Altcoin Newsletter #232

Features TAO RSR PENGU SPX VIRTUAL

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Bittensor (TAO)

- Reserve Rights (RSR)

- Pudgy Penguins (PENGU)

- SPX6900 (SPX)

- Virtuals Protocol (VIRTUAL)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

Bittensor - TAO/USDT

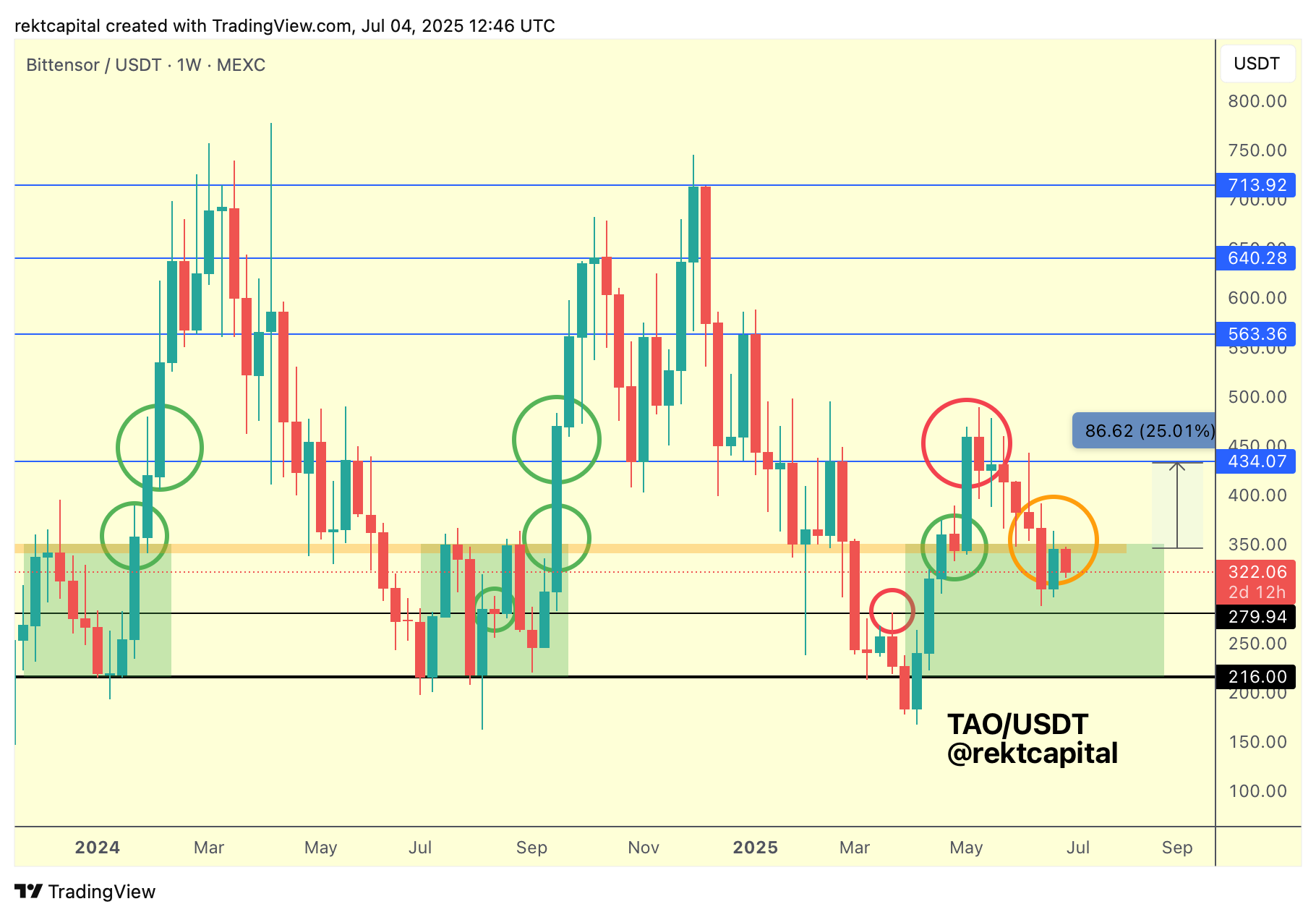

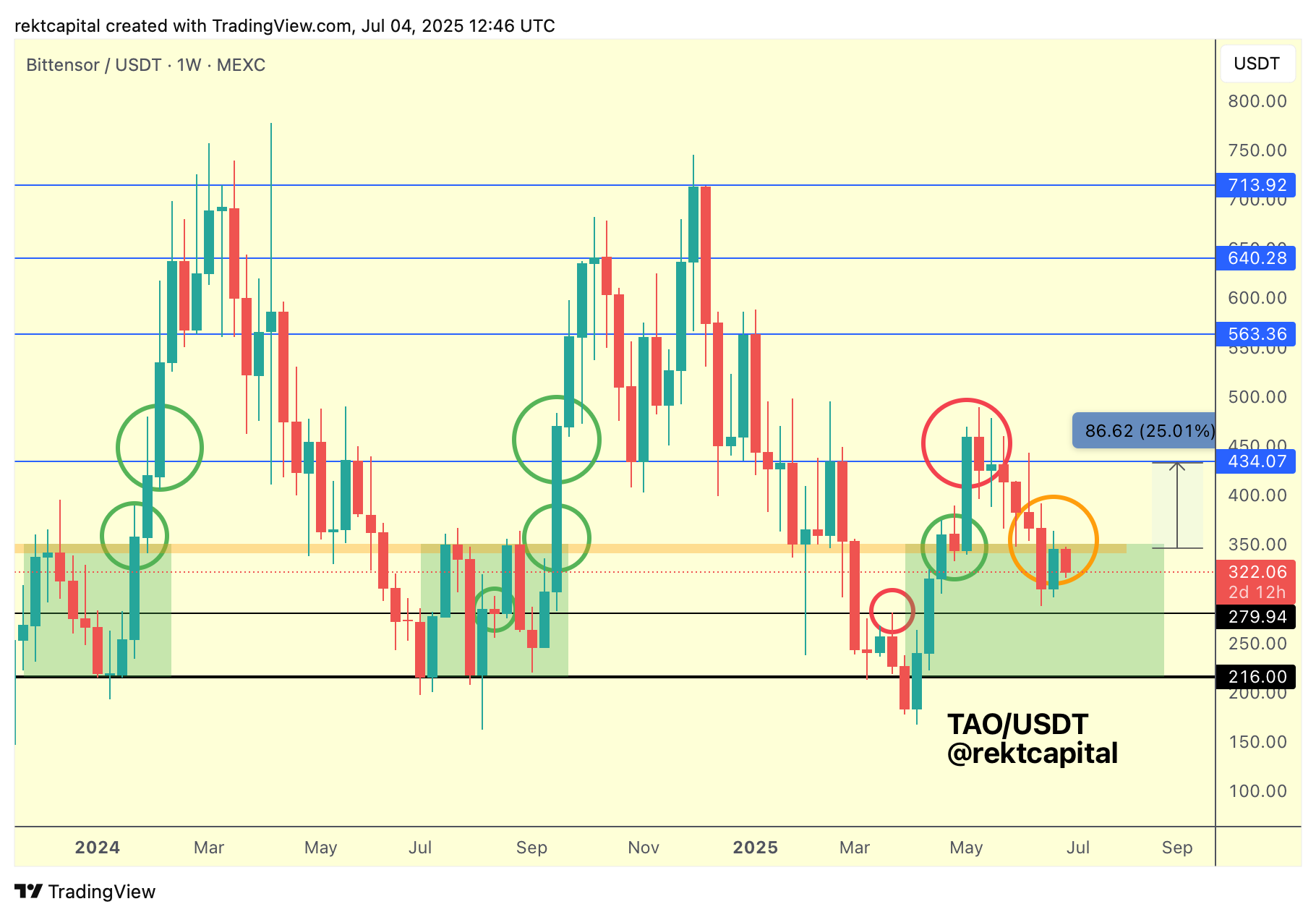

The multi-week Downtrend continues for Bittensor, to the point where price has Weekly Closed below the orange reversal zone and is showcasing signs of turning it into new resistance.

Of course, initial rejecting has taken place beneath the orange boxed area, however there hasn't been any strong downside continuation stemming from this technical development; and with many downside deviations occurring in recent weeks, it's key to keep this as a potential scenario in mind here as well.

For TAO to be experiencing a downside deviation, the validation for this sort of scenario is simple:

TAO would simply need to Daily Close above the top of the orange area to begin the reclaim process and would need to retest this region back into support going forward.

Generally, this has been the recipe for success for TAO holding the orange area as support - and this hasn't just been the recipe in late April 2025.

