Altcoin Newsletter #202

Features RENDER ADA POPCAT WIF NEAR APT

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Render (RENDER)

- Cardano (ADA)

- Popcat (POPCAT)

- Dogwifhat (WIF)

- Near Protocol (NEAR)

- Aptos (APT)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

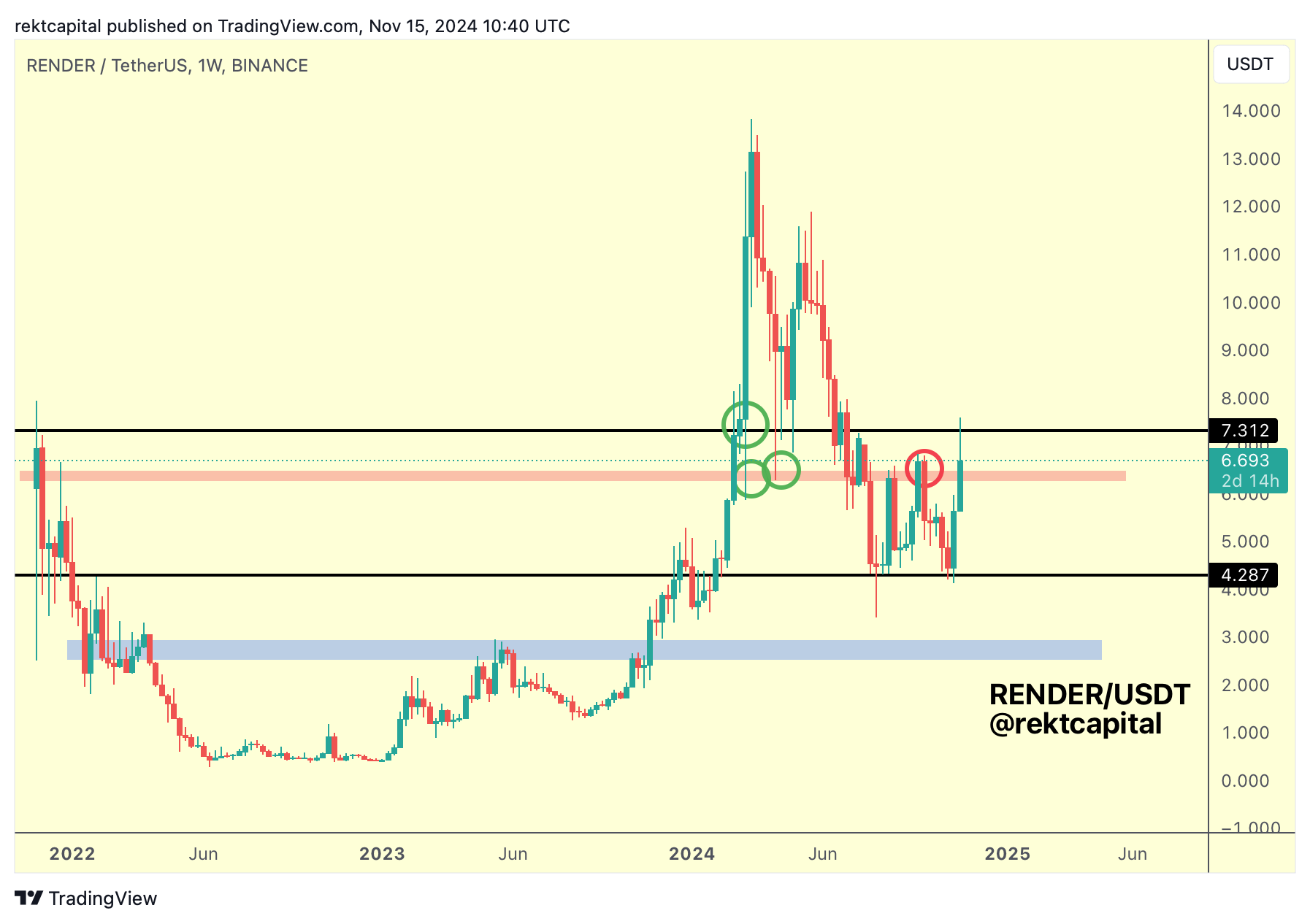

Render - RENDER/USDT

RENDER is consolidating inside its macro black-black range ($4.28-$7.31), having in recent weeks rebounded from the black Range Low to the Range High resistance.

The red region tends to be an important reference point for whether RENDER is capable of breaking beyond the Range High resistance (black $7.31).

Whenever the red region has acted as support (green circles), this has supported RENDER above the $7.31 Range High resistance.

Even better, Weekly Closes above the Range High resistance themselves followed by any retests of that level or even deeper downside wicks into the red boxed region would also be bullish signals for RENDER moves to the upside.

