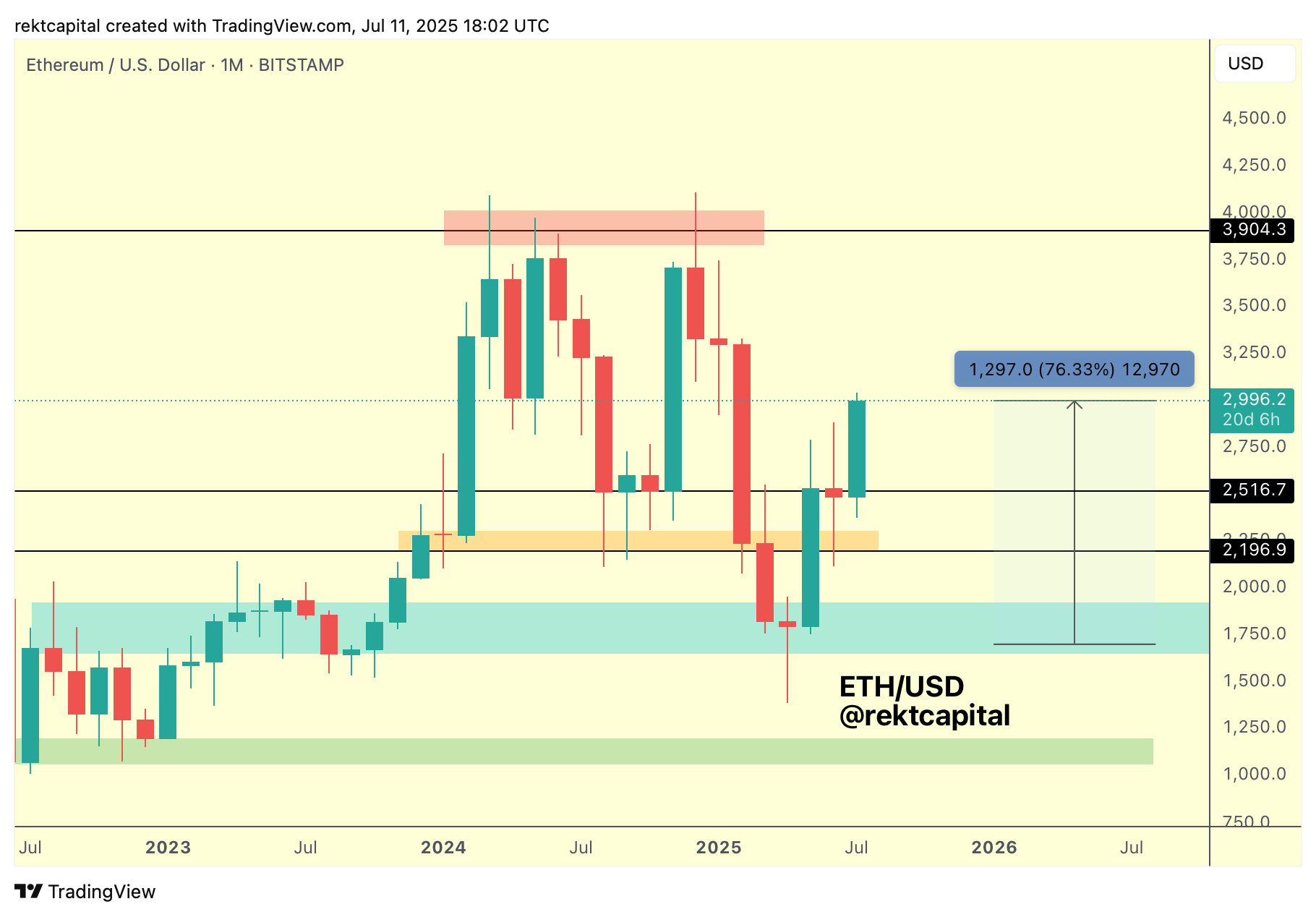

The goal for ETH was to break back into the black-black $2200-$4000 Range, which price has managed to do since:

Overall, since breaking into the Range and resynchronising with it, ETH's goal is to try to revisit the $4000 Range Highs over time.

