Altcoin Newsletter #229

Features HBAR APT FARTCOIN AVAX DOT FIL MOODENG

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Hedera Hashgraph (HBAR)

- Aptos (APT)

- Fartcoin (FARTCOIN)

- Avalanche (AVAX)

- Polkadot (DOT)

- Filecoin (FIL)

- Moo Deng (MOODENG)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

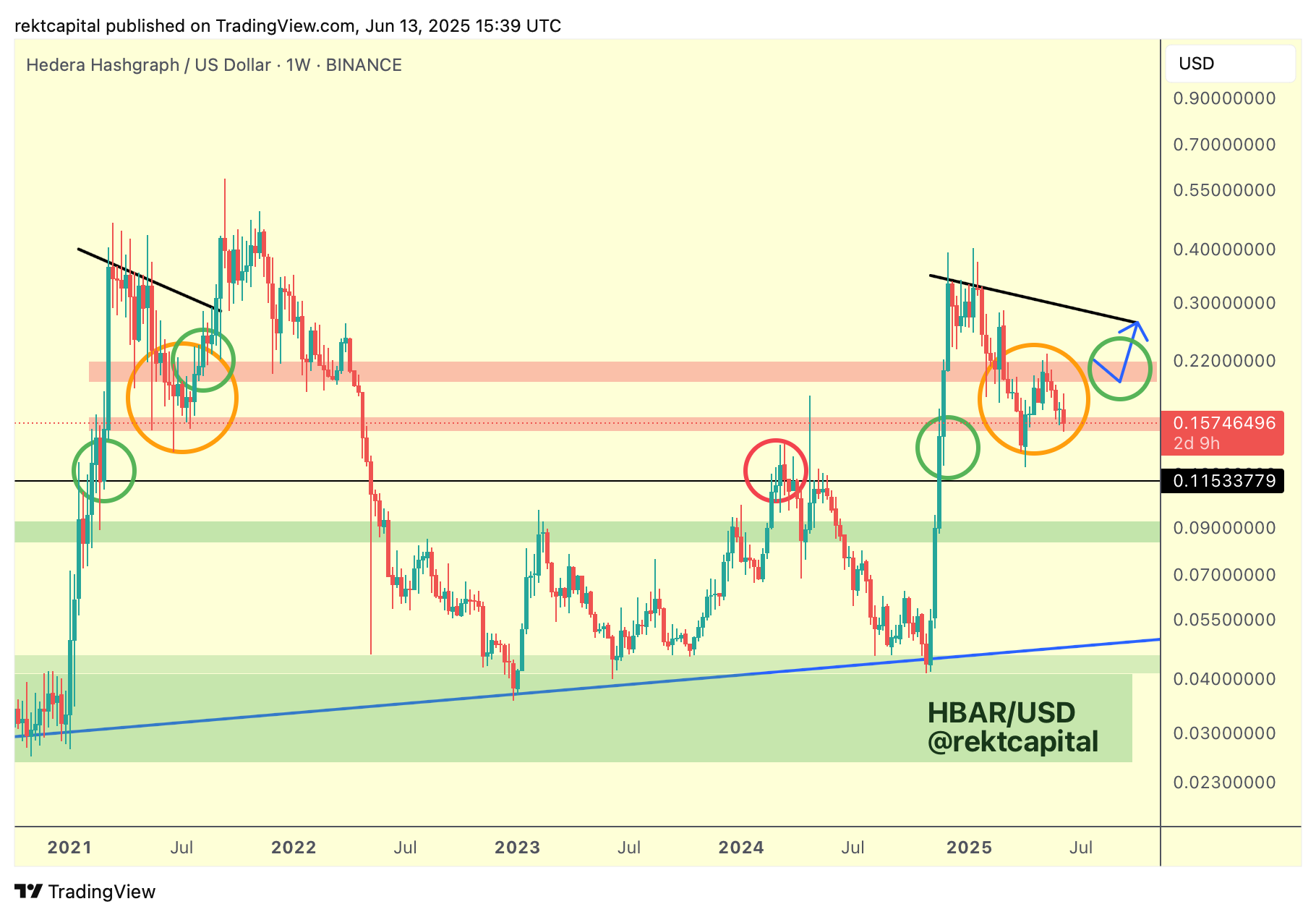

Hedera Hashgraph - HBAR/USD

HBAR has been following 2021 history very closely in this cycle, with some very small differences.

Right now, HBAR is in its orange circle, which effectively means that price is ranging between the two red order blocks.

In this cycle, the difference is that price downside deviated below the red support and has rejected on first attempt from the red resistance.

This is a little different to the 2021 cycle where HBAR built a base at the red support for multiple weeks and then broke the red resistance on the first time of asking.

Nonetheless, the macro predicament is the same, it's just that perhaps HBAR needs to consolidate between these two red order blocks a little longer than back in 2021.

For HBAR to breakout from here, it would need to repeat history with a Weekly Close and/or retest of the top red ressitance.

But until then, HBAR is going for another retest of the red Range Low and successful retest is needed to continue the consolidation.

It would be bullish, for example, for HBAR to either hold this Range Low as support but if price needs to downside deviate below the red boxed support, then it would at least need to form a Higher Low in doing so.

