Altcoin Newsletter #216

Features LINK WIF AVAX FIL DOG EGLD DEEP

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Chainlink (LINK)

- Dogwifhat (WIF)

- Avalanche (AVAX)

- Filecoin (FIL)

- Dog to the Moon (DOG)

- Elrond/MultiversX (EGLD)

- DeepBook Protocol (DEEP)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

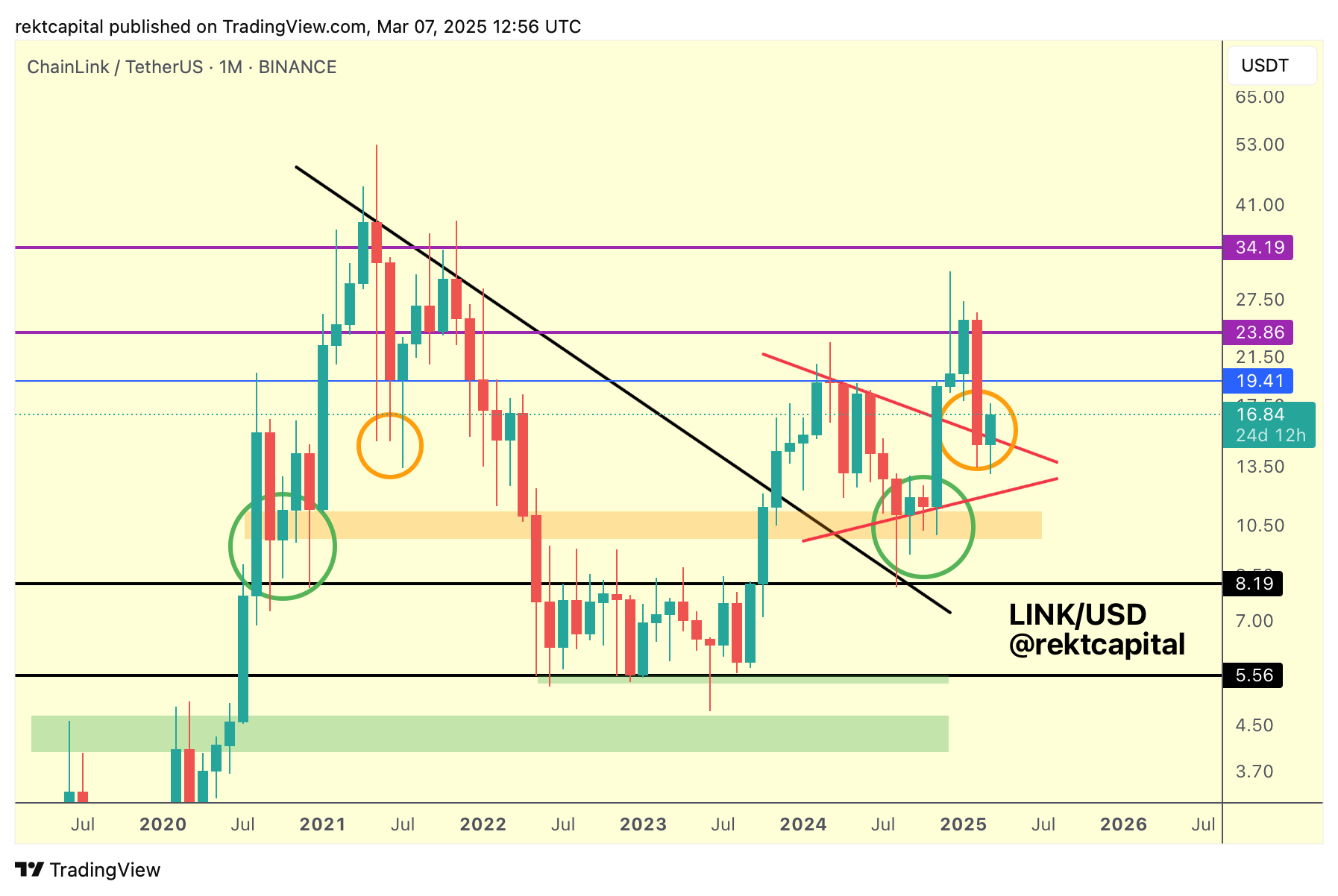

Chainlink - LINK/USD

In mid-2024, LINK confirmed a successful retest in the orange boxed historical demand area to repeat history with a rebound to the upside.

That rebound actually enabled a LINK macro triangle breakout.

Since the breakout, LINK has dropped into the top of the triangle for what looks to be a post-breakout retest which has been volatile indeed but generally successful.

Continue stability at the top of the pattern would enable trend continuation from here.

Historically, the orange circled area highlights how LINK tends to drop into this general price region; in early 2021 this drop was in the form of downside wicks whereas now we're seeing an entire candle-bodied drop.