In the meantime however, it's worth exploring what headwinds price could face, if any at all:

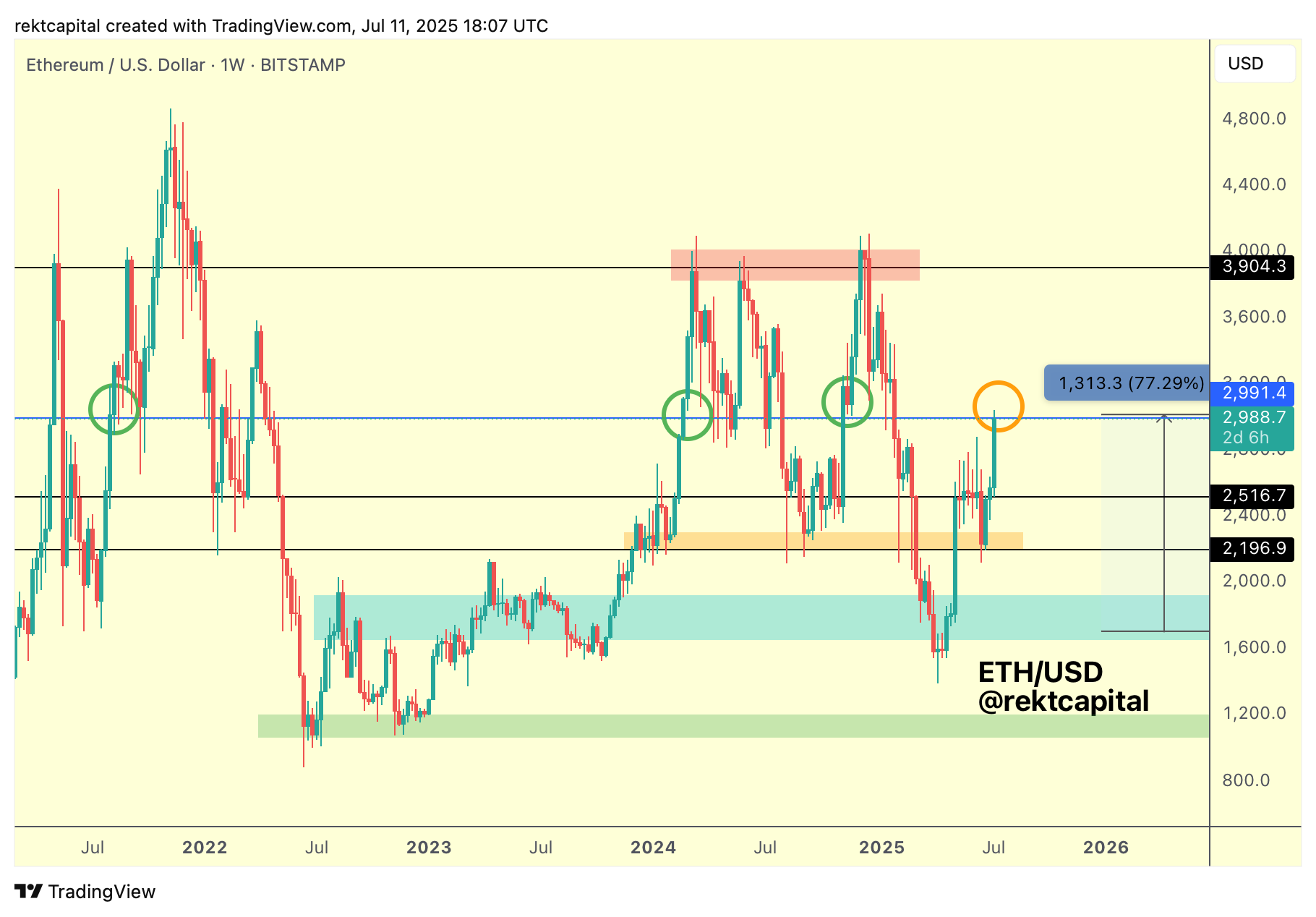

History suggests that a Weekly Close above ~$2991 followed by a successful retest of it into new support would enable a move to $4000; at least this has been the case on the previous three occasions that such a sequence of technical events took place.