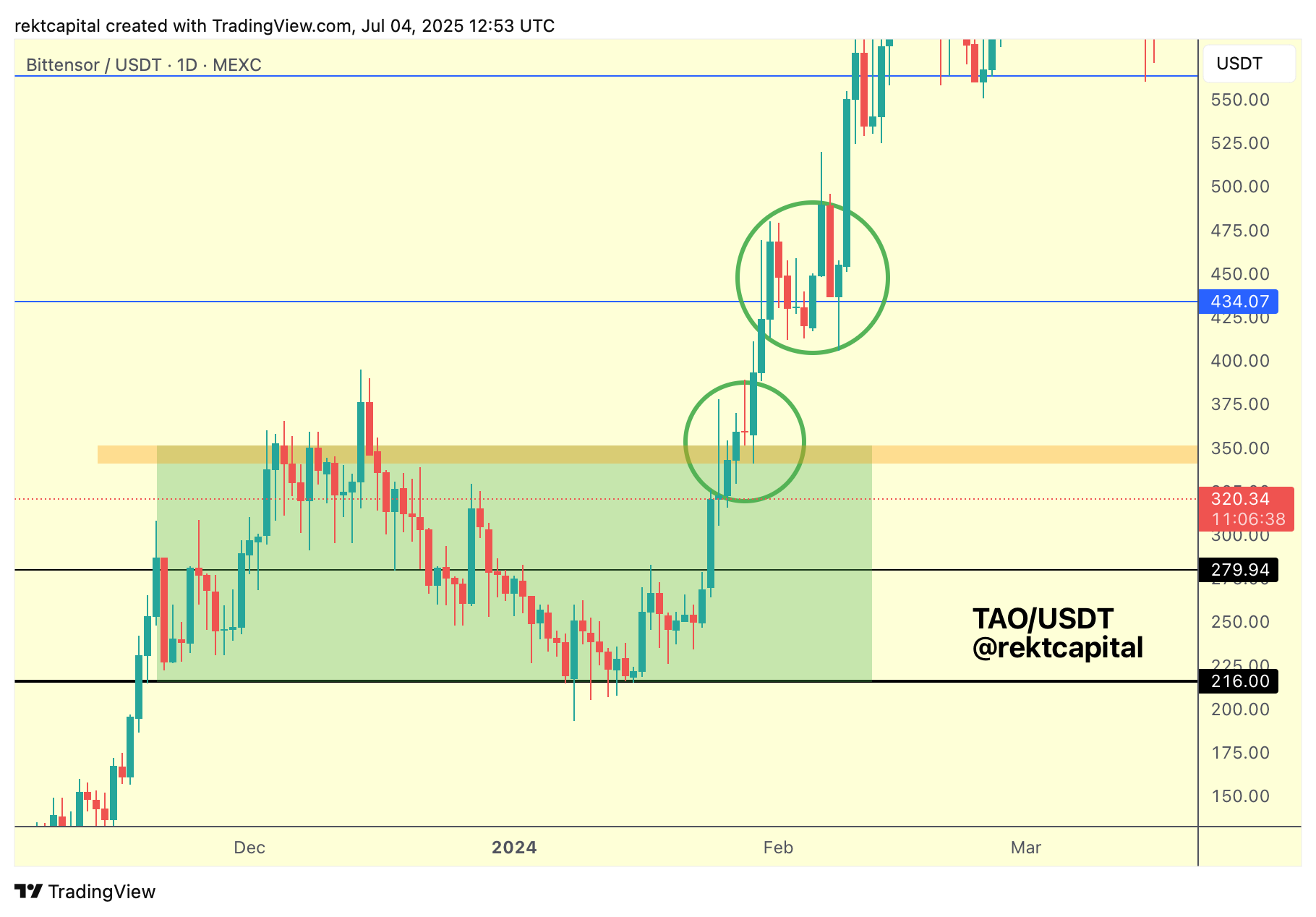

This sort of Daily Close and reclaim combination occurred to great effect also in early 2024:

So it's clear what Daily timeframe price moves TAO would need to make in order to confirm that this period is in fact a downside deviation and that price is ready to challenge for higher levels.

However, in the event that this confirmation is lacking, it's worth understanding TAO's positioning on the Weekly and then Monthly timeframe:

On the Weekly, failing to Daily Close above the orange area to reclaim said region as support could indeed mean that this region will act as a rejection to force price lower into the historical trend-basing zone (green); where historical trends have built and emerged from.

