Altcoin Newsletter #226

Features LTC ARB TAO FARTCOIN VIRTUAL

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Litecoin (LTC)

- Arbitrum (ARB)

- Bittensor (TAO)

- Fartcoin (FARTCOIN)

- Virtuals Protocol (VIRTUAL)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

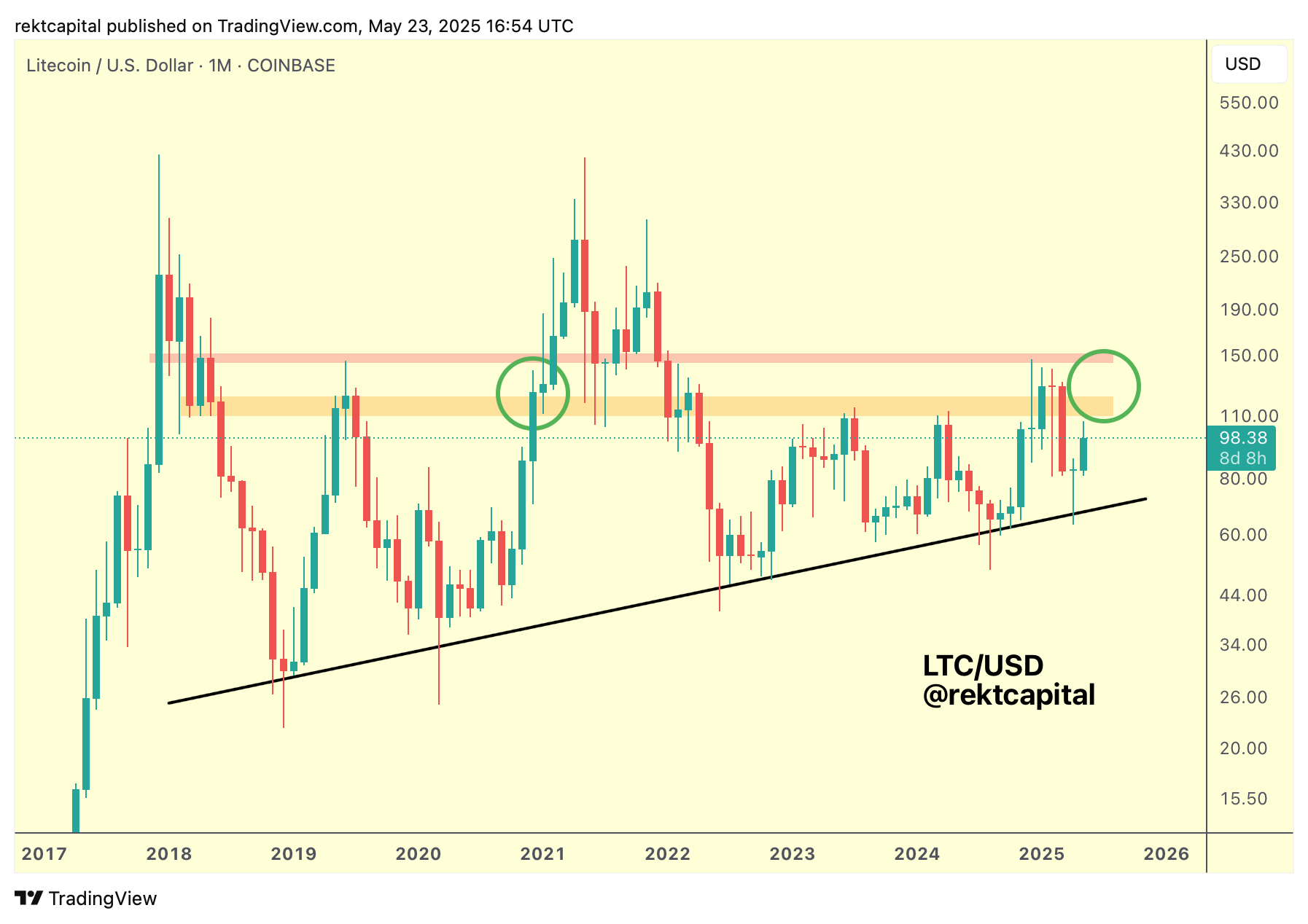

Litecoin - LTC/USD

Litecoin just needs a Monthly Close above the orange resistance followed by a successful retest to breakout beyond the red region of resistance into the $150+ levels.

When we think about the orange resistance, LTC spends most of its time below it and very little time comparatively beyond it.

If we look back to 2019, the rejections from the orange resistance have been getting progressively weaker across time to the point where only a couple of months ago LTC tried to retest this region as support.

Even though that retest was a failure in the end, it is a sign that this resistance is struggling to hold price down, which is why the next time price manages to break beyond the orange area, the chances of a successful retest are high.

But generally, it's clear that the orange resistance is weakening and the black Macro Higher Low of multiple years is in large part to thank for this.

So a Monthly Close above the orange resistance followed by a retest would enable the necessary strength to break beyond the red resistance to see price finally rally into the $150+ area for the first time since 2021.

Arbitrum - ARB/USDT

Arbitrum's price action structure is a little less clear compared to the clear pattern emerging on the Weekly RSI for ARB.

In fact, price action tends to top out for ARB near the top of the RSI channel.

However, the bottom of the RSI Channel is a little more complicated in timing price action bottoms.

Instead, the RSI Channel Bottom is serving as a powerful signal showcasing Higher Lows on the RSI while price action develops Lower Lows.

This brings about a Bullish Divergence for ARB.

So for this Bull Div to continue playing out, ARB needs to break back into this Macro Range (green-green):

The Range Low of the Macro Range happens to be the Binance Listing Price.

Generally, Listing Prices tend to be vital levels for price to mean revert towards.

A Weekly Close above the green area and/or post-breakout retest of it into new support would see price confirm a break back into the Macro Range.

However, the ascent across that Range won't be too easy:

Because there is a clear Macro Downtrend (red) that ARB will need to contend with if its wants to rally to the green Range High resistance.

And before even challenging the red Macro Downtrend, ARB would need to first reclaim the green Range Low and then Weekly Close above and/or retest the black horizontal to build a springboard towards the Macro Downtrend.

First thing's first - reclaiming the Macro Range Low (green).