Altcoin Newsletter #208

Features GALA ADA LINK ALGO HBAR VIRTUAL

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Gala Games (GALA)

- Cardano (ADA)

- Chainlink (LINK)

- Algorand (ALGO)

- Hedera Hashgraph (HBAR)

- Virtuals Protocol (VIRTUAL)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

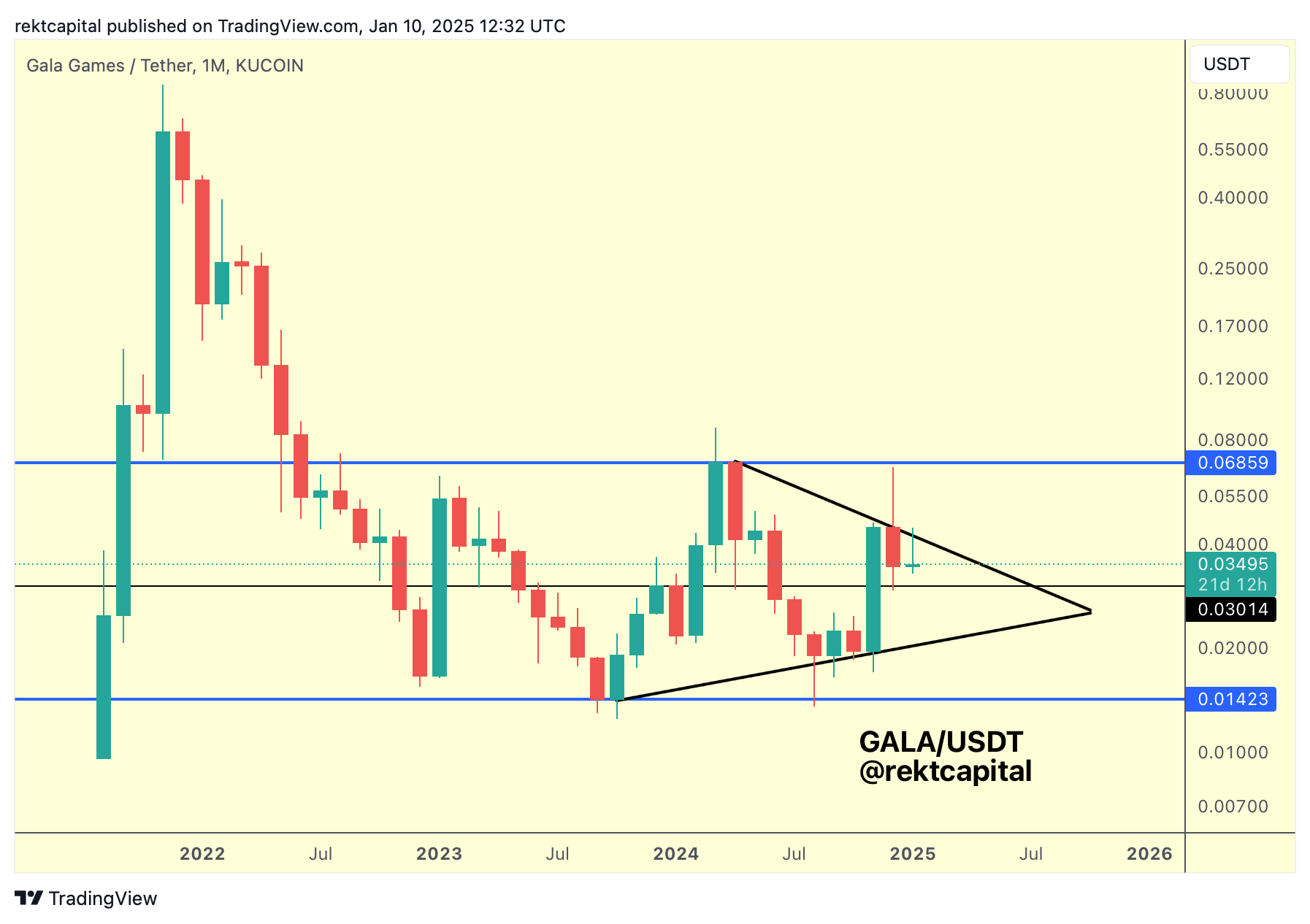

Gala Games - GALA/USDT

Macro-wise, GALA is still in its macro range-bound construction between $0.01-$0.06 (blue-blue), with the mid-point of this range being the blue $0.03 horizontal.

However, GALA is showing signs of developing a new triangular market structure within this macro range, having formed a new Lower High resistance as of late and having a fully developing Macro Higher Low since late 2023.

