Altcoin Newsletter #219

Features LINK HBAR TEL XRP TIA RSR

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Chainlink (LINK)

- Hedera Hashgraph (HBAR)

- Telcoin (TEL)

- Ripple (XRP)

- Celestia (TIA)

- Reserve Rights (RSR)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

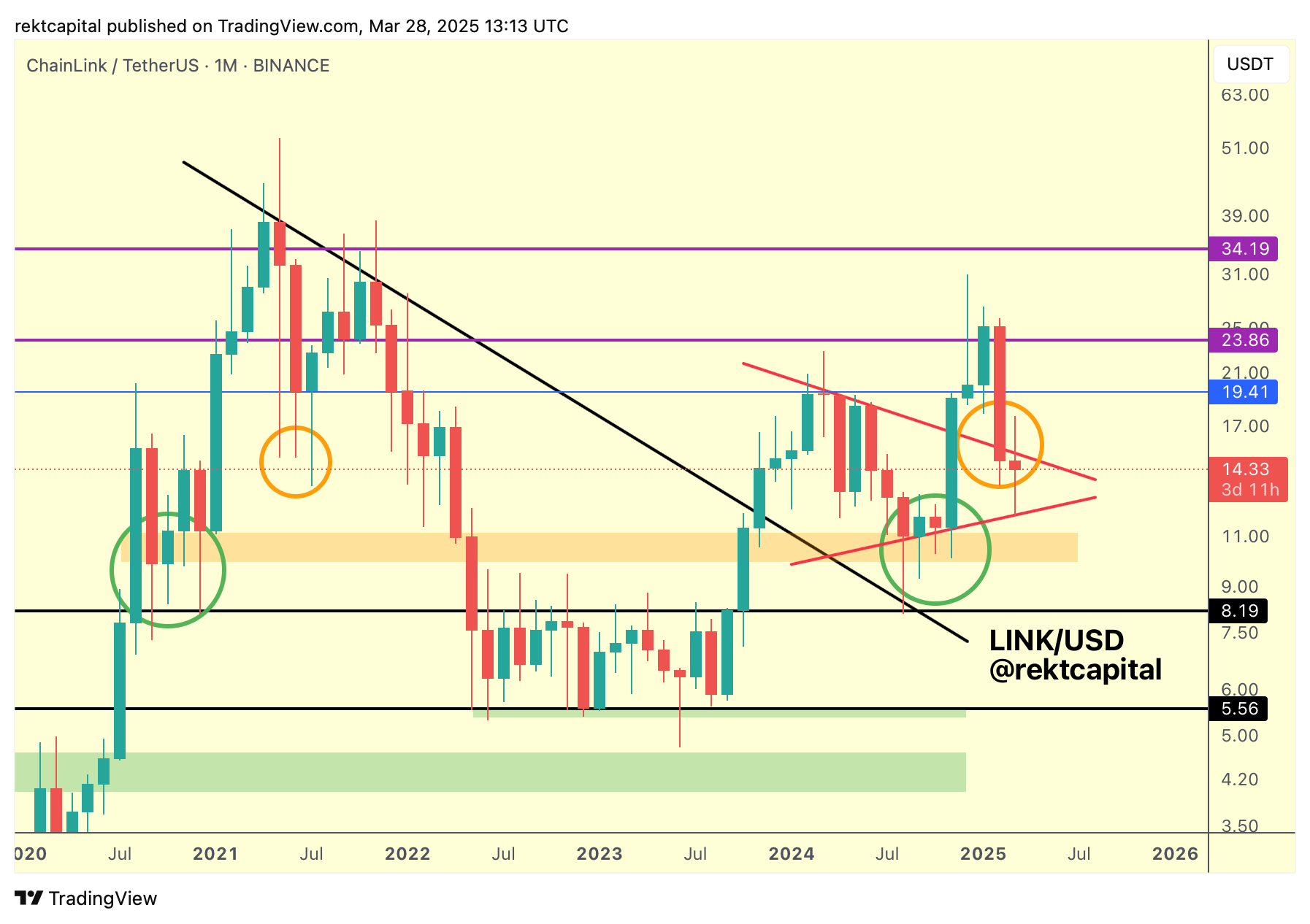

Chainlink - LINK/USDT

For most of 2024, Chainlink was consolidating inside a Macro Triangular market structure (red) before finally breaking out a few months ago into the $25+ level.

Since reaching that price point however, LINK has been in a downtrend which has seen price drop back into the Macro Triangle; price retested the Higher Low of this pattern successfully but the main goal for LINK here is to retest the top of the pattern to secure a successful post-breakout retest.

It's possible this is a volatile post-breakout retest - and in fact, historically LINK tends to produce downside deviations into this general price action (orange circles).

After all, back in mid-2021, LINK produced a downside deviation into this price area in the form of multiple Monthly downside wicks.

This time, LINK is downside deviating once again but in the form of actual candle-bodied closes rather than downside wicks.

