Altcoin Newsletter #201

Features UNI AVAX DOT RUNE SNX LINK

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- UniSwap (UNI)

- Avalanche (AVAX)

- Polkadot (DOT)

- Thorchain (RUNE)

- Synthetix (SNX)

- Chainlink (LINK)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

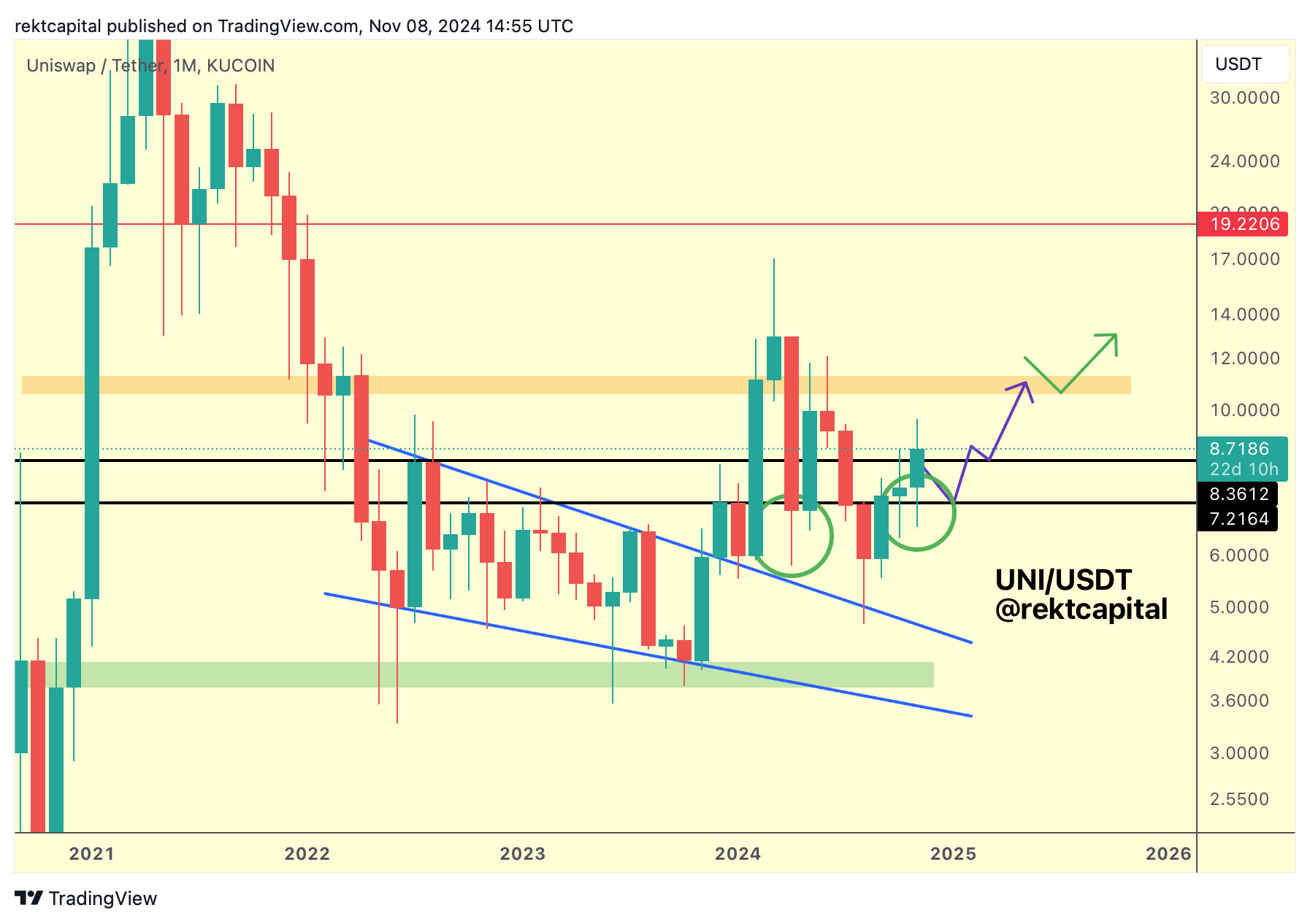

UniSwap - UNI/USDT

UNI has seen a strong rally as of late after successfully retesting the black $7.21 Range Low as support (in downside wicking fashion, green circle).

