Altcoin Newsletter #205

Features LINK APT PROPS TIA WIF SUI

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Chainlink (LINK)

- Aptos (APT)

- Propcase (PROPS)

- Celestia (TIA)

- dogwifhat (WIF)

- Sui (SUI)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

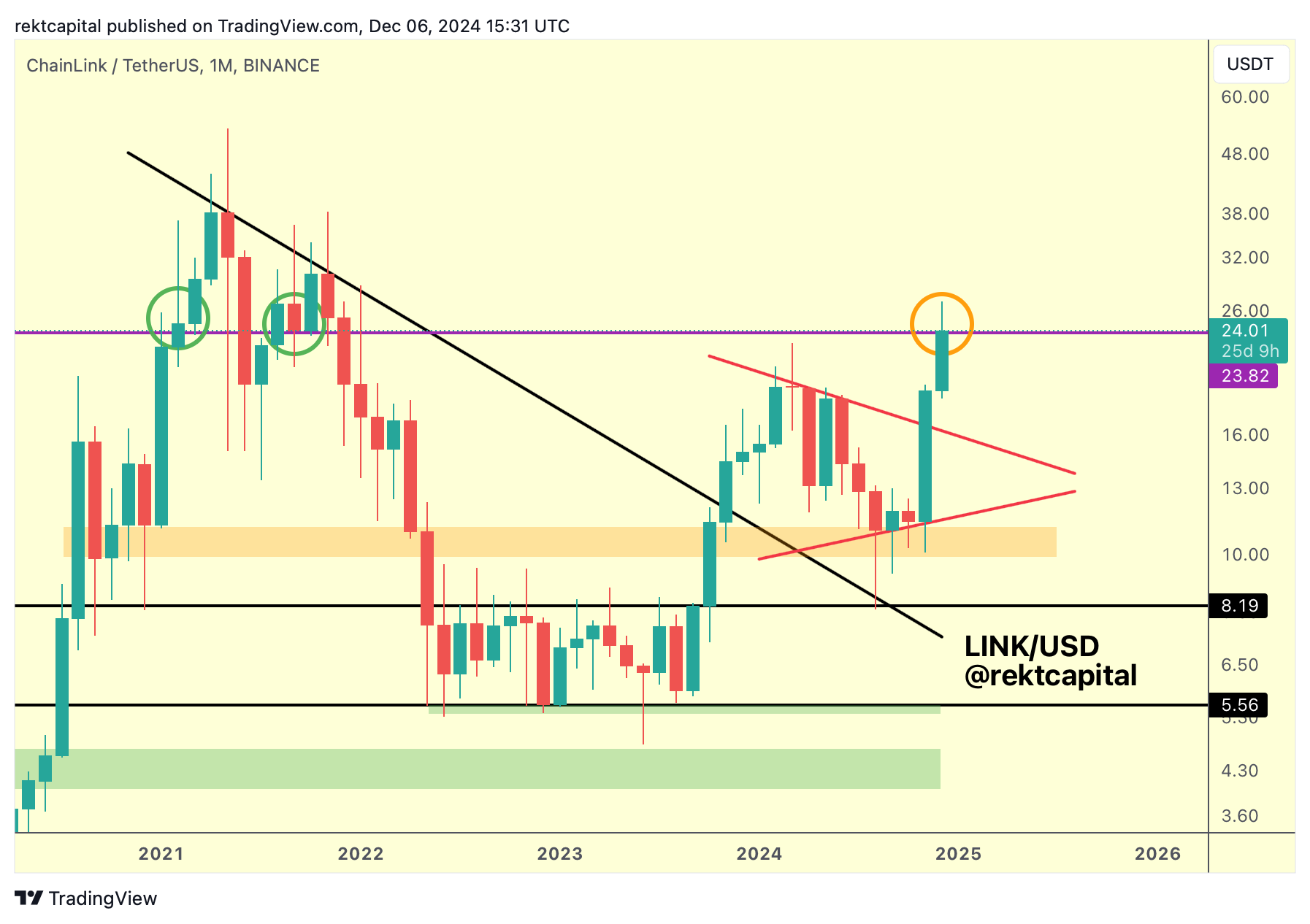

Chainlink - LINK/USDT

Chainlink has recently broken out from a multi-month consolidation structure (red triangle), the base of which formed at a historical demand area (orange box) late 2020 and early 2021.

In which, when LINK was retesting this historical demand area (orange), it also downside wicked into the confluent area of support that became the black Macro Downtrend and the $8.19 black Range High of its generational macro accumulation range.

Nonetheless, LINK has broken out from its red Monthly triangle and is now trying to position itself favourably for a reclaim of the $23.82 (purple) level into new support.

Historically, Monthly Closes above this level followed by successful retests (green circles) have preceded upside for LINK (Weekly Close may also be sufficient as well).