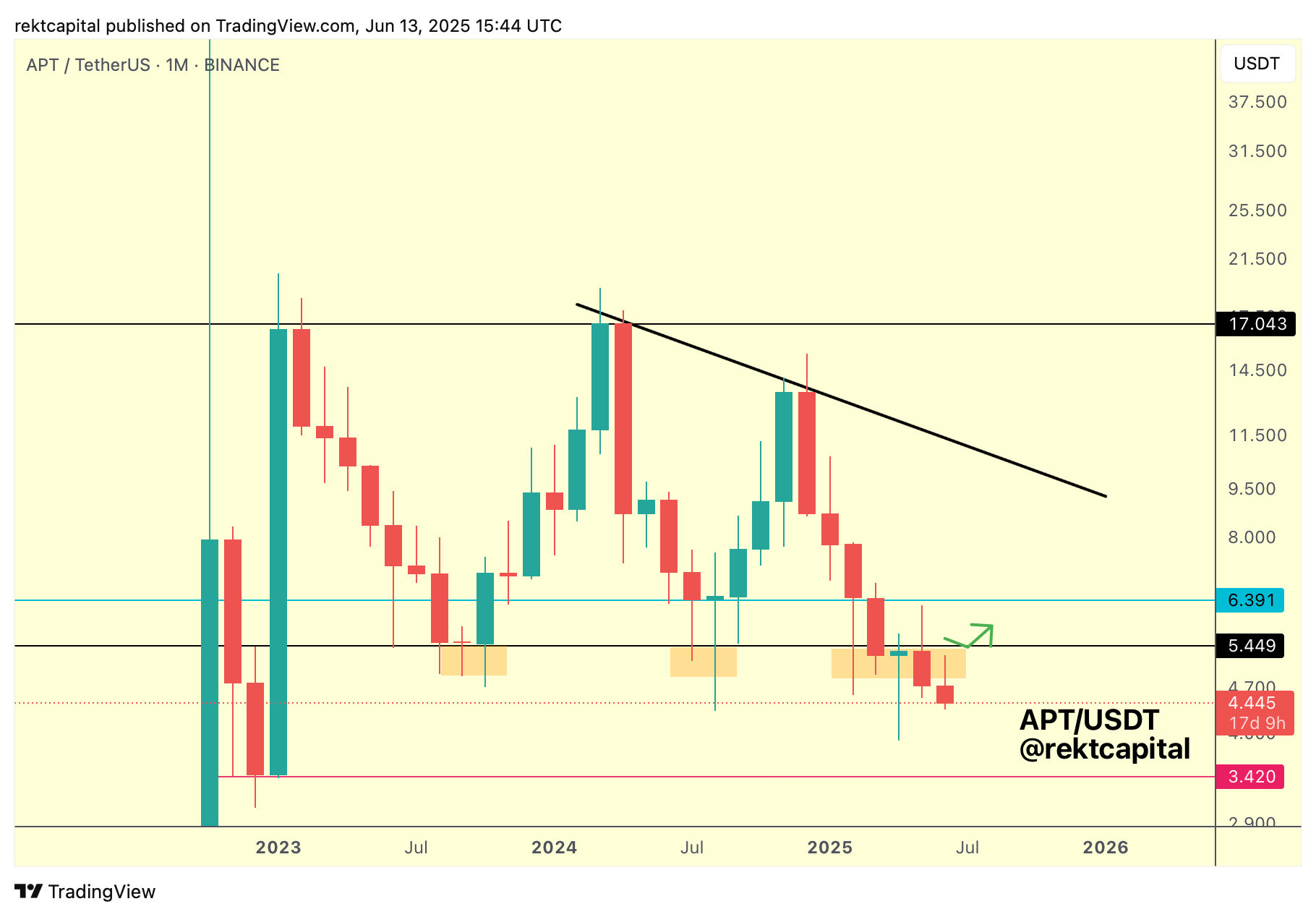

Aptos - APT/USDT

Still hovering below the Macro Range Low of $5.44.

In fact, APT Monthly Closed below the black Range Low a few months ago and has been upside wicking into said level for the past 2.5 months, turning it into resistance.

Aptos will need to break above and reclaim this level back into support to resynchronise with its Macro Range.

Let's take a look at the Weekly to understand more about APT:

Despite struggling to reclaim the Macro Range Low as support, APT continues to hold Higher Lows in its price action, relative to the early 2025 lows that is.

Meanwhile, the Weekly RSI has broken a key Downtrend (red) to enter a new technical RSI uptrend which should see the RSI reach the blue Diagonal above over time.

Historically, APT has seen extensive consolidation in its Weekly RSI around the orange boxed area but that extended consolidation has tended to precede upside for both the RSI and price.

The RSI is demonstrating emerging strength which price should trend-follow over time.

In the meantime, APT will need to not just Weekly Close above the black Macro Range Low, but also most importantly retest this price level into support.

APT has already seen two failed retests at the black level on the Weekly: third time a charm?

First, APT needs to protect the early April 2025 lows as support on the Weekly via a Higher Low or maybe even a Double Bottom; if a Double Bottom develops at those lows, it would make for a compelling case because the price action looks like a W-Shape in the making.

All about those early April 2025 lows now.