Altcoin Newsletter #218

Features POPCAT AERO ETC SOL HNT HYPE TIA RENDER

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Popcat and Aerodrome Finance (POPCAT and AERO)

- Ethereum Classic (ETC)

- Solana (SOL)

- Helium (HNT)

- Hyperliquid (HYPE)

- Celestia (TIA)

- Render (RENDER)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

Popcat and Aerodrome Finance - POPCAT/USDT & AERO/USDT

POPCAT and AERO have a key macro element in common: a Macro Downtrend.

POPCAT has dropped into its macro range (black-black) and is holding the Range Low as support and in doing so, price is trying to get closer and closer to the Macro Downtrend for at least a challenge to try to end the Downtrend and breakout into a new technical uptrend for the first time since November 2024.

AERO is the same but by contrast, AERO has simply been dwindling to the downside, without any success for the time being in terms of establishing support which would get price closer to a Macro Downtrend breakout attempt:

After losing its significant purple macro support of $0.52, AERO has a few downside wicking supports (green levels) but there is little evidence when it comes to how strong those levels are.

As a result, while POPCAT is demonstrating some basing which will enable price to get close to a Downtrend challenge, AERO is instead behaving a little bit like a "falling knife" with no signs of stability for the moment.

In both cases nonetheless, it would certainly be better to wait for AERO and POPCAT to breach the Downtrends as that would likely mean that they are ready to embark on new technical uptrends.

Neither are ready but at least POPCAT showcases some stability and thanks to that stability, it also showcases a proximity to the Downtrend resistance, whereas AERO is still pulling back and is a little far away still from its respective Downtrend.

Ethereum Classic - ETC/USDT

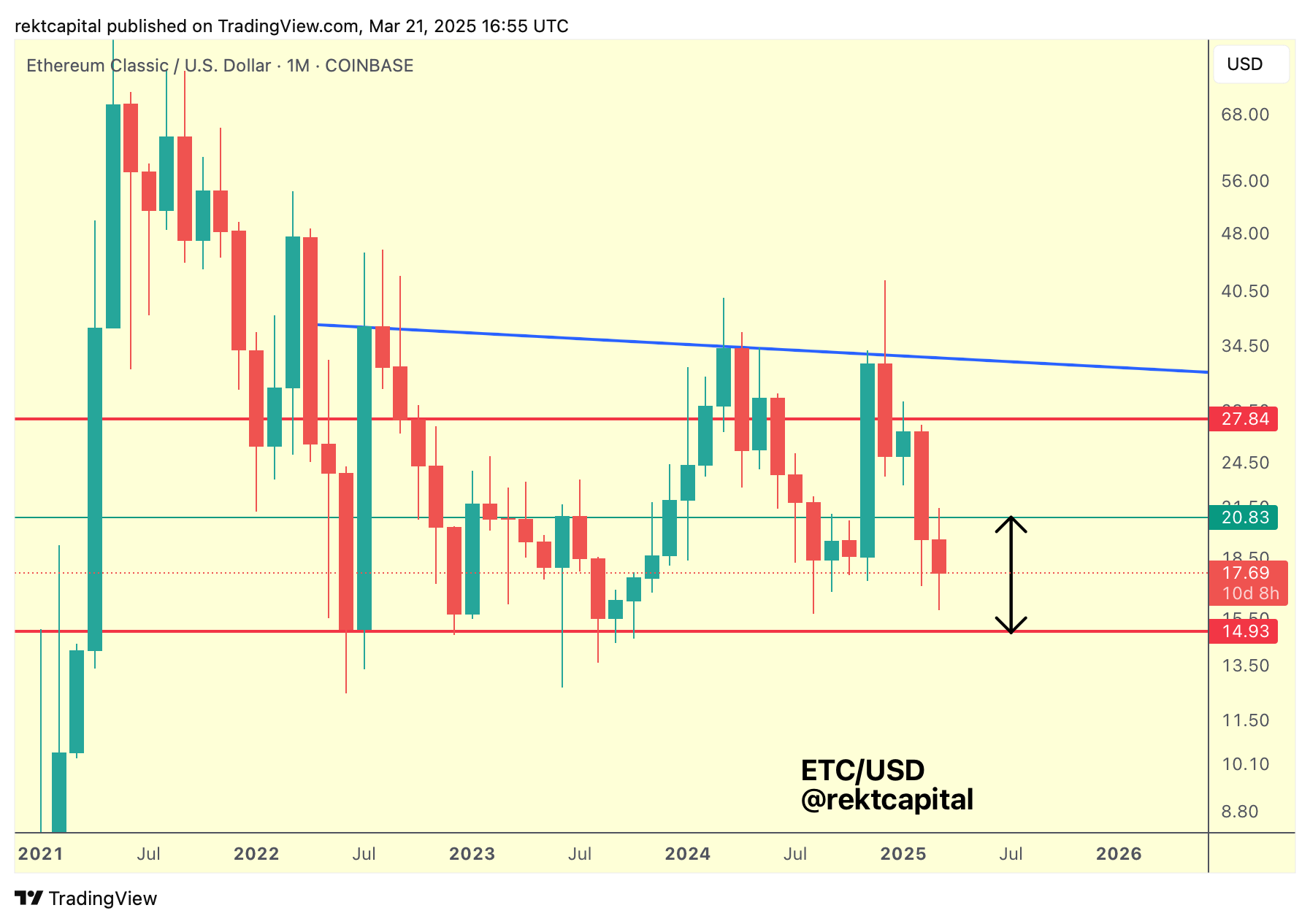

ETC has been generally occupying this $14.93-$27.84 Macro Range since mid-2022, producing predictable moves from Range Low to Range High, back to Range Low and back to Range High over time.

Above the Range High is a Macro Downtrend that has resisted price and rejected it into pullback periods that would get ETC closer to the red Range Low of $14.93.

As the mid-point of the red-red range, the green $20.83 acts as a pivot point.

Whenever it acts as a support, price rallies to the $27.84 Range High (red) and even overextends into the blue Macro Downtrend.

But when this pivot point rejects price, then ETC drops towards or even right into the red $14.93 support.

If the green level continues to act as resistance, then that red Range Low could become a potential target for ETC on this retrace.