Reject from here or actually Weekly Close above blue but failed the reclaiming retest, then ETH could pullback into at least ~$2500 (black), with scope for a drop into the ~$2200 Macro Range Low altogether.

Effectively, the $3000 level is acting as an approximate Mid-Point to the Range.

Breaking it would mean that ETH would be ready to occupy the upper half of the Macro Range and failing to break beyond it would sentence ETH to additional consolidation in the lower half of the Range.

The upcoming Weekly Close will be pivotal.

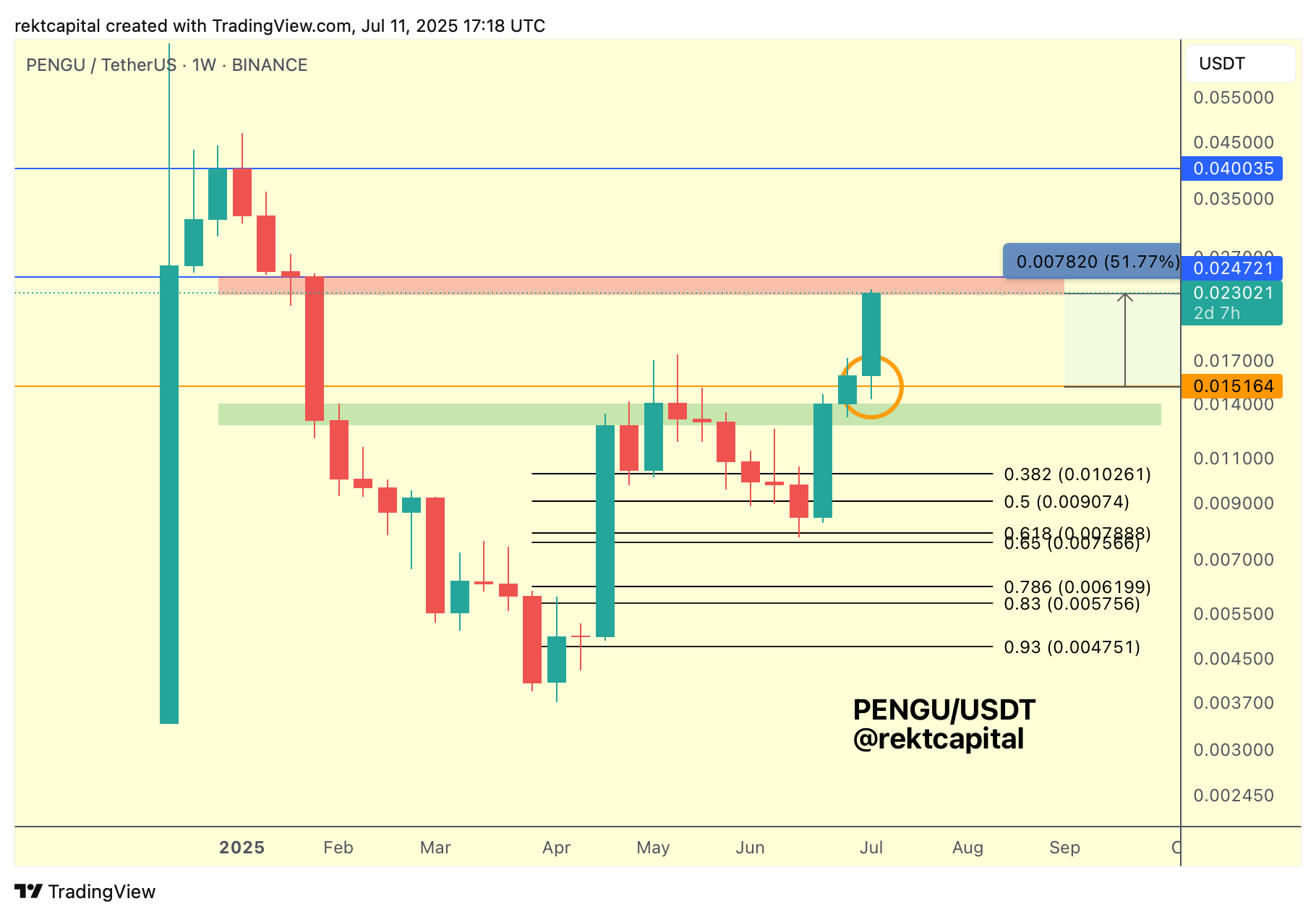

Pudgy Penguins - PENGU/USDT

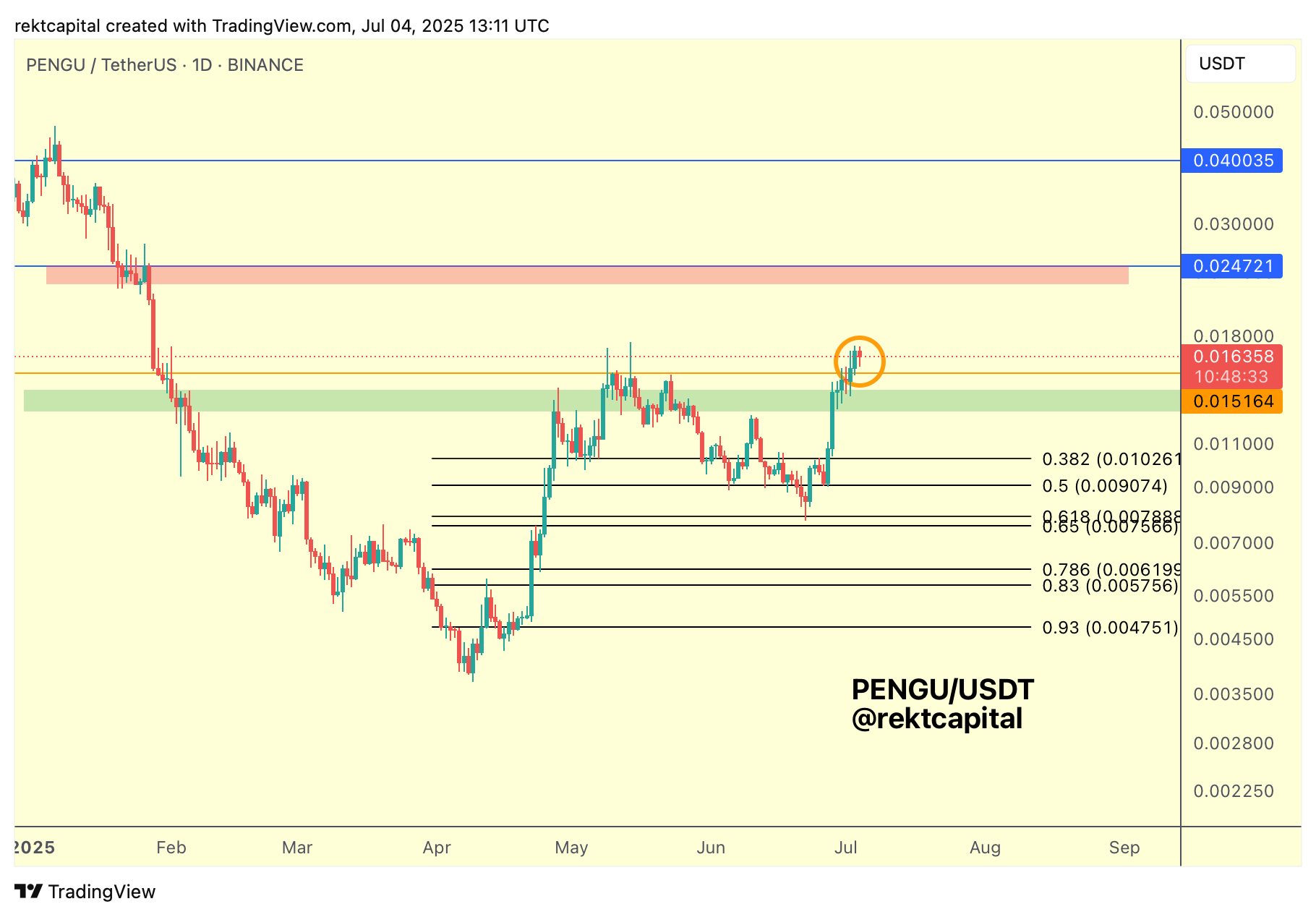

Last week, we spoke about what PENGU need to do to confirm a breakout to higher levels.

