Altcoin Newsletter #212

Features WIF ONDO API3 DOT PEPE IOTA

***Announcement***

I'm absolutely thrilled to announce that my brand new course Technical Analysis 2 is available for Pre-Order.

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Dogwifhat (WIF)

- Ondo (ONDO)

- Api 3 (API3)

- Polkadot (DOT)

- Pepe (PEPE)

- Iota (IOTA)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

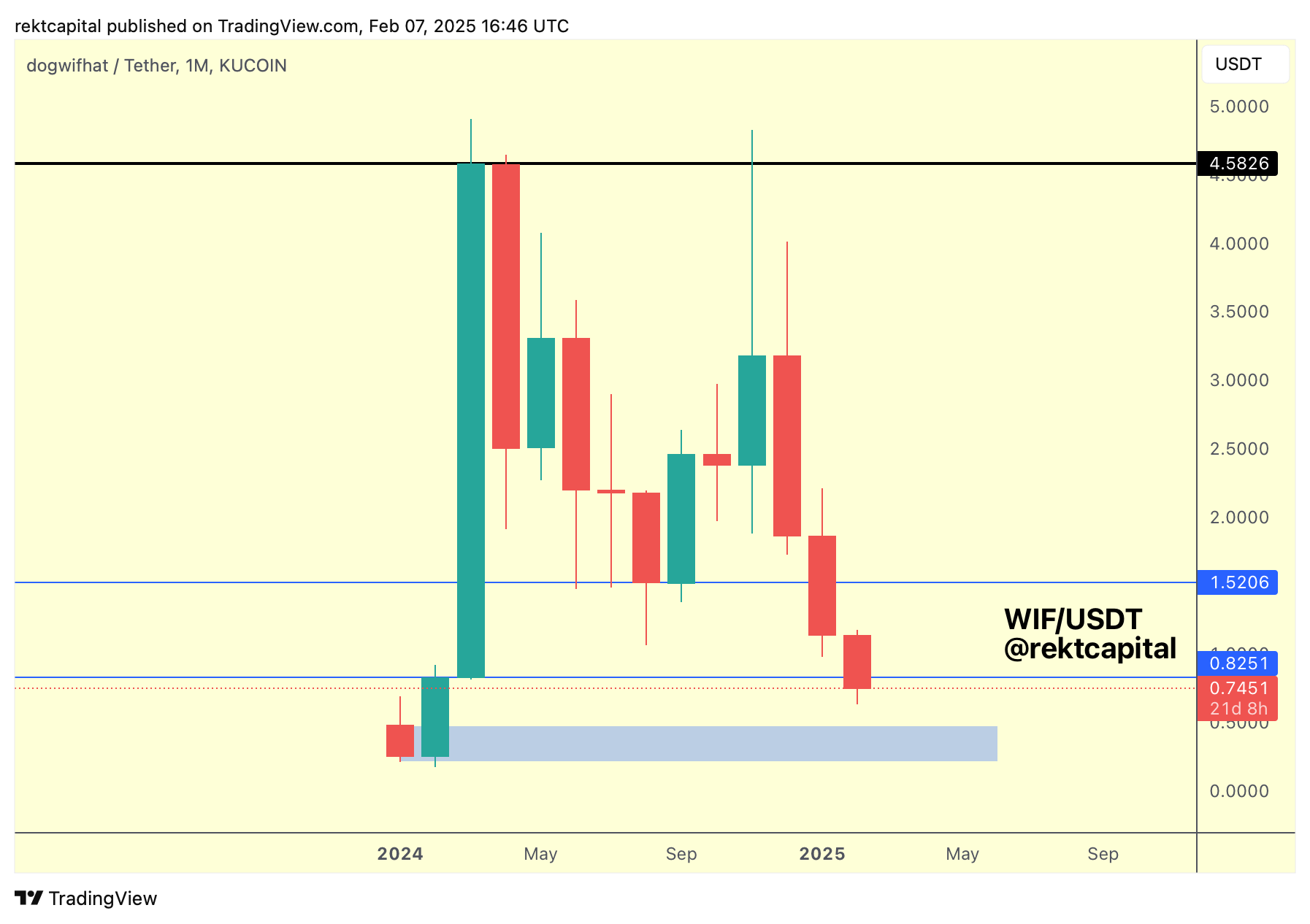

Dogwifhat - WIF/USDT

WIF is at its penultimate Monthly support which is available on the Kucoin price chart.

WIF needs to Monthly Close above $0.825 (blue) to essentially remain inside the blue-blue ($0.82-$1.52) macro range and avoid dropping into the final pool of liquidity (blue box) below.

