Altcoin Newsletter #223

Features ETH TIA RENDER RIO FIL VET

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Ethereum (ETH)

- Celestia (TIA)

- Render Token (RENDER)

- Realio Network (RIO)

- Filecoin (FIL)

- VeChain (VET)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

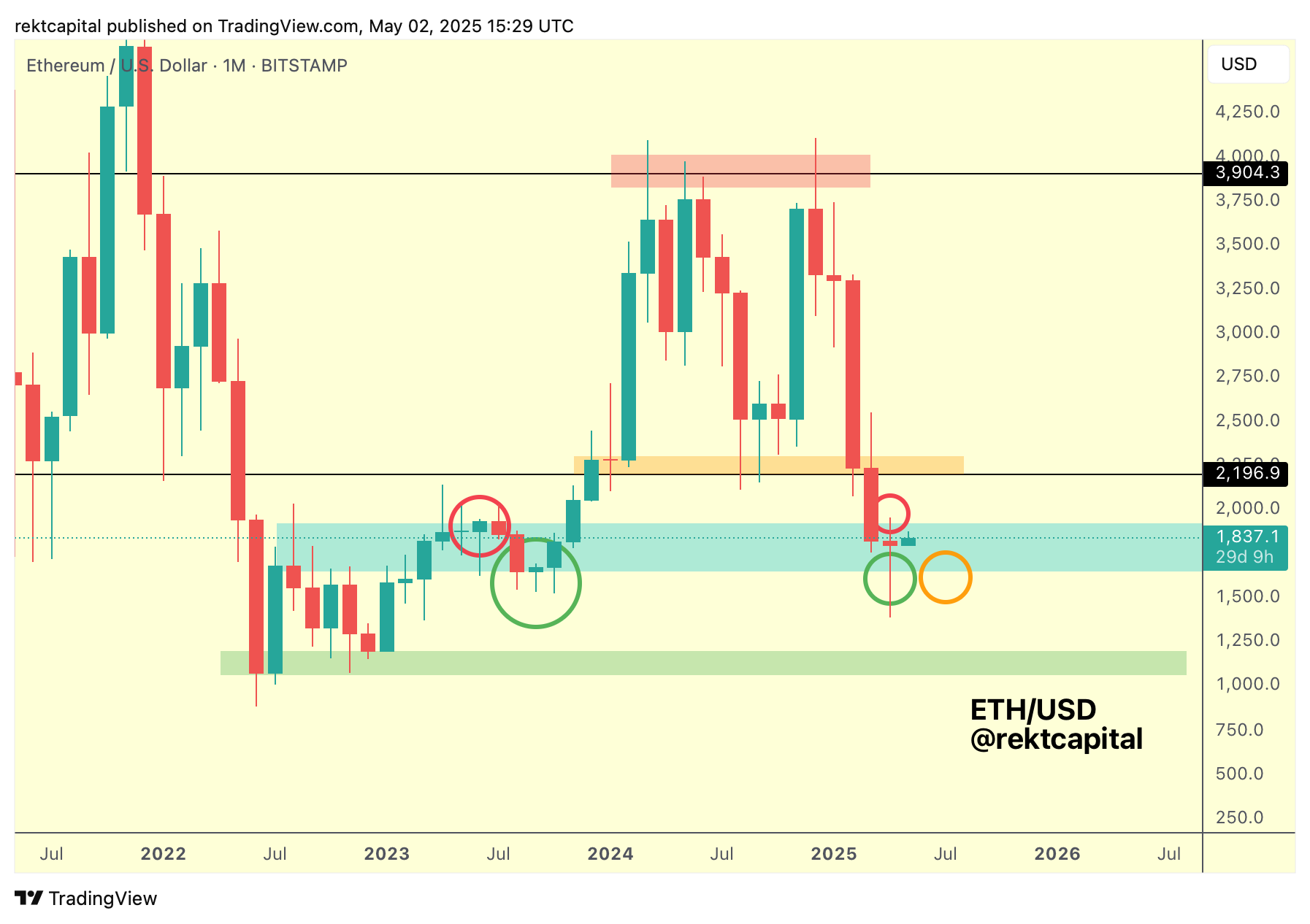

Ethereum - ETH/USD

Ethereum is simply moving sideways within a historical sideways environment (light blue area).

Throughout 2023, ETH would reject from the top of the light blue demand area (red circle) and then rebound from the bottom of the light blue demand area (green circle).

Throughout 2023, ETH would take 4 months to reject from the top of the light blue area and then take 3 months to rebound from the bottom of said area.

What we're seeing in this cycle appears to be a little accelerated by standards of 2023, whereby price has rebounded from the bottom of the light blue area and rejected from its top all within one month; more resembling that mid-2023 Monthly Candle where price did the same.

Overall, ETH needs to hold this light blue area of historical liquidity as support as holding here is a prerequisite to Ethereum reclaiming the $2200-$4000 black-black Macro Range over time.

ETH would need to Monthly Close above the light blue area top to kickstart the breakout and return attempt back into the black-black Macro Range.

