Altcoin Newsletter #230

Features AERO SUI ALGO ONDO DEEP NEAR

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Aerodrome Finance (AERO)

- Sui (SUI)

- Algorand (ALGO)

- Ondo (ONDO)

- DeepBook (DEEP)

- Near Protocol (NEAR)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

Aerodrome Finance - AERO/USDT

Late this past May, we spoke about how AERO and its scenarios:

And this past Wednesday, we updated AERO's price action showcasing how price had followed through completely on its blue pathway and how price had also started to embark on the green path as well:

Now here's today's update:

AERO has successfully completed both blue and green pathways, rallying +79% in total since rebounding from the all-critical green historical demand area, and rallying +34% via the green path this week.

Earlier this week, AERO downside wicked into the Range Low of $0.71 and upside wicked into the Range High of $0.96, emphasising typical range-bound behaviour here.

In the absence of a Weekly Close above the Range High, AERO will continue to maintain this range for additional consolidation.

In terms of a swing move, it's successfully come to fruition.

Of course, if AERO manages to Weekly Close above the blue Range High resistance, then trend continuation could continue.

But until price is positioned in a way that could enable such a Weekly Close, this Range High will figure as resistance and will continue to weigh down on price in a way that could promote further consolidation within the range, with price dropping as low as into the Range Low once again.

