Altcoin Newsletter #227

Features S WIF SOL AERO WLD FARTCOIN VIRTUAL

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Sonic (S)

- dogwifhat (WIF)

- Solana (SOL)

- Aerodrome Finance (AERO)

- Worldcoin (WLD)

- Fartcoin (FARTCOIN)

- Virtuals Protocol (VIRTUAL)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

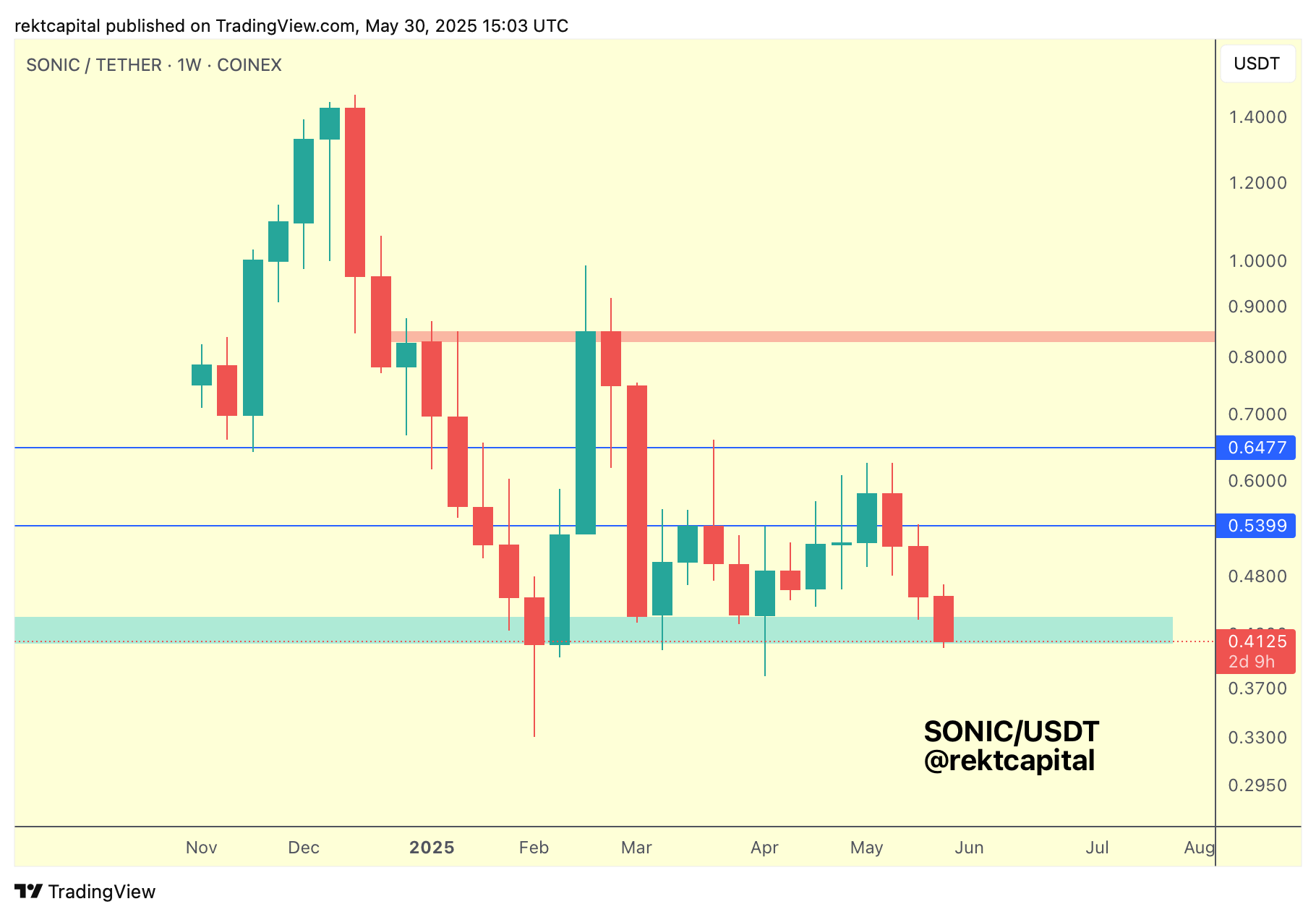

Sonic - S/USD

The absolutely most important thing for Sonic is price-strength confirmation at this light blue support area.

Continued Weekly Closing above this area is imperative for price to avoid facing additional downside into the sub-$0.40 region.

Downside wicking as part of a volatile retest here is permitted as long as price Weekly Closes above the light blue area altogether.

dogwifhat - WIF/USDT

WIF has enjoyed a fantastic rally ever since breaking the Macro Downtrend (black) however it has been rejecting from the green resistance over the past few weeks.

This green resistance has figured as a very strong support in the past so these recent rejections just show that price may not be ready to flip this region back into support.

If these rejections continue to take place, then price could even tumble to as long as the $0.76 Range Low for a retest; after all, WIF is inside the $0.76-$1.60 (black-green) range and so such price action would be part of normal price consolidation.