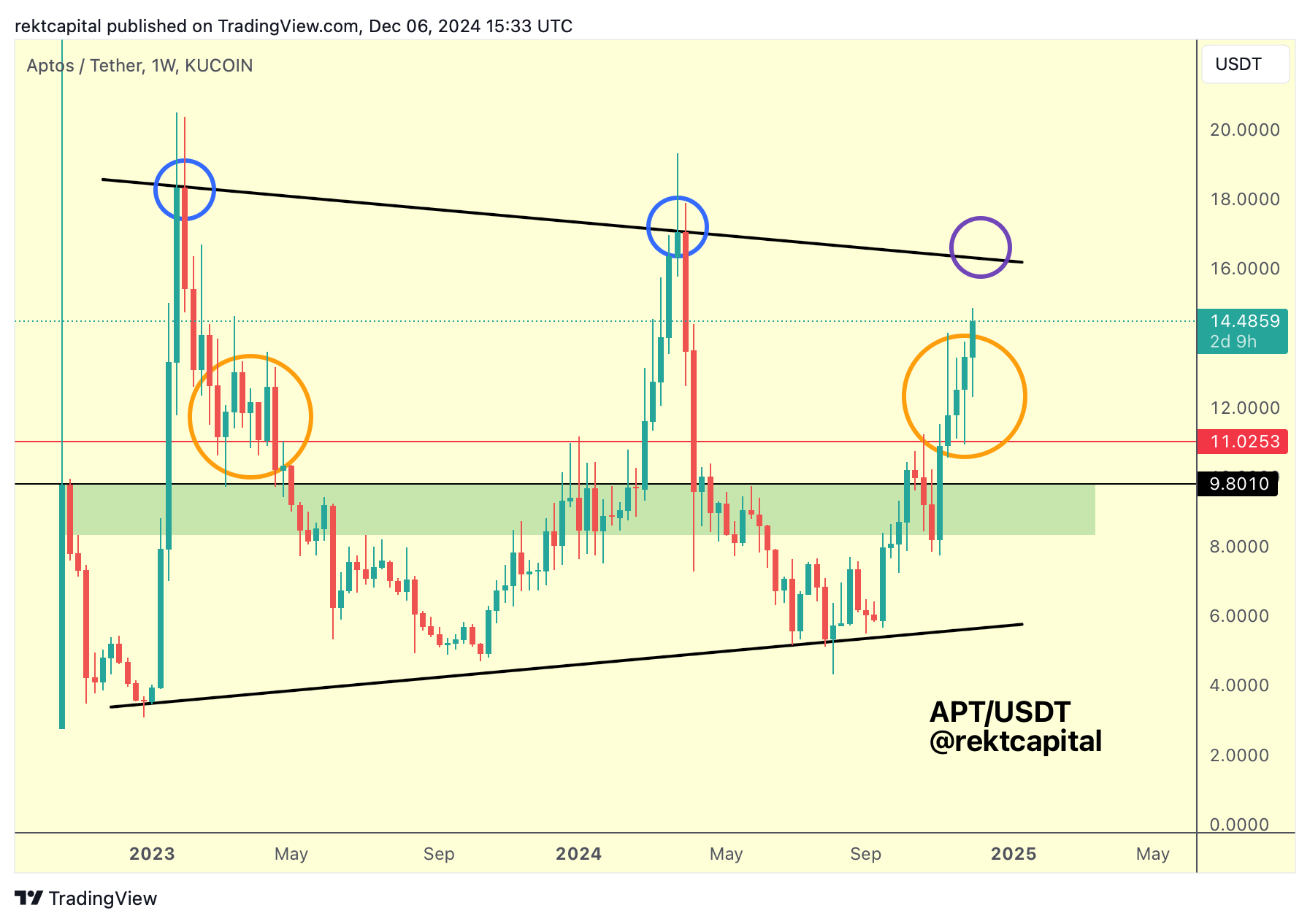

Aptos - APT/USDT

Aptos is developing a clear macro market structure (black macro wedge).

In fact, APT has successfully retested the red $11.02 mid-point of this pattern to confirm that it will now be rallying into the upper half of the macro wedge.

This retest is something APT had failed back in early 2023 but now the retest was successful which demonstrates a clear shift in market psychology towards this $11 red level.

Having successfully retested this mid-point of the pattern, APT will now try to revisit the top of the black wedge where it will face its final major challenge before breaking out from the structure entirely and rallying to new All Time Highs and Price Discovery:

The Macro Wedge Top (black) where historically APT would upside wick beyond but Weekly Close below (blue circles) to reject into deep downtrends.

APT will need to go against the grain of history to Weekly Close above the Macro Wedge Top, ideally turn it into new support before spring boarding to highs not seen since early 2023.