GALA would need to either Weekly Close above the Lower High and turn it into new support or Monthly Close above this LH to kickstart a breakout from this macro triangle to revisit the Range Highs (blue).

Until then, GALA could continue to consolidate between the Lower High resistance and Higher Low support, for as long as it needs to before breaking out from this triangular pattern entirely in an effort to also later breakout from the macro range as well.

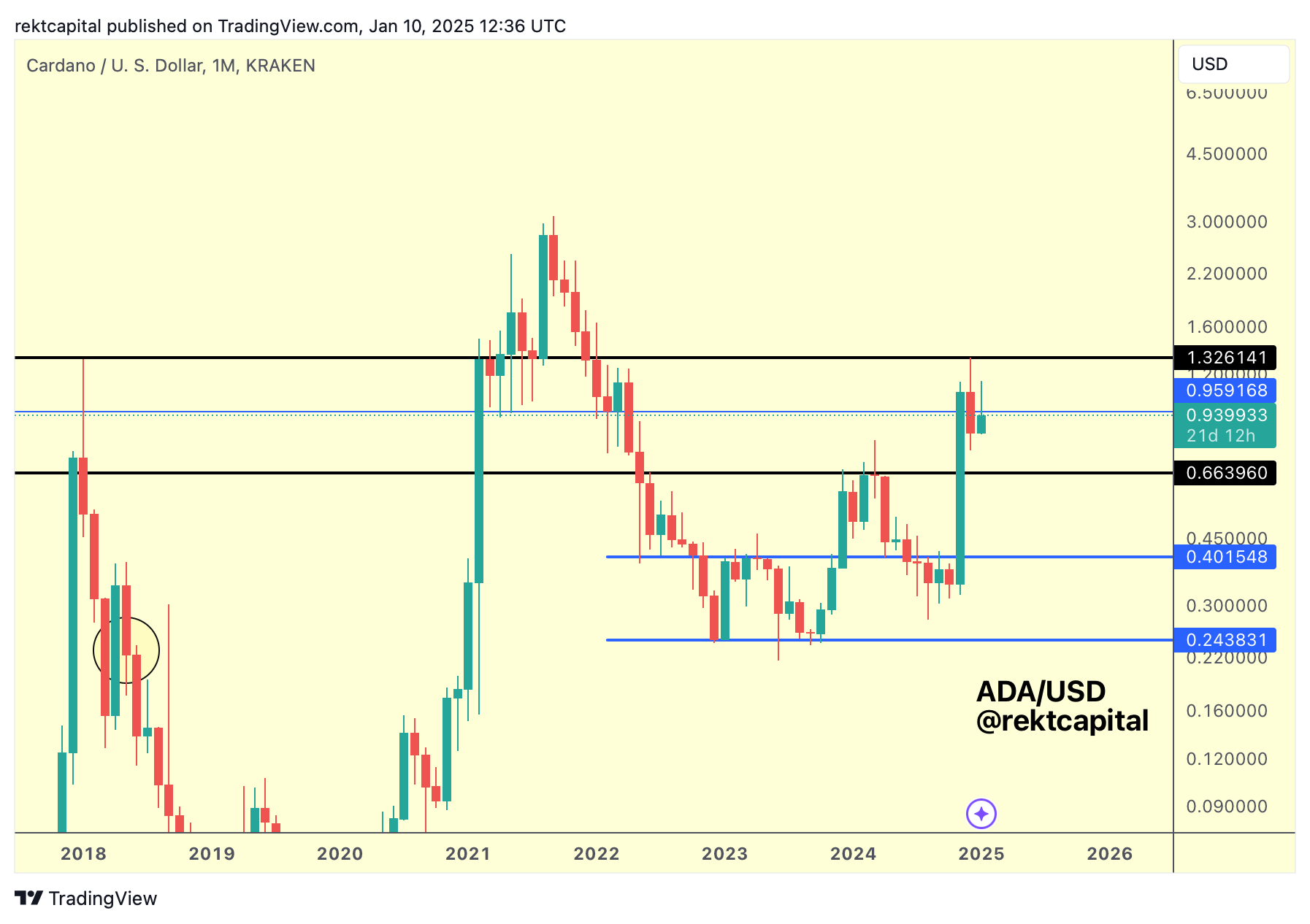

Cardano - ADA/USDT

Cardano is located in its macro range of $0.66-$1.32.

The $1.32 resistance is the old All Time High resistance from late 2017 and the $0.66 support represents the late 2023, early 2024 highs.

Right now, ADA is hovering around the blue mid-point of this black-black range but the reality is that that $0.66 support remains a possible tag zone on a deeper pullback.

After all, ADA is consolidating between $0.66 and $1.32 so turning the late 2023, early 2024 old resistance into new support would make sense from a technical point of view to confirm trend continuation.

