Altcoin Newsletter #225

Features SUI SOL TIA DEEP FET XNO HBAR

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Sui (SUI)

- Solana (SOL)

- Celestia (TIA)

- DeepBook (DEEP)

- Fetch ai (FET)

- Nano (XNO)

- Hedera Hashgraph (HBAR)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

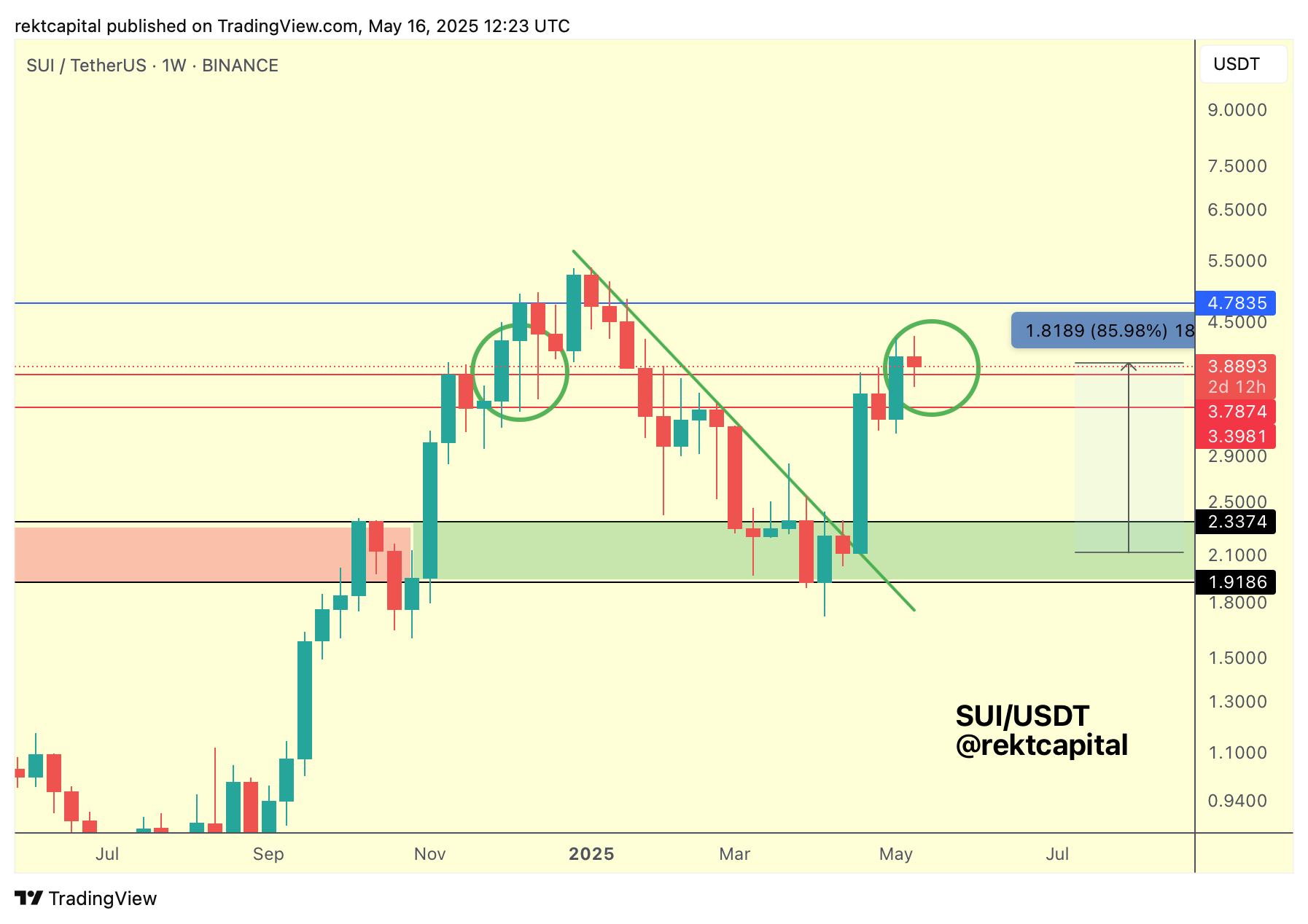

Sui - SUI/USDT

In late 2024, SUI built a Re-Accumulation Range between the $3.39-$3.78 (red-red).

Price consolidated there for a few weeks before Weekly Closing above the $3.78 Range High resistance, post-breakout retesting it as new support and confirming a breakout to new All Time Highs (most left green circle)

SUI has once again Weekly Closed above the $3.78 Range High resistance and is now positioning for a post-breakout retest in an effort to confirm a breakout and repeat late 2024 history.

The retest is in progress and history suggests it could even be a volatile one to produce a downside wick into even as low as the Re-Accumulation Range Low itself ($3.39).