To avoid downside, WIF should try to Weekly Close above the blue Monthly level of $0.82 to potentially experience a bout of consolidation.

But failing to hold the local blue level could see price drop into the Weekly cluster of price action below which is the final Monthly historical demand area before negative Price Discovery and new All Time Lows.

WIF is teetering around the Monthly level of $0.825 and hasn't lost it yet, but it will be crucial for WIF to reclaim it as support on the lower timeframes and avoid turning it into resistance.

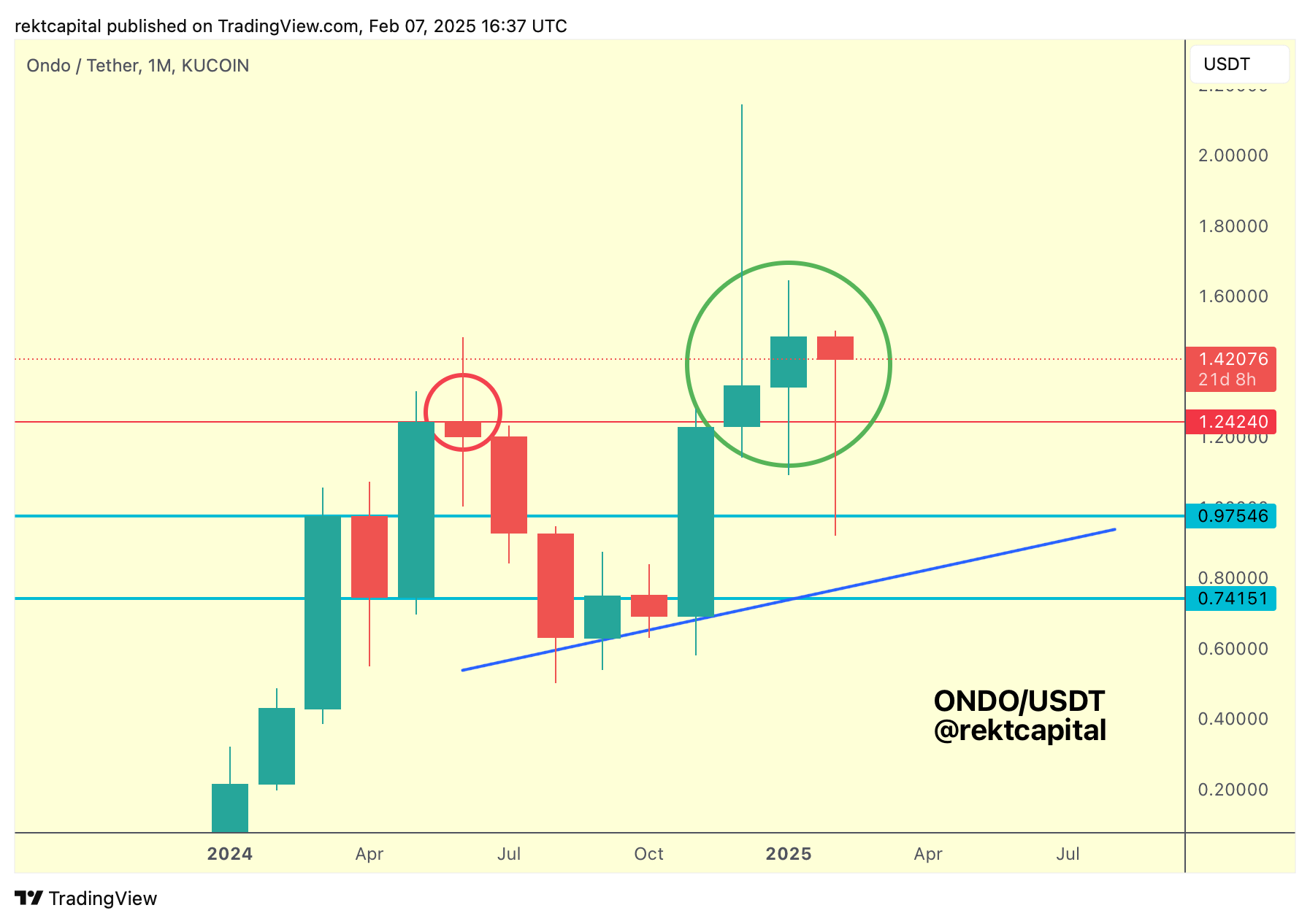

Ondo - ONDO/USDT

In early 2024, the $1.24 (red) level acted as resistance.