However, we can't focus on that support just yet until the current support of $0.84 is lost:

One could make an argument for a potential Monthly Bull Flag for as long as the $0.84 level acts as support.

If however ADA Weekly Closes below the $0.84 level and especially if it turns it into new resistance, then the $0.66 level would become a distinct possibility.

Until that technical step however, ADA will try to fight for additional consolidation inside this potential Monthly market structure.

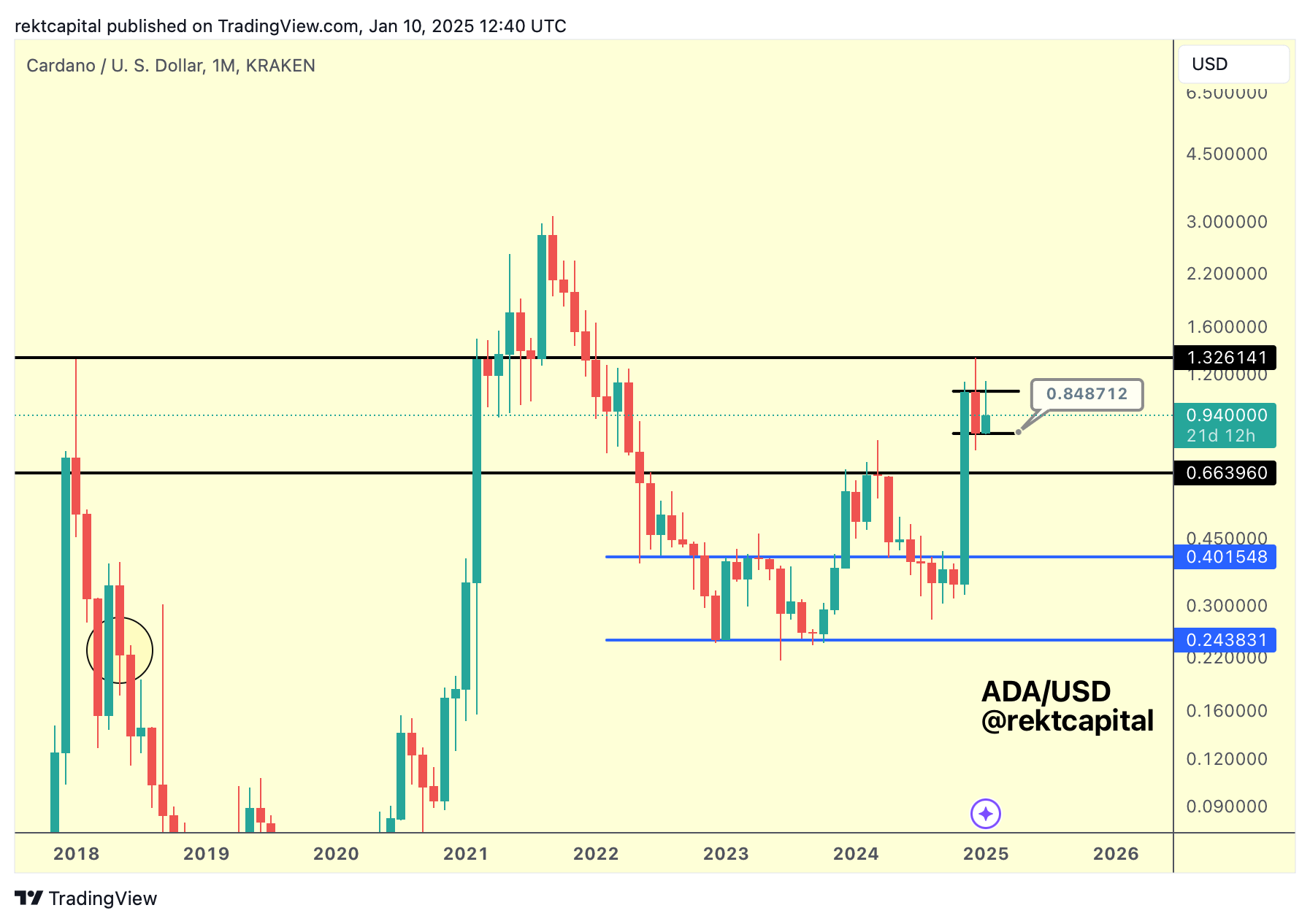

Interestingly enough, the 0.618 Golden Fibonacci pocket resides in and around the $0.66 Range Low:

These Golden Pockets have a high chance of getting revisited on pullbacks, however the takeaway is the same that ADA would need to lose $0.84 (i.e. the 0.5 Fibonacci level) to drop there.