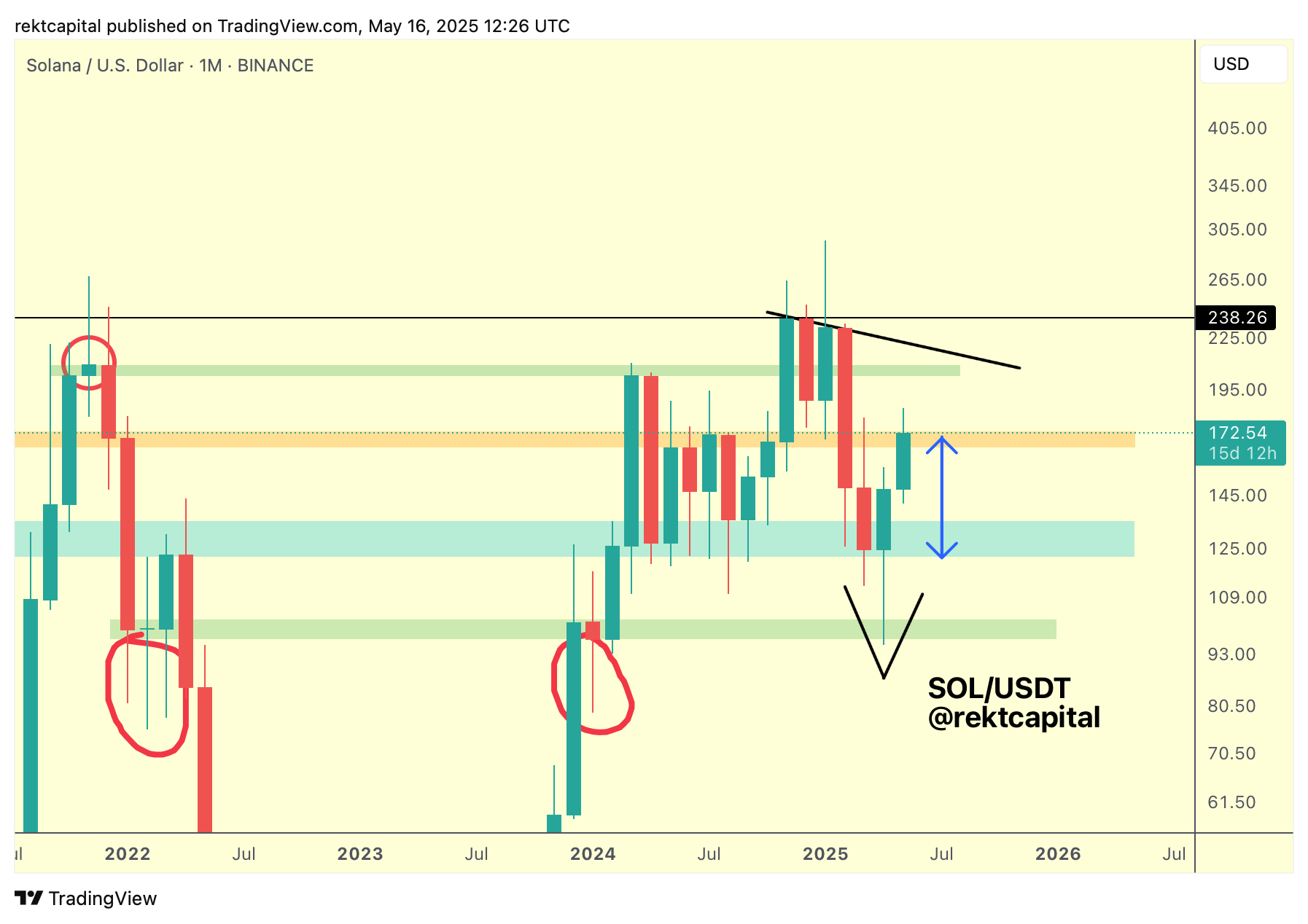

Solana - SOL/USDT

On the Monthly timeframe, it's clear Solana has broken back into its Post-Halving Re-Accumulation Range (light blue Range Low, orange Range High).

And in the most recent couple of months, SOL has successfully retested the light blue Range Low as support, spring boarding price to revisit the orange Range Highs.

Solana needs to break this Range High resistance to confirm a breakout and exit the Range.

But to exit the Range, SOL would need to confirm the Range High as new support.

Let's take a look at the Weekly timeframe:

SOL has Weekly Closed inside the orange Range High resistance area.

This isn't a bad Weekly Close although a Weekly Close above the orange Range High would've been better as that would've directly positioned SOL for a post-breakout retest.

However, perhaps SOL's current Weekly Candle will be able to compensate and turn the Range High into new support.

At the moment, SOL is doing just that but a Weekly Close above the Range High is needed to confirm that retest.

Granted, the green circle retest even shows that as long as SOL builds a base at the orange Range High resistance box, then there's a good chance for price breaking out.

SOL simply needs stability here at the Range High resistance as that would telegraph that this is an area that is becoming support.

Price needs to hold here if it wants to challenge the green area above for a reclaim of its own, but that's a story for another day.