In late 2024, this level still acted as resistance but failed to meaningfully reject price as it did earlier that year; instead, ONDO was able to Monthly Close above that level and has been successfully retesting it as new support ever since.

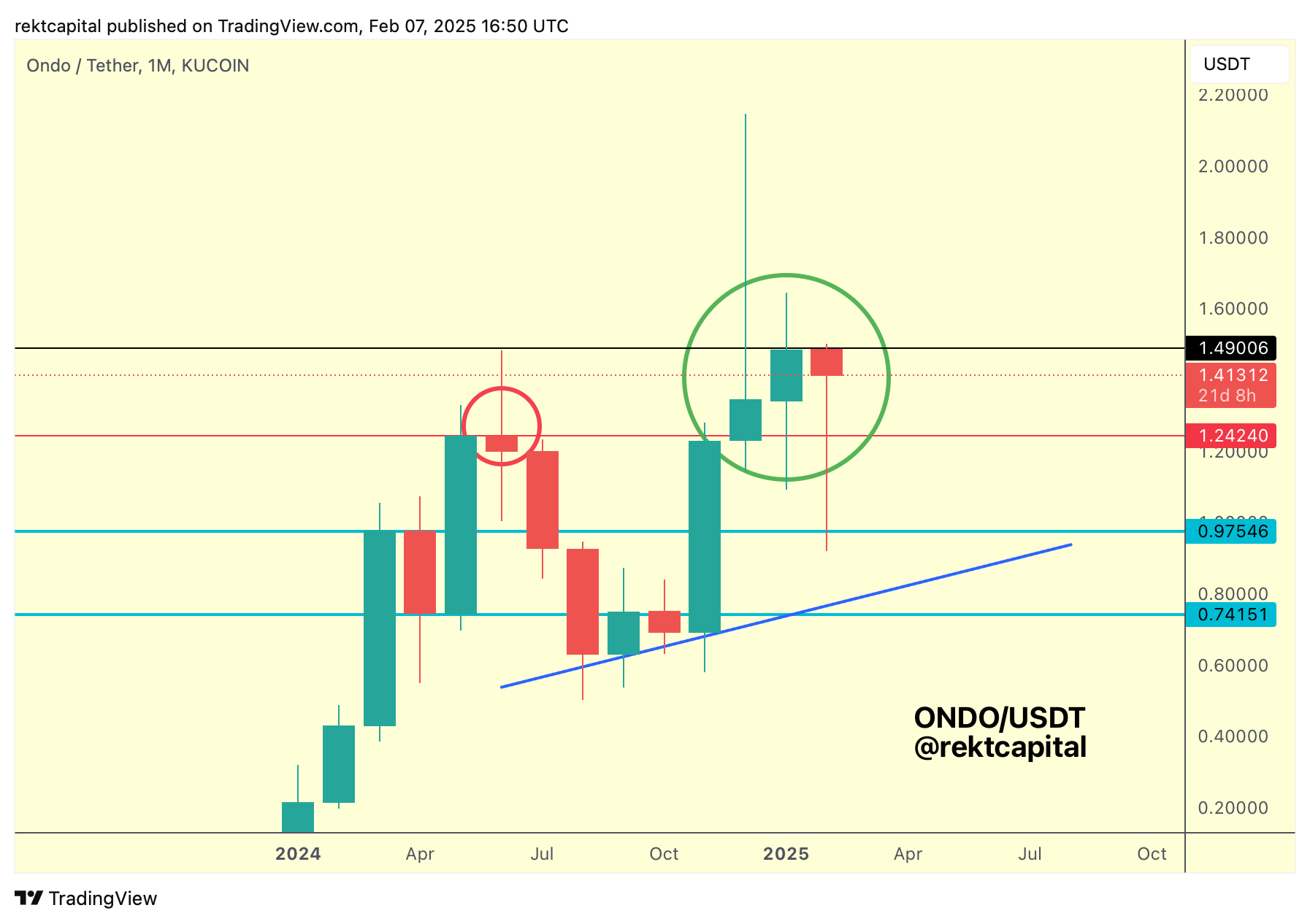

Despite the downside wicks, ONDO continues to respect the red level as new support while at the same time finding resistance at the black $1.49 level:

As a result, ONDO is developing a range at these highs, between $1.24 and $1.49 (red-black).