Effectively, it was all about price action retesting the general area around the orange level and green region as support on the Daily timeframe:

Why was that important?

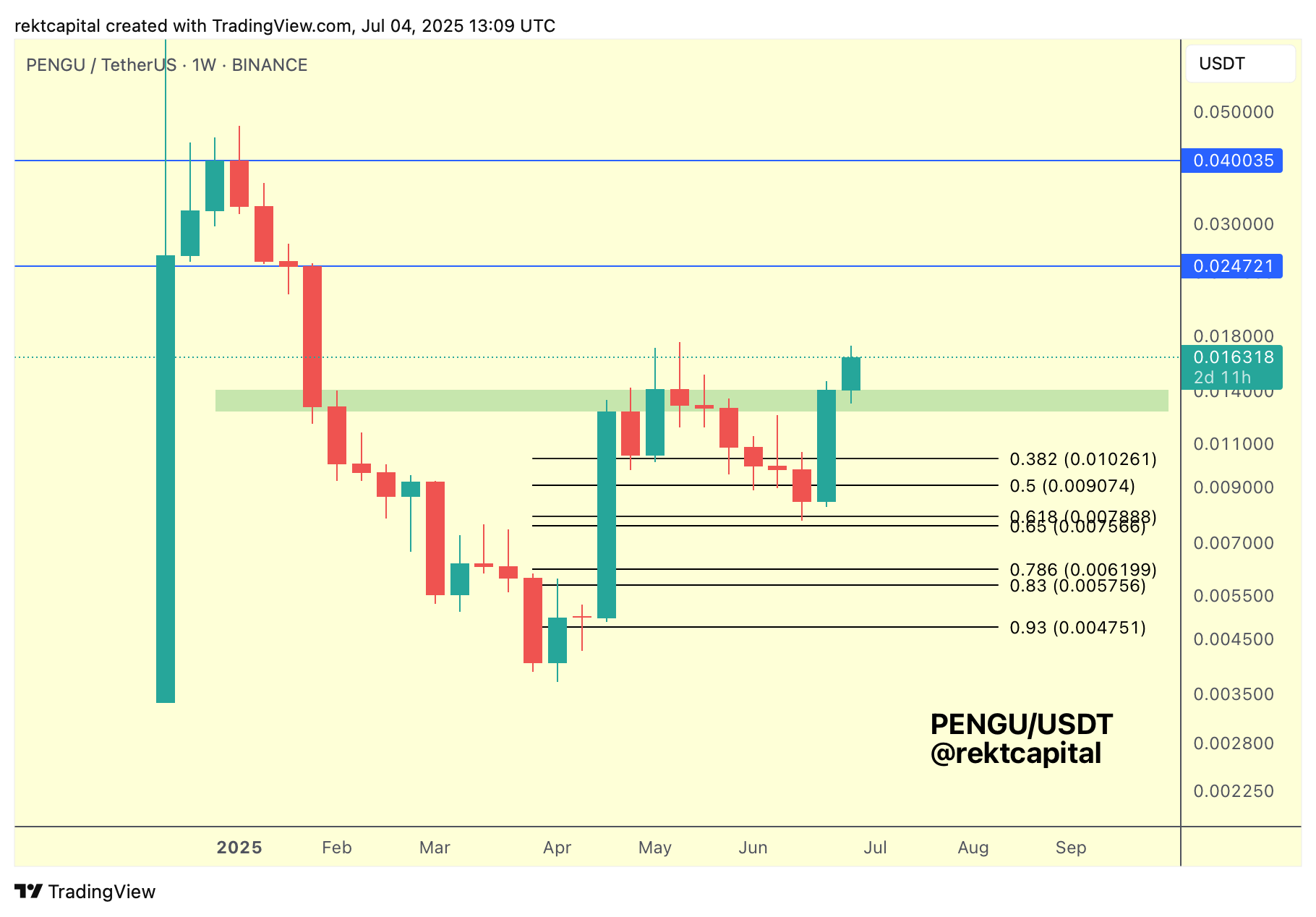

Because that was a Weekly resistance which needed to become a new support:

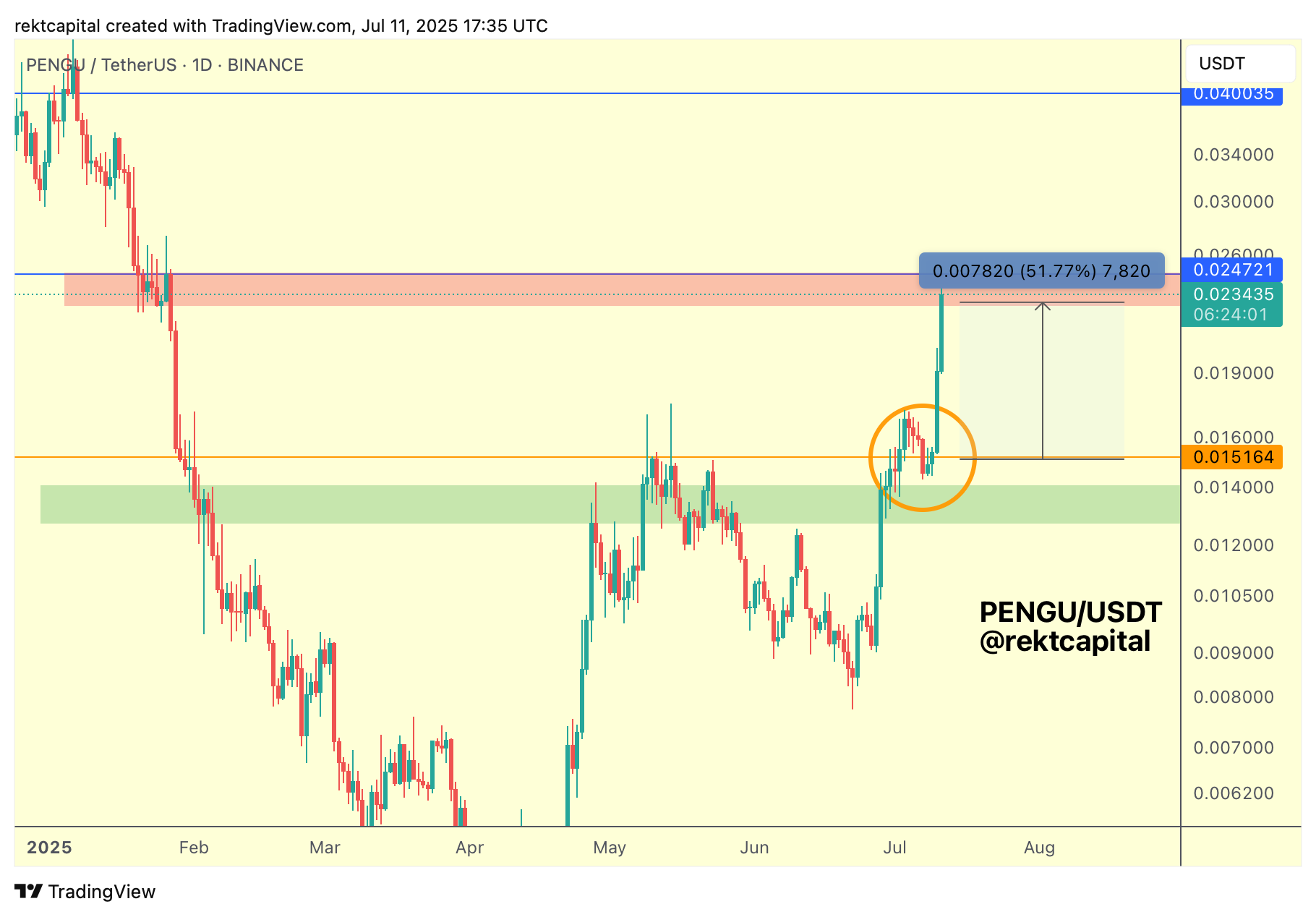

Here's today's update:

PENGU successfully retested that area and has since relied into a +51% uptrend across the entire Macro Range.

To try to rally higher, PENGU would need to Daily Close inside the red area, ideally even above the entire red box to position for a reclaim.

Such a turn of technical events would also enable a Weekly Close above the red region, which served as a key confirmation moment in late 2024 to get PENGU to revisit the blue $0.04 resistance above.