Price is now positioning itself for a potential breakout from the black-black range but it is not yet a confirmed one.

To kickstart the breakout, UNI would need to Monthly Close above the black Range High resistance of $8.36 and retest it as support before revisiting the orange highs (i.e. purple path).

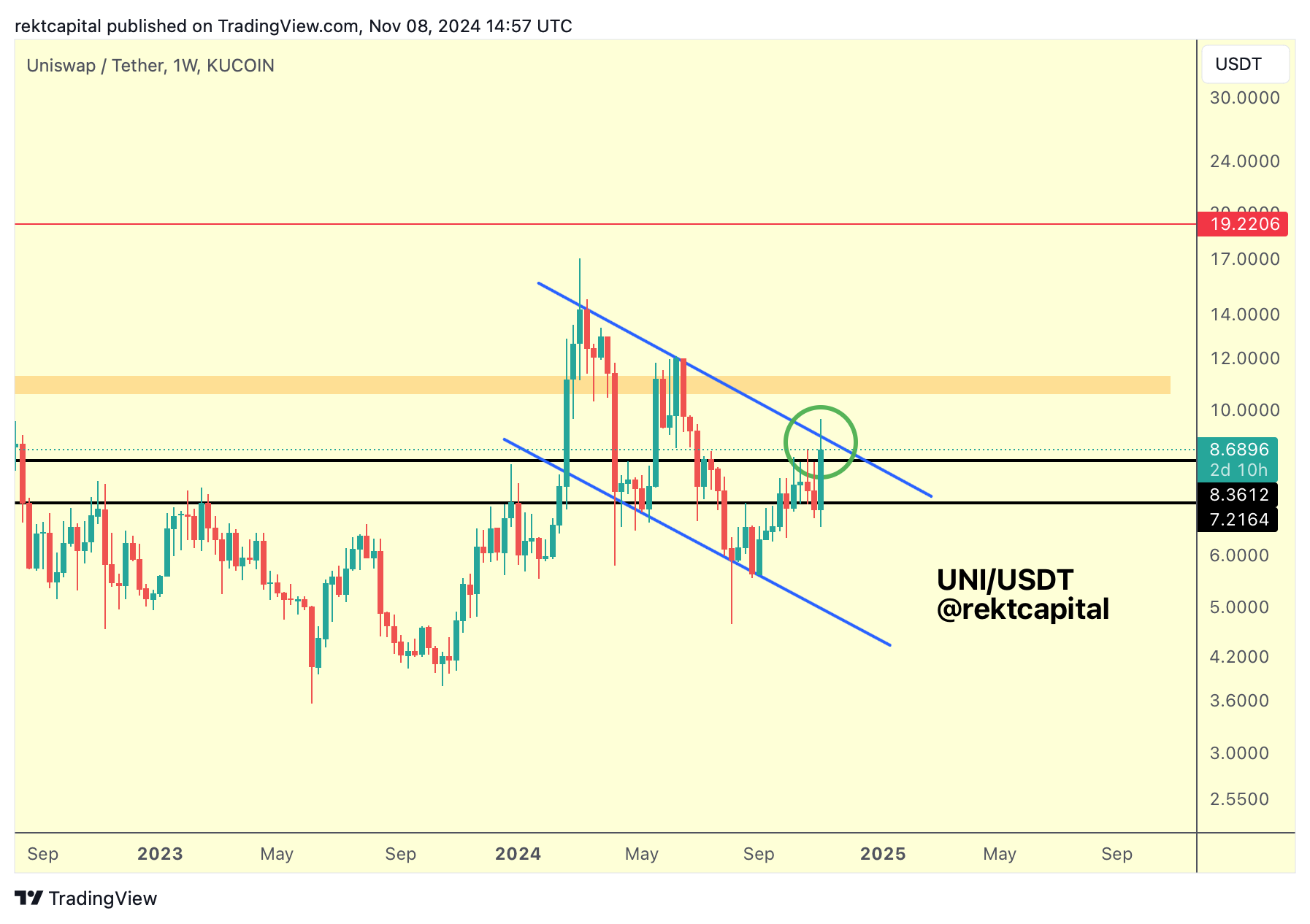

Of course, the Monthly Candle Close is still many weeks away so let's look at the Weekly timeframe:

UNI is forming a Downtrending Channel (blue) and in fact, if UNI is able to Weekly Close above the blue diagonal resistance (green circle), then UNI may not need to wait until the Monthly Close to breakout from this black-black range.