For RENDER to have a good chance at breaking beyond the Range High, it would need to turn the red region into support as doing so successfully would enable price to try to later position itself for a Weekly Close above $7.31 (black); and it's a Weekly Close above black that has historically led to tremendous upside.

In short, RENDER is consolidating at its cycle lows, waiting for confirmation of breaking into a new Macro Uptrend and reclaiming $7.31 as support would be trend-defining indeed.

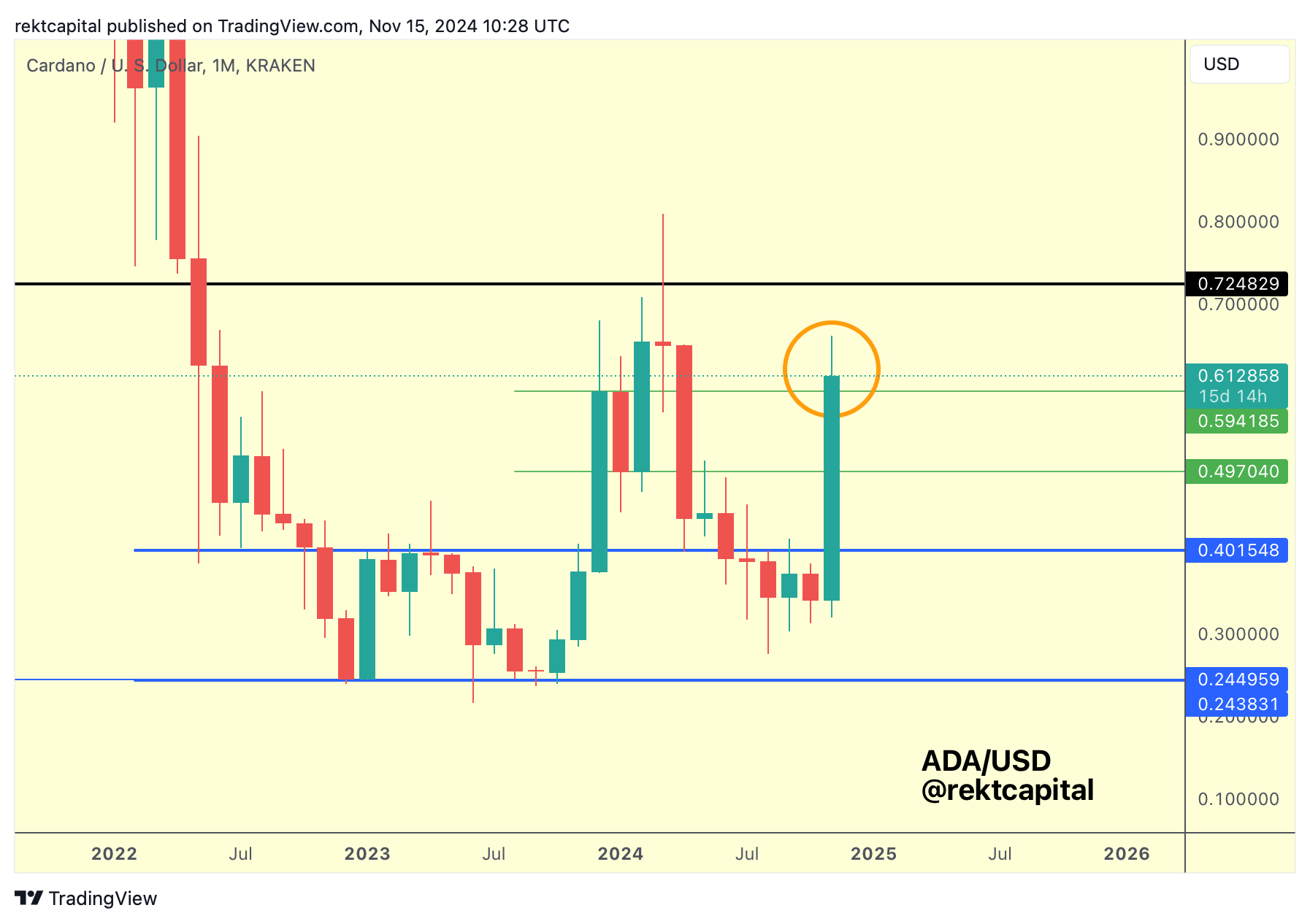

Cardano - ADA/USD

Macrowise, ADA is still technically in Macro Accumulation, consolidating near its cycle lows.

The Macro Range is from $0.24 to $0.72 (blue-black).

As ADA tries to approach the Range High resistance for a breakout from Macro Accumulation to confirm a new Macro Uptrend, here is what ADA would need to do to secure such a breakout:

Of course, ADA could simply rally to Range High without really dipping in the meantime, but the green $0.59 level is an old resistance of a previous re-accumulation range for ADA.