Sui - SUI/USDT

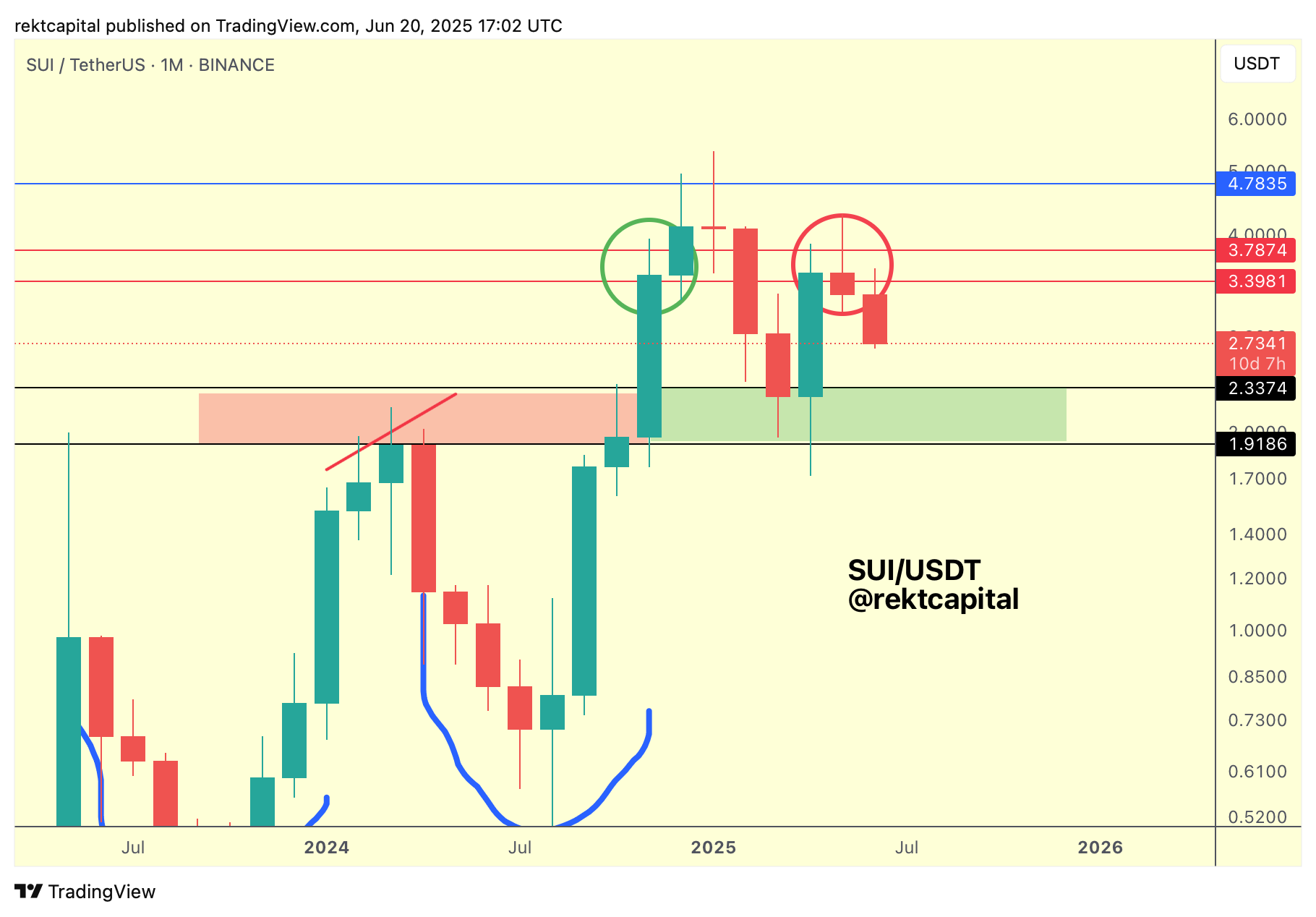

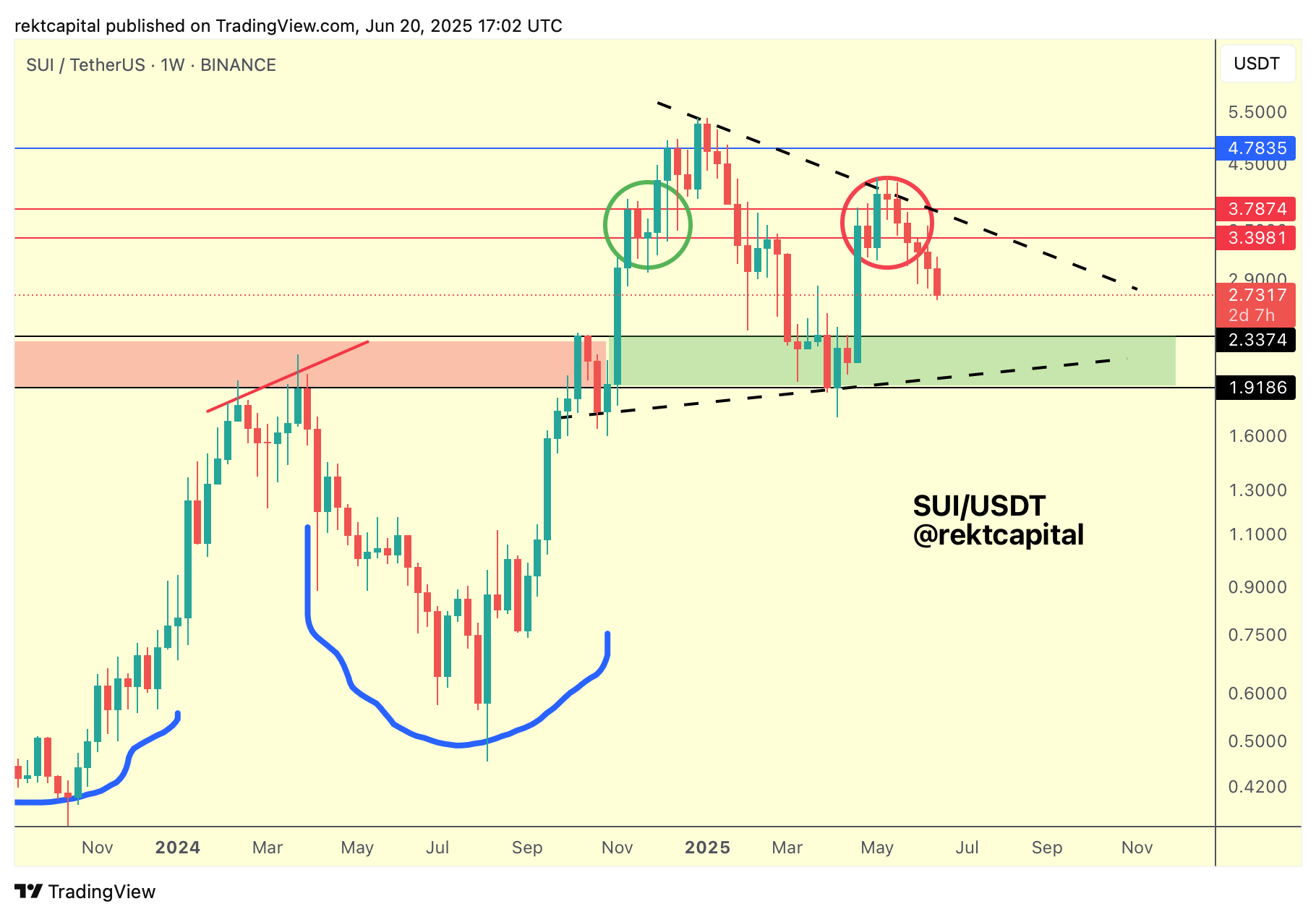

SUI had the chance to successfully reclaim its red-red ReAccumulation Range from late 2024.

After all, in late 2024 SUI Monthly Closed inside the red-red ReAccumulation Range, successfully retested its Range Low as support before rallying into new All Time Highs.

This past April, SUI once more Monthly Closed inside this red-red Range, setting itself up for a potential retest of the Range Low but instead price Monthly Closed below it, setting price up for a bearish breakdown.

Earlier this month, SUI upside wicked into the old Range Low to turn it into new resistance and price has rejected ever since.