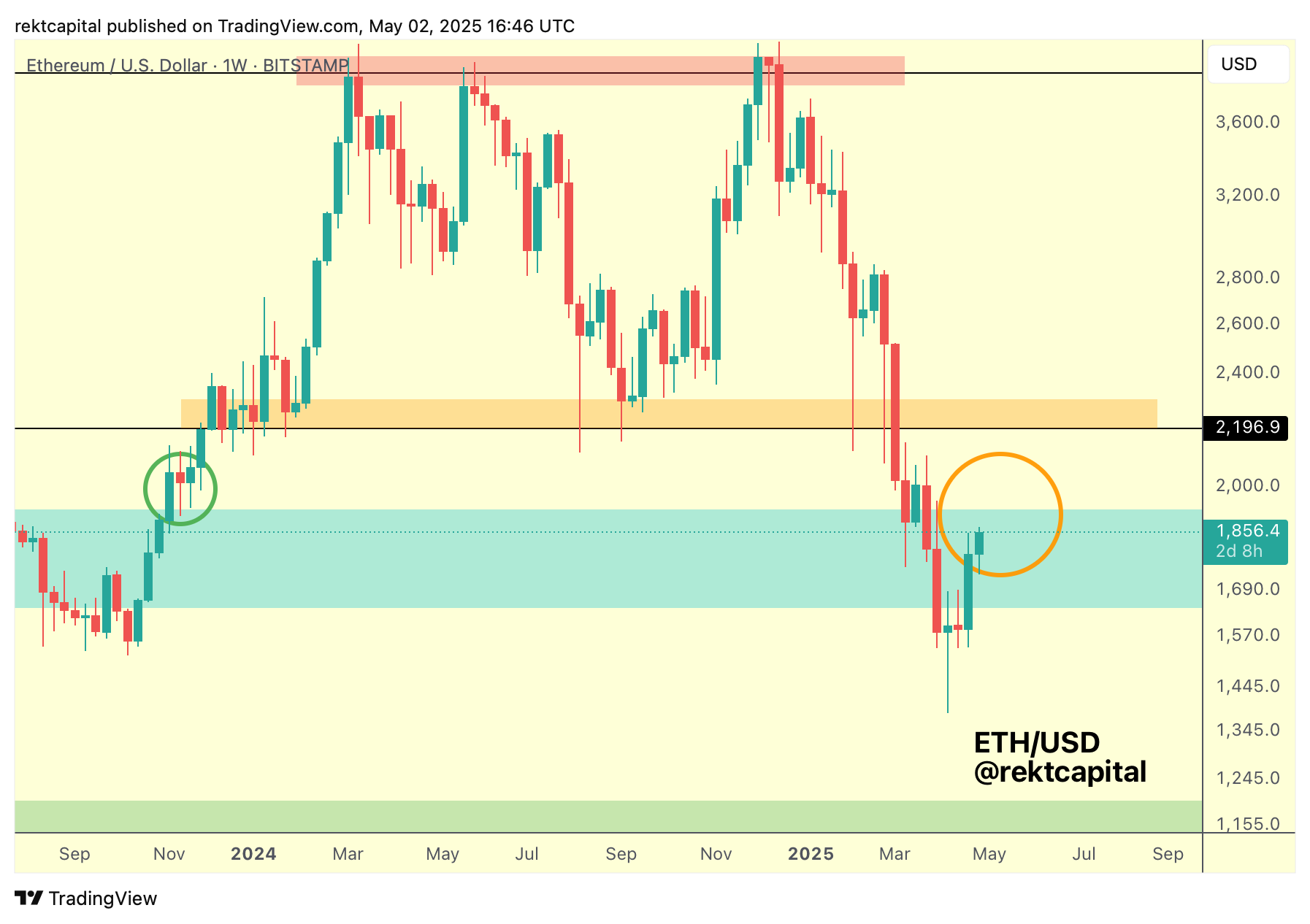

In fact, ETH could even produce a Weekly Close above the light blue area top and retest it into new support to confirm a breakout from this general region:

That was indeed the late 2023 breakout confirmation that ETH offered (green circle).

So it isn't necessarily the Monthly Close that is required but the Weekly Close and successful post-breakout retest to confirm a breakout from this historical demand area.

ETH will consolidate within this light blue area for as long as it needs to until it is finally ready to confirm a major trend shift.

And if ETH continues rallying like this, perhaps that Weekly confirmation will be worth observing sooner than we think.