Still, on this downside deviation LINK is in a historical demand area (green):

So just like in mid-2021, right now LINK is in the process of retesting this general region as new support (green).

LINK needs to successfully continue to hold this area as support to position itself for upside going forward.

More importantly, this retest of the green area as support is essential to position LINK for a successful retest of the top of its triangular market structure (red):

In other words, that green demand area needs to continue to hold to set LINK up for a potential reclaim of the top of the triangle to exact a successful post-breakout retest and enable price to follow through on the green path over time.

Can LINK Monthly Close above the triangle top later this month?

Doing so would position price for a successful retest, despite the downside deviation.

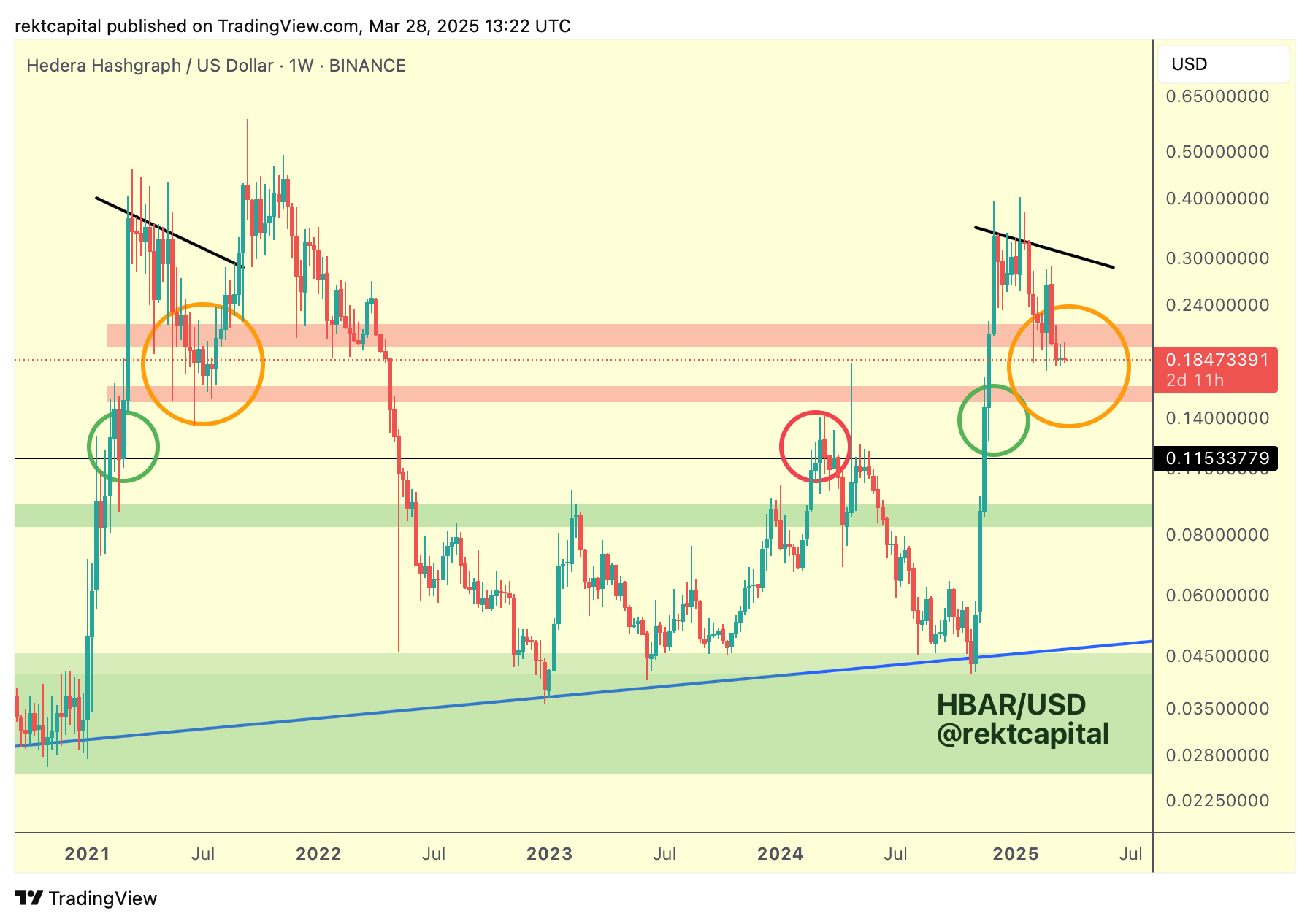

Hedera Hashgraph - HBAR/USDT

Since early February, I'd been discussing how history was looking very likely to repeat for HBAR in the form of additional downside:

And here's today's update:

Slowly but surely, HBAR is getting closer into that orange circled area.

In fact, almost three weeks ago, HBAR Weekly Closed below the red region and for the past two weeks price has been showcasing signs of turning the bottom of this red area into new resistance, setting up for a potential bearish retest.