The main technical step that WIF will need to perform for bullish momentum is a Weekly Close above the green area; back in late February 2024 WIF performed this exact Weekly Close to turn the green area into new support to springboard price to impressive highs.

That's the key trigger WIF needs to perform but at the moment, it's not close to doing so and consolidation may be on the menu until proven otherwise.

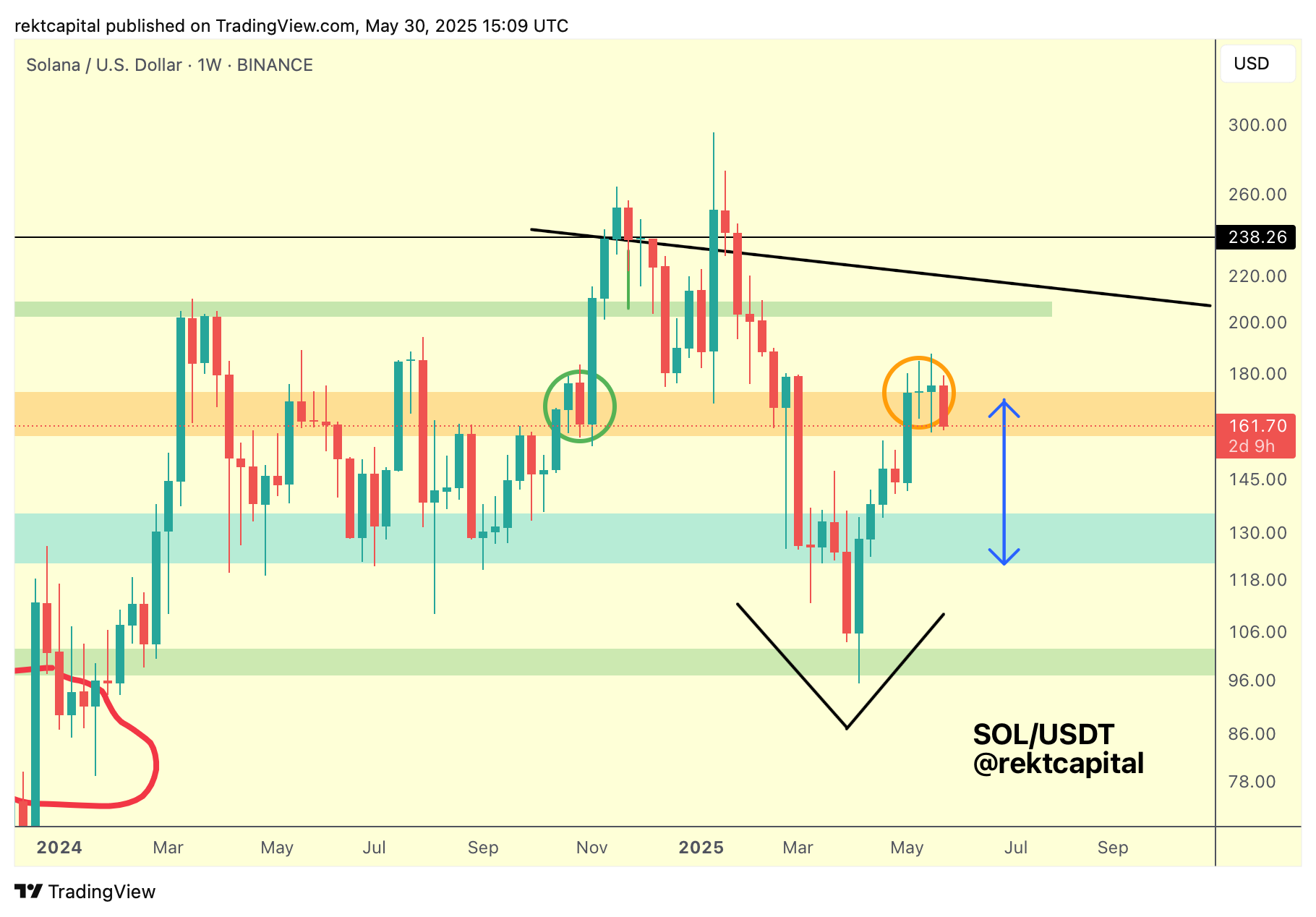

Solana - SOL/USDT

SOL finds itself back in its Post-Halving Range (light blue-orange), with price actually trying to continue Weekly Closing inside the orange Range High resistance.

SOL needs to continue demonstrating price stability at this Range High resistance as that is what is required for SOL to breakout from this range into the $200+ levels.

What SOL needs to aim for is that green circled retest from late 2024.

In recent weeks, SOL has been successfully retesting this orange area as support and the same is the case this week.

It's just important that SOL doesn't Weekly Close below the orange area to tease a possible loss of this region as support to resynchronise with the range and even drop into the Range Low (light blue) over time as a normal part of range-bound price behaviour; price stability at the orange Range High going forward is thus key here.