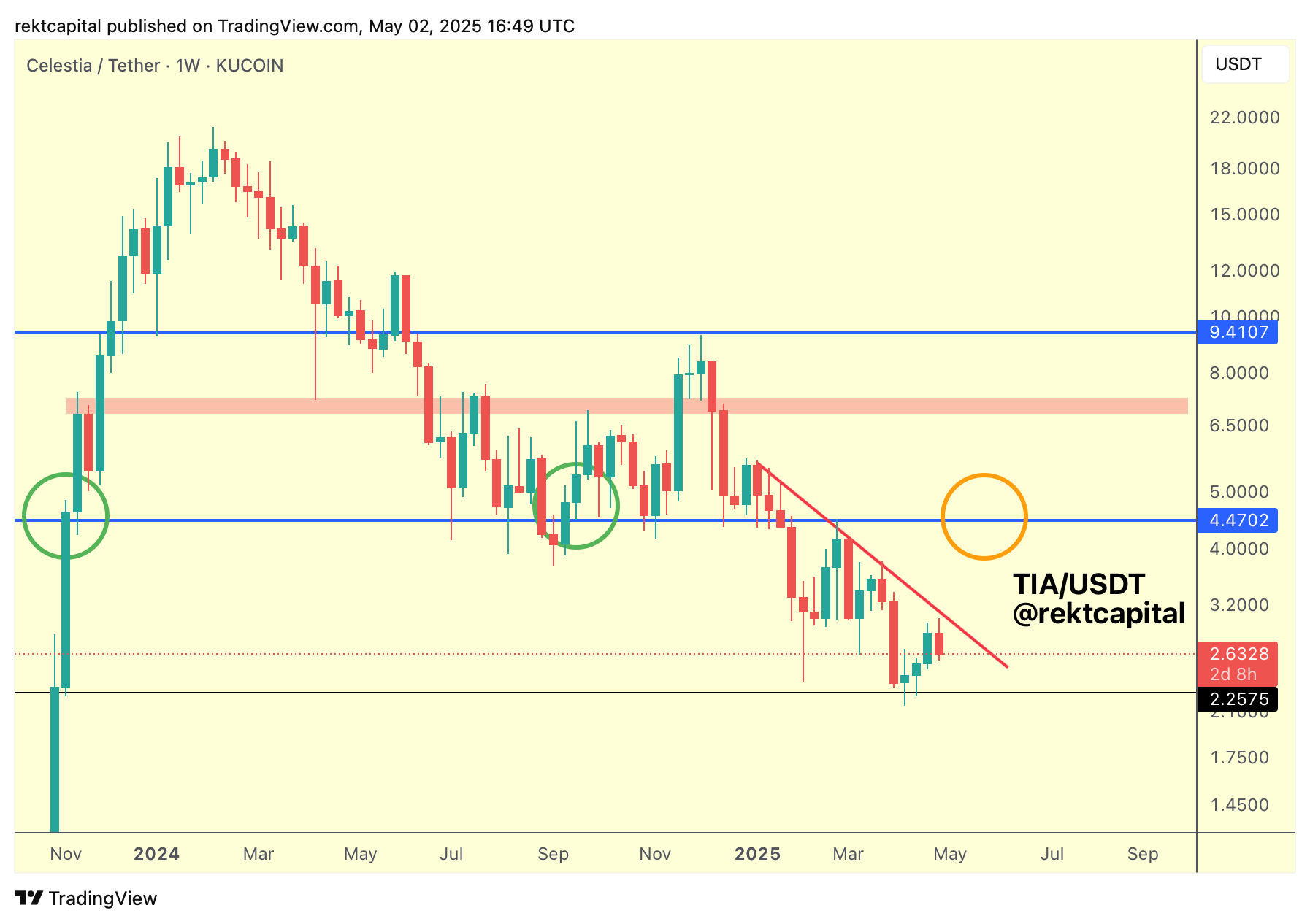

Celestia - TIA/USDT

Technically, TIA's prerogative is to try to break back into the blue-blue Macro Range from $4.47-$9.41.

But for TIA to do that, it first needs to do two things:

- Firstly, it needs to continue holding the black $2.25 level as support, which it has managed to do so successfully in recent weeks preceding the current run-up

- And secondly, TIA needs to break its 2025 Downtrend (red).

Breaking the Downtrend should enable TIA to transition into a technical uptrend with the goal of finally Weekly Closing back above the blue $4.47 level and retesting it into support like on previous occasions (green circle) to confirm a return back into the blue-blue Macro Range.

Going forward, it will be worth observing the Weekly RSI predicament for signs of emerging strength:

The Weekly RSI is compressing within a triangular market structure.

This is important because TIA's price action doesn't share this structure.

So should TIA, for example, see a breakout on the RSI from its pattern, then that would be a sign of emerging strength that price could enjoy a bullish move of its own.

But we're already seeing an early-stage sign on strength on the RSI: it lays within the Lowers Lows on the RSI.

Specifically, the Lowers Lows that form the triangle on the RSI are much less sharp than the Lower Lows on the price action:

That is, the Lower Lows on the price action at at a 23-degree angle whereas the RSI Lower Lows are at a ~2.5-degree angle.

This is effectively a divergence, which is showing a subtle shifting in where price will want to go in the future.

And that price action Lower Low completes the perspective to demonstrate that TIA is developing a Downtrending Channel overall.

Price will dwindle inside this Downtrending Channel until the RSI breaks out to indicate that price may be willing to trend-follow with a trend shift of its own.