At the moment, UNI is still below this resistance and in the absence of a Weekly Close, an actual rejection becomes more likely.

Let's see how the Weekly Close plays out for UNI but in the absence of a bullish Weekly Close, UNI will likely continue to consolidate in between the black-black range, producing bargain opportunities in the downside wicks below the Range Low (green circle) if necessary.

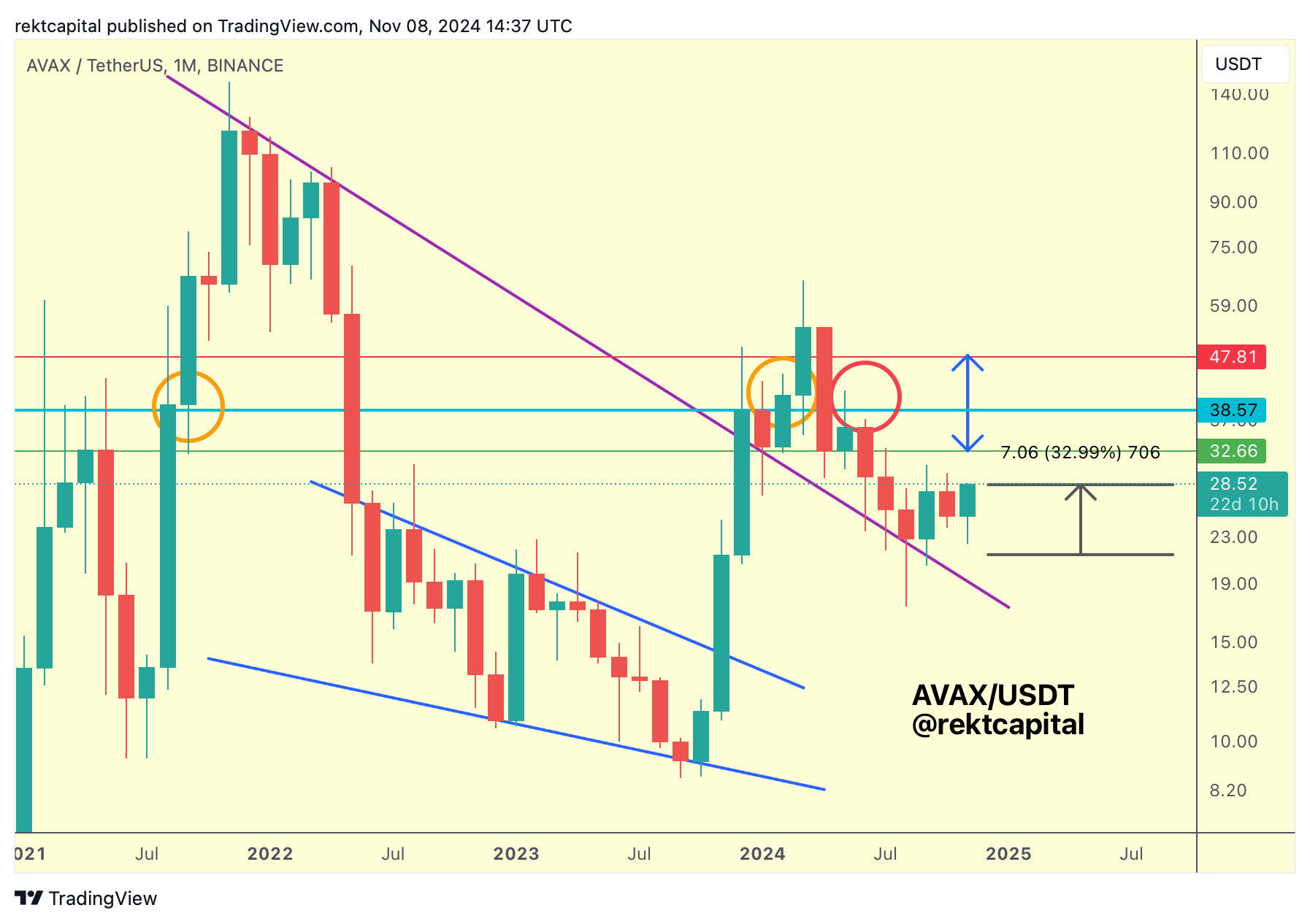

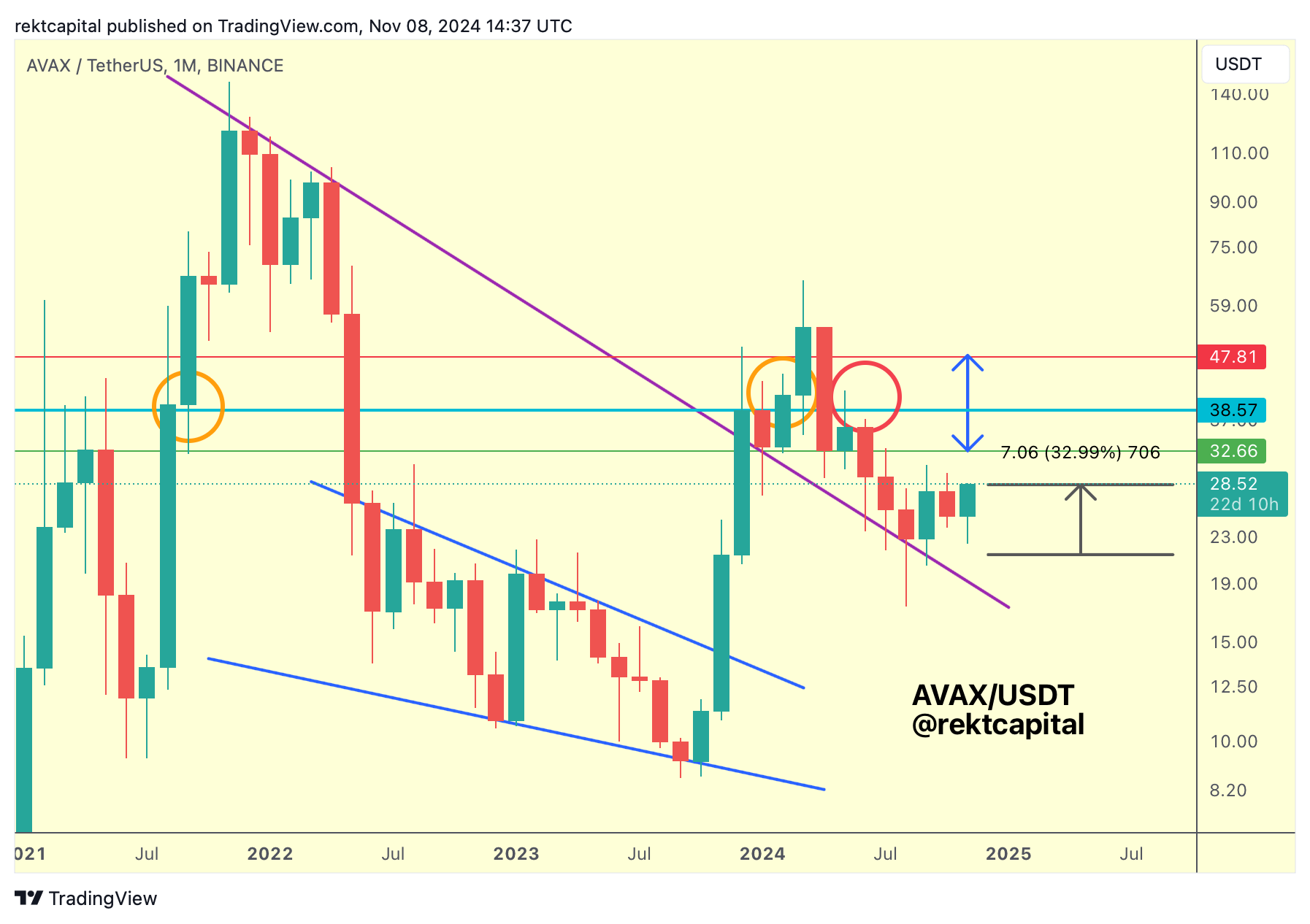

Avalanche - AVAX/USDT

AVAX has been successfully retesting the Macro Downtrend (purple) as support for the past several months.

AVAX would often downside wick below the Downtrend on these retests and it would often follow the Downtrend on these retests, meaning that price would need to downtrend itself to successfully reaffirm it as support.

But most importantly, AVAX has successfully retested the Macro Downtrend, the Downtrend is now over and AVAX is ready for a new Macro Uptrend.

After all, retesting the Macro Downtrend as support has confirmed a new Macro Uptrend for AVAX.