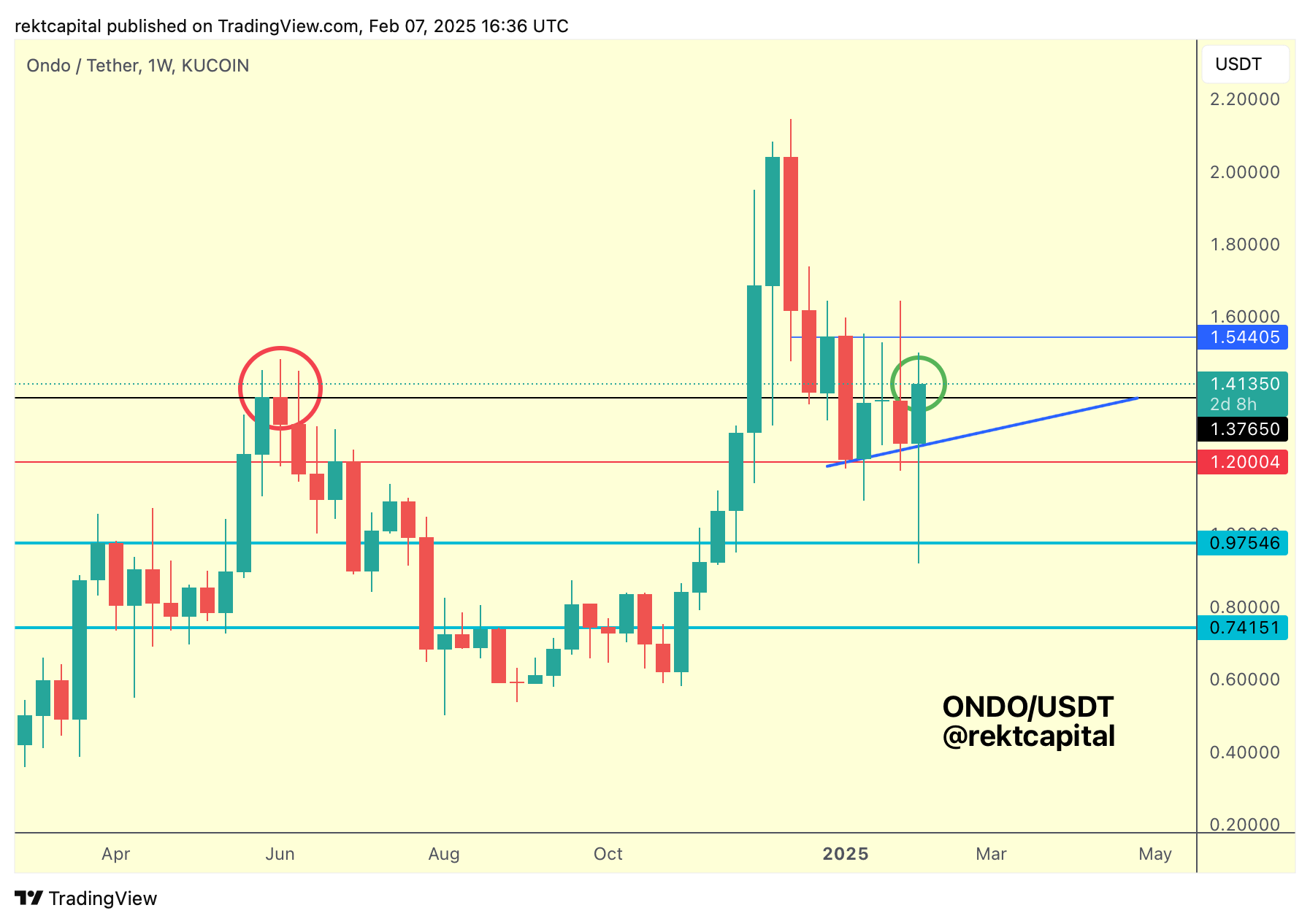

For ONDO to move higher across the range and even potentially revisit the $1.49 Range High resistance for trend challenge, ONDO would need to Weekly Close above the $1.37 resistance on the Weekly timeframe:

This Weekly resistance used to act as a clear point of rejection whereas now, ONDO has a chance to reclaim this level as new support, especially after performing Higher Lows (blue) over the past few weeks.

That said, ONDO has been upside wicking beyond the black $1.37 resistance, which is why a Weekly Close above here followed by a possible post-breakout retest of said level into new support would confirm a move to the $1.54 blue resistance which it would need to also Weekly Close above and retest to move to new highs for 2025.

Generally, on the Monthly timeframe ONDO has successfully retested a major Monthly resistance into new support and now ONDO will need to cover some ground via the Weekly timeframe levels to build on that Monthly predicament.