ADA would need to turn the $0.59 level into support to position ADA for a revisit of the $0.72 Macro Range High resistance (black) above.

Generally, the green-green range of $0.49-$0.59 is a previous re-accumulation range and failure to turn the $0.59 level into new support, ADA could revert to this range for some consolidation as part of another bout of re-accumulation.

For the moment, ADA has skipped through this green-green range on its most recent strong rally and if it manages to hold $0.59 as support, then it will be able to avoid spending anytime within it at all.

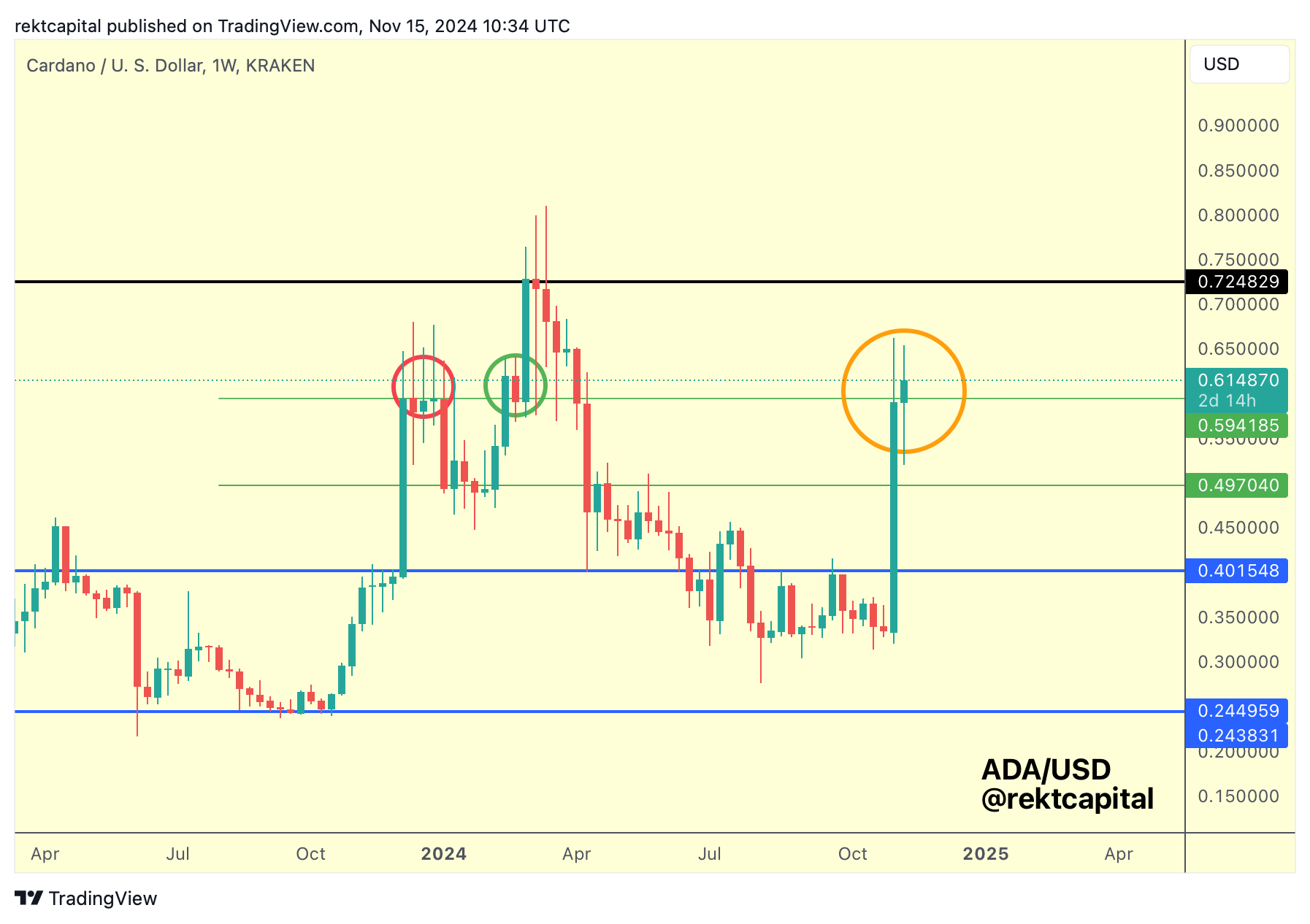

On the Weekly timeframe, ADA is already showcasing promising signs of a successful retest here:

In fact, this orange circled retest is looking very similar to the early 2024 retest that enabled the move to the black Range High resistance in the first place.

Continued stability here and a successful retest would enable ADA to challenge the $0.72 resistance above.