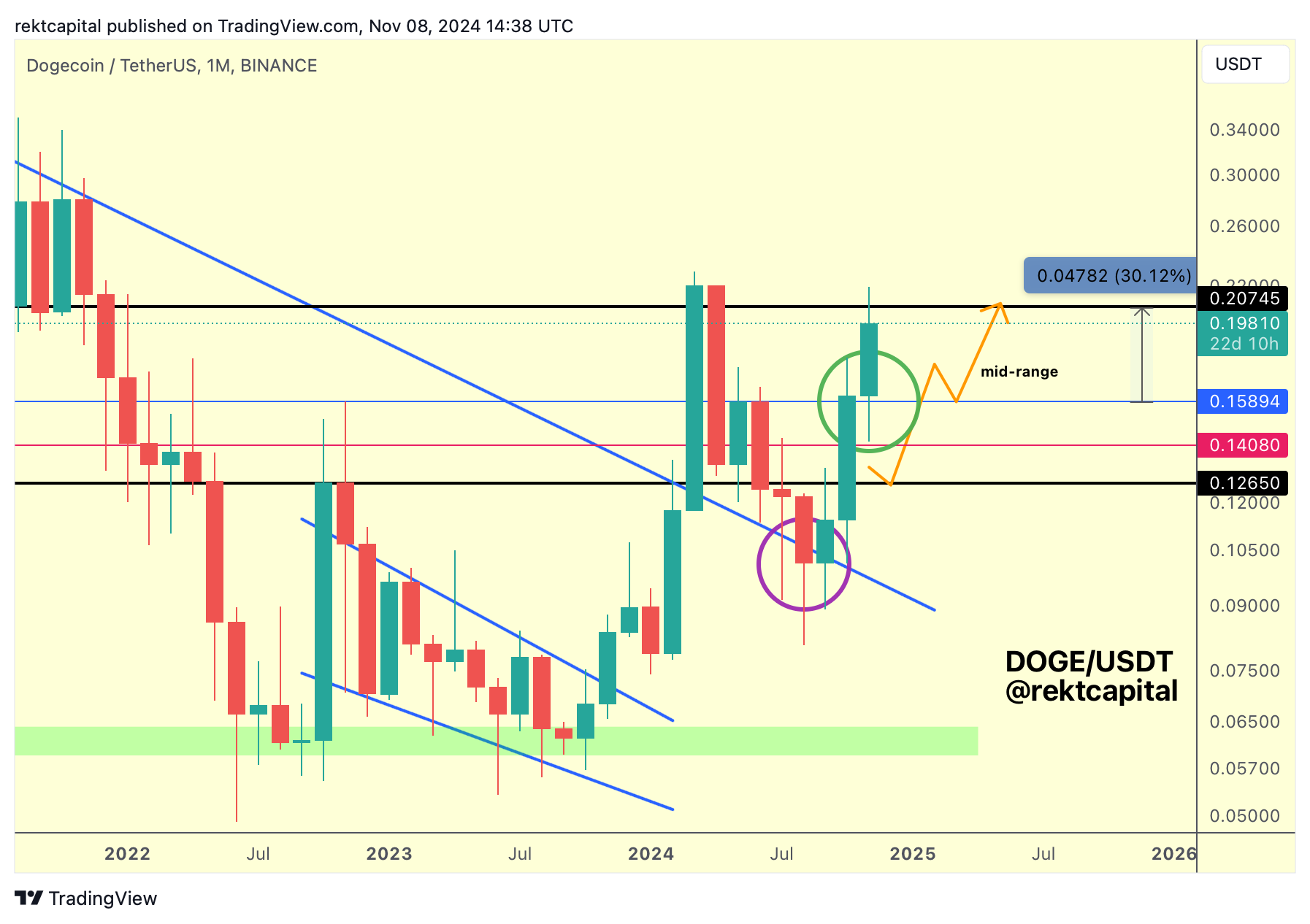

In fact, AVAX resembles DOGE in many ways:

Just like AVAX, DOGE also would retest its Macro Downtrend multiple times, downside wick below it and often follow it for these retests attempts over a period of months.

And once that Downtrend was retested for the final time, DOGE rallied to early 2024 highs.

AVAX is in a similar predicament, with the only difference being that DOGE is a leader and AVAX is a laggard in this respect:

As a result, over time, AVAX is likely to follow in DOGE's footsteps with a rally to revisit its early 2024 highs (red).