Altcoin Newsletter #215

Features ETH DOT ADA VIRTUAL ENA FET

***Announcement***

I am excited to announce that you can now enjoy early access to my brand new course "Technical Analysis 2."

Pre-order to gain Early Access to all course videos today:

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Ethereum (ETH)

- Polkadot (DOT)

- Cardano (ADA)

- Virtuals Protocol (VIRTUAL)

- Ethena (ENA)

- Fetch (FET)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

Ethereum - ETH/USD

On this recent downtrend, Ethereum has developed two brand new Daily CME Gaps.

One has developed between ~$2530 and ~$2630.

And the other is located between ~$2900 and ~$3030.

These two Daily CME Gaps feed into the overarching, more Macro CME Gap which has developed on the Monthly timeframe:

This Macro CME Gap on ETH has developed between ~$2,900 and ~$3,350 (blue circle).

Interestingly enough, this is only the second major Monthly CME Gap that Ethereum has ever developed; the previous one formed in the Summer of 2021.

Ethereum will have a very real chance of revisiting that CME Gap for as long as it is able to maintain its Macro Higher Low dating to the Summer of 2022:

Currently, ETH is downside deviating below the blue Macro Higher Low and with only a few hours left, it appears almost certain that price will actually Monthly Close below this trendline to potentially end the technical uptrend.

However, there is scope for a post-breakdown relief rally into the trendline to potentially turn it into a new resistance, but at that point there would be an opportunity for price to reclaim the Higher Low as support.

And that type of relief rally would be aided with a springboard from the $2279 Monthly support (blue), should price Monthly Close above said price level:

A Monthly Close above $2279 would mean that ETH, despite technically losing the Macro Higher Low, would still maintain its Macro Range (blue-blue) between $2279 and $3000.

Ideally, ETH should try to reclaim the Higher Low but in the absence of any real momentum, at least a Monthly Close above $2279 should suffice for ETH to at least start building a post-crash basing period which could transition into a reversal effort to revisit $3k psychological resistance in the future, provided $2279 continues to enjoy price-strength confirmation.

Polkadot - DOT/USDT

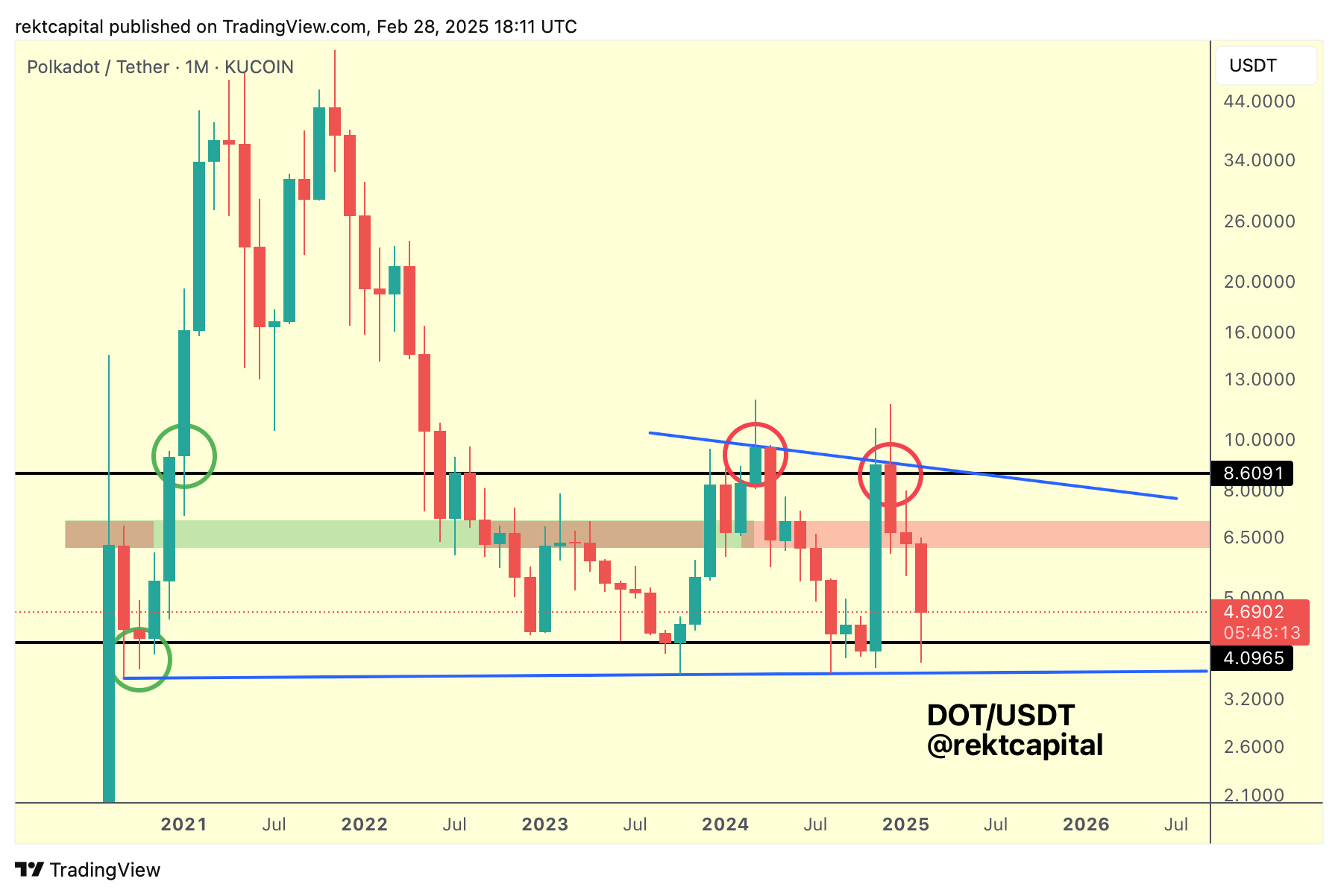

Macro-wise, DOT is still merely maintaining its Macro Range between $4.09 to $8.60 (black-black), as it has been since dropping back into it during the 2022 Bear Market.

DOT has a history of downside deviating below the Macro Range Low, tapping into an approximately confluent blue Macro Higher Low support, before reversing to the upside to upside deviate beyond the blue Macro Range High resistance.

DOT continues its macro ranging inside this range and continued Monthly Closing above the Macro Range Low will suffice to preserve the range.

As of late, DOT downside wicked into the Macro Range Low again and the Monthly Close looks set to occur much higher than said Range Low.

Overall, DOT just needs to continue holding the Macro Range Low to position itself for a reversal to the upside across the range with the aim of revisiting the Range High over time.