The Monthly timeframe better hones in on a major historical demand area within this Weekly zone:

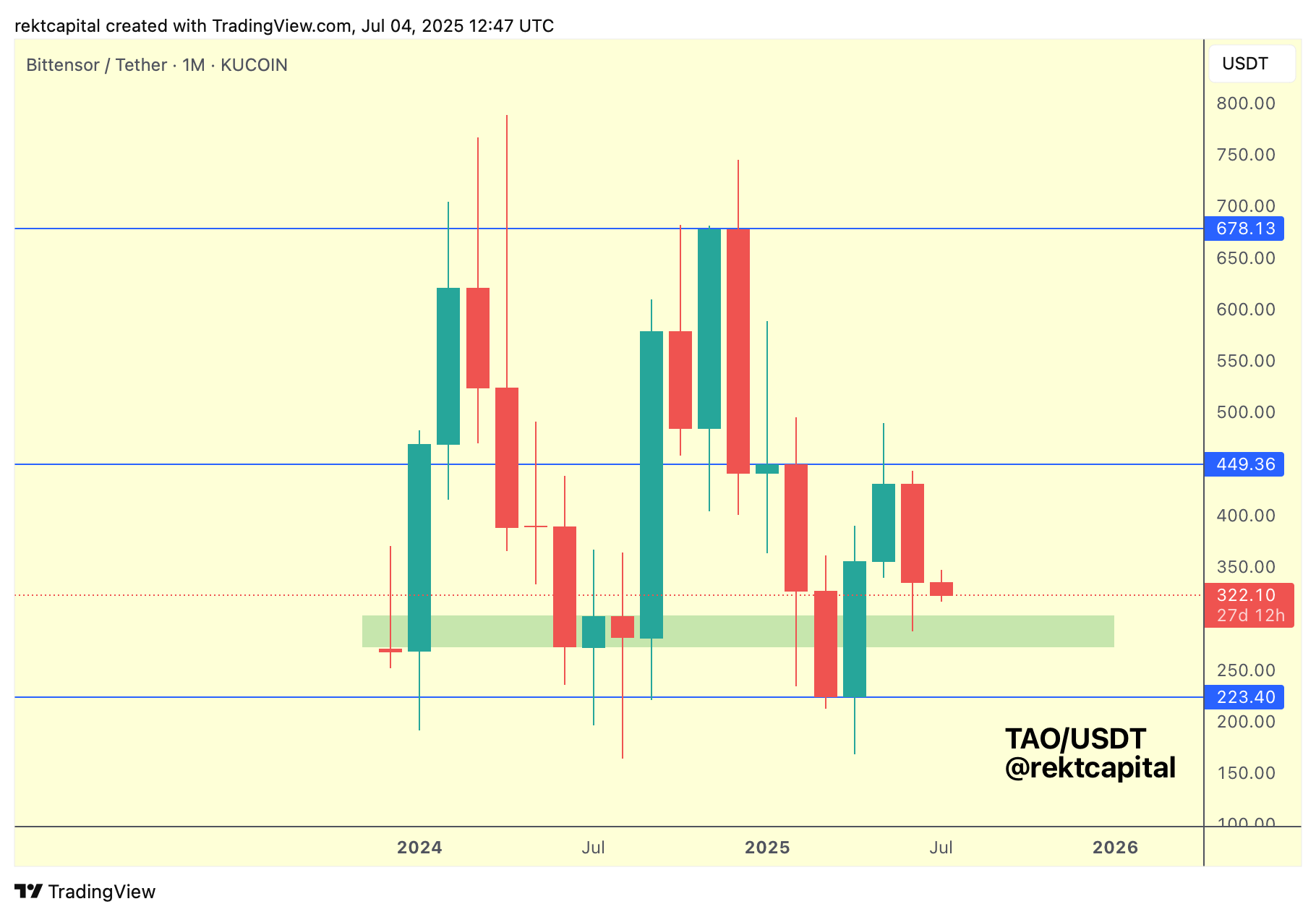

If we conceptualise TAO's price action on the Monthly timeframe as a Monthly Range, with the blue Range Low representing $223, the Range High being $678 and the Mid-Range being $449...

Then we'll realise that the Mid-Range has rejected price to the point where it is nearing a historical demand area (green) on the Monthly timeframe.

TAO has downside wicked into this area last month already but there's still scope for additional retesting if Daily bullish confirmation is left wanting.

More, retests of the green area have in general been volatile, with price producing downside wicks below it as part of the retesting process.

In fact throughout time, TAO has had a tendency to downside wick (mid-July 2024) or downside deviate (early 2025) into the $223 Range Low as part of a general volatile retest of the green area.

Failing Daily confirmation, the green region will likely get retested again in volatile fashion, with scope for downside wicking even down to the blue $223 level if the market suffers an extreme period of volatility.