To activate this bearish retest, trend continuation to the downside is needed; at the moment, that downside isn't occurring and it won't occur if price is able to Weekly Close inside the red region and reclaim the bottom of the red area as support.

However, history is suggesting that price is likely to revisit the red boxed area down below and thus far, history has played out perfectly.

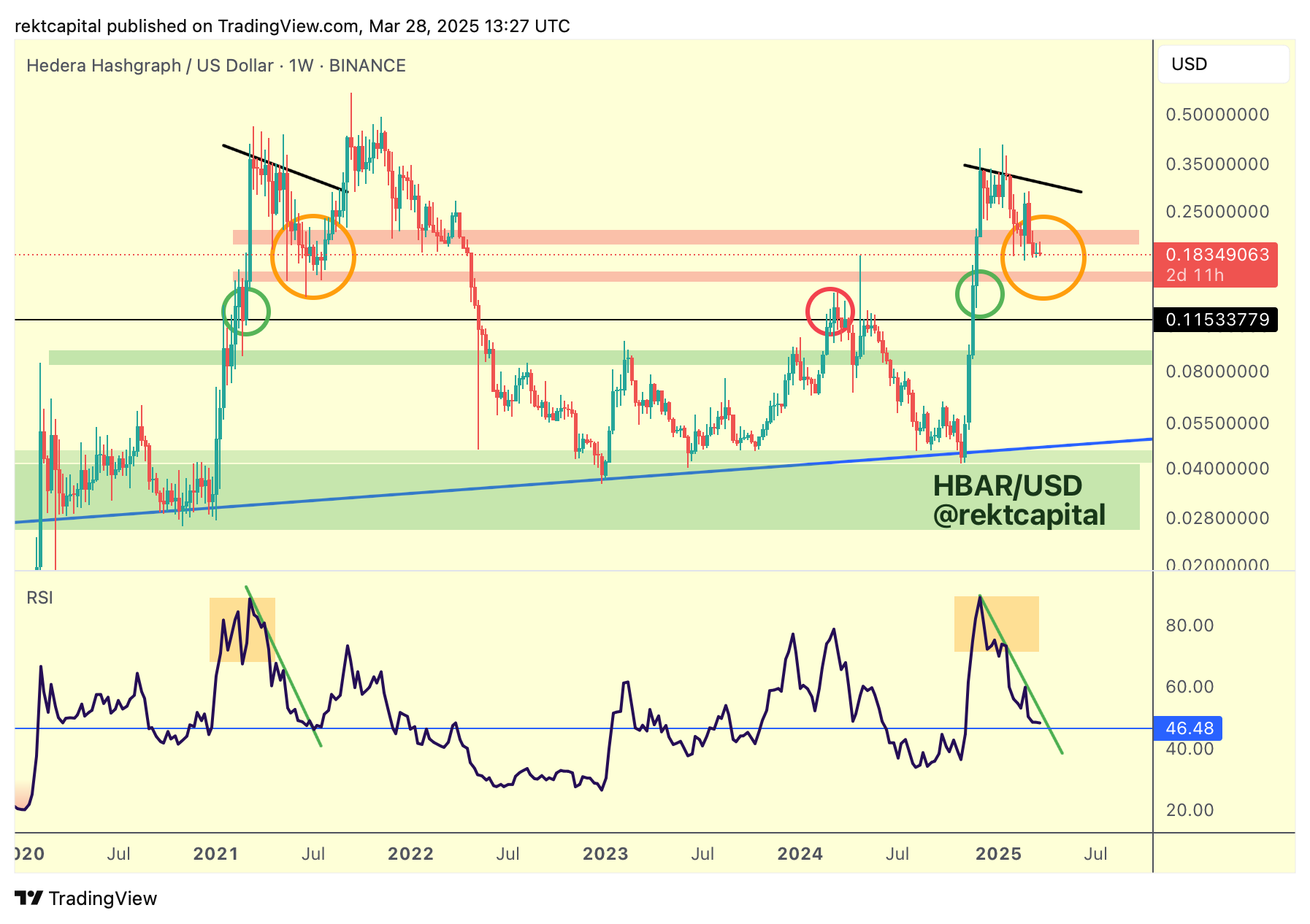

History certainly is repeating when it comes to the RSI:

The oversold RSI region (orange) preceded a drop both in mid-2021 and also in this cycle as well.

More, there are mounting similarities across cycles as well.

Once again, the RSI is in a Downtrend (green) and this downtrend is forcing the RSI to revisit its blue 46 horizontal support.

In mid-2021, when the RSI held the blue level as supprot and broke the green Downtrend, those were the confirmation signals that a price bottom was near and a reversal was not too far away.

In this cycle, the RSI suggests there is a little bit more room to go to actually reach the blue level but once it does and finds support there and musters the strength to breach the green Downtrend...

Then history suggests this would be the necessary display of emerging strength to prompt price into a trend reversal to the upside over time.