If LINK can hold the top of the triangle and use this as a springboard for price to reclaim the $19.41 (blue) level as support in the future, then price will have a chance at trying to resynchronise with the blue-purple range price has recently lost.

And properly resynchronising with the range would offer an argument for re-accumulation after a downside deviation.

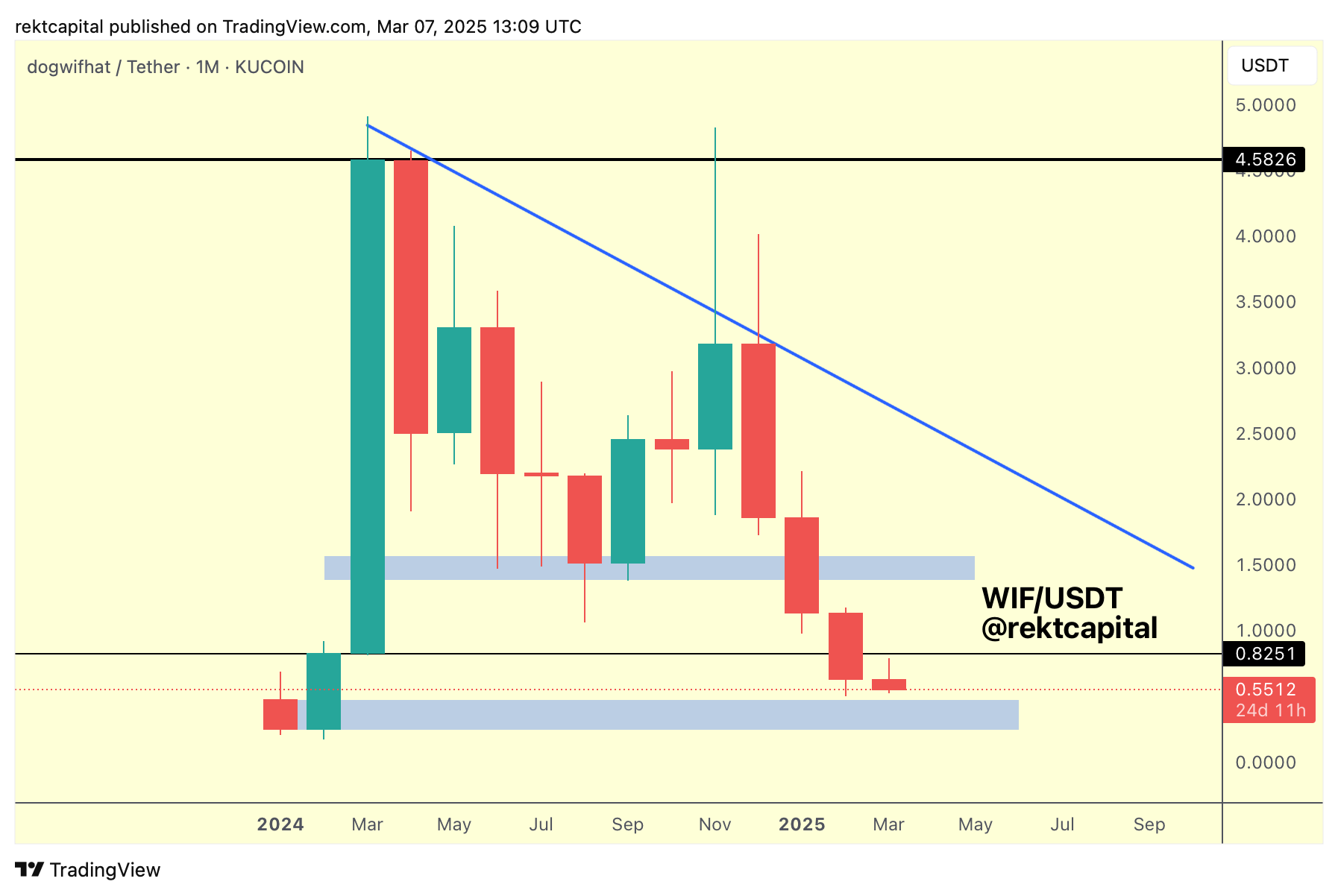

Dogwifhat - WIF/USDT

WIF recently Monthly Closed below the black $0.82 support and price has incidentally upside wicked into this level this month to showcase initial signs of said level flipping into new resistance.

If this setup continues then DOG could drop into the blue major area of liquidity, an area which acted as a demand region upon listing on Kucoin.

That being said, it's important to note that the Monthly seller candles are getting shallower and shallower over time, which may be a sign of slowing sell-side momentum over time from WIF.

And if price can slow down in the sell-pressure against a historical demand area, then that's going to be a potential promising sign for macro seller exhaustion.