If SUI can't curtail the downside from that confirmed bearish breakdown, then price could continue to drop into as low as the green region.

And if the downside continues, then SUI will have solidified a new Macro Lower High.

In which case it would be important for price to solidify a Macro Higher Low around the green region down below:

The dashed black diagonals represent these Macro Lower Highs and potential Macro Higher Lows to bring about a triangular market structure within which SUI might build a home for the foreseeable weeks ahead.

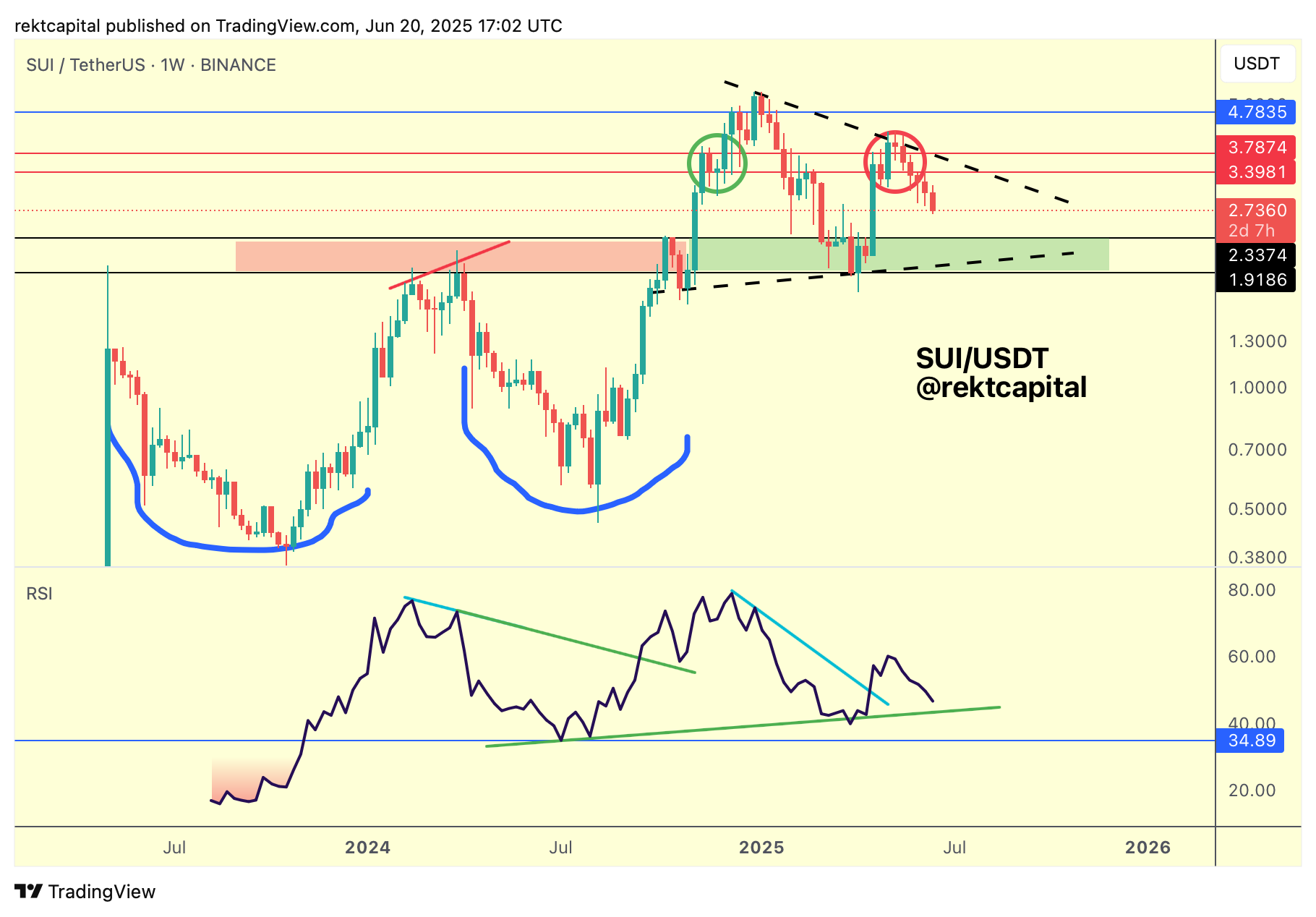

More, it will be interesting to see how price develops in the context of its Weekly RSI as well:

A few weeks ago, the Weekly RSI broke its multi-month Downtrend (light blue) to enter a multi-week uptrending phase.

But on this pullback, the RSI is heading closer towards the Macro Higher Low on the RSI (green) which has figured as a key support since mid-2024, so almost a year now.

A successful retest at the RSI trend line in conjunction with a possible retest of the green region of the price action would offer confluence for a local bottom for SUI.